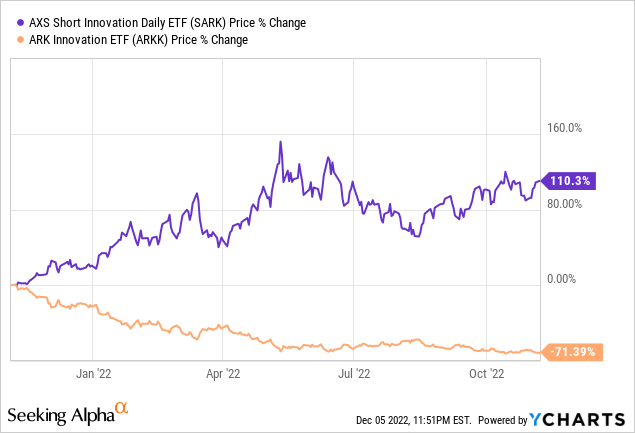

And here we find the saga of SARK, ARKK, and TARK visually depicted.

Hulton Archive/Hulton Archive via Getty Images

What is TARK?

In a world where exchange traded funds (ETFs) can be used to make various kinds of investment vehicles, we see levered funds like Investment Managers Series Trust II – AXS 2X Innovation ETF. Or NASDAQ:TARK for short.

TARK aims to give investors 2x leverage on the performance of a second ETF: the ARK Innovation ETF or NYSEARCA:ARKK. The fund and manager Cathie Wood are infamous at this point having been much discussed in investment media in recent years. We can turn to ARKK’s performance over that time as a way to understand why.

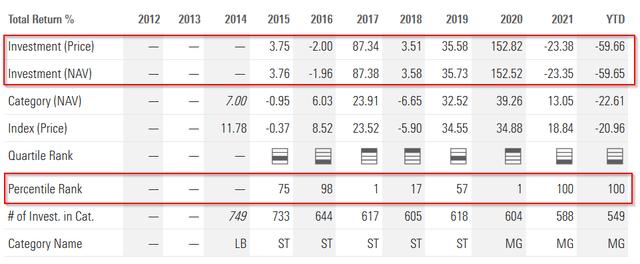

Morningstar: ARKK Fund Performance

Cathie Wood had two banner years with ARKK, one in 2017 returning 87% and then again in 2020 where the fund saw a huge 152% return. In each of those years the fund had a Morningstar Percentile Rank of 1 meaning they were the top returning fund in their category.

But then look at the performance in 2021. SPY returned 28.75% that year compared to ARKK’s -23.38%, earning the fund a Morningstar’s worst Percentile Rank. In just one year the fund had gone from best in class to worst. We can see hints of their poor relative performance from 2015 and 2016 where their percentile ranks were 75 and 98 respectively. And finally year to date performance has been a mammoth -59.66% loss which is, again, worst in class.

If we think about ARKK shares being down 59% year to date then 2x that performance for TARK would theoretically imply a -118% return (which clearly isn’t possible). It’s destruction of capital just the same, but the reality of returns is a bit more nuanced due to the mechanics of beta slippage built into levered funds which we’ll discuss later. Fortunately new investors have been spared this possibility by the fact that TARK is a relatively new fund having launched in May 2022.

Why Was TARK Launched?

It was launched by AXS Investments, an alternative investments firm which creates different investment vehicles. They have a number of ETFs like TARK which seek to give investors access to leveraged results on individual tickers. These are often high volume, popular stocks like Pfizer (PFE), Nike (NKE), PayPal (PYPL), NVIDIA (NVDA), and Tesla (TSLA). They also have the FOMO fund designed just for investors who “worry that they may be missing out on investment themes, memes and trends.“

That’s probably a good explanation of all their funds, actually. But I digress.

Managing director at AXS Instruments Matt Tuttle is key to this story. TARK basically is the result of another leveraged ETF which has seen positive results this year simply by recreating the inverse (-1x) of ARKK. This third fund, SARK, is now called the AXS Short Innovation Daily ETF but was previously known as Tuttle Capital Short Innovation ETF.

AXS Investments acquired Tuttle Capital Management’s suite of ETFs in April 2022 with Mr. Tuttle joining the team. SARK has seen significant positive year to date performance due to the disastrous results at ARKK.

Seeking Alpha: 1-year price return for ARKK and SARK

The attention predictably fed itself and AXS sought to capitalize further on this by offering investors a new 2x long-focused leveraged ETF on ARKK. Thus TARK was born. Tuttle stated in a promotional interview with CNBC about TARK’s launch:

The one thing people will agree on is that that’s an ETF (ARKK) that’s going to move and it’s going to have large moves. So we wanted to give investors that tactical ability to play both sides. Plus, we think it’s an interesting opportunity for some of ARKK shareholders who are really committed to the story.

Tuttle’s original fund even garnered a direct response from Cathie Wood who described the SARK ETF as shorting American innovation. So there’s that. But Tuttle and AXS Investments overall are likely to make the argument that these new tools add to investor’s trading and leverage options.

And leveraged ETFs are a unique way to trade. According to an article from The Balance leveraged ETFs showed up first in 2006, so they are relatively new trading vehicles overall. The authors note additionally that,

“Leveraged ETFs are regulated by FINRA, which placed supervisory requirements on firms that recommend them to their customers and margin requirements for trading the funds. The regulating body has also stated that these products are unsuitable for retail investors.”

I’d firmly agree with FINRA’s suggestion that all leveraged ETFs like TARK are not suitable for retail investors. New investors should take a double dose of that caution. If you are searching on the internet about whether or not TARK is a good investment then the unequivocal answer is no. Do not invest in what you don’t understand. And if you don’t understand how this leverage is created then you shouldn’t be using it. These are highly risky vehicles which can wipe out capital in an instant.

Further, one should understand that leveraged ETFs are traditionally designed for traders, not investors. And this isn’t just a semantic difference; traders and investors are two different classes of participants in the market which really delineate along a short- or long-term approach. If one is an investor with a long-term approach investigating TARK then the operative question here is what is your long term opinion of ARKK? If you as an investor do not have a long term opinion of ARKK then you should not be investing in TARK.

But TARK exists nonetheless given it is a very low cost way for investment firms like AXS to generate fee income from popular stocks/funds/trends with the expense ratio of their funds. While these companies may try to make it sound as if they are doing investors a favor by creating new tools, the reality is that they are businesses and the ETFs are their product.

What Are TARK’s Holdings?

The fund’s holdings are quite simple to evaluate as they have only three positions as of 12/1/2022. Here’s the information pulled from their website.

|

Ticker |

CUSIP |

Company |

% of Fund |

Quantity |

|

AXSBSBNFV9USD |

TRS ARK INNOVATION ETF |

199.78% |

2,804,595 |

|

|

CASH |

CASH |

92.68% |

49,313,518 |

|

|

AXSBSBNFV9USD |

TRS ARK INNOVATION ETF |

-192.46% |

-102,401,231 |

The two non-cash positions are total return swaps which are the primary vehicle through which TARK generates the leveraged returns. Another indicator here for readers: if you do not know what a total return swap then investing in TARK is an unwise choice. Total return swaps are a type of financial contract between two parties regarding the performance of an underlying security. In TARK’s case the swaps are in relation to ARKK and are the operating mechanism through which TARK seeks to generate the 2x levered results.

The investment objective is very specific though. TARK, through these swaps, “Attempts to achieve double (2x) the return of the ARK Innovation ETF (NYSE Arca: ARKK) for a single day, not for any other period.”

The reality of attempting to mimic returns daily creates a feature called beta slippage. The phenomenon is a multi-day tracking inefficiency created by the daily moves. And from a practical perspective it means that value erosion can happen fast. If we think about an index and two 3x leveraged funds trying to track daily performance this figure below helps to paint the picture.

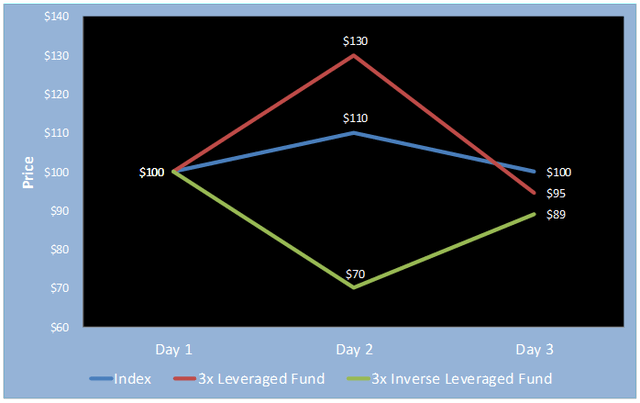

HIT Capital: Illustrative Chart for Beta Slippage

What’s happened in this example is that the rise of the index on day 2 by 10% to $110 necessitated a 30% change for the leveraged funds in either direction. On day 3 the index retreats 9% back to $100 where it started. But each of the leveraged funds are not back at $100 and instead are both below it. That’s because the levered fund’s objective is adjusted daily so they track a 3x on the 9% return of the index or 27% change on day 3 from their respective starting points.

Beta slippage is a statistical reality due to the focus on leveraging daily returns. What this means practically is that TARK is not going to match 2x performance over time of ARKK. So thinking about ARKK being down 59% year to date does not necessarily imply that TARK would be down twice that much. It depends on the single-day moves and volatility over time.

And this in part helps better contextualize why these vehicles are for traders. Explicitly, the fund’s objective is to track 2x performance just for the day. An investor would never seek to make their returns based on the performance of a fund in just one day, but a trader might. For someone interested in digging deeper into the peculiarities in these types of funds, SA contributor Warwick Langebrink wrote an in-depth two part series on leveraged ETF decay. Here’s the first one.

Really, What are ARKK’s Holdings?

Let’s put all that to the side for a second though and dig a bit deeper. Another way to interpret TARK’s holdings is to investigate the portfolio of ARKK. The fund has 32 different positions as of 12/2/2022 and here’s a listing of their top-10 positions which make up ~60% of the portfolio.

|

Ticker |

Name |

Market Value |

Weight (%) |

|

ZOOM VIDEO COMMUNICATIONS-A |

$690,359,375.88 |

8.93% |

|

|

TESLA INC |

$617,154,608.40 |

7.98% |

|

|

ROKU INC |

$575,752,119.74 |

7.44% |

|

|

EXACT SCIENCES CORP |

$536,222,000.00 |

6.93% |

|

|

BLOCK INC |

$431,122,637.66 |

5.57% |

|

|

SHOPIFY INC – CLASS A |

$382,394,882.80 |

4.94% |

|

|

UIPATH INC – CLASS A |

$363,817,264.52 |

4.70% |

|

|

UNITY SOFTWARE INC |

$352,152,833.92 |

4.55% |

|

|

TELADOC HEALTH INC |

$338,991,179.00 |

4.38% |

|

|

INTELLIA THERAPEUTICS INC |

$318,139,440.80 |

4.11% |

|

|

Total |

$4,606,106,342.72 |

59.53% |

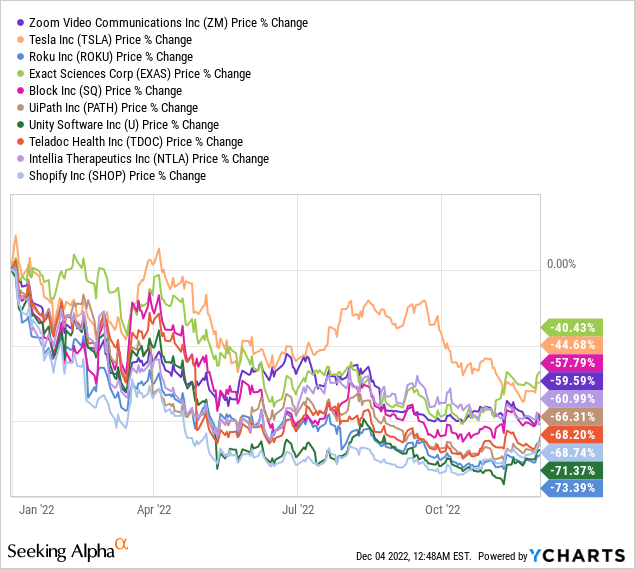

The portfolio has become increasingly consolidated down from 44 positions in October 2021. The remaining positions have seen steep losses this year. Just take a look at the year to date performance of these stocks and you’ll start to understand why ARKK is down so much:

Past performance is not a predictor of future results, yet in the case of a fund like ARKK we must contextualize results within their strategy. The fund’s stated approach is to focus on companies offering disruptive innovation. From their site, “ARK defines ‘‘disruptive innovation’’ as the introduction of a technologically enabled new product or service that potentially changes the way the world works.”

Wood published an article a few days ago entitled “Disruptive Innovation and Profitability” where they defend the fund’s approach. Her words from the first paragraph might help to set the context of their strategy even further:

For years, market pundits have been warning investors about “profitless tech”––companies ostensibly incapable of turning a profit. They describe stocks in ARK’s strategies as “concept capital” and suggest that our investment team either cannot distinguish profitable companies from unprofitable ones or seeks to invest in unprofitable companies. In our view, the companies in which we invest are sacrificing short-term profits to capitalize on the exponential growth and highly profitable opportunities that a number of innovation platforms are creating.[1] Companies catering to short-term oriented investors and leveraging their balance sheets to pay dividends or manufacture earnings with share repurchases do not seem to us to be investing enough to catch these waves of innovation. As a result, we believe many are likely to be disrupted, if not destroyed.

The profitless tech narrative seriously understates the profit potential of companies at the forefront of transformative innovation.

I for one am not a proponent of investing based on assumed exponential growth in the future. But the fund offers an opportunity to partner with Wood in this strategy. A bull perspective on ARKK comes from another SA contributor Julian Lin who posted a STRONG BUY rating for the fund in November based on a broad assumption of a “tech recovery”. In this article Julian draws comparison between Alphabet and Pepsi which highlights the kind of optimism built into the idea of this tech recovery. Lin writes:

There is a notion that tech stocks crashed because interest rates rose. That is in part true, as many tech stocks previously traded at bubbly valuations and the tightening monetary policy proved quite efficient in addressing the bubbles. But valuations have arguably swung too far in the other direction. Consider that Alphabet (GOOG) (GOOGL) is now trading at 20x earnings (that is before accounting for net cash and includes losses from Google Cloud and Other Bets) yet Pepsi (PEP) trades at 26x earnings. You’ll be hard pressed to find many investors who believe that PEP has a stronger long term outlook than GOOGL. All things being equal, GOOGL arguably should trade at a materially higher multiple than PEP.

So the kind of tech recovery envisioned is predicated on the idea that a company might be undervalued at a P/E of 20x based on comparison to another company at a P/E of 26x. I can say that I’ve never found a company I believe to be undervalued at either level.

Further, Lin supposes that “mega-cap tech stocks like GOOGL to rally significantly moving forward which in turn may lead to unprofitable tech stocks to rally significantly as well.” The implication Lin is drawing here is that this potential GOOGL led rally could drive returns for ARKK. Yet the risks involved with this potential are significant even from that bullish author’s perspective.

Lin points out that in order for ARKK to see successful returns one must assume long-term profitability profile their holding companies. And for some growth and momentum oriented investors the long term profitability profile isn’t as important one way or the other. But as a value investor my investment style is a bit different. My immediate question is why would you assume long term profitability?

Certainly every investor wants to assume a long term profitability profile for any investment they make and have that assumption be true. With the ongoing uncertain macroeconomic environment would it not be more prudent to be conservative with profitability profiles moving forward? Especially for companies with “disruptive” business models which may or may not last over the long term?

For those enticed by optimistic forecasts, I’d remind you of one of the most important things according to Howard Marks: defensive investing. Marks summarizes this neatly: “Defensive investing sounds very erudite, but I can simplify it: Invest scared!” [pg. 184; The Most Important Thing Illuminated, Howard Marks]

In that regard, I’m wary of an investment until proven otherwise. The holdings of ARKK do not fill me with confidence, nor does the strategy espoused. If we look at the long-term performance of ARKK we can see that it has cumulatively underperformed the S&P500 though that trend really started within the last year.

Seeking Alpha: 5-year price chart for ARKK and SP500

And if you recall our review of Morningstar data earlier the fund has seen absolute worst in class performance so far this year and in 2021. In this regard it seems reasonable to be wary of this fund’s future performance. Consider that out of their top ten holdings only two (ZM and TSLA) are actually profitable and even their P/E valuations after huge losses this year are still in the double digits.

I’ve included Seeking Alpha’s Valuation Grade for each of the stocks for a differentiated point of reference as well. There are two grades in the C range (ZM and TDOC). Otherwise the rest are not particularly compelling along this benchmark.

So in short, ARKK owns a concentrated basket of unprofitable yet potentially disruptive stocks that have seen huge losses this year. Some believe that this underperformance this year will lead to gains moving forward. Concentration is part of Wood’s strategy though it also creates a challenge for the fund that SA contributor Bill Maurer discusses more directly in a recent bearish take.

Given ARKK’s size ($7.673 billion), their concentrated positions can also result in owning a significant percentage of the stock’s float. Two of ARKK’s top ten holdings, ROKU and TDOC, represent greater than 7% of the float. Unwinding these positions will not be easy in a protracted down-market as their own selling would instigate significant downward pressure on the stock. A structural risk like this may turn out to be immaterial or it may turn out to be existential, at this point one really can’t know. What it does do is give me caution as an investor about the commitment to picks which are, again, unprofitable companies.

Which leads us back to leveraged funds which use ARKK as their target.

The SARK, ARKK, and TARK Connection

Earlier I mentioned that TARK (2x ARKK fund) was made really in response to the success of SARK (-1x ARKK fund). Both funds are run by AXS Investments at this point and offer investors two distinctive ways to trade around whatever one believe the daily returns of ARKK might be. SARK, similar to TARK, seeks to achieve the inverse (-1x) of whatever ARKK’s daily returns are.

Keen readers will note immediately that this leverage on daily returns means that beta slippage is at play with SARK as well. They’d be right. Another quick way to note this is in the year to date performance comparison of ARKK and SARK which is not exactly -1x.

Seeking Alpha: ARKK, SARK, & TARK YTD Performance

Annual performance was so good in its first year (113%) that they did a press release victory lap announcing it and promoting TARK as well. While the release makes a favorable comparison to S&P 500s much worse performance, they do not draw attention to the clear effect of beta slippage on SARK over that year. As you can see, over that time frame (Nov. 7th, 2021 – Nov. 7th, 2022) -1x of ARKK’s performance would’ve been just 71%.

While in this example it benefited owners of SARK, It’s important to note that this slippage can work on the downside to erode capital faster in the future. And, if we flip back to the other fund TARK (2x ARKK), if ARKK continues to see declines beta slippage could work to compound TARK’s losses. This is why these types of levered funds are so risky. And if you don’t want to take my word for it, take the word of the fund creator’s themselves from that press release:

The Fund is not suitable for all investors and should be used by knowledgeable investors, such as traders and active investors employing dynamic strategies, who understand the consequences of seeking daily inverse (-1x) investment results, including the impact of compounding on Fund performance. Investors should intend to actively monitor their investments as frequently as daily.

I don’t know about you, but I’m not particularly interested in monitoring my investments daily. It reminded me of a quote from Warren Buffett on the intensity of monitoring required in arbitrage positions, “What’s the sense in getting rich just to stare at a ticker tape all day?” [pg. 93; The Essays of Warren Buffett, Lawrence A. Cunningham]

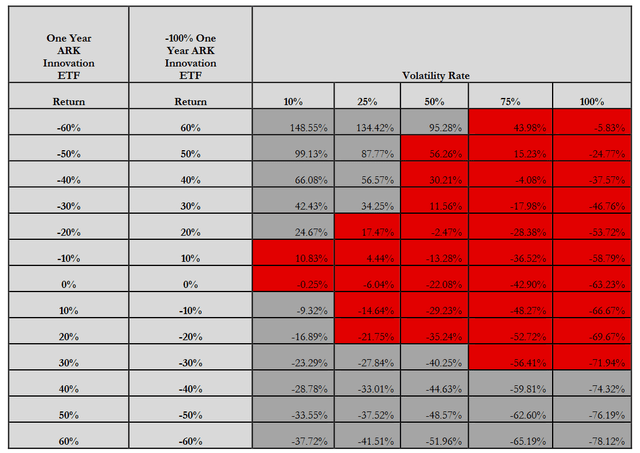

Yet for those still interested, SARK has a 0.75% expense ratio which is actually lower than TARK’s at 1.15%. The funds both work in essentially the same way with SARK using total return swaps to generate their -1x daily returns on ARKK. Here’s a table of potential results of SARK from their summary prospectus based on one year ARKK results and volatility.

SARK Summary Prospectus: Table of Potential Results Based on ARKK Performance and Volatility

Here’s a table which puts the basic concept of these ETFs in context.

| Perspective | Fund of Interest |

| Bullish on ARKK for the day? | TARK aims to return 2x that. |

| Bearish on ARKK for the day? | SARK aims to achieve -1x that |

Is TARK A Good Choice For New Investors?

Now that we’ve given a fair amount of background on both TARK, ARKK, and SARK I think we can return to the titular question: is TARK a good choice for new investors? I’ve alluded to my answer a number of times along the way but let’s be clear and concise about where we stand. Here are the reasons for why TARK is not a good choice (and these all apply to SARK as well).

-

TARK is a leveraged ETF. FINRA have noted that leveraged ETFs are not suitable for retail investors.

-

Leveraged ETFs are designed to track daily performance which makes them incongruent with the long term objectives of an investor.

-

To understand TARK one must really understand ARKK and their basket of over 30 holdings. That is no small task for any investor, let alone a new one.

-

New investors are also unlikely to understand what beta slippage or total return swaps are, key concepts for understanding how leveraged ETFs perform.

During my investigation of ARKK’s holdings I find further reasons to be skeptical that ARKK will have positive performance moving forward. While we’ve noted that beta slippage means that long term results of TARK will not track ARKK by 2x exactly, the returns are correlated. Just look at the chart since June where ARKK has seen negative performance.

Seeking Alpha: 6-month price chart of ARKK and TARK

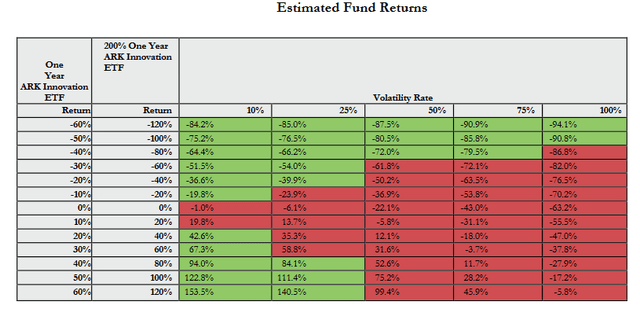

TARK is almost down three times as much as ARKK which again highlights the risk of beta slippage. Leverage is a risky instrument whether it is done via lending, options, or ETFs like TARK. The performance has been so bad since the fund launched, which was only in May, that TARK has already done a 1-5 reverse split of shares on December 1st. In the fund’s summary prospectus they provide a table regarding estimated fund returns based on one year of ARKK returns and different volatility rates.

TARK Fund Prospectus: Estimated Fund Returns Chart

Here we see a visual of what must happen moving forward for TARK to generate a positive return in a one-year period. Of particular note is that even in situations where ARKK generates a positive return, if the volatility rate is too high the results turn negative for TARK. Just look at the last cell in the bottom right corner for an extreme example. A one year return of 60% for ARKK with 100% volatility would create negative returns for TARK.

While this table is a range of possibilities, not of likelihoods, it is reasonable to take a step back and consider the impact of a continued downward trend. Any fund with a sustained downward trend is at risk of not existing given its assets under management are eroding. Leveraged ETFs are no different and in fact have peculiar risks.

During the volatile COVID crash in 2020 dozens of leveraged ETFs like TARK & SARK ceased trading, sometimes overnight. This happened through a handful of different levers but almost all as a result of significant price declines.

-

Mandatory Redemption: Issuer closes the fund due to a trigger of some redemption clause set forth in the prospectus. Usually this occurs when an ETF’s price falls below some minimum indicative value.

-

Elective Redemptions: Issuer redeems funds at their discretion. Terms are sometimes favorable and sometimes unfavorable to the fund owners. Usually a pre-emptive attempt to prevent delisting.

-

Delisting: An ETF can be delisted from something like failing to meet a minimum trading price. Trades would then only be able to execute over-the-counter making them more illiquid.

TARK’s reverse share split likely was preemptive against a possible delisting if the funds price had continued declining. With an AUM of just $48.98 million TARK is vulnerable to delisting factors with a continued decline in ARKK. Since inception the fund is already down 54%.

These risks further support my reasoning that TARK is not a good investment choice. By extension I would argue that SARK isn’t either, and I think as a blanket statement I can go further and say that leveraged ETFs as an asset class are not a good investment choice. They are financial instruments. Use them at your own risk.

But if all my cautioning still leaves you interested, I’ll leave you with a checklist AXS Investments provides themselves in their prospectus documentation on their leveraged funds and you can decide if you meet the criteria. You’ve been warned.

The Funds are not suitable for all investors. The Funds are designed to be utilized only by sophisticated investors, such as traders and active investors employing dynamic strategies. Investors in the Funds should:

(a) understand the consequences of seeking daily leveraged or inverse investment results;(b) understand the risk of shorting; and(c) intend to actively monitor and manage their investments.

Be the first to comment