simonkr

Dear readers/followers,

In this article, we’re going to take a look at NextEra Energy Partners (NYSE:NYSE:NEP). The company isn’t a standard c-corp, but an L.P, a limited partnership. This can make investing more complete for some, but the company is still worth a look as well as trying to understand both what the company does, and its potential upside.

Here we’re going to try to do just that.

So, let’s see what the company is – and what it does.

NextEra Energy Partners L.P – What is this?

NEP is a growth-oriented LP formed by NextEra Energy (NEE), which also trades on the market. I begin with this partnership because I find the mix and the portfolio as well as the company’s ambitions to be interesting.

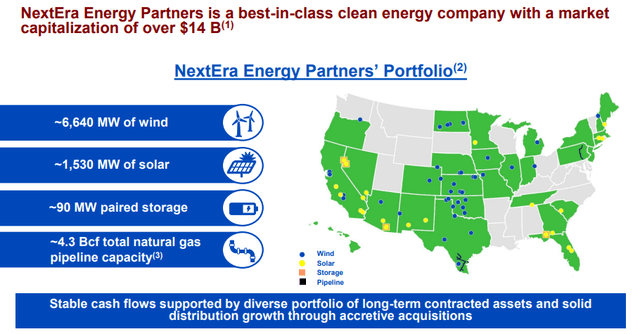

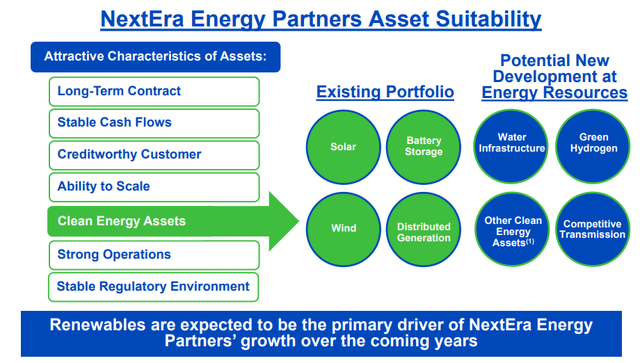

Because what it does is focus on growth-oriented renewable-focused energy projects and income-generating assets with very stable cash flows. It’s primary interest is found in Wind and Solar projects, as well as some natgas infrastructure assets found in Texas as well as Pennsylvania. All of the company’s assets are found in the US, none outside of the nation (yet).

Now, on the surface, this sounds very appealing, because who wouldn’t want to be investing in that sort of play?

NextEra Energy manages 62 GW of essentially clean energy with total market cap of $167B and $152B in terms of assets. It is the largest electrical utility by retail MWh sales and a number of customers. NextEra Energy Partners L.P, meanwhile, is a $14B market cap clean-energy company that manages around 6,640 MW of Wind, 1,530MW of solar, some paired storage, and a decent amount of natgas pipe capacity.

It doesn’t take an engineer to realize that the growth in clean energy generation, which by the way is ongoing, is going to be a major tailwind for this company. The prospective/potential development from large-scale assets to smaller-scale modular assets and generation is bound to have an almost transformational impact on the company. With tax credits, storage of energy and expected growth in key generation assets, this partnership is expected to grow significantly moving forward – just not in the immediate, near term.

When investing in NEP, shareholders get access to best-in-class O&M and development expertise and financing efficiency as well as in-depth financial expertise. NEP is structurally advantaged and freed from any meaningful levels of U.S taxation for at least 15 years. This makes the company’s position not dissimilar to other tax-advantaged structures such as REITs.

The current renewable backlog and additional potential growth is expected to add no less than 35 GW more to the company’s portfolio, more than doubling the current asset base, to a 2025E asset base of 52GW in total.

The company considers these growth objectives to be very realistic.

Fundamentally speaking, the company does not have a credit rating. Some factors push it down to a BB-rating, though this should not be taken as the company being inherently unsafe, as I see it. The company is somewhat unusual in that in addition to the publicly traded parent, NEE, it has its affiliate which also is on the market. Understanding, fundamentally, the structural ties between parent and affiliate here is complex. It can be said that NEP and NEE together own yet another subsidiary, the Operating partner vehicle through which NEP invests in its various projects. NEP’s shareholding of this venture is around 45%, with NEE owning the rest.

For reporting purposes, if you want to view the filings, NEP consolidates the JV’s onto its balance sheet, while NEE reports profits and does not consolidate NEP on its balance sheet.

So, some complex accounting going on here – at least for the uninitiated.

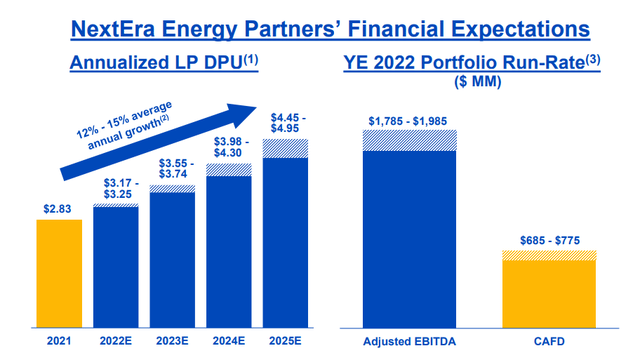

NEP isn’t a new dividend-paying company. It has been growing distributions for the past 7 years, coming to total dividend growth of 300%, and is expecting forward growth in the double digits in terms of its dividend. The company’s cash flows easily, at this time, cover the company’s 3.5%+ yield. It’s not the highest yielder – there are plenty of other utilities or businesses in the space that yield more than NEP does, but there are, to my knowledge, very few companies with the asset base and portfolio that NEP offers you.

There is comparatively low volatility to the company’s earnings, given their extremely low reliance on fossil – and the company’s earnings reflect this fairly well. Few surprises come from NEP, even if the market is treating the company perhaps a shade more volatile than I would have expected, given what NEP offers us.

The company’s finances, despite its low credit rating, are relatively stable. It’s long-term contracted cash flows have historically been able to support a range of low-cost financing alternatives, and the company has a revolver with $2.5B in availability. The latest revisions to the company’s credit risk have all been positive, and Fitch is the first rating company to bump to a BB+, with the company inching closer to investment-grade credit.

The company is on an outperformance streak that seems set to continue at this time, and the company is forecasting further growth here. With dividend coverage good, forecasted growth prospects excellent, and management qualitative, what remains are a few risks that could be argued to be, in part, out of the control of management.

We also need to remember that since the early Ukraine conflict, the entire space of energy has been at least partially rewritten. What were self-evident truths to even myself only a year ago, with Europe relying on Russia for much of its energy needs, has been thrown out the window – and for good reason.

The need for friendly sources of energy, including gas, has never been greater. This change has put into question years of “green” development against things like natural gas pipelines and gas infrastructure, all being questions that are now back up on the table. NEP/NEE also has such assets, with the MVP (Mountain Valley Pipeline) worth mentioning here. The company did a writedown of this asset back in the last quarter, but the pipeline recently won a legal battle, and the final word here is likely not said yet. What’s more, the project is almost 95% completed.

My expectation is for gas assets and infrastructure that are newly built and not reliant on unfriendly nations will be trading and be viewed with a premium, and this once again puts NEP in a very positive overall position.

The one risk I would ascribe to NEP, given NEP/NEE Florida exposure is the increasingly complex political situation in the southern state, which began when the company was no longer considered a special district. While I try not to bring politics into investing, any sudden changes such as this, no matter how well-motivated, bring about investor uncertainty, and this is generally not something you want as a state. Like any utility, NEE/NEP is dependent on macro. As we see with attractive peers like Pinnacle West (PNW), the development of utilities is largely dependent on population growth, which in turn comes from among other things, business growth. If one part of this equation fails because the area is not considered attractive, it can hamper company growth.

For now, this is unclear – but this is really the one risk I see with the business I thought to mention (aside from the complex capital structure, which essentially has EPS flowing back and forth a few times before landing).

Let’s look at valuation.

NextEra Energy Partners Valuation

I don’t often or typically invest a whole lot in LP’s. I was more favorable to them years ago, but back then I took more risks (when I had less capital, ironically enough). Today, I’m looking more for safety. NEP does qualify here, I feel.

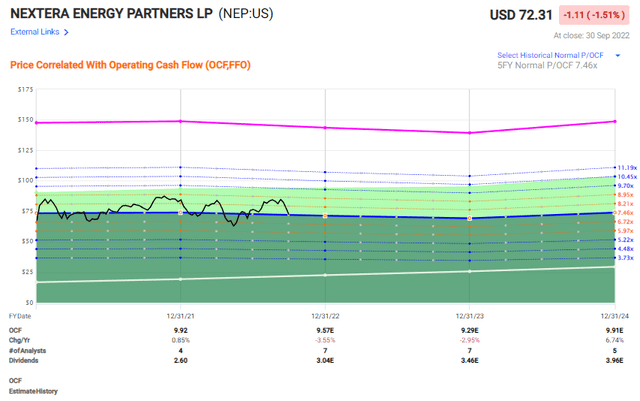

Given the extreme volatility of its earnings and even adjusted earnings, I feel a better method to evaluate NEP in terms of finding conservative and historically-accurate targets, is looking at the company’s cash flow. Here we can find patterns, though even cash flow has been volatile between 2015-2018.

NEP typically trades hands at around 6-8x P/OCF normalized, which means that the current 7.49x P/OCF is just in line with where we would expect things to be. The company has had a tendency to stick to a relatively decent premium to this 7.5x P/OCF average during the past few years, but currently trades at pretty much exactly this number.

NEP Valuation (F.A.S.T Graphs)

How far we discount the company depends on the reliability and forecastability of its earnings and cash flows. Higher certainties mean I tend to view higher multiples as more favorable. Unfortunately, this is not the case with NEP. Analysts miss targets more often than they hit them – both 1-2 year forecasts are wrong more than 50% of the time on the negative side, even with 10-20% margins of error. This implies a hard-to-forecast business, and given the capital structure and how earnings flow, this makes sense.

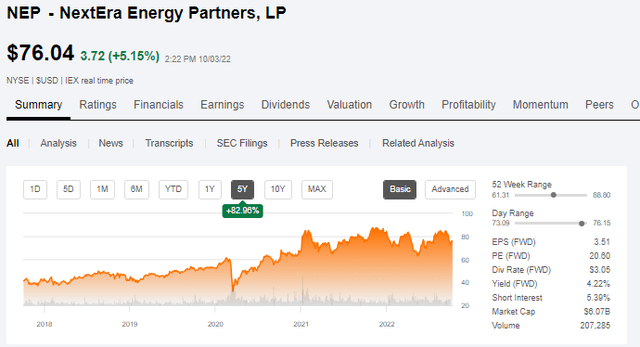

I wouldn’t call NEP “unstable” in the long term though, not even in valuation. A quick look at the share price development shows us that, all things considered, this company is generally in a pretty stable upward trajectory.

Seeking Alpha NEP Price (Seeking Alpha)

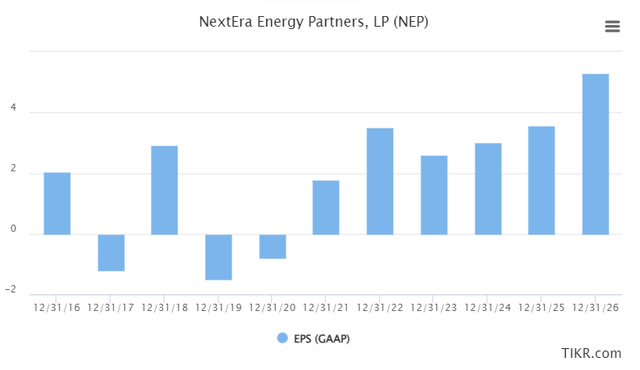

In matters of forecasting, I would expect this company to be able to generate EPS growth of double digits between 2022-2025, on the back of good prospects and good macro. This is also something that analysts other than myself are forecasting, with the S&P Global average calling for around annualized 10% EPS growth until 2026 – though most of that is in the outlying 2026E.

NEP EPS growth forecasts (Tikr.com/S&P Global)

Revenues and other variables are also expected to grow at around the 10-15% mark on an annual basis, on the back of impressive macro. I see no reason to put this in question under the current and expected 2-5 year macro, as the world moves into a potential recession and further difficult situations.

NEP deserves a fair bit of discounting for the capital structure – but to disregard the upside here would be foolish. I’m putting the company at a $80/share price for the longer-term 8x P/OCF target, which gives the company an upside of around 7% to the share price we’re seeing as I’m writing this piece. S&P Global analyst average calls for targets between $70/share and $95, finding an average at around $86, which calls for a 15-18% upside, depending on the share price. I view this as slightly too much.

At current levels, the company is a good way to secure a 4% yield in the renewable space. That being said, if you open your eyes to international prospects, you’ll find utility giants many times the size of NEP that offers renewable exposure, and yields nearly twice the size that NEP offers.

That is where my current capital is going.

That being said, I consider NEP a fair-value “BUY” here and give the company a single-digit upside. My PT is $80/share.

Thesis

My thesis on NextEra Energy Partners L.P is as follows:

- The company is a complex, but appealing play on renewable energy with a strong backing and an appealing yield. With its attractive assets, I would consider the company an appealing part of a diverse utility portfolio at a good valuation.

- I would be willing to pay 8x cash flow for the company – it currently trades below this. My PT is $80/share.

- That makes the company a “BUY” to me here.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment