Dilok Klaisataporn

As a fervent supporter of profitability and efficiency-focused investment philosophy, I have always had a special interest in ETFs that attempt to make their portfolios quality-heavy.

Meanwhile, I have never argued that quality is a factor to be considered in isolation. To navigate the shifting tides of market sentiment, investors must pay due attention to a combination of factors, reasonably tilting their portfolio to one or another. Quality for the highest price imaginable is probably fine for a bull market supercharged by ultra-loose monetary policy and consistent economic expansion. But even in this idyllic scenario, resilient margins must come with a reasonable growth profile. Of course, this works for a relatively short period of time until it does not. But longer-term, quality and value should be mixed to avoid painful losses.

Today, I would like to give the Invesco S&P 500 Quality ETF (NYSEARCA:SPHQ), one of the largest ETFs in the market mindful of profitability overseeing a $3.6 billion portfolio, a second look.

Last year, I justifiably concluded the fund is not a Buy since the quality factor in its case simply did not translate into consistent alpha. But since then, a great deal of froth has been removed, with valuations across the board bouncing back from precarious levels. Besides, the current version of the SPHQ portfolio inherited just ~48% of its May 2021 equity basket. Hence, tectonic shifts in factor exposure might lie beneath its surface. So, the question is whether after a euphoric July on Wall Street, SPHQ became a Buy. There are numerous facts to assess, so let us delve deeper into them.

Investment strategy recap: ROE, accruals, and leverage at the crux of quality factor

SPHQ’s investment mandate is to track the S&P 500 Quality Index.

Adhering to the principles of quality investing, the index provider picked the three most relevant metrics that can tell whether a company has a desired level of profitability. Return on Equity, Accruals Ratio, and Financial Leverage are blended in the composite score, which is used to whittle the 500-strong U.S. bellwether cohort to only 100 worthies. The constituents are then assigned weights depending on their float-adjusted market capitalization and the CS. More details on the process can be found in the methodology document.

Though I criticized the composite score for being an incomplete one, it should be noted that it still has advantages. Combining ROE, a fairly questionable indicator prone to misrepresenting a company’s true level of capital efficiency, with debt and accruals allows eliminating the risk of ROE being inflated artificially (the higher the debt, the lower shareholder equity; this creates a false image of more profits generated per dollar of net worth). Companies demonstrating elevated leverage and inadequate accruals would have minuscule chances of entering the index, thus freeing up space for those that have robust, reliable returns on equity.

SPHQ portfolio deeply recalibrated, factor exposure shifts not to overlook

Since my May 2021 article, the SPHQ portfolio has been recalibrated three times, in June and December 2021, and June 2022.

As I said above, less than half of the SPHQ holdings were present in its portfolio from May 2021. Amongst the most notable deletions are Johnson & Johnson (JNJ), NVIDIA (NVDA), and Merck & Co. (MRK). Amongst additions, I see a few remarkable oil & gas players like Exxon Mobil (XOM) and Chevron (CVX). This was more likely the consequence of their profit growth undergirded by the oil price rally which has also allowed the supermajors to improve their balance sheets fortifying them with cash.

Overall, now SPHQ has ~10.8% of the net assets in the energy sector spread between 8 holdings vs. just 0.1% invested in Cabot Oil & Gas when I reviewed the ETF last year; the company merged with Cimarex (OTC:CIMXP) and is now known as Coterra Energy (CTRA).

Besides, a few defensive names like Coca-Cola (KO) and PepsiCo (PEP) also seemingly delivered improvements in their returns on equity and financial positions, which secured their place in the SPHQ portfolio.

So, a fairly massive shift, yet the traditionally expensive IT is still the top allocation, accounting for 36.7% vs. ~40% before.

Now, let us quickly look at the two major factors. The first factor of concern is value. I dislike SPHQ’s valuation as 70% of its net assets are deployed to rather overpriced companies (D+ Quant Valuation grade or worse). Just ~56% were relatively expensive in May 2021. Even the iShares Core S&P 500 ETF (IVV) has ~65% invested in such stocks. Also, we see 6.6% allocated to comparatively inexpensive stocks vs. 23.5% previously.

Next, quality. Little can be said here.

Almost 97% of IVV’s holdings have Profitability grades of at least B-. For SPHQ, the figure is close to 99%. Only PPL Corporation (PPL) and DuPont de Nemours (DD) have issues on the profitability side. E.g., DD has a negative levered FCF and low asset turnover ratio, which marred its otherwise acceptable profile.

Of course, for some meticulous investors, even this level of quality could not be satisfying enough. For those of my dear readers who demand even higher profitability characteristics, I recommend reading my recent article on the First Trust Capital Strength ETF (FTCS). The current version of the FTCS portfolio does not have even a trace amount of stocks with softer profitability. Yet this ETF has a few meaningful weaknesses, which are elaborated on in the note.

In sum, above I said that value should be mixed with quality. I see robust quality but little value. So, my answer to the question of whether SPHQ is cheap enough to accumulate is no.

Final thoughts

The stock market performance this year offers ample food for sobering, careful reflection. We have seen massive swings in the story stocks, growth premia being pulverized, with 20%+ share price declines in just one trading session. We have seen how forgotten and despised commodities roared back, and loudly.

Months of calamitous performance create rare bargains and promise phenomenal long-term returns, especially when it comes to repriced stalwarts. And I would love to conclude that SPHQ is abundantly equipped with all the requisites to outcompete IVV going forward. Unfortunately, this would be wrong.

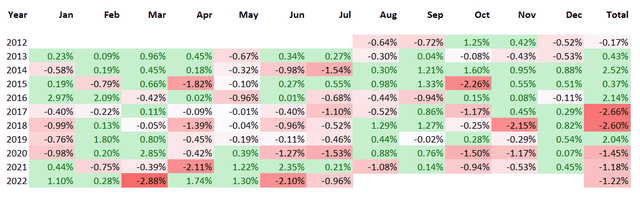

I appreciate its marginally better quality compared to its larger bellwether peer. Yet it does not justify investing in it. Is it worth paying a 5x expense ratio (15 bps vs 3 bps) of IVV then? It can be explained by the steady alpha observed over the course of the years. I do not see it here. For better context, let us review the weekly and monthly returns data over the previous ten years. Green cells symbolize SPHQ’s outperformance, red is used for periods when it lagged IVV.

Created by the author using data from Portfolio Visualizer

This was a tough tug-of-war, and IVV has emerged as a winner, for now.

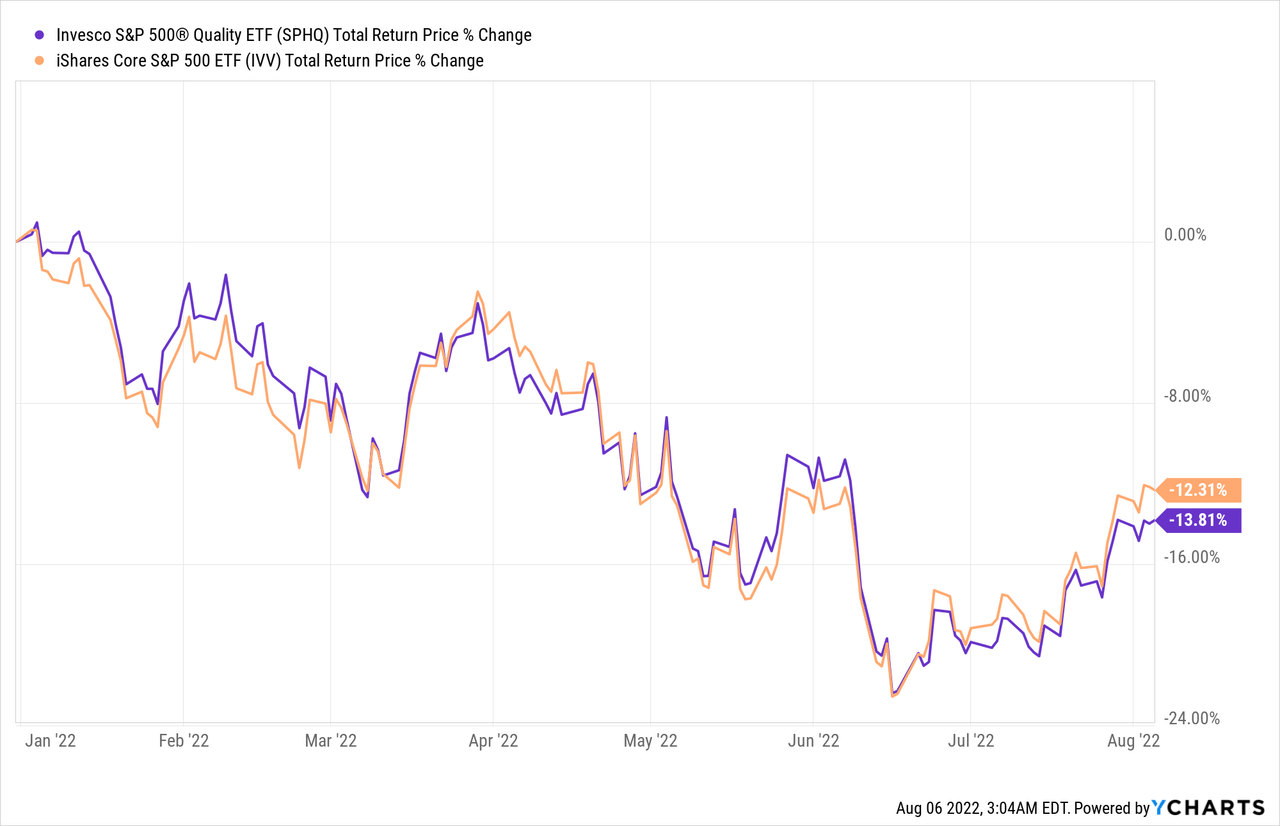

In the 2010s and early 2020s, SPHQ had five alpha years, mostly in the early-to-mid-2010s, but during the coronavirus and early post-pandemic economy, it lagged marginally. A hypothesis may be constructed that the easy money narrative was more supportive of FAANGM-dominated IVV, less so of SPHQ, but this year, when hawks have regained control, this ETF has underperformed anyway. Finishing ahead of the S&P 500-tracking fund in January, February, April, and May, it was still behind by ~1.22% in the first seven months. With the first week of August factored in, the picture is barely better.

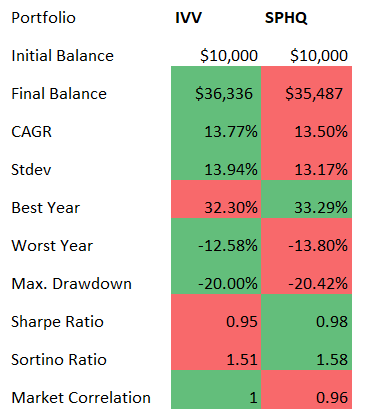

Perhaps the 10-year risk-adjusted returns and volatility paint a different picture.

Created by the author using the data from Portfolio Visualizer

Truth is, as the standard deviation and the Sortino and Sharpe ratios illustrate, they are, but the differences are diminutive. So, in conclusion, I still do not see any meaningful reason to own it instead of the cheaper S&P 500 ETF.

Be the first to comment