monstArrr_/iStock via Getty Images

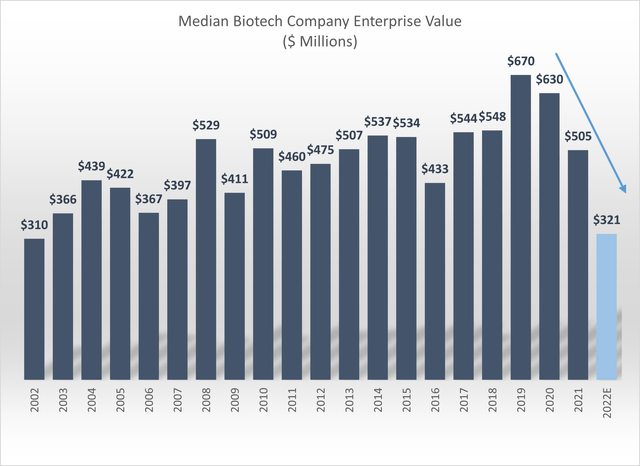

The US biotechnology sector has been an absolute loser so far in 2022. S&P Biotechnology index is down 60% from its 2021 highs. The investment community remains concerned about inflationary pressures in the US, the monetary tightening and the ongoing global geopolitical tensions.

We have hardly seen any major acquisitions so far in 2022. Well, that might change very soon as big pharma companies are having troubles with the expiration of patents.

M&A activity

In 2021, against the backdrop of record highs in the biotech sector, M&A activity in it has fallen to a multi-year bottom, and after such a large drawdown, many mid-sized biotech firms may be of great interest to large companies as cheaper targets for acquisitions. According to Fierce Biotech, big biopharmaceutical companies have more than $1.7 trillion in cash. So, big pharma has enough money to flood the M&A market with.

Many of the major pharmaceutical companies are facing patent expirations on key drugs and their interest is shifting towards biotech developments, which have been growing rapidly in the last couple of years. At the same time, it is much more convenient to acquire biotech firms with already launched studies that have shown good preliminary results than to start their own from scratch.

Potential deal makers

Pfizer is a company that has earned a lot on the COVID vaccine as Comirnaty revenue reached $36.8 billion in 2021. Pfizer is the one who can become a key deal finder. The pharmaceutical giant has a lot of free funds for acquisitions and is probably already looking at promising objects.

Pfizer (NYSE:PFE) has already bought Biohaven for $11.6 billion. That was the only major (above $5 billion deal size) pharma deal in 2022. I think that given the size of the company and the cash it has on hands, Pfizer will hunt for more.

Vertex Pharmaceuticals (NASDAQ:VRTX) also has acquisition resources and I believe could consider its $5.4 billion market cap CRISPR Therapeutics (NASDAQ:CRSP) research partner for this purpose. In 2021, Vertex developed a preliminary agreement. Vertex agreed to pay $900 million to CRISPR and cover 60% of the cost of development of investigational gene-edited therapy CTX001 in exchange for 60% of profits. Vertex and CRISPR are long-term partners and if the combo will be able to commercialize CTX001, the deal will look like a logical step for Vertex.

Vertex has a market capitalization of $65 billion and is an extremely interesting target for a potential takeover itself. Thanks to its status as a virtual monopoly in the treatment of cystic fibrosis, the company manages to defend high prices for its drugs and to obtain government funding for treatments for citizens. It might be a huge deal for Pfizer, for example, to get access to an enormous market like this.

We know that biotech M&As are not limited in scale. Even larger deals in the pharmaceutical sector happened earlier. For example, in 2000, Pfizer acquired Warner-Lambert for $90 billion and in 2009, the same Pfizer acquired Wyeth for $68 billion. We also saw massive acquisitions in recent years. In 2019, Bristol Myers (BMY) acquired Celgene for $74 billion and in 2018, Takeda Pharmaceutical (TAK) bought Shire for $62 billion.

How to play it

M&A activity recovery is a positive sign for the industry. Stocks are likely going to recover as smaller companies will get the premium acquisition valuation to their current market price and larger companies will become larger as the growth through acquisition will help them to gain massive competitive advantages. Acquisitions help large companies to align their pharmaceutical portfolios in response to the changing strategy.

M&A deals are also leading to market consolidation: 35 years ago in 1987, the top 10 pharmaceutical manufacturers accounted for about 12% of sales. However, after 15 years, by the beginning of the 2000s, this figure had reached almost 50%. An attempt to capture a larger share of the market is likely to be perceived by investors as a positive signal.

With that being said, it makes more sense to buy an ETF instead of individual stocks as it is less risky since you bet on the whole industry instead of one company.

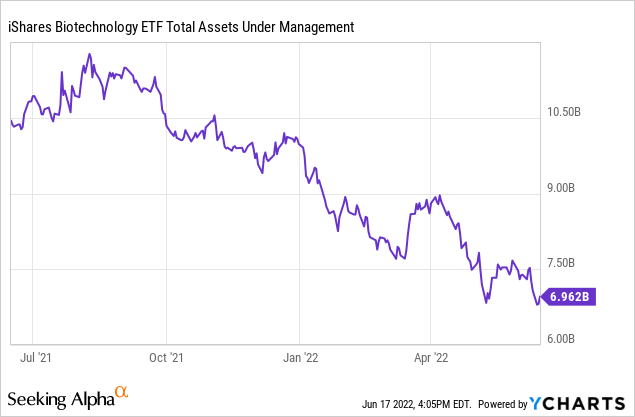

The iShares Biotechnology ETF (NASDAQ:IBB) is an exchange-traded fund that seeks to track the ICE Biotechnology Index, which in turn includes shares of biotech and pharmaceutical companies listed in the United States. As of March 2022, the ETF portfolio includes shares of 373 issuers traded on the NASDAQ exchange. The fund is managed by the investment holding Blackrock, the management fee is 0.45%. The value of assets under management as of 17th of June, 2022 is $6.96 billion.

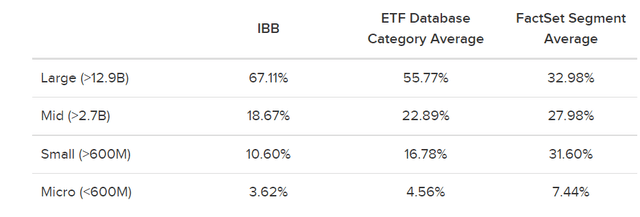

The fund consists of large-, mid-, small- and micro-cap companies.

I believe that IBB is the best way to play the upcoming M&A drama since there is no point in holding a bunch of small-caps hoping that it will eventually be bought out. It is much better though to hold large-cap companies since acquisitions will regain investors’ trust as these companies will enter new profitable markets or strengthen the positions in the markets that they have already captured.

| IBB | Closest peer (XBI) | |

| AUM | $6.96 B | $3.69 B |

| Expense ratio | 0.45% | 0.35% |

| Large-cap companies share | 67.11% | 12.24% |

| 10-yr return | 155% | 131% |

Conclusion

M&A activity in biotech has noticeably eased in 2021, but after a significant drawdown, many mid-sized biotech firms could be of great interest to large companies as depreciated acquisition targets.

M&As return is the reason why I think that IBB is going to recover soon.

I believe IBB is a buy.

Be the first to comment