Ismail Rajo/iStock via Getty Images

Opportunity Overview

One of the challenges of investing in emerging markets is finding the right vehicle as a retail investor. This article will cover some of the challenges of accessing Indonesia’s stock market on U.S. exchanges:

-

There used to be a U.S.-listed CEF (closed-end fund) (Aberdeen Indonesia Fund), but this option is not available.

-

Other funds (i.e., Fidelity’s Indonesia Fund) have higher fees relative to this Indonesia exchange-traded fund (“ETF”).

-

Indonesian ADRs have extremely low liquidity, so there are very few options available.

- It would be hard for retail investors to replicate the index/fund performance due to the higher trading fees and lower liquidity of U.S. OTC listings. It is difficult to directly invest in Indonesian equities.

Therefore, the iShares MSCI Indonesia ETF (NYSEARCA:NYSEARCA:EIDO) is one of the best and easiest ways to gain access to the market:

-

The fee for this ETF is very low (0.59%) and it invests directly in Indonesian equities that are hard for retail investors to access.

-

There are not any major tracking errors or other issues with this ETF, as it very closely follows the MSCI Indonesia index.

-

The main issue is that nearly half of the fund’s assets are invested in financials. Bank’s NIMs will not benefit from rising rates.

-

Indonesia’s macroeconomic performance has been pretty impressive relative to other emerging markets.

Indonesian macroeconomic state is intriguing, and capital markets should do well during the next decade:

-

Indonesia is the world’s 4th most populous country and 14th largest economy.

-

The stock market cap of around $540 billion lags behind regional peers such as Singapore, Taiwan, Thailand, India, and South Korea.

-

Inflation has been tame relative to other emerging markets.

-

However, Indonesia is not immune to broader turmoil that may occur to emerging market equities.

I plan to watch the market and accumulate during the next 1-2 years. I will gain exposure to Indonesia by investing in the MSCI Indonesia ETF and 1-2 other ADRs that provide direct exposure to domestic consumption.

No Closed-end Fund Option

Closed-end funds are often one of the best ways to gain exposure to international markets. Although most of these funds mainly trade at an approximate 10% discount, you can access them at 15-20% when sentiment is not as favorable and sell later at a 10% or lower discount. Moreover, most ETFs provide exposure to the market and are not betting on specific stocks, and most closed-end funds resemble ETFs. One of my favorite closed-end funds in Indonesia that I covered in 2015 is no longer an option, as the fund’s assets were acquired in 2018.

The MSCI Indonesia ETF

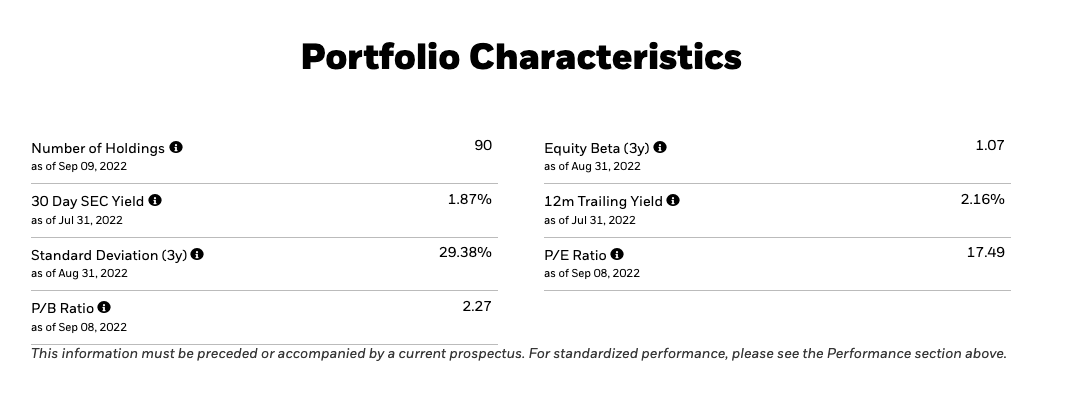

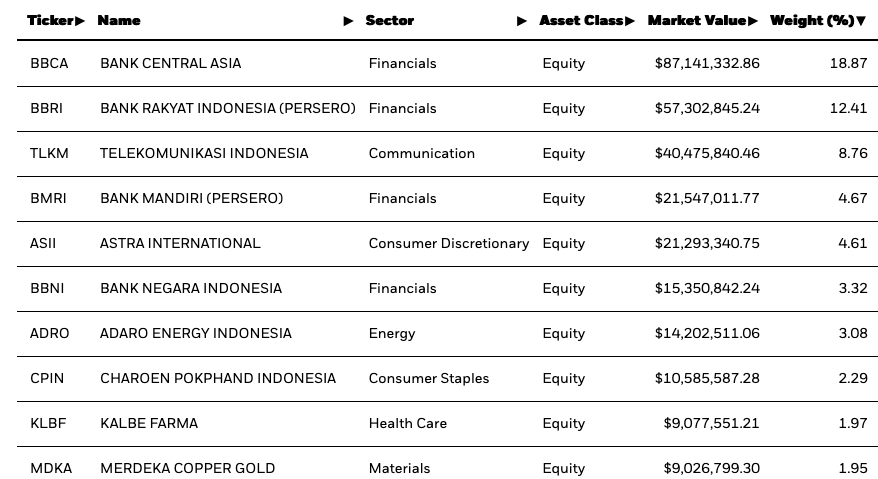

The MSCI Indonesia ETF invests directly in Indonesian equities and only charges a 0.59% fee. The ETF invests in 90 companies in Indonesia and primarily invests in banks. The ETF is able to closely follow the index, as it does not invest in other unrelated international equities that provide limited exposure to Indonesia.

iShares

The top 10 holdings of the ETF account for around 62% of the fund’s total assets, and four out of ten of these companies are banks. Consequently, many small and mid-caps do not significantly impact the ETF because they represent less than 1% of the ETF’s assets.

iShares

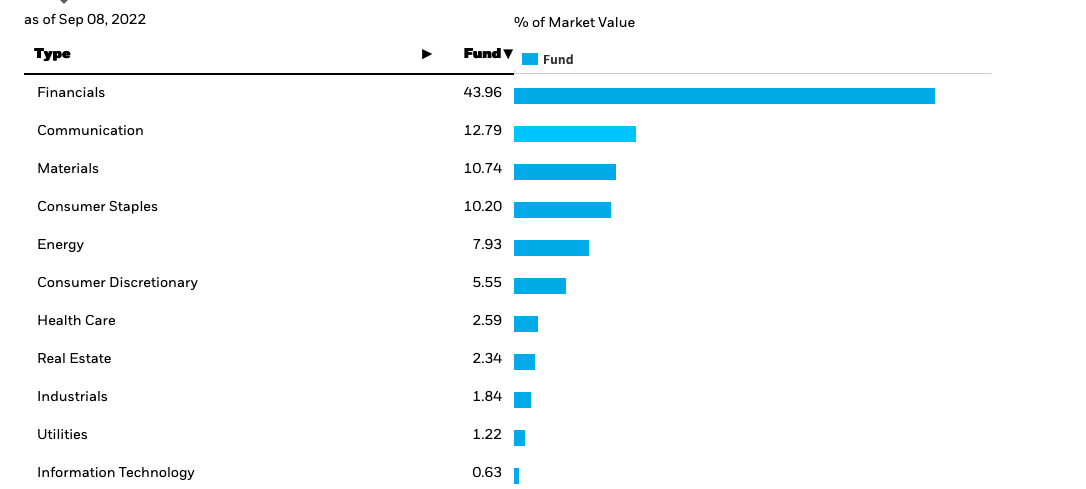

One of the key risks of this ETF includes the fact that around 44% of its assets are invested in financials in Indonesia. Moreover, there is lower to other favorable themes such as consumer and healthcare companies. Furthermore, banks in Indonesia are not significantly benefitting from rising interest rates. Indonesia’s benchmark interest rate was only 3.5% as of August 2022, much lower than many emerging market peers. However, NPLs have been steady at around 2-3% during the past 5 years.

iShares

However, this ETF industry exposure is not uncommon, as financials are usually the largest industry in these ETFs, mainly because most large-cap companies are banks. Industry diversification could result in liquidity challenges for the ETF provider.

Value Stocks in Indonesia

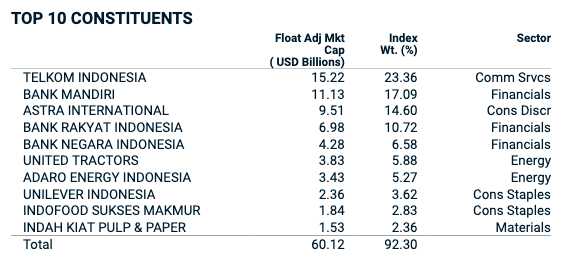

The MSCI Indonesia ETF follows the MSCI Indonesia Index, which trades at around 16x earnings, and primarily invests in financial companies. It is always interesting to observe locally listed value stocks and to see why they trade at a discount to the broader index. This can usually occur because of low liquidity, lack of research coverage, and also because the company is in an inferior industry. The MSCI Indonesia Value Index is intriguing because it trades at 10.7x forward earnings and has multiple consumer companies in the top 10 holdings.

iShares

However, in this case, the valuation does not appear to be primarily due to industry choice, as there are also many consumer companies in the top 10 holdings. An index heavier in energy or materials in a frontier/emerging market usually trades at a lower single-digit P/E ratio. Romania is a good example of this.

Overall, it appears that there could be some consumer names to shop for that trade in line with, or at a discount too, the broader market, while also offering superior growth prospects. Some of these above stocks can be accessed on U.S. exchanges (U.S. OTC listings), so this is an option to consider if you want to access Indonesia at a lower valuation.

Investing in ADRs

There are several options available if you want to invest in ADRs, but there are several issues to consider:

-

The liquidity for many of these is very low.

-

Brokerage fees can be expensive, and not logical if you are making smaller trades (you would need to invest $1,000 or more in a company for it to be worthwhile).

-

Thinly traded U.S. OTC stocks can sometimes trade at a discount to local listings.

Telkom Indonesia is the most liquid option, and since it does not trade OTC, investors do not have to pay trading fees with most brokerages. Astra International is one of the best bets to consider if you are trading OTC, as the liquidity is suitable. As you can see, three of these stocks do not even have a daily turnover exceeding $1,000. Most of these stocks are likely out of reach for most investors because of the extremely low liquidity. Stocks like these can also have a higher bid-ask spread, which can further complicate things. Furthermore, some brokerages will charge $7 or more to buy some of these companies, so the fee is not worth it unless you have a strong interest in Indonesia. A $7 fee on a thousand-dollar investment would be around 70bps.

The ETF, on the other hand, invests directly in some of these smaller names on the local market in Indonesia, where there can be greater liquidity. Overall, it is nearly impossible for a retail investor to attempt to replicate the ETF performance, mainly due to the higher fees, but also because of the lower liquidity associated with some of the US OTC listings.

ETF Global Comparison

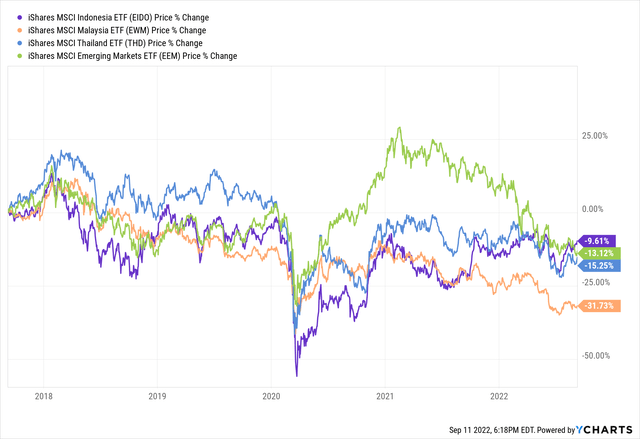

Indonesia has been a relatively safer bet in emerging markets and deserves more attention, in my opinion, because of the demographics. Emerging markets have been out of favor for the past five years and likely will have another rough year. But emerging markets are certainly due for a bull run later this decade.

Indonesia has outperformed regional emerging market peers, as well as the iShares MSCI Emerging Markets ETF (EEM).

Takeaway

When limited to U.S. exchanges, the best option is to initiate a position in the Global X MSCI Indonesia ETF, and perhaps add one or two ADRs. I plan to follow this ETF and Telkom Indonesia for the time being.

Be the first to comment