Risto0

Nokia Oyj (NYSE:NOK, OTCPK:NOKBF) used to be a household name, but not anymore. I will go out on a limb to say that Nokia will never become a household name again, but this does not mean Nokia cannot make a strong comeback. In an article published in April of 2021, I claimed Nokia was looking attractive on the back of the early success of its reorganization efforts to reset the company’s cost structure. Since then, Nokia stock has gained 10.7% while the S&P has lost 11.5%.

It’s fair to say that Mr. Market has been rewarding Nokia shareholders for taking on the risks associated with a company that is trying to make a comeback to the big leagues. With Nokia set to report Q3 earnings tomorrow, I thought it best to revisit my thesis for Nokia and highlight potential risks investors need to look out for.

Nokia Q3 Earnings Preview

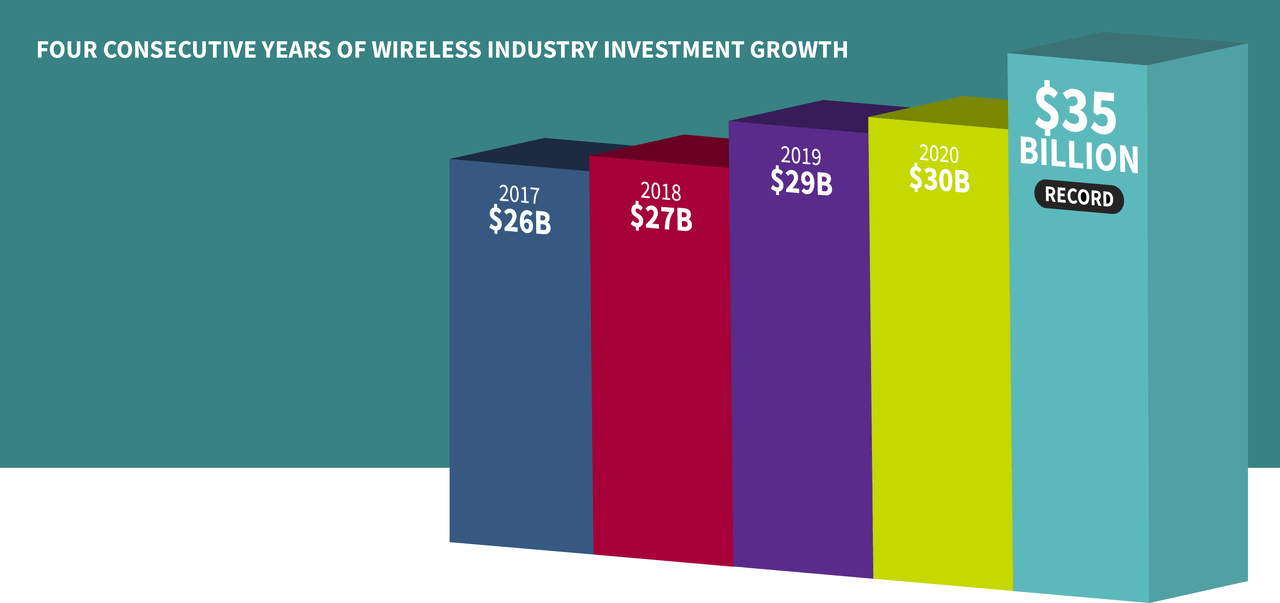

Wall Street analysts expect Nokia to report 10 cents per share in earnings for the third quarter on revenue of around $6.3 billion. The company has a stellar track record in beating Wall Street estimates for earnings in the last 8 quarters (7 out of 8). Nokia stock has responded positively to previous earnings surprises, which is a good enough reason to keep a close eye on Nokia tomorrow.

Exhibit 1: Nokia earnings surprise history

Although the focus will primarily be on Q3 earnings, investors should also pay attention to a few other data points to understand where the company is headed:

- How did supply chain challenges impact Nokia’s business in the third quarter and are these challenges expected to be a feature in the coming quarters as well?

- Is Nokia’s contract renewal process negatively impacting Cloud and Network Services segment revenue?

- Will Nokia’s international business take a hit from the ongoing depreciation of major currencies?

- Is Nokia effectively allocating cost savings toward R&D investments?

Finding answers to these questions will help investors get a better idea of Nokia’s long-term prospects, and I will keep an eye on the Q3 earnings release to find answers myself.

Can Nokia Continue To Grow?

My investment thesis for Nokia is centered around its ability to win lucrative deals from wireless carriers across the world that are spending billions of dollars on improving their technological infrastructure to support 5G technology.

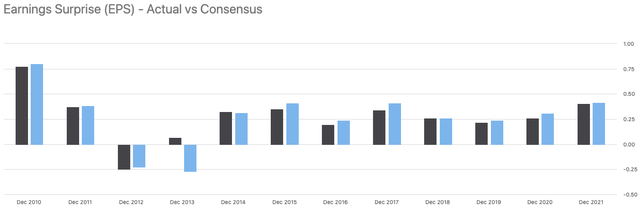

Since the launch of the 5G technology in 2018, telecommunication companies have aggressively invested in building the necessary infrastructure to support 5G-related services while catering to the dramatically increasing data consumption needs of consumers. According to data compiled by CTIA, wireless carriers invested more than $35 billion to improve their network capacity and capabilities in 2021, which makes it the fourth consecutive year in which telecommunication companies boosted their R&D budget on network infrastructure development.

Exhibit 2: Capital expenditures of wireless carriers by year

CTIA

CTIA’s data also shows that mobile data consumption skyrocketed to 53.4 trillion MBs in 2021, a massive leap from just 42.2 trillion MBs in the previous year. To offer some more color on mobile data consumption trends, wireless data traffic in 2010 was less than half a trillion.

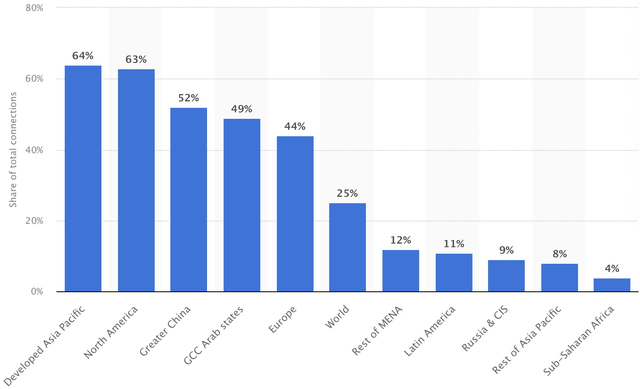

With a record number of Internet-connected devices, especially 5G-enabled devices, expected to be in use in every corner of the world by 2025, telecommunication service providers have no option but to invest aggressively in infrastructure projects or lose their edge to competitors. To give you an idea, the number of 5G-supported devices in the United States grew from just 14 million in 2020 to 85 million in 2021. This is good news for Nokia, as the company is one of the leading CSP equipment providers in the world, alongside Huawei, Ericsson (ERIC), and Samsung (OTCPK:SSNNF, OTCPK:SSNLF).

Exhibit 3: Projected 5G share of mobile connections in 2025 by region

Recent deal wins with India’s Reliance Jio and Bharti Airtel, Brazil’s Flex, and AT&T Mexico confirm the company’s expanding presence in international regions that are expected to drive the growth of the CSP equipment market in the next 5 years. 5G deployment will, on the other hand, help Nokia’s cloud services business as well – a business segment that needs a boost to see positive operating margins. As 5G gains traction, Nokia seems well-positioned to grow but investors need to closely monitor two significant risks.

First, we are not seeing a slowdown in infrastructure investments among top-tier wireless carriers in the world despite inflationary pressures as 5G investments are considered mission-critical but this is not a guarantee that things will stay the same in the foreseeable future. Persistent inflation could force wireless carriers to cut back on investments and postpone planned network investments, which would negatively impact Nokia’s revenue and profitability.

Second, Nokia has to overcome the threat of competition. Although Nokia does not face an existential threat today as the leading CSP equipment providers offer similar products and services with comparable quality, price-based competition is likely to increase in the future as CSP equipment providers try to gain market share before the industry matures. Price-based competition will negatively reflect on Nokia’s operating margins.

Takeaway

Nokia’s Q3 earnings will help investors get a better understanding of how the company will perform amid challenging macroeconomic conditions. More than the financial performance of the company in the third quarter, I believe investors should find answers to the concerns highlighted in this article. At a forward P/E of less than 13, Nokia is cheaply valued in the market today but investors need to monitor a few risks carefully to identify potential inflection points. Nokia stock, in my opinion, is not the ideal pick for traders looking for short-term profits. Investors’ patience will be tested in the next few quarters as the company navigates a difficult operating environment not just for CSP equipment providers but for all companies alike.

Be the first to comment