carterdayne

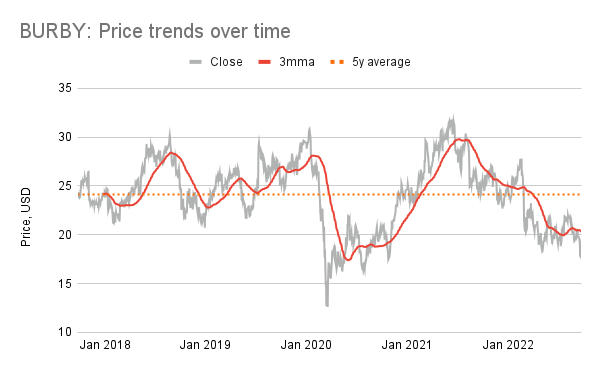

British luxury brand Burberry Group plc (OTCPK:BURBY) was up 7.7% at the last close (28 September). This adds to gains made over the past week, rising by 6.9% at the time of writing, even though the S&P 500 (SP500) was relatively flat during the period. This is in sharp contrast to its weak price trends seen this year, calling for a closer look at whether this could be the start of a trend or if it’s just a one-off rise.

The analysis reveals that while the company’s performance is strong despite a high-pressure macroeconomic environment, there are risks, too. These include its vulnerability by virtue of operating in a cyclical sector in a slowdown, especially in its big Chinese market. The risks ultimately outweigh the positives, encouraging a wait-and-watch approach for now.

Burberry’s stellar performance

The biggest challenge for consumer cyclicals right now is sluggish demand. But Burberry has performed well, with revenue growth for the financial year ending 2 April 2022 (FY22) at 20.6% YoY. This is because of a low base, since it saw an 11% decline in 2021, but even compared to FY20, its growth is at 7.3%. Even if we consider that FY20 too was a relatively low base since China was impacted by COVID-19 as early as 2019, it’s notable that the company has managed to grow since even FY19, albeit by a smaller 3.9%.

It continues to make progress in FY23 as well. As per its latest trading update for the 13 weeks to 2 July, it showed a 5.4% YoY retail revenue rise. And this is despite the continued lockdowns in China. The latest growth is driven by positive momentum in the Europe, Middle East, India and Africa (EMEIA) market with a 47% rise in comparable store sales in the first quarter, indicative of its strength as a geographically diversified multinational company.

Inflation proof, debt in check

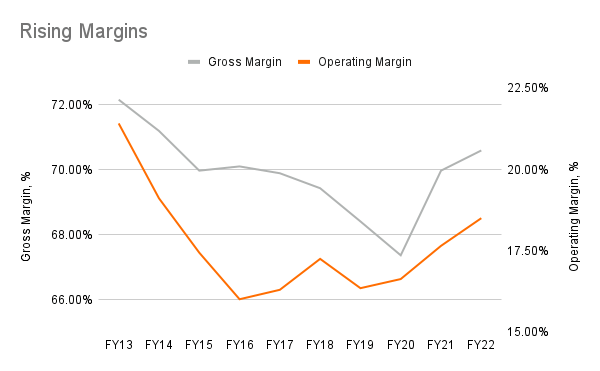

It’s also weathering the sharp increase in inflation quite well. Its gross margin, at 70.6% for FY22 is high in any case, but it’s also the highest seen in eight years, as is its adjusted operating margin at 18.5%. This is saying something considering its operating costs are up by a significant 18% YoY. It follows that Burberry’s profits growth has been strong too, with a 32% YoY rise in its adjusted operating profits, though its reported operating profits saw a much smaller increase of 4% as did its net income, of 5.3%.

The big picture, however, suggests that not only is the company keeping its head above the water but is probably having no problems passing on increased costs to customers. Burberry’s is also well-placed in a time when high inflation is necessitating interest rate hikes. This is evident in the fact that its current ratio is at a healthy 2.5x while its debt-to-equity ratio at 0.9x remains contained.

Seeking Alpha

Fair market valuations

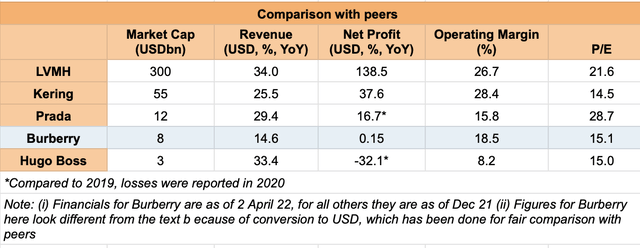

Compared to other consumer discretionary companies, its market valuations are high. Its twelve months trailing price-to-earnings (P/E) ratio is at 15.1x compared to the sector average of 11.7x and its forward P/E is at 13.2x while the sector average is at 12.5x. However, the more accurate comparison is with other luxury stocks, which shows that it appears more fairly valued.

Among the five luxury stocks compared (see table below), the modal P/E value is at around 15x, which makes Burberry’s valuations exactly on point keeping relative financial performances in mind. It was compared with four European stocks – LVMH, Kering, Prada and Hugo Boss – across the three metrics of revenue growth, net profit growth and operating margin. Burberry’s performance is most lacking in revenue growth, while its net profit increase is only better than that of Hugo Boss, which showed a decline in income. It fares better than both Prada and Hugo Boss in terms of operating margins. However, in totality, this comparison doesn’t make a case for higher valuations at all. Kering, for instance, has a better performance across indicators, but its P/E is not very different from Burberry’s.

Seeking Alpha, Author’s Estimates

Weak share price momentum and China are big risks

There are other challenges for the Burberry price too. The trends are weak (see chart below), with a largely downward movement in its three-month moving average (3mma). This could be seen as a positive to the extent that there’s little reason for the Burberry price to be trading near its 2020 lows when its financials are as robust as they are at present. However, going by the bearishness in the broader markets and the fact that its market valuations don’t justify a rise, suggests that the weakness could continue.

Yahoo Finance, Author’s Estimates

This risk is exacerbated by the fact that the Chinese economy is expected to grow at just 3.3% in 2022. This is at least in part because of the strong base effect from the 8.1% rise seen in 2021. However, continued lockdowns there have likely played a role as well and in 2023 too, growth is expected to recover only to 4.6%, which is below its pre-pandemic growth levels. Burberry’s revenue growth is unsurprisingly closely correlated with Chinese growth, with a correlation coefficient of 0.84 over the 2014-21 period. This indicates that the company’s sales could continue to be dragged down, which is disappointing at a time when they are already lagging behind peers’ revenue growth as seen from the table above.

Change of guard

Further, Riccardo Tisci, who was the company’s Chief Creative Officer until recently has just stepped down after a five-year stint. During his time, Burberry has seen improved performance, even though much of the period was marked by the long COVD-19 setback.

The new creative head is Daniel Lee, who reportedly has strong experience, especially in categories like shoes and bags. This could be instrumental in giving a push to revenue growth, since leather goods have performed well outside of mainland China, with a 21% comparable sales growth as per its latest trading update. With a spurt unlikely from China in the foreseeable future, it could be a savvy strategic move to focus on a winning category outside of it.

It’s worth noting that the Burberry price responded positively yesterday to the announcement of his appointment. At the same time, reports also flag that Burberry is a bigger brand than Lee has experienced so far. This change of guard follows the appointment of Jonathan Akeroyd as Chief Executive Officer earlier this year, indicating that the company’s in flux right now.

Wait and watch

In sum, the odds appear to be stacked more against Burberry than not. The company’s operating in a challenging environment, with continued risks to its markets. Changes in top management this year add to uncertainty about its future performance. Its valuation further suggests that there’s little upside to it for now, which isn’t encouraging at a time when Burberry’s price has been falling fast. Yet, it’s hard to overlook how well the company has performed against multiple macroeconomic pressures. If it’s able to keep up with its financial growth, its price could rise. As of now, though, it’s better to wait and watch.

Be the first to comment