Ian Tuttle/Getty Images Entertainment

Meta Platforms (NASDAQ:META) is not the kind of stock that you would expect to have fallen this much even amidst a broader tech crash. The company is highly profitable, was trading at reasonable valuations prior to the crash, and trades even cheaper now. Sure, its growth may be pressured in the near term on account of a weak economy, but its long-term positioning in online advertising and the metaverse is not currently being reflected in its 14x earnings multiple. I rate shares a strong buy.

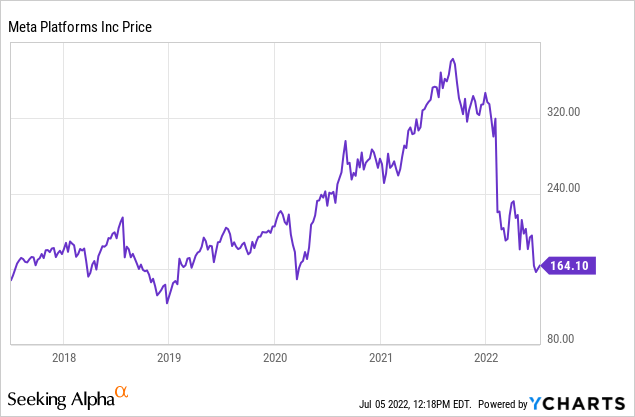

META Stock Price

It took META many years before it was able to make up for lost time from its Cambridge Analytica scandal. All that progress has been lost in just a few months.

I last covered META in April where I discussed the pros and cons of buying the stock. The stock has since fallen another 28% – furthering the attractiveness of the buying opportunity.

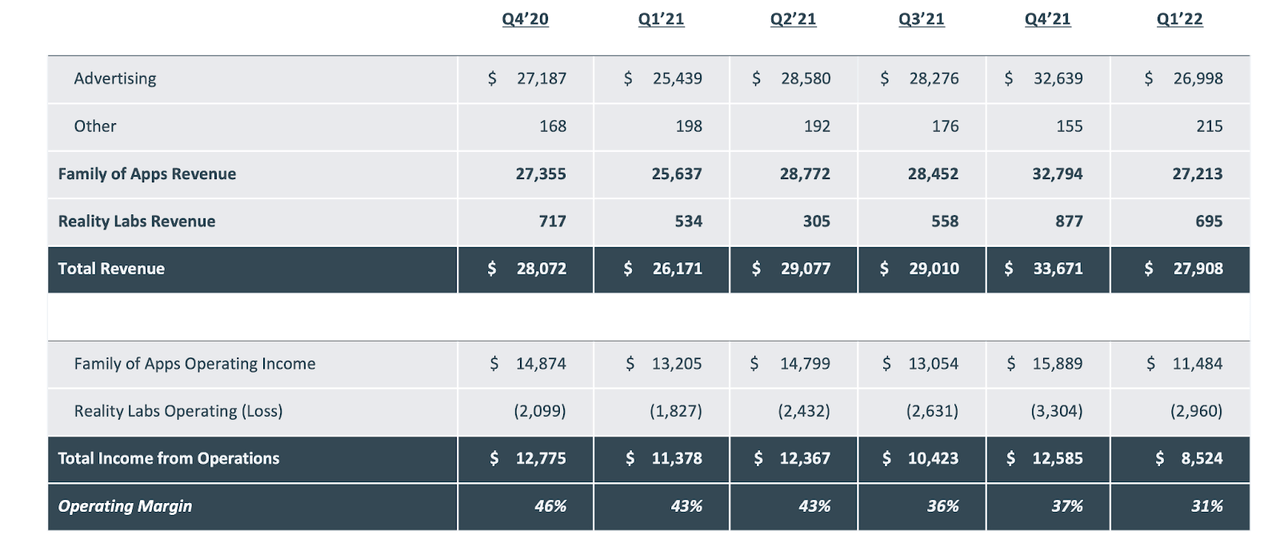

META Stock Key Metrics

Revenue growth was OK, but not stellar at 6.5% year over year, coming in at the low end of guidance. Operating income dipped heavily as the company simultaneously increased expenses in its core businesses as well as expenses in the metaverse.

2022 Q1 Slides

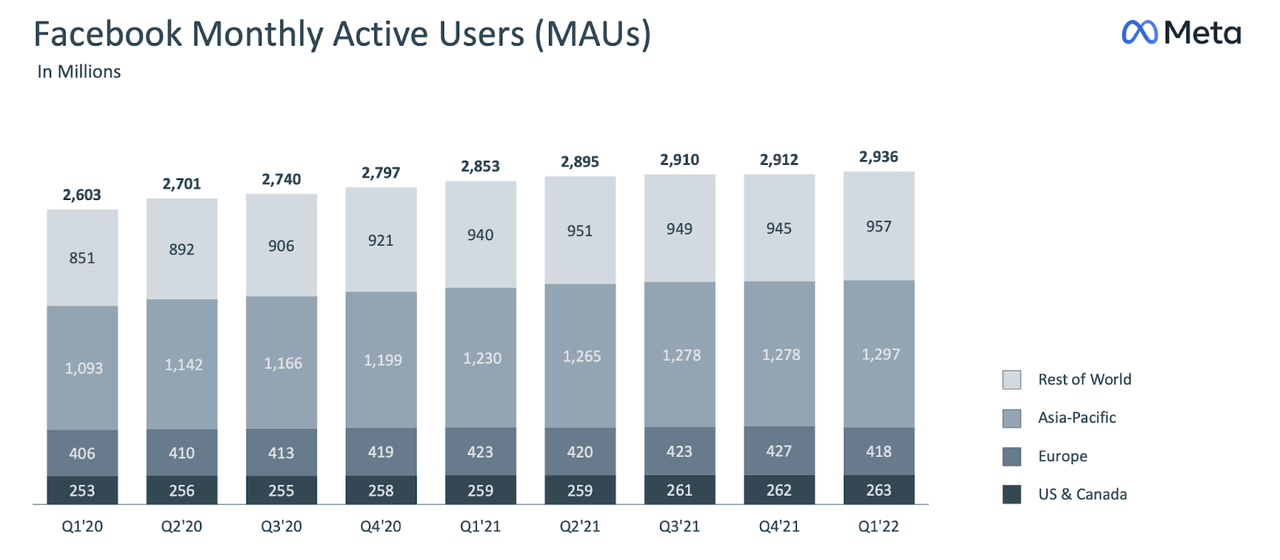

Both of these results were more or less expected. What was surprising was the growth in monthly active users. After seeing surprising weakness last quarter, FB delivered strong results this quarter.

2022 Q1 Slides

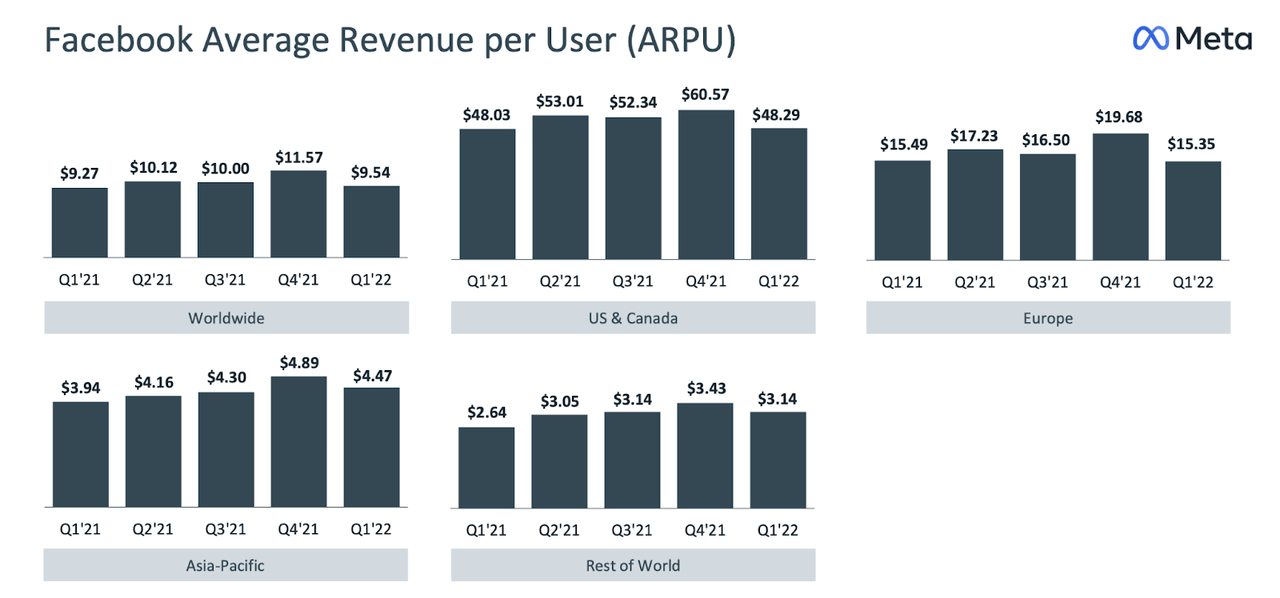

Average revenue per user growth was more muted, but that is understandable considering the increased emphasis on reels. Historically when the company moves on to newer formats, monetization is light at first.

2022 Q1 Slides

My personal take is that the growth in MAUs was nice, but didn’t change anything in my long-term thesis, as I never doubted the growth story to begin with. Instead, my excitement stems from the fact that the company spent $9.4 billion on share repurchases versus generating $8.5 billion in free cash flow. Like Alphabet (GOOGL), FB is proving itself to be a company which has finally embraced share repurchases – and the timing couldn’t be better with the stock trading so cheaply. Cash and cash equivalents and marketable securities were $43.89 billion, making up nearly 10% of the market cap.

Looking forward, the company expects second quarter 2022 total revenue to be in the range of $28-$30 billion – that represents growth of only 4.9% at the high end. On the conference call, management emphasized their belief that both growth and margins will recover in the future, and I believe them. At these prices, it is quite easy to.

Why Has Meta Platforms Stock Been Dropping?

But at the same time, the worsening economic picture makes it easy to see near-term pressure. The risks of a recession loom large, making it plausible that online advertising spend may decline, at least in the near term. Couple this with declining margins and some investors appear to have gotten cold feet. Investors appear to be afraid that net income may decline in the near term.

Can Meta Platforms Stock Reach $200 Again?

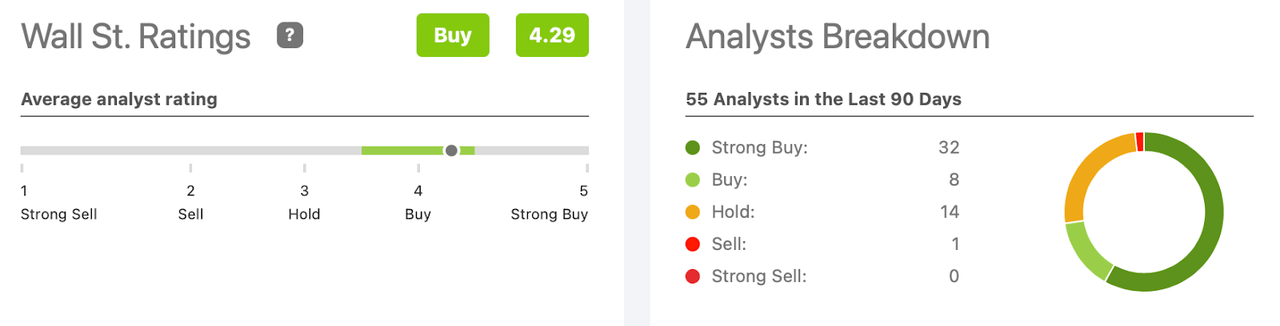

Wall Street analysts seem to believe so. The average buy rating is 4.29 out of 5.

Seeking Alpha

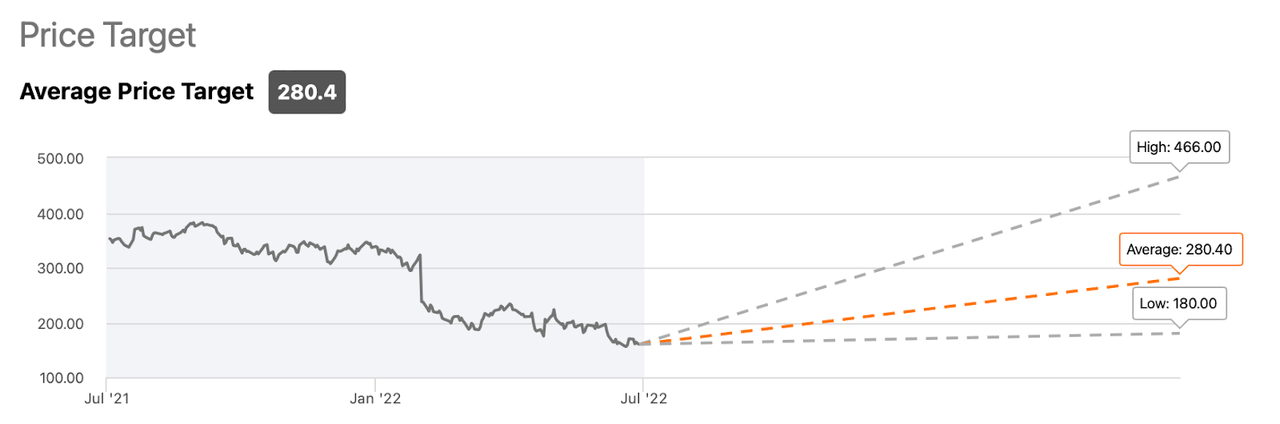

The average price target is $280.40 – far higher than $200 and representing 75% potential upside.

Seeking Alpha

Is META A Good Long-Term Pick?

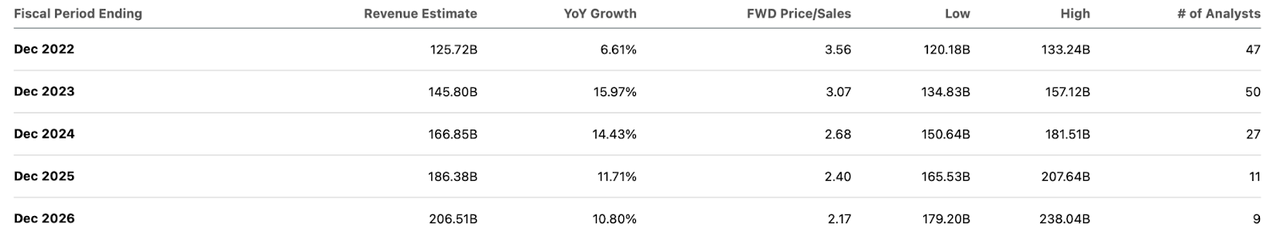

It is anyone’s guess what the near-term fundamental picture will look like. But over the long term, I see META continuing its track record of consistent growth as it continues to take market share in online advertising. Consensus estimates call for a near-term slowdown before a return to double-digit growth through 2026.

Seeking Alpha

META is a company with a tremendous track record of growing its user count through innovation. The near-term pressures from TikTok are not pleasant to the say the least, but I am confident that META will be able to innovate its way out of the near-term headwinds.

Is META Stock A Buy, Sell, Or Hold?

Yet with the stock trading at just 14x forward earnings, a return to strong growth might not be necessary. The earnings power may be understated as consensus estimates imply a 26.1% net margin this year – far lower than the 33% net margin in 2021. Excluding losses from Reality Labs, its metaverse division, META trades at just 11x earnings. It is true that any stock can always get cheaper. But this is a company which converted 97% of net income into free cash flow in 2021 and has shown an active willingness to buy back shares. The lower the stock goes and the longer it stays low, the more shares that the company will be able to repurchase out of free cash flow. Assuming a return to double-digit revenue growth, I could see earnings growing at a 15% to 20% clip over the medium term. I could see the stock trading at a 1.5x to 2x price to earnings growth ratio (‘PEG ratio’) due to the ongoing share repurchases, strong balance sheet, and secular growth story. That implies a valuation of 22.5x to 40x earnings, or a stock price of $265 to $470 today.

I have already discussed the near-term risks due to a weak economy. META was not public during the Great Financial Crisis and even if it was, it was still in hyper-growth mode, so investors do not have a historical guide as to what to expect in a true slowdown. It is possible that META even sees declining financials if economic conditions are severe enough. However, I am less concerned about that risk as it should prove near term in nature. Instead, the longer-term risk is if META loses relevance with the younger generations. What if newer generations do not care to document their lives on social media? What if newer generations all move to TikTok instead of Instagram? While META is highly profitable right now, its growth engine would slow considerably if competitors manage to take market share. I view it to be too early to throw in the towel on CEO Zuckerberg and his team, as this company has arguably earned the benefit of the doubt – at the very least, the company was able to move past the Cambridge Analytica data privacy scandal. If the company were to show many quarters of a user decline, then that may prove to be a red flag, though the stock is arguably already trading as if that has occurred. META is the rare tech stock that has a strong long-term growth outlook, is generating envious free cash flow margins, trades at a low double-digit multiple of earnings, and is buying back stock. I rate the stock a strong buy for the long term.

Be the first to comment