jetcityimage

The iShares U.S. Treasury Bond ETF (BATS:GOVT) is a US Treasury ETF with a decent amount of duration. As we start wondering where rates will peak, with the first sign of faltering inflation showing itself, duration isn’t such a bad thing. Among these higher duration ETFs, GOVT has two distinct advantages. The first is the exceptionally low expense ratio. The other is the relatively higher YTM than what bonds of a similar duration would command. Quite simply, GOVT is a buy for those with a bond ETF appetite.

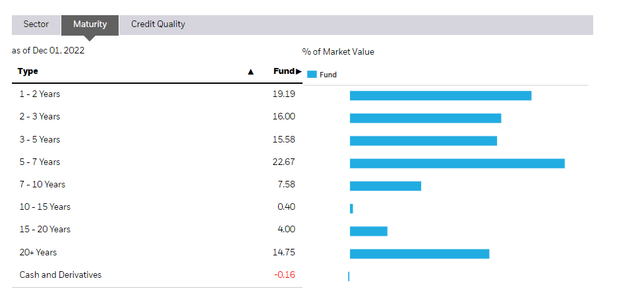

GOVT Breakdown

It all comes down to yield curve. Before speculating on where it could end up, a good place to start is where it is. Currently, bonds with 10 years to maturity are issuing at 3.48% YTMs. The average modified duration of GOVT is between 6-7 years, which is about consistent with what the maturity would be for a 10 year coupon bond.

The average YTM of GOVT is substantially higher than that YTM. Average YTM is 3.93%, which gives you almost a 0.5% bonus to the rate for the same non-existent AAA Treasury credit risk.

Part of the reason is likely that GOVT has a variety of maturities. It has shorter term bonds that are higher YTMs now, and then average up the duration with some very long-term bonds at the other extreme end of the tail. Still, the average YTM should be as high as a single bond with an equivalent duration, which is what defines the risk of the bond in a rate-volatile environment.

Bottom Line

Besides the value angle, there are the general macro considerations that might have investors favouring higher duration bonds nowadays. CPI has come off highs sequentially. Cost-push factors that were big concerns like logistics have recede meaningfully. Energy is still an issue, but in general if there is less pressure on logistics, the cost of a lot of trade goods should start going down, especially as inventories are able to build once more, and utilisation of manufacturing can finally come down. The whole point of rate hikes were to calm down the goods boom, and that is happening. CPI likely has peaked.

Considering that, rates should be peaking soon too. We still believe investors are jumping the gun with recent bidding up of the markets, and related depreciation of the dollar. Firstly, the Fed will have to stomp out expectations of inflation. It is critical to do this and they have made it clear that this is an essential part of the plan. Rates will have to continue to rise to stop things like rent inflation and food inflation spurring a wage-price spiral. There’s no evidence of wage-price spiral yet, but the Fed will risk nothing here. Rates will keep rising. The other thing is the jobs reports continue to show strong US demand, meaning demand push factors aren’t receding in the price level equation. This will incentivise rates up more.

We are actually getting a soft landing in the US, not in Europe though. This is good for asset prices, but is maybe not so great for longer duration issues because it means more scope for rate hikes and consequent price declines in longer term bonds. On the other hand, the Fed may be able to score some economic points by not raising rates much further, or at least be able to reset them to the level implied by the current yield curve. If that happens, the value proposition discussed above applies.

GOVT also has a very low expense ratio of 0.05%. Therefore, net of expenses, YTM is still above fair levels implied by the yield curve. It might be a little early for buying duration, but GOVT is good value within the higher duration category.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment