Justin Sullivan

Article Thesis

Johnson & Johnson (NYSE:JNJ) will report its second-quarter earnings results on July 19. We will take a look at what investors can expect for the quarter, and we’ll highlight why Johnson & Johnson is a good investment for investors seeking a low-risk income stock with a strong dividend growth track record. That being said, the valuation isn’t ultra-low today, so near-term upside potential might be limited.

What To Expect From Earnings

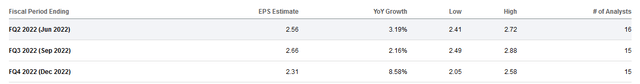

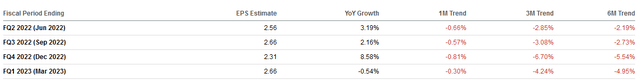

JNJ’s second-quarter results should get released on July 19, which is a Tuesday. The analyst community is currently predicting the following earnings per share for the quarter:

$2.56 in earnings per share for the second quarter would mean a 3% increase versus the previous year’s period. That’s not especially strong, but not a disaster either. Earnings per share growth is also seen accelerating to around 5%-6% during the second half of the year, with growth being backloaded towards the fourth quarter.

Revenues are seen coming in at $23.9 billion for the second quarter, which also represents a growth rate in the low single digits range. Over the last couple of months, earnings estimates have trended downwards, as we can see in the following chart:

Over the last month, EPS estimates declined marginally, but over the last three and six months, they declined by a couple of percentage points. One factor for that is that higher COVID case counts in some of Johnson & Johnson’s markets have resulted in fewer elective surgeries, which hurts its medical tech business. But since these surgeries will most likely be done at some point in the future, these sales likely aren’t lost forever — instead, they are pushed into the future by a couple of quarters, which isn’t too bad.

JNJ isn’t especially vulnerable to inflation, as margins are high and since input costs aren’t an overly large factor. But still, inflation might have a negative impact on the company. When consumer budgets are pinched by inflation, due to high energy and food prices, they may spend less on other goods. They will still buy consumer staples, of course, but may opt for cheaper store brands instead of buying the higher-quality, higher-priced products Johnson & Johnson is selling.

Johnson & Johnson is active around the globe, which means that a large portion of its revenues and earnings are generated outside of the United States. That, in turn, makes JNJ exposed to currency rate changes. When the US Dollar strengthens versus other currencies, JNJ’s non-US revenues are worth less once denominated in USD. With the US Dollar strengthening quite a lot in recent months, versus many other currencies such as the Euro or the Yen, this foreign exchange impact will hinder JNJ’s earnings and revenue growth during Q2 and the remainder of the current year.

The combination of these factors explains why Johnson & Johnson’s earnings per share estimates have been trending down to some degree in recent months. But considering the many crises around the world today, even a 3% earnings per share growth rate is far from bad, especially when it comes from a resilient low-risk stock such as Johnson & Johnson.

Johnson & Johnson Stock Key Metrics

Johnson & Johnson has a diversified business model across several industries. Pharmaceuticals, medtech, and consumer staples are all relatively resilient versus recessions, which makes JNJ a solid pick for those fearing a potential recession in the United States. It is feeling some headwinds from inflation, the COVID pandemic, and a strengthening US Dollar, but those will likely not be major issues in the long run. Even in the near term, JNJ is still expected to grow its revenues and profits, showcasing its resilience.

Johnson & Johnson’s resilience is also proven by its excellent dividend growth track record. The company has managed to grow its dividend for a hefty 59 years in a row, which makes JNJ receive an A+ grade in the Dividend Growth and Dividend Payments categories of Seeking Alpha’s scoring algorithm. Overall, JNJ is rated neutral (3.4) by Seeking Alpha’s Quant model, although it is relatively close to a Buy rating (3.5 and above). Wall Street rates Johnson & Johnson a Buy, with an average price target of $189, implying an upside potential of 7% over the next twelve months. With the dividend yield of 2.5% added to that, Johnson & Johnson could thus offer total returns in the 10% range over the coming year if Wall Street is right.

Over the last five years, Johnson & Johnson has raised its dividend by 6% annually. The most recent dividend increase was announced this April, thus it will likely take another nine months or so for the company to raise its dividend again. In terms of dividend safety, the ultra-long dividend growth track record already suggests that the risk of a dividend cut is very low. This is further underlined by the fact that Johnson & Johnson will pay out just 44% of its profits in the form of dividends this year. Even a 50% drop in its earnings would thus not make the dividend payout ratio rise above 100%, and that is extremely unlikely.

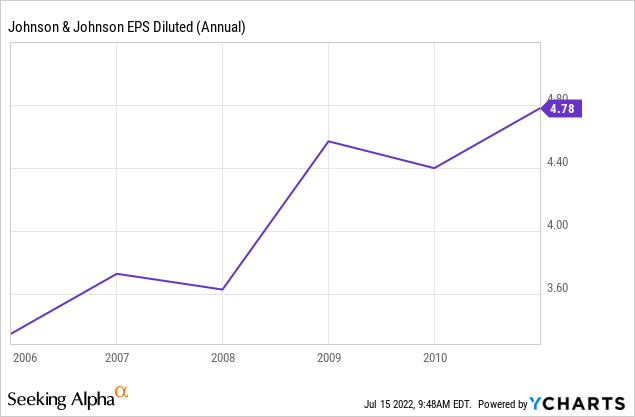

In fact, during the Great Recession, Johnson & Johnson experienced an earnings per share decline of just a couple of percentage points in 2007 and 2009, while earnings per share overall rose significantly between 2006 and 2010. A potential recession in 2022 or 2023 would likely be less severe than the Great Recession, at least that’s what most analysts believe. In such a more shallow recession, Johnson & Johnson would likely see its profits come under even less pressure. Investors thus don’t have to worry about a dividend cut at all, as JNJ seems to be among the best-positioned companies to weather any macro crisis.

Is JNJ Stock Overvalued?

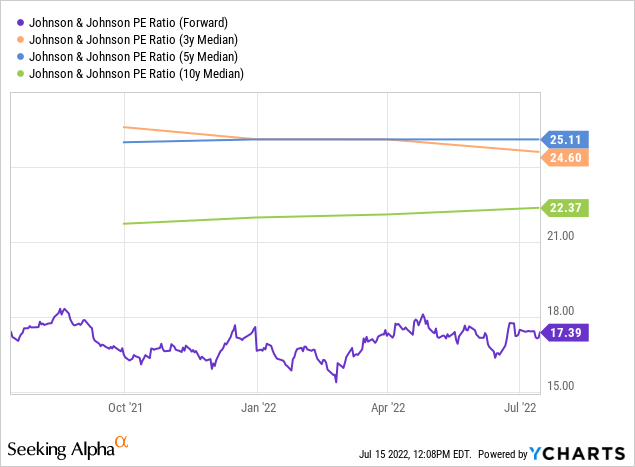

Today, Johnson & Johnson is trading for around 17x this year’s profits. That’s not an ultra-low valuation, but it is not especially expensive either. That holds true when we compare its valuation to that of the broad market (currently around a similar level), and even more so when we look at how JNJ was valued in the past:

The 3-year, 5-year, and 10-year median earnings multiples are all substantially higher compared to the current earnings multiple. To some degree this is justified as Johnson & Johnson’s growth deccelerated over the years, but the discount still is considerable even when we assume that the current fair value valuation is a couple turns of profit lower. I do believe that JNJ could easily be valued at 18x to 20x net profit, which would still represent a 10%-30% discount compared to the longer-term average valuation.

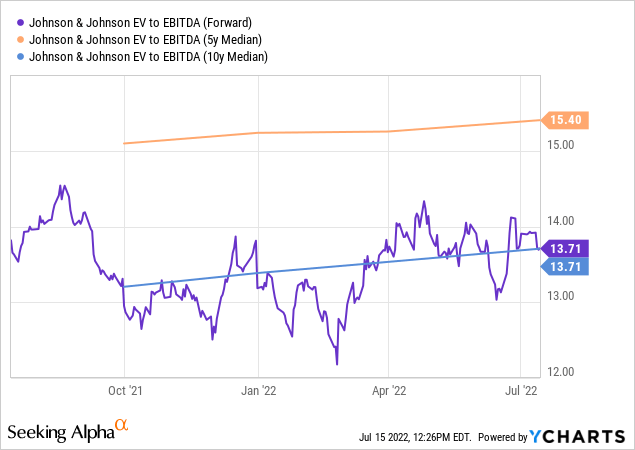

We can also look at JNJ’s enterprise value to EBITDA multiple:

We see that Johnson & Johnson trades at a discount of around 10% compared to the 5-year median EBITDA multiple. At the same time, the company trades perfectly in line with the 10-year median EBITDA multiple, suggesting a fair valuation.

I thus do not believe that Johnson & Johnson is overvalued right now. It’s not an absolute bargain stock, either, but shares seem to be fairly valued or potentially moderately undervalued today. JNJ’s ultra-high quality, showcased by it being one of just two companies in the world with an AAA rating, justifies a premium relative to how other lower-growth companies are valued. It may not be a perfect time to buy JNJ stock today, but it surely doesn’t look like an especially bad time, either.

Is JNJ Stock A Buy, Sell, Or Hold?

Johnson & Johnson will generate some earnings and revenue growth during the current year, although headwinds such as a strong US Dollar will prevent the company from generating a lot of growth this year.

Nevertheless, Johnson & Johnson remains a quality pick that offers reliable dividend growth, a dividend yield that is well above the market’s average, and that is resilient versus recessions. Especially the last point could make JNJ attractive in the coming months on a relative basis, as a recession has become increasingly likely as the Fed needs to tighten financial conditions in order to drive down inflation.

Shares look fairly valued to moderately undervalued. Shares were available for $155-$160 at times over the last year. But even for someone buying in the $170s, it seems likely that longer-term returns will be solid between some earnings and dividend growth and the dividend yield. For a low-risk stock, that’s not a bad deal at all.

Be the first to comment