Siegfried Schnepf/iStock via Getty Images

One of the appeals of Miller Industries (NYSE:MLR) is that it is one of the easiest companies in the world to understand. The company builds tow trucks, vehicles that are called “wreckers” in my home state. The company does not hold a monopoly on the industry, but it is widely acknowledged to be by far the largest. The company also produces some carriers, but it does not break out those figures.

Miller Industries’ Prospects

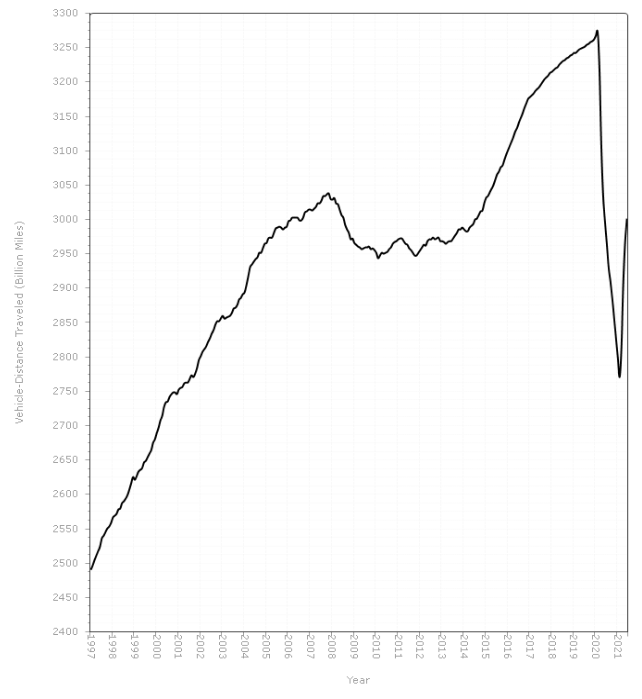

The farther cars go, the more likely that they will need a tow truck. Total miles driven fell to their lowest levels in twenty years during the pandemic, but they have been rapidly increasing again:

Total Miles Driven (U. S. Department of Transportation)

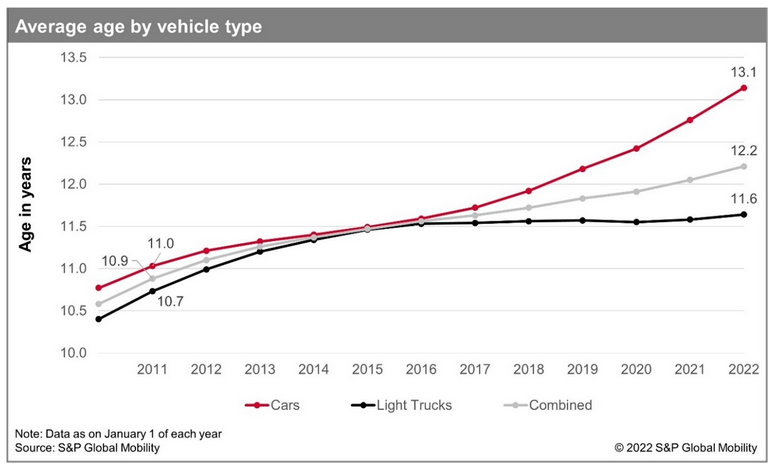

In addition, the average vehicle age in the United States is more than 12 years old, a new record:

Average of Vehicles (S&P Global Mobility)

Supply chain problems producing new cars are cited as the biggest cause of increased age, especially problems with finding microchips. “The ongoing of supply chain constraints has led to a decrease in vehicle scrappage,” according to S&P Global.

As vehicles get older, they are more likely to break down:

According to a recent report by roadside-services provider AAA, more than two-thirds of calls for assistance involved vehicles that were at least 10 years old, Meanwhile, of the stranded vehicles AAA wound up having to tow to a repair facility, 81 percent were a decade old or more. (cars.com)

More cars breaking down mean that more tow trucks are needed.

All of these factors bode well for an increase in demand for Miller’s products. The most recent earnings call from the company confirms that backlog has indeed been strong. President & CEO Will Miller said:

We continue to experience a strong backlog and are seeing continued elevated demand as evidenced by not only our year-over-year revenue growth, but also our sequential revenue growth from the end of last year, as material shortages ease and our price increases go into effect. We are continuously optimistic about future top line growth, prospects and fully capturing demand.

Miller Industries Problems

However, the supply chain issues that are bedeviling auto manufacturers are also causing problems for Miller. When an analyst on the earnings call asked what components were giving problems, Will Miller said that the company has gone out of stock in hydraulic and electrical components. The company has since found additional suppliers for some components, but problems persist.

The cost of operations has gone up due to higher component prices and the scarcity of parts.

Another issue is labor. New employees are taking more time to train because they don’t have the necessary skill sets or the level of skill sets that the company has seen in the past. The company’s hourly labor is fully staffed, but the company sees a significant turnover rate with new hires. The cost of operations has gone up due to wage inflation.

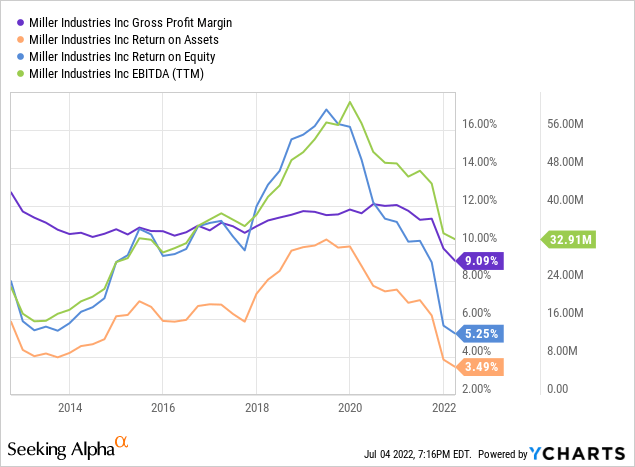

The only way the company can compensate for increased costs is to increase prices. The company has done that. Still, returns have suffered as a result, as has its margins. The company has posted the lowest levels of returns and margins in 10 years. It also posted the lowest EBITDA in 4 years.

When asked during the earnings call what might be done to return to pre-pandemic margins, Will Miller deferred to CFO Debbie Whitmore. She said that everything is in place to return to those levels “once the supply chain is back to a normalized.” Miller had said earlier in the call that inflationary pressures and supply chain challenges had already “persisted longer than any of us had anticipated.” In short, the company does not know when margins will return.

Volkswagen (OTCPK:VWAGY) offered some hope of relief last week to supply chain woes. The automaker reported that shortage of chips is starting to ease up, offsetting supply chain bottlenecks and rising costs.

Similarly, Micron (MU) forecast lowered income for the current quarter, and said that its market had “weakened considerably in a very short period of time.”

Samsung (OTC:SSNLF) is reportedly reducing orders over rising inventories. Their cuts apply to parts for televisions, appliances, and smartphones, but the cuts still highlight worries of a chip glut.

Sound Management, Sound Dividends

Miller Industries boasts 46 consecutive quarters of dividend payments. As of this writing, the yield is a little bit more than 3%. The dividend is quite safe, despite falling earnings. The company’s accounts receivable alone is worth more than all their total liabilities. The company has always run a conservative and clean balance sheet.

Despite strong dividend payouts, the company has not raised its dividend since 2017.

The company did draw $20 million in debt last quarter, half for temporary working capital needs. The other half went toward building an inventory of chassis, to offset the risk of supply chain delays. In years past I have made note of such indebtedness with some minor concern, but the company has always paid down the debt before. It most likely will do so again.

Valuation

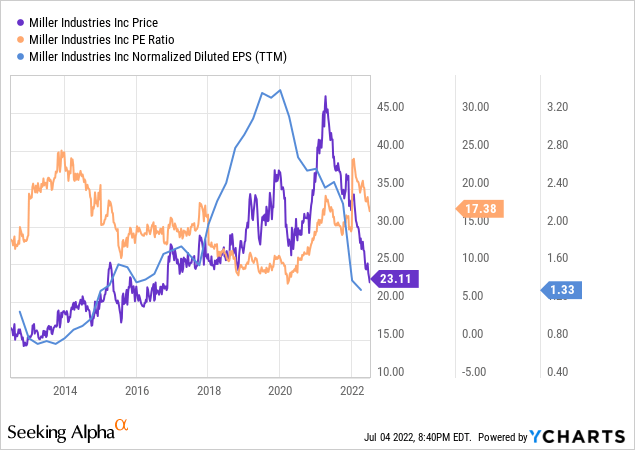

The stock price did not immediately follow the drop in earnings, but when it did, it fell hard. The stock price broke through multi-year technical resistance level at about $30 and never stopped.

The Price / Earnings Ratio, which was in single digits just two years ago, is currently more than twice that at 17.

Tentative Forecast

The fall in earnings and corresponding fall in stock price has almost caused me to liquidate my own holdings of Miller stock. The news that management does not know when supply chain problems will resolve makes matters worse. If supply chain woes do not resolve next quarter, it seems likely that the stock price will continue to fall.

However, Volkswagen has reported that the problem the chip supply problem is easing. Other semiconductor companies are reporting similar issues. Given that, Miller’s supply chain issues may get some relief in coming weeks. Investors will not hear of it, though, until the company next reports earnings, presumably in August. So the stock price will probably continue to keep falling until then. Once the company reports easing in chip supply chain issues, the company should see improvement in earnings. If so, the stock price may well reverse at that time.

The stock price might bottom sooner than the earnings call if the market continues to hear news of a chip glut in coming weeks. Either way, the stock could be considered a sell in coming weeks, but a buy in coming years.

Conclusions

Miller Industries is a strong company with a healthy balance sheet. The company should survive well as it has in years past. It also has a decent dividend.

It is difficult at this time to know when supply chain issues will resolve for Miller, and more difficult to predict when earnings will show improvement. The potential risk is significant in the short term, especially in the weeks before the earnings report. The potential rewards are significant in the long term. I rate the stock a hold in between the two extremes.

For my own portfolios, I most likely will sell my shares over the next couple of days to cut my losses, with the expectation that the stock will continue to go down for some weeks yet. Then when there is some sign that earnings have improved, I will most likely buy back in, presumably at a lower price.

Be the first to comment