Maria Korneeva/iStock via Getty Images

The retail industry is incredibly competitive and cutthroat. Low margins and a large number of players, both online and in-store, can make this a difficult market to thrive in. Generally speaking, when investors decide to buy into this space, they would be well advised to buy only the highest quality companies that demonstrate consistent attractive growth on both their top and bottom lines. But from time to time, you come across a retailer with mediocre operations but with a share price that is trading at a very low level. One great example of this can be seen by looking at The Cato Corporation (NYSE:CATO). Results from the COVID-19 pandemic era notwithstanding, the company has been inconsistent in terms of its store count and has seen its bottom line fluctuate quite a bit. But given how cheap shares are, it may not make for a bad investment for investors who don’t mind a little bit of extra risk in their portfolio.

Specialty retail in action

Cato has a long operating history. After all, the company was originally founded back in 1946. Today, the business boasts 1,315 locations across the US, with most of them located across the southeastern portion of the country. In addition to having these stores under the Cato brand name, the company also has a few other names at its disposal. These include Cato Fashions, Cato Plus, It’s Fashion, It’s Fashion Metro, and Versona. Through these stores, the company sells a variety of fashion-oriented products. For instance, under the Cato brand names, it sells apparel and accessories like dressy, career, and casual sportswear, as well as coats, shoes, costume jewelry, handbags, lingerie, and more. Some of the products sold in its stores, a good portion in fact, fall under its own private label brands. This is important because private branded labels generally carry higher margins than brands sold on behalf of third parties.

Today, the company’s brand stores also saw a variety of other styles. For instance, under the It’s Fashion brand names, the company sells what it considers to be the latest trendy styles for individuals of all ages. And under the Versona brand name, it offers fashion apparel items, jewelry, and other related accessories. It’s also worth noting that the company’s stores can range significantly in size. The smallest is around 2,100 square feet, while the largest is roughly 19,000 square feet. Although the company aims to cater to the latest fashions, it is worth noting that the business also is focused on the value customer. To further facilitate their needs, the business has a layaway program that enables the purchase of goods over a specific timeframe. However, this represents just a small portion of the company’s operations, comprising just 2.7% of sales in 2021.

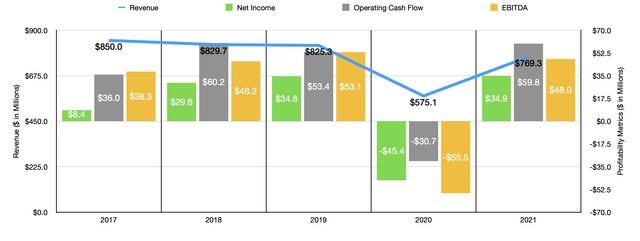

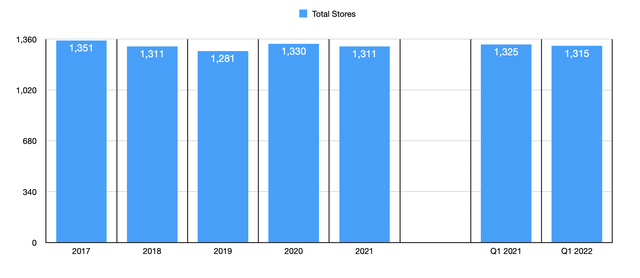

Generally speaking, the goal for an investor, particularly one in the retail space, is to buy stock in a business that is exhibiting steady and consistent growth. Unfortunately, Cato does not meet these criteria. Even before the pandemic, revenue with the business was declining. Sales dropped from $850 million in 2017 to $825.3 million in 2019. This was driven by a couple of factors. For starters, the firm has suffered from mixed comparable store sales from year to year. In 2017, for instance, comparable store sales dropped by 12%. They were flat in 2018 before inching up just 2% in 2019. But an even larger contributor to this decline can be seen by looking at the company’s store count. By the end of 2017, Cato had 1,351 stores in operation. By the end of 2019, this number had dropped to just 1,281.

The pandemic proved to be an interesting time for the company. Despite the pain inflicted on the retail sector, the number of stores the company owned actually increased, jumping to 1,330 by the end of 2020. That being the case, sales still declined for the year, plummeting to just $575.1 million as comparable-store sales plunged 32%. Fortunately, sales rebounded in 2021, climbing to $769.3 million. This came even as the company’s store count resumed its decline, with the number of units in operation dipping to 1,311. What made up for this was a 34% increase in comparable-store sales.

The bottom line for the company has been similarly wild but in ways that are perhaps unexpected. Even as revenue declined from 2017 to 2019, net income at the company increased, climbing from $8.4 million to $34.6 million. In 2020, the company generated a net loss of $45.4 million. That pain was short-lived as evidenced by the $34.9 million profit achieved in 2021. The company has also experienced some stability when it comes to cash flow. In three of the past five years, operating cash flow was positive in a range of between $53.4 million and $60.2 million. These years were 2018, 2019, and 2021. Another interesting relationship can be seen when looking at EBITDA. This metric ultimately increased from 2017 to 2019, climbing from $38.3 million to $53.1 million. The metric turned negative to the tune of $55.5 million in 2020 before turning positive again in the amount of $48 million last year.

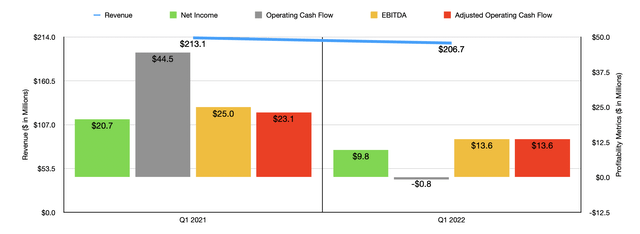

What this all seems to indicate is that even though the company has suffered a sales decline in recent years, management has done well to improve the firm’s bottom line, likely as a result of closing underperforming locations and otherwise consolidating operations where possible. Now that we are into the 2022 fiscal year, a good question is what the picture looks like. Unfortunately, the business is experiencing some pain. Revenue of $206.7 million is lower than the $213.1 million reported the same quarter one year earlier. Management attributed much of the decline to lower comparable store sales driven by cooler, and wetter weather. They also attributed some of this to late merchandise shipments caused by supply chain disruptions. Inflation also had an impact, management said, on disposable income. The company also suffered from a reduction in store count in the amount of 10 units compared to the same time one year earlier, bringing the total number of stores in operation to 1,315.

Given these causes, it should not be a surprise that profitability for the company would also suffer some. Net income more than halved from $20.7 million to $9.8 million. Operating cash flow fared even worse, plunging from $44.5 million to negative $0.8 million. But if we adjust for changes in working capital, the picture was not quite as bad, with cash flow going from $23.1 million to $13.6 million. Meanwhile, EBITDA for the company also declined, dropping from $23.1 million to $13.6 million. Even though the company is experiencing some pain this year, management has decided to increase their share buyback authorization by 1 million shares, taking it up to 1.38 million as of this writing. On the other hand, even though the company opened five locations in the first quarter and closed only one, it is planning to close a total of 25 stores throughout this year. Instead of seeing management buy back stock, I would prefer that they allocate the capital to improving their supply chain or otherwise creating value for the long haul.

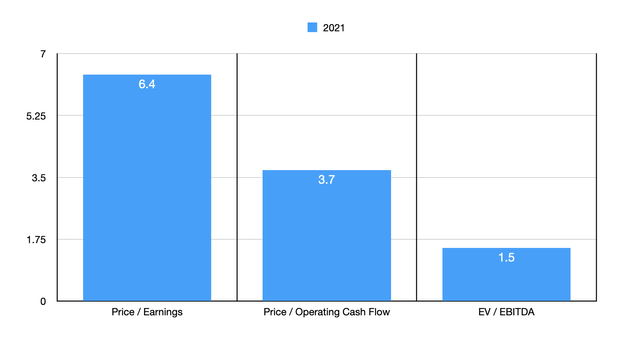

Although it’s looking like 2022 might be a bit rough for the company, shares of the company do still look quite cheap. Using our 2021 results, the firm is trading at a price-to-earnings multiple of 6.4. The price to operating cash flow multiple is even lower at 3.7. But which really awesome is that the business has $149.8 million in cash on hand and no debt. This ends up translating into an EV to EBITDA multiple for the company of just 1.5. While the business is very cheap on an absolute basis, it is not the cheapest out there. As part of my analysis, I looked at five different firms in comparison to Cato. On a price-to-earnings basis, four of these companies had positive results, with their multiples ranging from 3.4 to 8.4. In this case, three of the four companies were cheaper than our prospect. Using the price to operating cash flow approach, the five firms ranged from a low of 3 to a high of 10.3. In this case, two of the five were cheaper than our target. And finally, using the EV to EBITDA approach, the range was from 1.2 to 12.9. In this scenario, only one of the five companies was cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| The Cato Corporation | 6.4 | 3.7 | 1.5 |

| Tilly’s (TLYS) | 4.3 | 8.6 | 1.2 |

| Citi Trends (CTRN) | 3.4 | 3.4 | 1.6 |

| J.Jill (JILL) | N/A | 3.0 | 12.9 |

| Express (EXPR) | 8.4 | 10.3 | 3.5 |

| Destination XL Group (DXLG) | 4.7 | 4.4 | 3.4 |

Takeaway

At this point in time, I feel comfortable saying that Cato is absolutely a mediocre company. Fortunately, on the bottom line, things have gotten better even though this year is off to a rough start. Relative to similar players, the company is perhaps slightly on the cheap side but nothing special there. Due to exactly how cheap shares are on an absolute basis, I do think investors who don’t mind some risk, particularly at a time when inflation is picking up, could find this business attractive. But because of the mediocrity of the company, combined with broader economic issues, I am personally rating it a ‘hold’ at this time.

Be the first to comment