Sundry Photography/iStock Editorial via Getty Images

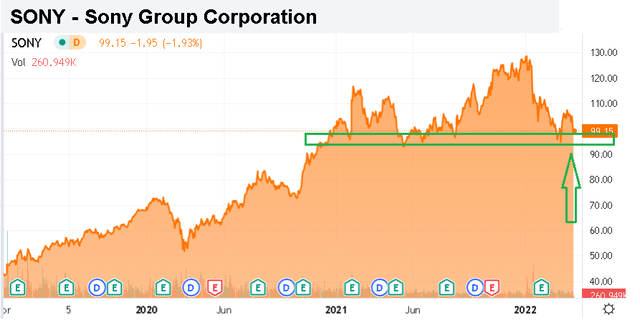

Sony Group Corporation (NYSE:SONY) is recognized for its history of tech leadership, continuously evolving over the last several decades to stay relevant. The attraction here is a unique global conglomerate that often gets overlooked next to other mega-cap tech leaders but benefits from solid fundamentals.

Sony recently made headlines for the acquisition of the boutique game developer “Haven Studios” highlighting the strategic importance of gaming and its commitment to the “PlayStation” console. Despite undisclosed terms of the deal, we sense Sony got a bargain considering Haven brings onboard a leadership team with deep experience producing mega-hit titles. The effort here is all about intellectual property allowing Sony to compete with “Xbox” from Microsoft Corp (MSFT) through new exclusive franchises.

SONY Investment Thesis

We are bullish on SONY eyeing compelling value in the stock following its recent selloff. While the addition of Haven Studios likely only has a limited near-term impact on financials and the stock, our take is that it adds to the positive long-term outlook, particularly in the high-stakes gaming segment.

Keep in mind that Sony Group is much more than just the PlayStation 5 with a diversified portfolio of products and services that includes Sony Music, Sony Pictures entertainment properties, consumer electronics, imaging solutions, and next-generation initiatives that all represent significant growth opportunities.

Seeking Alpha

What Is Haven Studios?

Haven Studios was founded by Jade Raymond in 2021. The Canadian game maker has a 20-year history in the industry since working at Electronic Arts Inc (EA) as a producer on “The Sims Online” back in 2002. At Ubisoft Entertainment SA (OTCPK:UBSFY), she is credited as a producer and managing director on groundbreaking game franchises like “Assassin’s Creed”, “Tom Clancy’s Splinter Cell”, “Watch Dogs”, and “Far Cry”.

Reports suggest Jade decided to go independent by starting Haven Studios bringing together a team of developers she had previously worked with to foster a collaborative atmosphere. While Haven Studios does not have a published title in hand, the value of the group is its talent and proven experience.

Why Did Sony Acquire Haven Studios?

Sony initially partnered with Haven Studios in early 2021 as the start-up’s first client commissioned to work on a new “AAA multiplayer experience”. In many ways, the latest reported acquisition takes the relationship a step further by bringing into the Sony umbrella full ownership of the yet-to-be-announced title. There is a thought that Sony through its “Sony Interactive Entertainment” group can more closely be involved with the final product in an effort to streamline branding and concept. There is also an extra layer of collaboration with the availability of a larger development team to speed up the process.

The Haven Studios deal follows a trend in the industry towards consolidation with several high-profile mergers and acquisitions in recent years. On this point, Sony Group also acquired the developer “Bungie Inc” earlier this year which is known for its “Destiny” franchise and includes a team of over 900 employees. The move was made in part to bolster PlayStation’s online model with “live gaming” features. Separately, Sony has announced the launch of a new “PlayStation Plus” service that will offer gamers access to over 700 games with an entry-level price point of $10 a month.

The Bungie transaction valued at $3.6 billion was materially larger than the Haven Studios deal, although we would argue that bringing Jade Raymond onboard has more upside with the potential to launch a new blockbuster from the ground up. The deal with Bungie allows for its games to play on multiple platforms. We expect any launch from Haven Studios to be an exclusive title.

In our view, the moves from Sony Group are in direct response to Microsoft’s mega-acquisition of Activision Blizzard, Inc.(ATVI) earlier this year, in a deal valued at $69 billion. The strategy here considers Activision’s flagship franchises like “Call of Duty” and “Warcraft”. In 2020, Microsoft also acquired “ZeniMax Media” for $7.5 billion which included rights to games like “Fallout” and “The Elder Scrolls”.

Both companies are vying for supremacy within the global gaming market. Estimates are that from a total value of $198 billion in 2021 considering all platforms and types of devices including mobile, the market is expected to reach $340 billion by 2027. With the category getting a boost during the pandemic with gamers worldwide spending more time at home, themes like expanding internet access in developing markets and the rise of “e-Sports” are expected to mark the next round of growth.

With data through December, Sony has sold approximately 17.3 million PS5 units which are estimated to be about 1.7x more than sales of the Xbox X and S systems, although Microsoft does not break out hardware figures. By this measure, Sony has a solid lead in the gaming console war which it intends to maintain.

SONY Stock Key Metrics

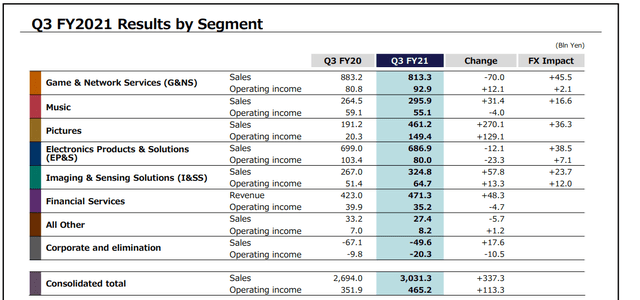

Sony Group last reported its fiscal Q3 results in early February which beat expectations highlighted by revenue of JPY 3.0 trillion, approximately $24 billion, which climbed 13% year over year. Group operating income at JPY 465 billion was up 33% y/y, in large part related to the recovery of the “Pictures” business. The reopening of movie theaters worldwide supporting the release of titles like “Spiderman: No Way Home” which remains one of the highest-grossing films of 2022 has added to company earnings.

source: company IR

For context, the “Game & Network Services” segment which includes PlayStation hardware and games with sales of JPY 813 billion is the largest business for Sony and represents about 27% of the total sales. The group has faced a relative slowdown with sales down about 8% y/y which considers a more difficult comparison period during the peak pandemic sales levels. Favorably, operation income in the gaming group was still able to climb 15% y/y in part related to higher average pricing on the PS5 console moving past some early promotions and momentum in services.

The “Imaging & Sensing Solutions” segment which covers specialized image sensors for mobile products was also a strong point in the quarter with sales up 22% y/y. Management notes a positive gain to operating income in all segments based on a weaker Japanese Yen currency and the corresponding FX impact.

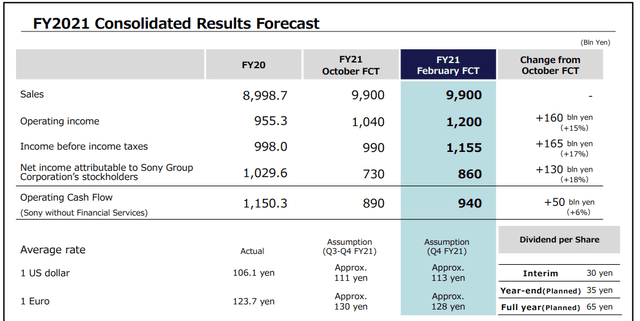

In terms of guidance, Sony maintained its full-year target for sales at JPY 9.9 trillion from the October 2021 update. If confirmed the estimates represent an increase of 10% over last year. More favorably, management revised higher its forecasts for operating income, now expecting to reach JPY 1.2 trillion which is a 26% y/y increase. All segments are expected to contribute positively to higher operating income. The company also bumped up its estimate for net income and operating cash flow, although both measures are expected to be down marginally from last year considering non-recurring items.

source: company IR

Is Sony Stock Expected To Rise?

There are several reasons to get excited about SONY stock for the rest of the year. The company has many moving parts which together continue to benefit from the global post-pandemic recovery. One of the challenges last year with the launch of the PS5 gaming console at the end of 2020 was limited availability amid supply chain constraints. Management notes continued strong consumer demand and expect to produce 11.5 million units for the full fiscal year, with a quarterly run rate approaching 4 million compared to 2.3 million at the start of 2021.

For Sony, the expectation is for production conditions to improve going forward which could set up a strong holiday shopping season with better availability of the device globally. As the ecosystem of users grows, the company captures ancillary sales opportunities related to services and gaming subscriptions. We expect the new subscription service to boost earnings. New high-profile titles including a potential finished product from Haven Studios can add to growth going forward.

Beyond the obvious example of stronger results from the Pictures segment and new theatrical releases, the music business also gets a boost from what is expected to be a strong summer concert and festival season given the company’s extensive recording and publishing catalog. During the earnings conference call, management noted that the growth of streaming services worldwide has been positive for the business. Within the top 100 songs on the Spotify Technology SA (SPOT) platform, 36 songs had an affiliation with Sony Music through one of its record labels.

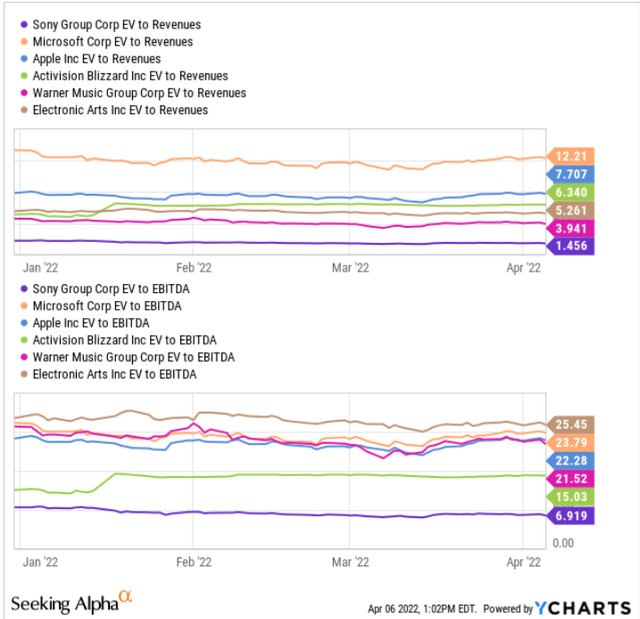

We mentioned what we believe to be a compelling valuation for SONY. Indeed, across nearly every metric, the stock looks cheap compared to global peers. SONY with an EV to revenue ratio of 1.5x is at a large discount to company leaders in segments like consumer electronics with Apple Inc (AAPL) at 7.7x. We note that the Microsoft deal to acquire Activision valued the company at a 15x EV to EBITDA multiple which is a large premium to SONY trading at just 7x EBITDA.

Even Warner Music Group Corp (WMG) as a major player in music recording and publishing also commands a spread to Sony’s valuation. Recognizing all of these companies have key differences, the point here is to say that shares of SONY stand out as the value-pick in this group. Again, all this is in the context of positive growth and earnings trends for the company. We like the quality of Sony’s assets which include top-tier brands with a loyal following.

source: YCharts

Is SONY Stock A Buy, Sell, or Hold?

We rate SONY as a buy with a price target for the year ahead of $130.00 which represents a 22x forward P/E multiple on the current 2022 consensus EPS which is in line with management guidance. Our bullish case here considers that the “entertainment” and services side of the business within Sony Group can remain a strong point in the current market environment.

Putting it all together, our call is that the company still has room to outperform expectations which should be positive for the stock. The steps the company has made to ensure the long-term leadership of the PlayStation platform, including the recent deals to expand its gaming studio, can add upside to shares.

In terms of risks, Sony remains exposed to macro conditions and financial market volatility. A deterioration of consumer spending trends or signs of a pending global recession could force a reassessment of the long-term earnings outlook. PS5 production figures, music streaming trends, and box-office indicators are important monitoring points going forward.

Be the first to comment