Just_Super/iStock via Getty Images

Thesis

Now is an interesting and challenging time for investors. Equity valuation is near a historical record high and inflation is enough to make real treasury rates negative. To top it off, we also have a major conflict undergoing in the Russian-Ukraine region. Under such uncertain times, precious metals have become appealing as an effective tool for hedging and capital preservation. And both the iShares Gold Trust ETF (NYSEARCA:IAU) and the SPDR Gold Trust ETF (NYSEARCA:GLD) offer convenient exposure to investors.

In particular, you will see 3 reasons to consider adding gold to your portfolio now.

- The first two reasons are to hedge against volatility and inflation. In the short term, gold helps to stabilize our portfolio. And in the long-term, they have been effective fighting inflation. And the underlying reasons are because of its role both as a currency metal and also its extensive commercial applications.

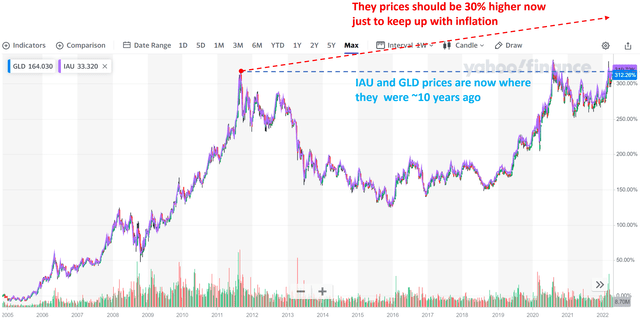

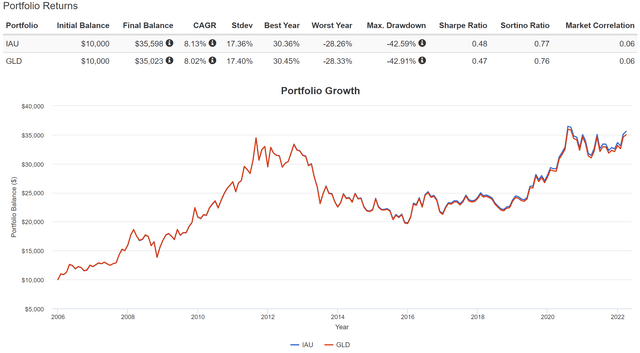

- And third, there are favorable odds for its price rebound after years of compression. Our view is that gold price now is overdue for an upward correction. As you can see from the chart below, both IAU and GLD prices are currently where they were about ten years ago. Their price should be at least 30% higher now just to keep up with inflation in the past decade. Besides the surging inflation and negative interest mentioned above, there are other catalysts to trigger a price decompression. For example, the war between Russia and Ukraine is disrupting the supplies of major commodities (which in turn may even exacerbate the inflation).

- Finally, this article also analyzes the similarities and differences between IAU and GLD. You will see why we prefer IAU ourselves for its lower costs and situations why you may prefer GLD for its better tradability.

How we use gold in our portfolio?

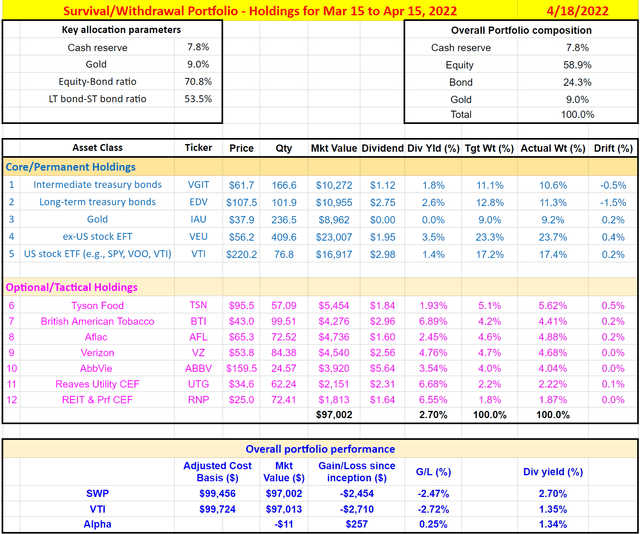

Under the above background, the following two charts show the detailed holdings in our SWP (survival/withdrawal portfolio or sleep well portfolio). The first chart shows our positions. You can see we hold about 9% of IAU and we will explain why we prefer IAU over GLD later. We performed our account maintenance regularly during the mid of each month. And this month, we performed it right after the market opened on April 18. And all the prices information shown below was taken around 10 am Eastern Time.

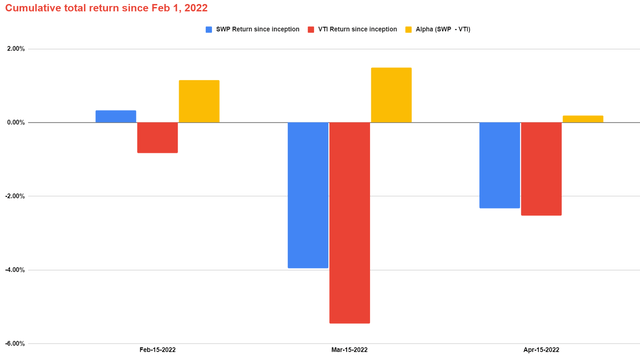

And the second chart shows its performance since Feb 1, 2022 (since we launched our marketplace service even though we have been using this portfolio strategy for more than a decade). Thanks to the balanced and disciplined approach, our portfolio has been outperforming the overall market consistently both on a monthly basis and also on a cumulative basis. Especially during the past few months, our SWP has benefited from our gold positions (and we also held some silver in our aggressive growth portfolio).

IAU and GLD: basic information

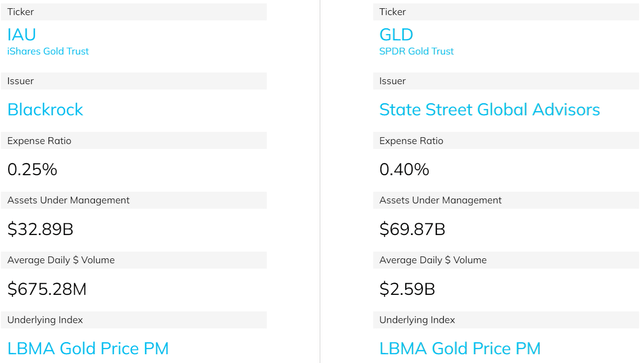

Both funds are popular and large funds among gold investors, and we assume they need little introduction. Here we just highlight a few things for investors who are not familiar with them yet to facilitate a more in-depth discussion later.

- Both are indexed to the LBMA gold price. And both are quite large funds. IAU has more than $33B of assets under management. And GLD is even larger, almost $70B.

- Investment in a gold ETF that is backed by physical bullions is treated as ownership of physical gold. Both IAU and GLD are backed by physical gold and are taxed at the same maximum tax rate of 28% or 29.6% rate as collectibles instead of the normal long-term and short-term capital gains.

- IAU charges a lower expense ratio of 0.25% and GLD charges a slightly higher expense ratio of 0.4%. The 0.15% difference is a key consideration that we prefer IAU ourselves over GLD. However, on the other hand, you can see that GLD trades better than IAU. GLD has an average daily volume of more than $2.5 billion, almost four times that of IAU. As result, GLD will feature a tighter spread.

- And next you will see, the choice between these two funds largely depends on the consideration of A) whether you actively trade or not (we do not), and B) if GLD’s tighter spread can overcome the higher expense ratio if you do.

Why gold?

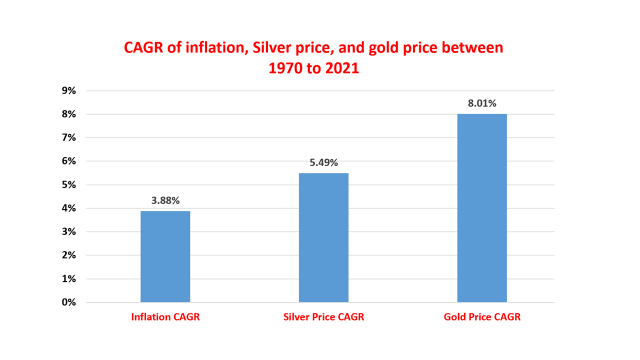

First, gold has been effective in fighting inflation in the long term. The next charts summarize the price data of precious metals and compare them against inflation data in the long term. The data span over the past 5 decades, from 1970 to 2021. As can be seen, over the long term, gold is very effective in fighting inflation. Over this period of time, inflation is on average 3.88% CAGR and the silver price has appreciated at 5.49% CAGR, outpacing inflation by a decent margin of more than 1.6% per year.

And gold is even more potent in fighting inflation. Its price appreciated by more than 8% CAGR, outpacing inflation by a whopping 4%+. And as aforementioned, IAU and GLD prices stopped keeping up with inflation in the past 10 years or so. Their prices should be at least 30% higher now just to keep up with inflation in the past decade.

Author

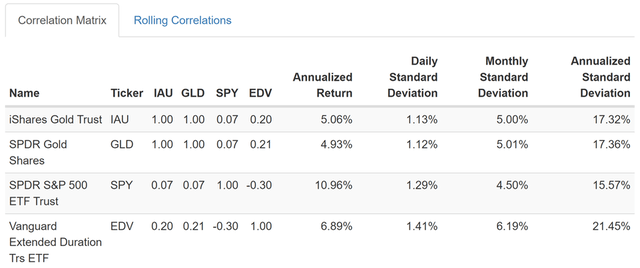

Second, gold is considered a safe haven asset because of its role as a currency metal and also its extensive commercial and industrial applications. As a result, historically both IAU and GLD prices have shown a low (almost zero) correlation to the overall market, as you can see from the following chart. Both IAU and GLD have demonstrated a correlation coefficient of only 0.07 relative to the overall market represented by SPY. Although note that:

- Both IAU and GOLD have suffered larger price volatility than the stock market in terms of standard deviation (about 17.3% vs 15.5% annually).

- As a side note, long-term treasury bonds offer an even lower (and negative) correlation against the stock market. Currently, with the long-term treasury bonds rates (both 10-year and 30-year) close to 3%, I see treasury yields close to their long-term targets already. As a result, we see treasury bonds as a viable option too as detailed in our earlier article.

Why we prefer IAU over GLD?

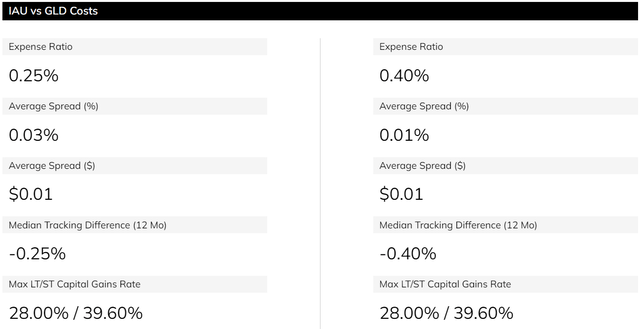

As aforementioned, we prefer and hold IAU ourselves due to its lower expense ratio of 0.25%. In contrast, GLD charges a slightly higher expense ratio of 0.4% and 0.15% above IAU. However, you can see that GLD trades better than IAU and feature a tighter spread of 0.01%, compared to the 0.03% of IAU. So the choice between these two funds largely depends on the following considerations:

- If you are buy-and-hold investors like us, you will benefit from the lower expense ratio charged by IAU. We only adjust our positions slightly from month to month. And as a result, the lower expense ratio works out better for us. Do not overlook the 0.15% difference. It is indeed a small difference in absolute terms. However, the difference needs to be interpreted under the average return that gold offers, which is about 8% in the long-term as shown by the data above. Secondly, such a small difference accumulates and shows over the long-term, say if you hold them for ten years or longer as shown in the second chart below.

- If you are an active trader, then the tighter spread from GLD can justify its higher expenses ratios. GLD’s spread is about 0.02% lower than IAU. So the 0.15% higher expense ratio can be approximately compensated in about 7 round-trip trades per year.

Conclusion and risks

There are good reasons to consider gold to your portfolio now, and more specifically, consider using IAU or GLD to gain exposure to gold. These reasons include:

- Both feature a large AUM, excellent tradability, and lower expense ratios.

- Both are good hedges in the current negative-rate environments. They also offer low correlation (nearly zero correlation) against the overall equity – which mind you, whose valuation is near the second-highest level historically and only lower than during the dot.com bubble around 2000.

- We ourselves allocated about 9% of the total portfolio for gold and we prefer IAU over GLD. The main consideration is IAU’s lower expense ratio. For more active traders, GLD’s tighter spread may justify its higher expense ratio.

There are risks associated with IAU, GLD, and gold in general though:

- Gold prices are subject to large volatility, larger than the S&P500 index by a good margin.

- Neither IAU or GLD pay dividends.

- IAU’s expense ratio is relatively lower than GLD, but the operative word is relatively here. An expense ratio of 0.25% is still high compared to other asset classes. For example, it is about 10x higher than our other core funds such as VTI (whose expense is 0.03%).

- And finally, gains from both IAU and GLD are taxed at the same maximum tax rate as collectibles.

Check out our marketplace service

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 2x in-depth articles per week on such ideas.

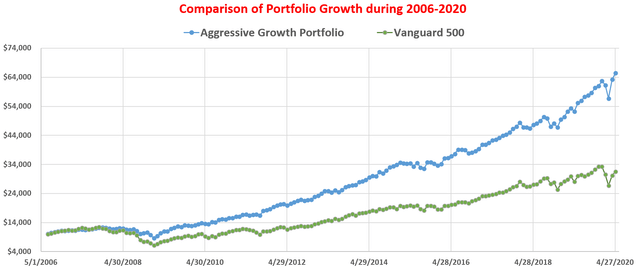

We have proven and perfected our methods with our own money and efforts for the past 15 years. For example, our aggressive growth portfolio has helped ourselves and many around us to maximize return with minimal drawdowns.

Lastly, do not hesitate to take advantage of the free-trials – they are absolutely 100% Risk-Free.

Be the first to comment