nicoletaionescu/iStock via Getty Images

I’m not against a straight-up buy & hold strategy with something like Silver. If I hold it like that, it replaces a small portion of a “cash”-like portion of my portfolio. I don’t love to buy & hold with most commodities as part of an aggressive allocation. However, there are great diversification benefits of adding a commodity (like silver) to a portfolio that’s not already rich with the stuff. I’m very interested in diversification and how to take a portfolio through tough times. It’s the primary reason why I’m focused on special situation investing (investments that aren’t as dependent on general market trends).

My experience with commodities, in general, is these behave a bit differently from either stocks or bonds. They aren’t the most profitable in an absolute sense (most of the time), but at times, it’s the only thing holding up. Why are my general return expectations for silver pretty low? Well, basically because we’re still mining more at a pretty good clip. It’s expensive enough where it pays to recycle some of it, and our technologies to do either is still improving.

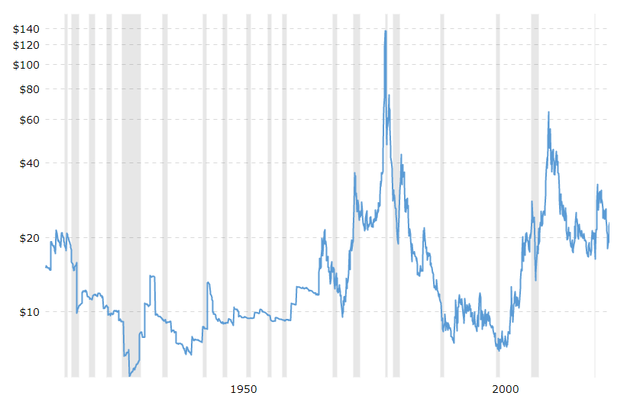

Demand for silver isn’t growing much faster than supply over the long term. However, things are changing on that front, as silver supports many technologies related to the energy transition. Until today, though, the price hasn’t changed that much over the past 100 years:

Do keep in mind the chart is inflation adjusted, so you could argue it has outperformed inflation, which isn’t half bad. The volatility is staggering, though, so definitely not a great store of value in isolation.

Meanwhile, the biggest economy in the world has recently thrown its weight behind said energy transition through the “Inflation Reduction Act.” Around ~$400 billion is earmarked to address energy security and climate change. This could turn out to be a powerful tailwind. Silver is used in the production of solar cells. According to the Silver Institute, this is how it’s used:

Silver powder is turned into a paste which is then loaded onto a silicon wafer. When light strikes the silicon, electrons are set free and the silver – the world’s best conductor – carries the electricity for immediate use or stores it in batteries for later consumption.

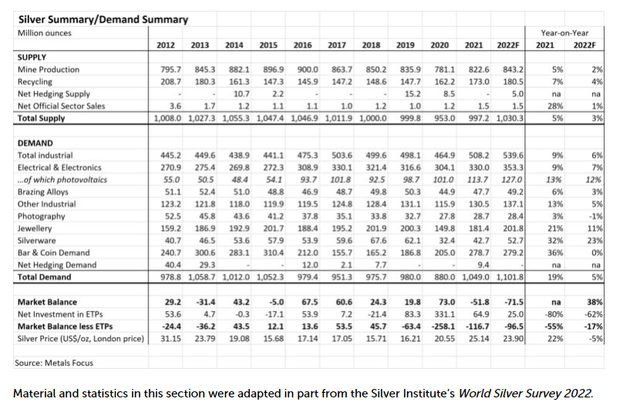

The Silver Institute has been tracking the supply and demand for silver for quite some time, and recently (2021/2022) we’re in a slight supply deficit.

Silver institute supply/demand picture (Silver institute)

Use in solar cells is currently accounting for 10% of silver demand. Ten years ago, this industry accounted for around 4% of silver demand. If it grows another 150% over the next decade, the impact on the total demand will become much more significant.

But silver isn’t just used in solar panels. It is the most conducive of metals and is used in many electronics (the most significant category currently and growing high single-digits per year). One subset of the electrical & electronics category is vehicles and, more specifically, electric vehicles. At least 15 countries are now banning sales of new combustion engines over the next decade or so. This transition is another powerful tailwind.

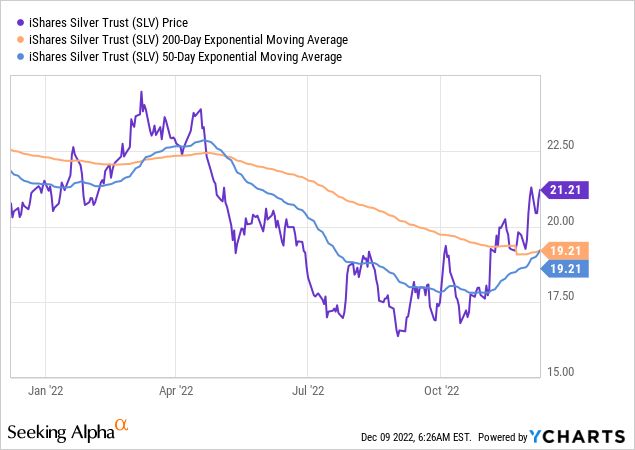

Given the above tailwinds and the interesting diversification benefits to my portfolio, I’ve been interested in taking a stab at incorporating silver. I think things are lining up nicely to do so. I’m not big on technicals, but it is worth mentioning the metal recently crossed its 200-day moving average. The 50-day is just crossing the 200-day to the upside, in case you care about these signals.

As I said, I’m not in love with technicals. It does look like the trend could be changing from bearish to bullish. Meanwhile, we’re also moving into what’s been historically a strong seasonal period for silver. I’m not sure for the reason why, but between halfway through December until 2/3rds through February, silver tends to perform well. According to Seasonax data (based on nearly 60 years of data), if you buy on the 15th and sell on the 23rd of the next February, the average annualized return (historically) would have been ~37%. The average return on a position would have been 7% and the median return around 5%. Of the 54 years of date, there were 40 years where this period showed a positive return. I’m not sure of the reason behind the strong seasonality, but it is an additional positive data point.

To bet on silver, there are perfectly fine futures for those who know how these work. A very convenient option is to buy the iShares Silver Trust (NYSEARCA:SLV). It has a 0.5% fee, which is a drawback.

As a Euro, the SLV ETF actually isn’t directly investable to me. There are other exchange-traded funds (“ETFs”). But what I’ve done instead is implement a synthetic long future position through the SLV options. I bought the $21.50 call contract and sold the $21.50 put contract. Graphically, the position looks like this:

synthetic future silver position (Optionstrat)

If SLV moves above $21.79, the position becomes profitable. On the flipside, below $21.79 the position remains unprofitable and the maximum loss on a contract is $2179. For that to happen, SLV needs to go to zero, however.

Be the first to comment