BraunS/E+ via Getty Images

Article Thesis

Interest rates have been rising in recent weeks, but treasuries still do not seem like especially attractive investments. Their yields aren’t overly high, they will drop in price if interest rates rise further, and there is no built-in inflation protection at all. In fact, with inflation running at an 8%+ rate right now, the real yield and real return outlook for treasuries are not compelling at all. Investors that seek inflation protection will likely flock to equities instead, which makes sense. The SPDR S&P 500 Trust ETF (NYSEARCA:SPY) is one of the most common ETFs equity investors can pick for their portfolios. It offers broad-based exposure to the US stock market and should provide for decent returns in the long run. At the same time, investors should note that this isn’t a high-yield investment at all, which means that it may not be suitable for most retirement portfolios, depending on one’s income goal.

SPY ETF Key Metrics

The SPDR S&P 500 Trust ETF is one of the largest ETFs in the world, with close to $400 billion in assets under management. The ETF, managed by State Street Global Advisors (STT), seeks to replicate the performance of the S&P 500 index (SP500). In doing so, it is naturally well-diversified across hundreds of equities, although those are not equal-weighted. Instead, the largest companies in terms of market capitalization have the highest weight in both the index as well as the SPY ETF. These include Microsoft (MSFT), Apple (AAPL), Alphabet (GOOG)(GOOGL), Amazon (AMZN), and Tesla (TSLA), which make up around 23% of the ETF’s assets — despite these making up just 1% of the overall number of companies the ETF invests in.

According to SPDR S&P 500 Trust ETF’s fact sheet, which is available here, the dividend yield of the ETF is 1.4%. That’s not a very high yield, but it’s on par with what the broad equity market offers today. The rather low yield can be explained by the fact that many of the ETF’s top holdings do not make any dividend payments at all (AMZN, GOOG, TSLA), while other mega-caps offer dividends, but only with low yields, such as MSFT and AAPL. Due to the large weight of these stocks, it’s not too surprising to see that Information Technology is the largest sector by far. 28% of the ETF’s assets belong to that sector, with Health Care and Consumer Discretionary being the next two sectors by weight, at 14% and 12%, respectively. In contrast, Materials, Utilities, and Real Estate make up less than 3% each. For someone looking for more equal-weighted exposure across different sectors, that could be an issue.

The growth outlook for the earnings per share of the underlying companies the ETF invests in is very solid. With easing COVID concerns, improving supply chains, resuming travel, out-of-house spending, and so on, it is expected that the ETF’s earnings per share will grow by around 14% a year over the next three to five years (analyst consensus estimate according to SPY ETF’s fact sheet). Depending on how fast the Fed is tightening, that may be too optimistic in case there’s a “harsh landing”. Still, the overall outlook for the economy over the coming years is far from bad as the pandemic hopefully comes to an end soon. At the same time, it should also be noted that record buyback activity by S&P 500 companies also bodes well for the earnings per share performance that can be expected in the coming years.

For ETF investors, expenses are an important factor to consider. In SPY’s case, the expense ratio is pretty low, at just 0.09%. Investors have to pay some fees, but compared to what one can expect from mutual funds, where expenses are oftentimes in the 1%-2% range, a sub-0.1% expense ratio is very small. Over a ten-year time frame, investors could expect a total return impact of 1%. But whether an investment returns, as an example, 100% or 101% in that time frame isn’t all that important.

How Has SPY’s Long-Term Performance Been?

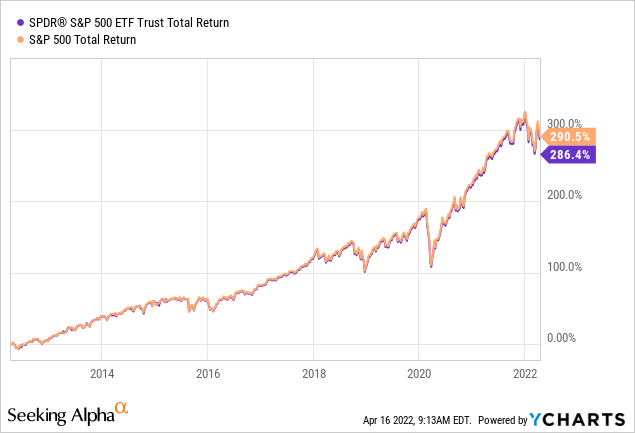

Over the last decade, the broad market has performed very well by historic standards. There were some temporary drawdowns, such as in 2018 or during the initial phase of the pandemic. Still, SPY ETF has risen 210% in those ten years. On a total return basis that includes dividends, the last decade was even better:

The SPDR S&P 500 Trust ETF returned 286% in that time frame, while the underlying index was marginally ahead, with a 291% return. The difference is explained by the (small) expenses of the ETF over that time frame. A ~290% return in 10 years pencils out to an annual return of around 15%, which is highly compelling. It should be noted that valuations a decade ago were still relatively low, as the world was beginning to recover from the Great Recession then. Over the last decade, multiple expansion was thus an important driver for total returns. This is why future returns will very likely be considerably lower, as were total returns when we take a look at the ETF’s performance since inception in 1993. Since then, SPY ETF has returned 1,620%, for an annual return of 10% in those 29 years. That’s not as exciting as the 10-year return, but still pretty compelling overall.

Is SPY ETF A Safe Investment?

Equities are volatile, and that also holds true for SPY — an ETF that owns equities. During times of crisis or uncertainty, such as the initial phase of the pandemic, equities oftentimes perform badly for a while. That doesn’t mean that they will drop to a lower level permanently, however. Instead, SPY and other equity ETFs have a tendency of experiencing drawdowns from time to time, with them eventually recovering and climbing to new highs at a later point in time. Permanent capital destruction thus seems unlikely for SPY ETF, as it would require a significant portion of the companies the ETF invests in to go belly-up. As long as the US economy is doing alright in the long run, I thus do not believe that this is likely at all. Investors have to live with temporary drawdowns from time to time, however. Depending on one’s risk tolerance, that could be no problem, or it might be an issue.

Is SPY ETF A Good Investment For Retirement?

The answer depends a lot on what a retiree’s goals are. Many retirees seek a reliable and meaningful income from their investments. In that case, SPY ETF does not seem like a great pick. Its dividend yield is pretty slim, and even though dividends have risen over time, there is no ultra-reliable upwards trend. The Dividend Aristocrats, for example, are more suitable for those seeking very predictable income growth.

Retirees seeking a more meaningful dividend yield will likely flock to other investments, such as a higher-yield ETF or individual stocks that offer considerable yields. Some sectors contain a wealth of higher-yielding income stocks, such as real estate, utilities, or energy.

Some retirees are not focused on income growth — or at least not with all their portfolio holdings. Despite not offering a lot of income, SPY ETF has still generated compelling long-term returns. Compared to individual stocks, SPY ETF also offers considerable diversification across sectors, market capitalization ranges, and also on a pure number-of-holdings basis. For someone seeking total returns over income, SPY could thus be a solid addition to a retirement portfolio. Outperformance versus the broad market is not a possibility here, as SPY basically represents the broad market, but SPY could be a solid addition to some portfolios nevertheless. In the long run, SPY ETF should provide meaningful total returns that will likely best what one can expect from treasuries. The built-in inflation protection of most equities is an added bonus as well.

Is SPY A Buy, Sell, Or Hold?

SPY ETF represents the broad market. The broad market is facing some difficulties, such as the ongoing Ukraine-Russia war, Fed tightening, and other macro uncertainties. At the same time, equities seem like a favorable choice compared to treasuries and other fixed-income investments in a high-inflation world. The broad market is not particularly cheap, but it’s not ultra-expensive either, and the earnings growth outlook for the coming years is solid for the broad market as a whole.

Overall, I thus believe that SPY ETF is neither especially attractive nor especially unattractive at current prices. I would rate SPY ETF a hold right now for those seeking total returns and not focusing too much on income generation.

Be the first to comment