Osamu Takeishi/iStock via Getty Images

Japanese stocks are looking increasingly attractive relative to their developed market peers thanks to cheaper valuations, continued improvements in returns on equity, and, perhaps most importantly, an incredible degree of currency undervaluation. Despite its relatively high expense ratio compared to the current dividend yield, the iShares MSCI Japan ETF (NYSEARCA:EWJ) looks highly likely to outperform its peers.

The EWJ ETF

The EWJ tracks the performance of the MSCI Japan index, while excluding the bottom 15% of Japanese companies by market cap, which tilts it slightly larger than the benchmark. With a huge AUM of USD11.3bn and an average daily volume of USD446mn, the ETF is highly liquid. The ETF is also among the most diversified major equity markets, with the largest stock, Toyota, making up just 5.5% of the index and the top 10 stocks making up just 24%. The biggest drawback is the 0.51% expense ratio which is particularly high relative to the dividend yield of just over 2%.

Undervalued Relative The International Average

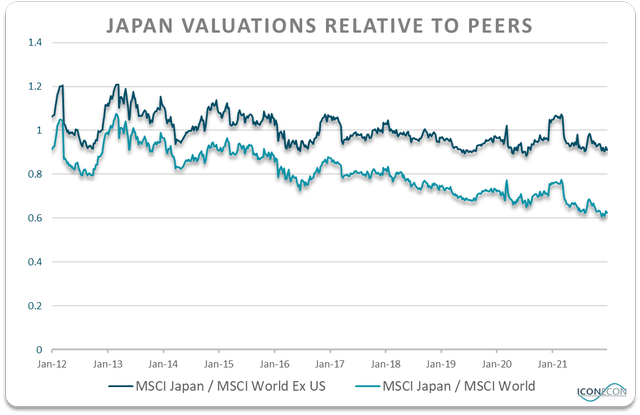

The EWJ’s underlying MSCI Japan index trades at a steep discount to the U.S., as well as a discount to its international peers. The chart below shows the valuation ratio of the MSCI Japan over the MSCI World and the MSCI World ex-U.S. index, based on an average of forward PE, EV/Ebitda, Price/Sales, Price/Book, and Price/Dividend.

Japan Valuations Vs DM Peers Bloomberg

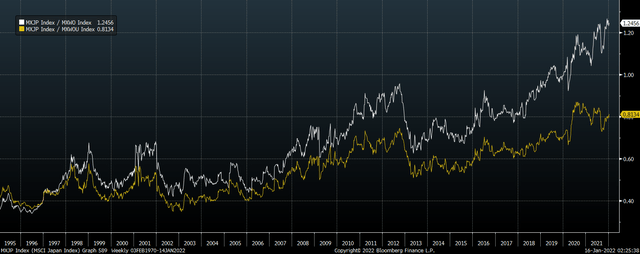

While Japanese stocks have long traded at a discount to their peers in terms of their price-to-book value, they now trade at a discount on every metric including the dividend yield. The following chart shows the MSCI Japan’s dividend yield relative to the MSCI World and the MSCI World Ex-U.S.

In just 9 years, the MSCI Japan’s dividend yield has doubled relative to the MSCI World, and is now 25% above it. This is testament to the systemic improvement in corporate governance that has been seen in Japan over this time, which looks set to continue over the long term.

MSCI Japan Dividend Yield Vs MSCI World And MSCI World Ex-US Bloomberg

Corporate Governance Improvement Set To Continue

The rise in Japanese dividend payments reflected in the above chart has resulted from a combination of factors that have driven companies to raise returns on equity and increase shareholder returns. Since 2012 in particular, with the re-election of Prime Minister Shinzo Abe, Japanese companies have benefitted from a series of regulatory and policy initiatives that have aimed to increase capital efficiency and promote cooperation between management and investors. The Corporate Governance and Stewardship Codes, efforts by the Tokyo Stock Exchange to encourage independent board directors, and a shift in investor behavior, have combined to see Japan’s corporate governance environment move closer towards what we see in the U.S.

A recent article by investment firm GMO does a great job of explaining the encouraging trends in place in Japan’s corporate sector. The article notes that while shareholder activism was previously unheard of in Japan, today the country is home to the second largest number of companies targeted by activist investors. The article also argues that cyclical drivers explain about 40% of the changes in Japan’s long-term profitability, with the remaining 60% of the change due to secular factors. GMO also notes that while dividend payouts have improved markedly, they have not kept pace with profit and free cash flow growth, leaving balance sheets more bloated. As company management and outside shareholder interest focuses more on managing balance sheets, they see significant opportunities for boosting shareholder returns.

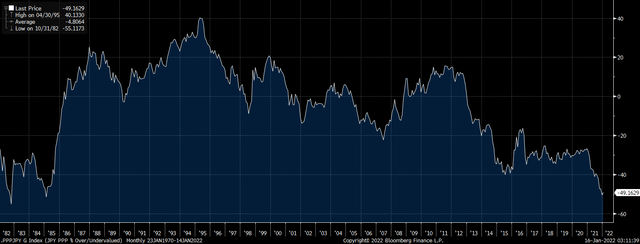

The Yen Is Deeply Undervalued

As a dollar-based ETF the performance of the yen can have a material impact on the performance of the EWJ, and the good news here is that the currency is almost 50% undervalued in real effective terms, even after last week’s strong rally. As the chart below shows, the yen is currently trading 49% below its fair value relative to the U.S. dollar in purchasing power parity terms. This is a level not seen since the 1980s.

JPY % Undervaluation In PPP Terms Bloomberg

It is extremely likely that the yen outperforms the dollar over the coming years from such an incredible starting point, and this should help the EWJ to outperform its peers. Furthermore, the yen’s tendency to outperform during periods of global risk aversion should provide a degree of support to the EWJ in the event of a period of global equity weakness. During the 2008 crash, for instance, the surge in the yen allowed the EWJ to outperform the MSCI World by around 25% during that year.

Be the first to comment