JannHuizenga/iStock Unreleased via Getty Images

Elevator Pitch

I have a Hold investment rating for Lucid Group, Inc. (NASDAQ:LCID).

LCID’s shares have corrected by more than -30% in 2022, which is largely attributable to its fourth-quarter top line miss and its below-expectations production volume guidance for the current year. I think that Lucid Group’s forward Enterprise Value-to-Revenue of 3.3 times is reasonable at less than half of what Tesla (TSLA) is trading at. A share price recovery for LCID is less likely in the short term, as I am of the opinion that investors would prefer either TSLA as a pure-play EV company or other legacy automotive companies which are investing aggressively in the EV space over start-up EV makers like LCID. As such, I don’t think Lucid Group is nearing a buy point, and I assign a Hold investment rating to the stock.

LCID Stock Key Metrics

In the company’s FY 2021 10-K filing, LCID describes itself as a “technology and automotive company that is setting new standards with its advanced luxury electric vehicles.” The company also specifically mentions in its recent 10-K about its flagship EV, Lucid Air, which is referred to as “a luxury electric sedan” that boasts an “industry-leading EPA(Environmental Protection Agency)-accredited range of more than 500 miles on a single charge.”

Lucid Group issued its Q4 2021 financial results press release on February 28, 2022, and the company’s top line fell short of market expectations. LCID’s revenue jumped from $3.6 million in the fourth quarter of 2020 to $26.4 million in Q4 2021, but this was less than half of the $59.9 million top line that investors were expecting.

As an EV start-up, Lucid Group’s production figures, the number of reservations and its capital position are the metrics that investors are watching closely, apart from revenue.

LCID guided that it expects to produce between 12,000 and 14,000 units of the Lucid Air this year as indicated in its Q4 results media release, and this was disappointing. A March 1, 2022 Seeking Alpha News article cited a Bank of America (BAC) sell-side research report which highlighted that “the lowered outlook (for 2022 production) ” was “somewhat surprising in magnitude with LCID attributing the new outlook to supply chain and logistics challenges.”

On the flip side, Lucid Group’s increase in reservations and robust cash position sent positive signals to investors.

The company revealed at its Q4 2021 earnings briefing on February 28, 2022 that the number of reservations for its Lucid Air EV grew by +47% from 17,000 in the middle of November 2021 to 25,000 by the end of February this year. This points to strong demand for the Lucid Air. Also, based on BAC analysts’ estimates, LCID’s 25,000 reservations are equivalent to a $2.4 billion order book, which is +84% higher than the company’s consensus FY 2022 revenue forecast (source: S&P Capital IQ) of $1,307 million.

Separately, Lucid Group had $6,263 million of cash on its books as of December 31, 2021. LCID emphasized at its recent quarterly investor call that “we are funded well into 2023” based on its current cash balance. This is aligned with the Wall Street analysts’ financial forecasts as per S&P Capital IQ. The market consensus expects Lucid Group to be free cash flow negative to the tune of -$3,281 million and -$3,548 million for FY 2022 and FY 2023, respectively which can be funded by its cash on hand. In other words, LCID has no immediate financing needs.

In summary, I will see this a mixed quarter for LCID, but the company’s share price performance appears to suggest otherwise as I will discuss in the subsequent section.

Why Has Lucid Stock Dropped This Year?

Lucid stock has dropped by more than -30%, or -33.9% to be exact, this year. LCID’s revenue miss for the fourth quarter of 2021 and its disappointing FY 2022 production guidance as mentioned in the previous section of this article are definitely the key reasons for Lucid Group’s 2022 year-to-date share price fall.

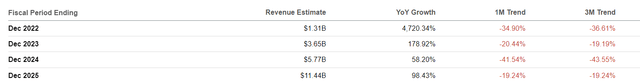

Notably, LCID declined to offer guidance for the company’s FY 2023 production at this point in time. Lucid Group stressed at the company’s Q4 2021 results call that “the supply chain situation is quite dynamic, and we will share (fiscal 2023 production) guidance as we experience more of the following quarters.” As such, it is understandable that the sell-side analysts have been cutting Lucid Group’s future revenue estimates (as per the chart below) in the past one month after the company reported Q4 2021 results and hosted its earnings call at the end of February 2022.

Revisions To LCID’s Consensus Revenue Forecasts

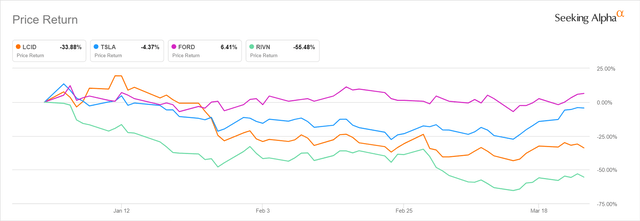

Another factor that might help to explain Lucid Group’s share price weakness in 2022 is the relative stock price performance for the listed company vis-a-vis its peers. As per the chart below, Lucid Group and its start-up EV peer Rivian Automotive (RIVN) have done very poorly this year thus far, declining by -33.9% and -55.5%, respectively. In comparison, Tesla only declined slightly by -4.4% this year, while Ford Motor’s (F) shares actually still rose by +6.4% over the same period.

2022 Year-to-Date Stock Price Performance Of LCID And Key Automotive Peers

It is clear from the share price chart presented above that investors betting on the EV investment theme now prefer to invest in legacy automotive companies pivoting towards EVs like Ford or established EV makers with a certain level of scale such as Tesla. In comparison, investors in general now have lower risk appetite, and are obviously avoiding Lucid Group which is a high-risk, high-reward investment proposition as an EV maker which has yet to scale up.

What Is Lucid Stock’s Price Target?

Lucid stock’s consensus sell-side target price suggests that Wall Street is becoming less bullish on the stock. The average sell-side analyst price target for LCID is $34.75 as of March 25, 2022, which represents a -19% drop as compared to the stock’s consensus Wall Street target price of $42.75 as of December 31, 2021 as per S&P Capital IQ.

More importantly, there is a huge divergence in how the sell-side analysts think about Lucid Group’s valuations. The most optimistic analyst sees LCID’s share price going up to $50, and this implies that Lucid Group’s shares could almost double from its last traded price of $25.16 as of March 25, 2022. On the other hand, the analyst with the most pessimistic view of LCID thinks that the company’s shares could potentially fall by another -76% to trade as low as $12.

In the next section, I discuss if LCID is an attractive investment candidate based on its valuations.

Is Lucid Stock Nearing A Buying Point?

Lucid stock is not nearing a buy point, in my view.

Peer Valuation Comparison For LCID

| Stock | Consensus Forward Fiscal 2025 Enterprise Value-to-Revenue Multiple |

| Lucid Group | 3.3 |

| Tesla | 7.2 |

| REE Automotive Ltd. (REE) | 0.1 |

| Lordstown Motors Corp. (RIDE) | 0.2 |

| Fisker Inc. (FSR) | 0.4 |

| Rivian Automotive | 1.1 |

Source: S&P Capital IQ

LCID does deserve to trade at a premium to other start-up EV makers as per the peer valuation comparison table, as it has a very good and popular product in the form of Lucid Air and it has no financing pressures in the near term as highlighted above.

But if Lucid Group continues to disappoint in relation to its future production numbers, its valuation premium over its peers might narrow. Also, as more investors rotate away from startup EV stocks to either Tesla or Ford, the valuation de-rating for Lucid Group and its startup EV peers might continue. Separately, Lucid Group currently trades at a -54% discount to the proxy stock for the EV sector, Tesla, based on the forward FY 2025 Enterprise Value-to-Revenue metric, and this seems fair to me.

In conclusion, I don’t think that LCID is at a compelling buy point now based on current valuations.

Is LCID Stock A Buy, Sell, or Hold?

I rate LCID stock as a Hold. The stock’s -33.9% price decline year-to-date is justified by uncertainty over the company’s short-term production and revenue growth as mentioned earlier in this article. Lucid Group’s valuations are also not sufficiently attractive to warrant a Buy based on a peer valuation comparison.

Be the first to comment