mphillips007/iStock Unreleased via Getty Images

Netflix’s (NFLX) stock has corrected sharply post-earnings as investors panicked over the disappointing subscriber addition guidance. While the stock has shown some recovery from the bottom as renowned fund manager Bill Ackman took a stake and the company’s co-CEO Reed Hastings also bought its shares, it is still significantly below the levels it was trading at prior to its Q4 2021 earnings.

Why Is Netflix Stock Dropping?

Netflix’s Q4 earnings release served as a catalyst for the sharp correction its stock saw last month. While the company’s Q4 revenues of $7.71 bn was in line with the sell-side estimates and GAAP EPS of $1.33 beat estimates by $0.50, its subscriber addition of ~8.3 mn in Q4 missed the guidance of ~8.5 mn. However, the most troubling part was subscriber addition guidance for Q1 2022. Usually, Q1 is a strong quarter in terms of subscriber addition and after somewhat modest FY2021 investors were expecting subscriber growth to return to normal in FY2022. However, when the company came out with a just 2.5 mn subscriber addition guidance for Q1 2022, it surprised many investors. Management was also not able to give clear reasoning behind low subscriber addition guidance for Q1 on its earnings call which further added to the investor anxiety resulting in a sharp drop.

Can Netflix Stock Rebound?

The future course of Netflix’s stock will be decided by how its subscriber growth is trending and whether the launch of new competing services like Disney Plus (DIS) will pose any threat to its leadership position.

There are two ways to look at it. First, with competition increasing, it is natural to expect that the extremely high subscriber growth which Netflix has seen over the recent years might slow down.

However, there is a counterargument as well. More and more mainstream players entering the OTT space might actually accelerate OTT adoption. So, cord-cutting for linear TV may accelerate and the OTT industry may start seeing faster growth enabling Netflix to offset some impact of competition and maintain the healthy growth rate.

Netflix’s 2.5 million subscriber addition guidance has instilled the fear among investors that the first case is materializing, causing this drop. However, I don’t think one quarter makes a trend and if the subscriber growth rebound over the coming quarters or the company does better than its guidance, the stock may see some recovery as the year progresses.

Netflix Stock Forecast

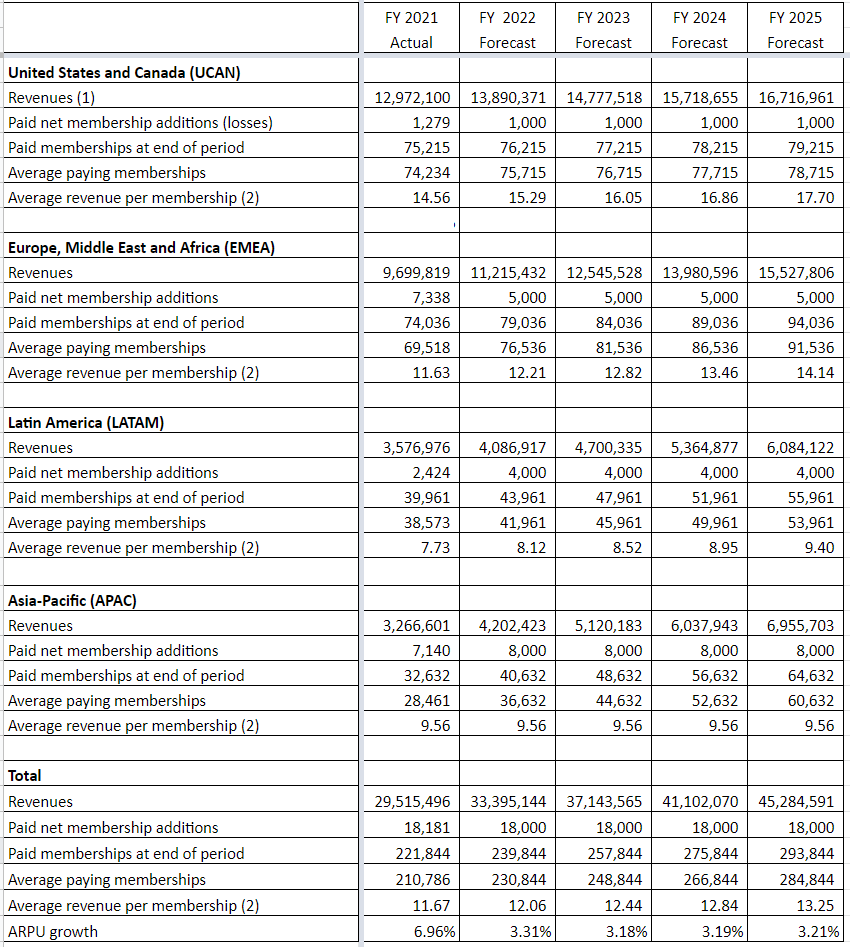

Netflix grew its subscriber base by ~28.6 mn in FY 2018, ~27.8 mn in FY 2019, ~36.6 mn in FY 2020 and ~18.2 mn in FY 2021. I have assumed its growth at the low end of this range for FY 2022 and the next couple of years. I have also assumed most of this growth coming from the low ARPU APAC region. So, the mix impact will be negative. For pricing, I have assumed a flattish trend in APAC where the company faces relatively tough competition from Disney + Hotstar, and mid-single-digit growth in other geographies where it commands a leadership position.

This gives us the following revenue forecast for Netflix.

Company Data, GS Analytics Estimates

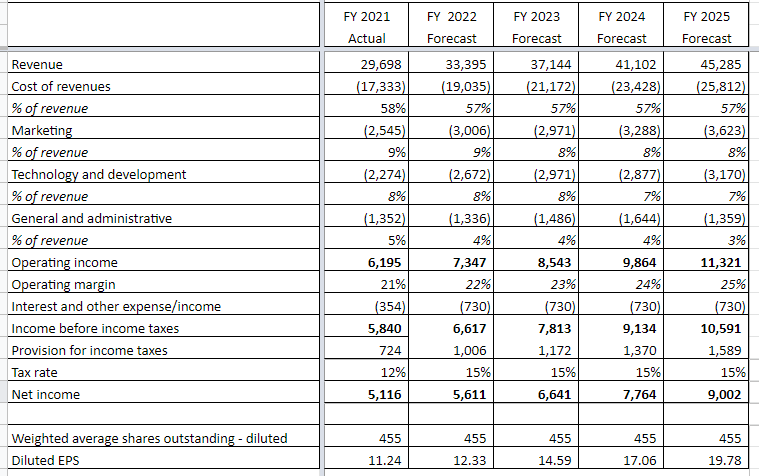

In terms of margins, the company has seen significant margin improvement in recent years. It saw its operating margins improve from ~18% in FY2020 to ~21% in FY2021. Given the recent increase in competition, I am assuming a much more modest ~100bps annual increase which gives us a mid-20s operating margin by FY2025.

Using these assumptions, we get an estimated EPS of $19.78 by FY2025. [Calculation: Using 18 mn net subscriber addition per year ( ~1 mn in the U.S., ~5 mn in EMEA, ~4 mn in LatAm, and ~8 mn in APAC) and flat ARPU in APAC and ~5% pricing increase per annum in other geographies, we have ~$45.3 bn revenues by FY2025 (see table above.) Using ~25% operating margin, we have ~$11.32 bn in operating profit. This year the company had ~$400 mn of forex gains which were included in other income. Other than these gains I have assumed other costs, interest, tax rate and share count to be in line with the current levels or the consensus estimates. For more details on my assumptions see the table below.]

Company Data, GS Analytics Estimates

While I believe my assumptions are reasonable, I understand that many of the readers might have different assumptions and might find my estimates optimistic/conservative. In case you want me to run your assumptions through my model please feel free to leave a comment and I would be happy to model in a scenario based on your assumptions.

Is Netflix Stock A Buy?

Netflix is currently trading at ~ 36x FY2021 EPS. It has traded at a much higher P/E multiple over the last five years, but that was because earnings were depressed due to high investments and its competitors didn’t have significant user traction. A couple of years down the line, I believe, some of its competitors will also gain significant user traction and the industry will have a few major players. But even in that scenario, Netflix will still be the leader with multiyear growth and margin expansion potential. So, even if I am reasonably conservative, a P/E multiple in high 20s is still likely in that scenario.

Using 28x P/E on FY 2025 EPS of $19.78, we get a price target of $553.84 or ~37% upside over the next three years. So, I believe despite being reasonably conservative, we can see a low double-digit CAGR over the next few years.

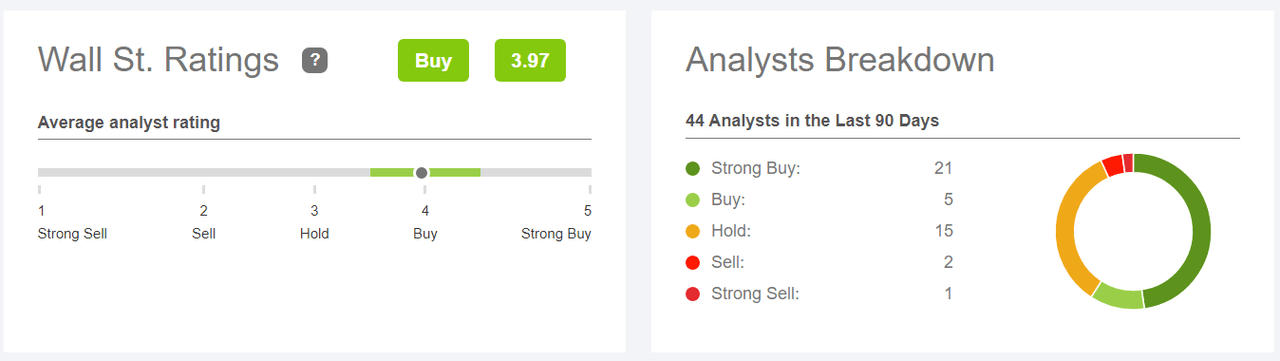

If we look at the rating summary, Seeking Alpha Author ratings and Quant ratings is neutral on the stock while Wall Street is bullish.

Seeking Alpha

I believe risk-rewards are attractive at the current valuation and rate the stock a buy.

Be the first to comment