Michael Vi

Investment Thesis

We follow up with a timely update to apprise readers of some noteworthy developments since we published our previous article on Palantir Technologies Inc. (NYSE:PLTR). We highlighted PLTR as our preferred software buy in our last article, as we believe its valuations and price action was constructive.

Our Buy thesis on PLTR has been progressing well, as it notched a 13.4% gain against the SPDR S&P 500 ETF’s (SPY) -5.5% loss since we published (based on July 7’s close). Notwithstanding, our early H1’22 articles on PLTR have widely missed the mark, as we had not considered its price action and valuation carefully enough.

Notwithstanding, we believe Palantir should fare pretty well in a recession given the criticality of its enterprise OS amid the current geopolitical crisis created by Russia. Also, CEO Alex Karp & Co. has consistently maintained their 30% revenue CAGR guidance through 2025, which lends tremendous visibility into our valuation model. Therefore, it highlights the resilience of its business model, which could see it gain tremendous operating leverage moving forward.

Our price action analysis indicates constructive price structures. Notwithstanding, it’s at a critical juncture. Therefore, we need to see PLTR continue to exert robust buying momentum to retake its near-term resistance convincingly to help regain its bullish bias in the medium-term.

Accordingly, we reiterate our Buy rating on PLTR, given its resilient operating model, reasonable valuation, and constructive price action.

Is Palantir Stock Recession Proof?

We don’t think any company can guarantee investors that a recessionary scenario would not impact them. Furthermore, Goldman Sachs was particularly downbeat on Palantir’s outlook. It noted, “Palantir’s average deal size is $8M, which could be impacted if the economy goes into a recession and companies are reluctant for larger transformation projects.”

Therefore, it’s critical for the company to communicate its ability to continue its 30% revenue CAGR cadence despite a slowing economy. Even though management has not deviated or revised its revenue guidance, the market has de-rated PLTR significantly since November 2021 (down more than 60% from its November highs).

However, our analysis suggests that it was mainly attributed to its embedded growth premium that couldn’t justify a 30% growth cadence. Hence, the battering seems warranted.

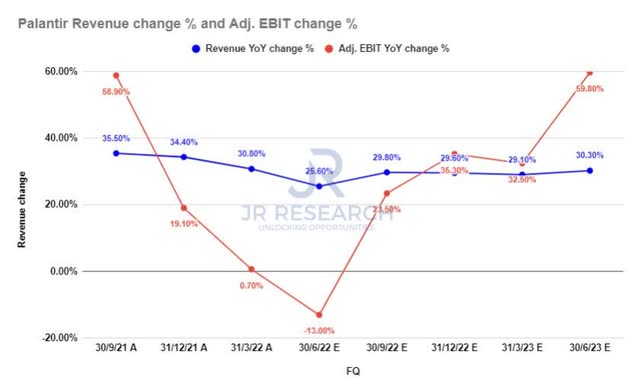

Palantir revenue change % and adjusted EBIT margins % consensus estimates (By FQ) (S&P Cap IQ)

Furthermore, the revised consensus estimates (generally neutral) remain confident in management’s guidance. Therefore, the Street seems convinced that Palantir’s revenue growth would not be impacted by the increasing likelihood of a near-term recession in the US or Europe.

Furthermore, Palantir’s adjusted EBIT margins are projected to hit a nadir in FQ2, given its recent OpEx investments. Notably, its inherent operating leverage could gain massively through FY23, helping it recover its EBIT profitability.

In addition, a recent commentary by BofA (BAC) also did not accentuate any near-term impact of a possible recession. Instead, it emphasized the criticality of Palantir’s enterprise OS that should see it gain momentum with governments in the US and Europe. It articulated (edited):

While geopolitical tensions pose a risk to worldwide software penetration, they are an opportunity for Palantir’s national security solutions in the US and allied countries, as militaries and intel services will need enhanced data and logistics capabilities as soon as possible – Seeking Alpha

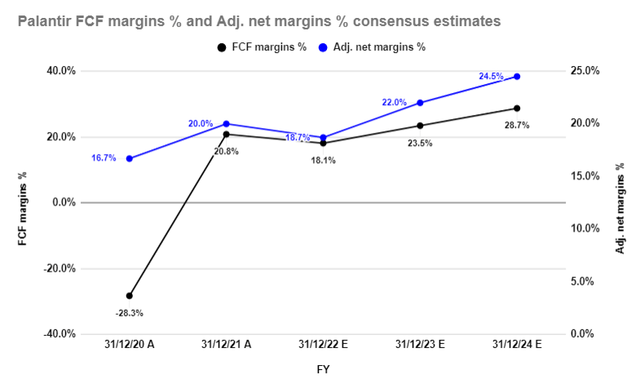

Palantir FCF margins % and adjusted net margins % consensus estimates (S&P Cap IQ)

Consequently, we are confident that the consensus estimates seem credible, given the extensive role that Palantir’s platforms could play. In addition, investors should consider the robust operating leverage gains Palantir could deliver through FY24.

The consensus estimates suggest that Palantir could continue to post robust FCF margins reaching 28.7% by FY24. Therefore, it corroborates the strong FCF capability of its operating model.

Accordingly, if Palantir can execute well (barring any unforeseen additional investments that could impact its near-term profitability), we believe the market will likely re-rate PLTR even if a recession hits.

Is PLTR Stock Undervalued?

| Stock | PLTR |

| Current market cap | $20.82B |

| Hurdle rate (CAGR) | 25% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 2.5% |

| Assumed TTM FCF margin in CQ4’26 | 26.5% |

| Implied TTM revenue by CQ4’26 | $5.34B |

PLTR reverse cash flow valuation model. Data source: S&P Cap IQ, author

We used a market-outperform hurdle rate of a 25% CAGR for PLTR, given its growth focus. As a result, we accord it a lower FCF yield requirement of 2.5% (last traded at 2.2%) to give it some space to justify its growth premium.

Applying a blended TTM FCF margin of 25% (factoring in an appropriate discount against the Street’s consensus), we derived a TTM revenue target of $5.67B by CQ4’26.

Therefore, our valuation model suggests that Palantir needs to deliver a revenue CAGR of about 28% from CQ1’22 to CQ4’26. Hence, it indicates that Palantir should be able to meet our revenue target if it maintains its guidance.

As such, PLTR seems undervalued at the current levels, despite its surge from its May bottom.

Is PLTR Stock A Buy, Sell, Or Hold?

We reiterate our Buy rating on PLTR stock.

However, investors should note that PLTR is testing a critical dynamic resistance at $10.50 and attempting to maintain above its previous near-term resistance of $8.90. Therefore, it’s vital for PLTR to continue consolidating along the current levels without losing its buying momentum. Then, it could likely indicate a potential accumulation phase conducive to buying the dips.

Our valuation analysis suggests that Palantir stock seems undervalued at the current levels. However, investors should be careful not to chase further momentum if it surges and wait patiently for a retracement.

Be the first to comment