Md Saiful Islam Khan/iStock via Getty Images

We thought we’d revisit Isoray (NYSE:ISR) as we haven’t looked at this company for quite a while and they announced what could be an interesting merger. However, we didn’t come away with a renewed sense of urgency to take a position; quite the contrary.

While promising long-term, revenue growth is stagnating, costs are rising so margins are squeezed and the merger isn’t going to produce revenues for years.

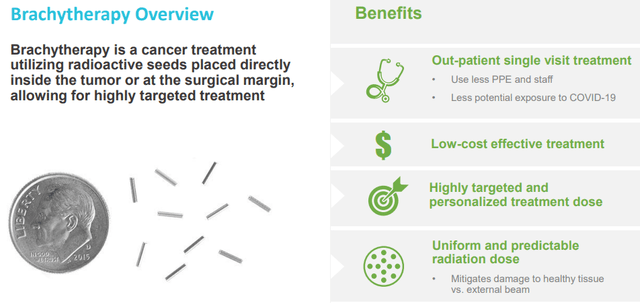

The company brachytherapy administers little seeds of isotopes, Cesium-131 in or at cancerous tissue in order to zap these with radiation, with significant benefits, from the 10-K:

Minimally invasive brachytherapy such as that provided by the Company’s Cesium-131 brachytherapy seeds provides significant advantages over competing treatments including lower cost, equal or better survival data, fewer side effects, faster recovery time and the convenience of a single outpatient implant procedure that generally lasts less than one hour

ISR IR presentation

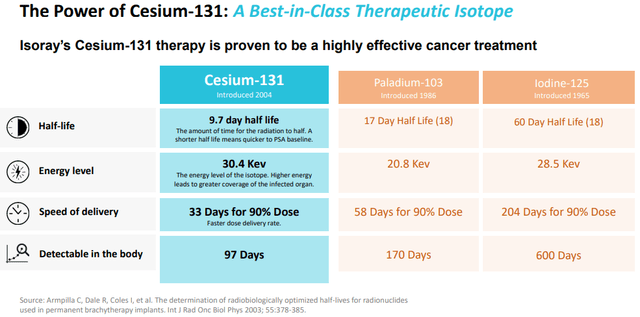

It uses a more or less proprietary isotope, Cesium-131, which it sources from two Russian reactors.

ISR IR presentation

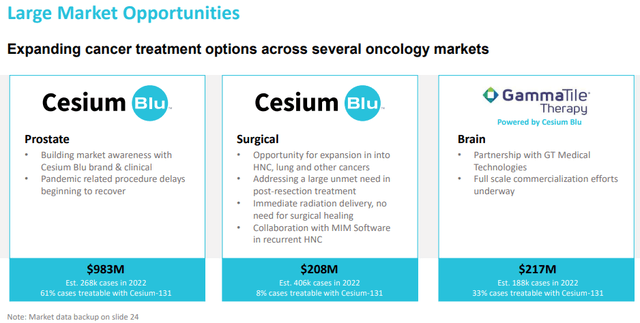

There are already 17K+ patients treated in the past 10 years. It’s mostly used in prostate cancer, but there are expansions and future expansions:

ISR IR presentation

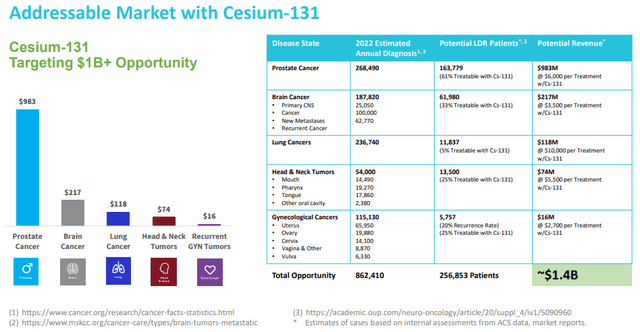

In all, they have a $1.4B TAM:

ISR IR presentation

But the worrying fact is that they’ve been approved for by far the biggest part of that already and they are not making all that much headway.

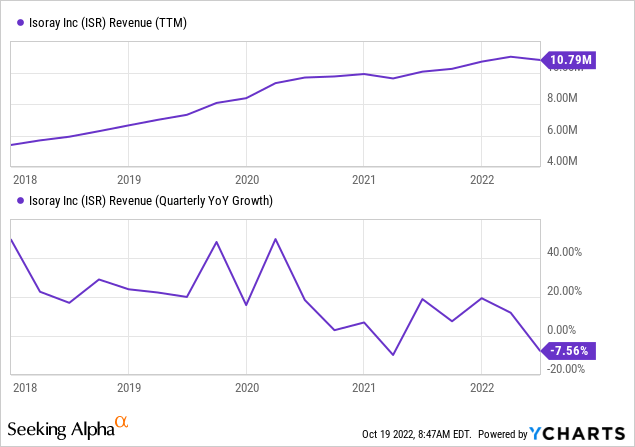

Low growth

ISR IR presentation

The company’s core business, brachytherapy for prostate cancer which is responsible for 70% of its revenue in Q4 and 75% in FY22, is not really growing, despite a host of growth drivers and a large (almost $1B) TAM.

Growth has given way to stagnation and even shrinkage. The last couple of years this was due to the pandemic which still played a role in Q4 (their fiscal year runs until the end of June), with more doctors on vacation and a resurgence in Omicron leading to postponed appointments.

Then there were additional factors like the Russian reactors closing for maintenance which left the company without its isotopes supply for a couple of weeks (they are in the process of vetting additional supply sources but that will take time).

More curious is that the expected backlog of patients that weren’t treated or even diagnosed during the pandemic still hasn’t come through the system.

The other uses (brain cancer and GammaTile) are still growing, by 6% to $744K in Q4 and by 23% to $2.74M for FY22. That’s positive, but from a small base so it doesn’t move the needle all that much.

Why the stagnation? There was an interesting discussion in the 10-K:

As such, the industry has experienced an overall decrease in the number of low risk cases of prostate cancer diagnosed due to reduced PSA screening, as well as a larger number of men who are deferring treatment altogether at a higher rate than seen historically. Intense competition in the space due to numerous established treatment options along with added entrants such as robotic surgery and proton therapy has further eroded the overall brachytherapy market share.

That is, there are three main reasons:

- Reduced screening

- Active monitoring, that is, postponing of treatment

- Intense competition

While none of these might be going away anytime soon, however (10-K):

Management believes the current review of cost effective treatment comparisons with other treatment options, the aging population worldwide and the efficacy of treatment has recently contributed to the revitalization of brachytherapy treatment for prostate cancer.

The merger with Viewpoint

Viewpoint, which came out of the University of Iowa, is developing interesting technology very similar to Isoray as it zaps tumors with isotope particles that emit radiation with the help of alpha-particle therapies and complementary diagnostic imaging agents. In order to be precise, we quote at some length from the Q4CC:

The Viewpoint team has developed a platform of unique, targeted alpha therapy radiopharmaceuticals using lead-212 that produces alpha particle radiation at the site of the tumor. It works together with complementary imaging agents, which can be used to diagnose and then treat cancers…

Our platform, which is based on the use of what are called elemental twins of lead isotopes, provides a distinctive advantage that we can see in advance how our drugs will pinpoint the tumor, which also allows us to calculate in advance in a very precise way how much radiation will be delivered to the patient’s tumor.

Our two lead candidates are in the clinical stage and are dually focused on therapeutic, as well as diagnostic use, what we refer to as theranostics. These products are VMT-alpha-NET for neuroendocrine tumors and VMT01 with its companion diagnostic VMT02 for advanced melanoma patients.

In each of these, the therapeutic isotope is lead-212 and lead-203 if used in the diagnostic. The isotope is combined with a peptide drug conjugate that is then injected into the patient. This chelator or chemical cage allows the body to transport the highly potent lead-212 particles directly to the tumor or to be eliminated quickly from the body, once the peptide and isotope attach to the cancer cells, the high energy alpha particle start eradicating the targeted cancer cells with a short half life of just under 11 hours.

Their isotope generator VMT-alpha-GEN is the size of a thermos, auto regenerates overnight, and has a shelf life of about a week. The approach has been highly successful in animal studies and are now embarking on a series of phase 1 clinical trials.

The company has a multi-billion dollar opportunity in melanoma and neuroendocrine cancers. Besides neuroendocrine tumors and advanced melanoma they have additional targets in breast, prostate and pancreatic cancers. These are large markets but since the P1 trials haven’t even started yet it’s very early days.

The company has been funded by $36M including $18M of government grants but we don’t know how much of that remains on the books and there is a considerable cash bleed as they have 30 people, most of them scientists, on the payroll and clinical trials aren’t cheap either.

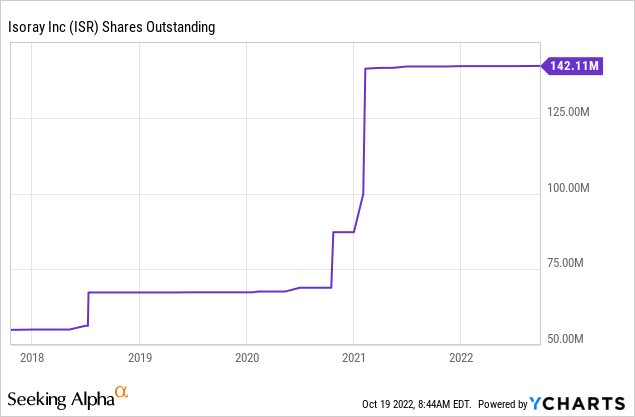

Viewpoint will become a 100% subsidiary of Isoray and Viewpoint owners will own 49% of the combined company, which will basically double the share count:

The new share count post-merger will approach 300M.

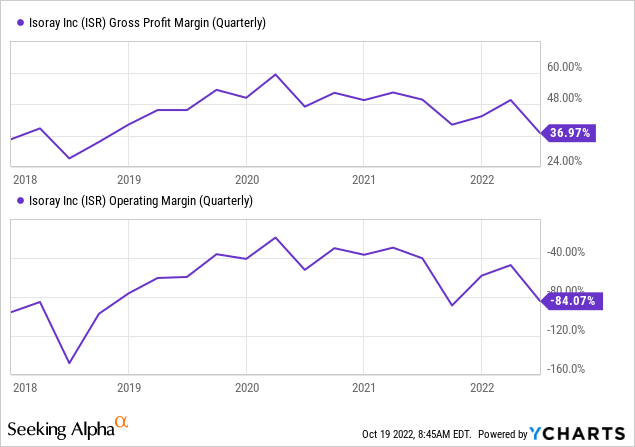

Costs are increasing

Even without adding the 30 Viewpoint employees and trial cost, the cost of Isoray was already increasing and margins shrinking as revenue growth stagnated:

Higher isotope material and payroll cost and lower sales caused the gross margin decline. Gross profits were $926K, down 31% from Q4/21. OpEx was $3.03M versus $2.44M in Q4/21 with R&D cost increasing 70% to $796K and G&A increasing from $1.31M in Q4/21 to $1.58M in Q4/22 on higher payroll cost. Net loss was $2.08M.

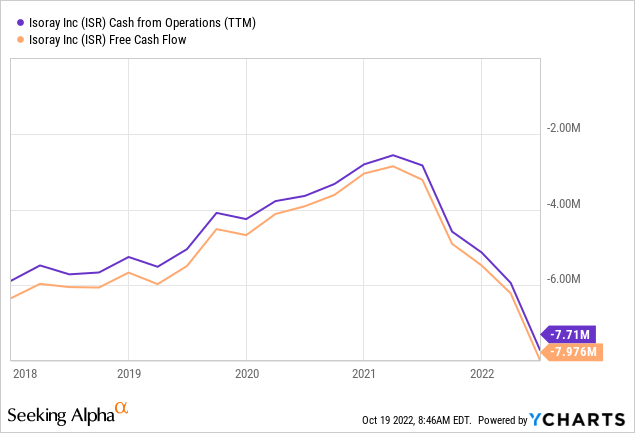

With these high and continued losses, investors will wonder how long their cash will last:

This isn’t going to improve anytime soon:

- Q1/23 revenues will disappoint and only be $1.6M-$1.8M

- The company will assume Viewpoint’s cost (which doesn’t produce any revenue)

Isoray had considerable amounts of cash and equivalents at the end of Q4, $55.9M and we don’t know whether Viewpoint will add something to that. We also don’t know what the new cash burn rate will be but given that Isoray itself has 61 employees versus 30 for Viewpoint we can expect the cash burn to increase by roughly 50%, plus the cost of the P1 trials.

Valuation

At roughly 290M shares and a $0.35 share price the company has a market cap of just over $100M and an EV of $45M. One could argue that this is a fraction of the potential of the combined companies, but a fraction is all they have achieved right now.

Conclusion

We would love to see this company do well as they offer much less invasive and cheaper treatments which produce less side effects. However:

- Revenue growth has stalled and they only have a fraction of the nearly $1B in TAM of the condition they already have been selling into, prostate cancer.

- The pandemic created obvious headwinds, which were already present due to reduced screening, active monitoring, that is, postponing of treatment and intense competition

- Costs are actually increasing considerably and will increase further when the merger with Viewpoint closes.

- Viewpoint’s therapeutics are undoubtedly promising and have a similarly large TAM, but are in the early stages yet so they won’t generate revenues for quite some time.

- While the company still has a large amount of cash, cash burn has been rapidly increasing and will increase further as a consequence of the Viewpoint merger. It’s still likely to last the company a couple of years though, there is certainly no immediate need for cash.

Be the first to comment