Olemedia/E+ via Getty Images

Fortinet Inc. (NASDAQ:FTNT) is a cybersecurity and network solutions leader with its “FortiGate” product family recognized as the world’s most deployed network firewall. From the core platform, the company has expanded into areas covering secure networking, zero trust access, cloud security, and security operations which has driven strong growth and firming profitability over the last several years.

Indeed, the attraction of FTNT is its high-quality profile with solid fundamentals supported by several long-term market tailwinds. The stock just completed a stock split which represents a good opportunity to confirm the bullish thesis for the company which includes an impressive earnings runway as it scales and consolidates market share. We’re bullish on FTNT and view the recent pullback as offering a new buying opportunity.

When Was Fortinet’s Stock Split?

Shares of FTNT completed a five-for-one stock split on June 23rd initially announced back in April and formally approved by shareholders at the annual meeting held on June 17th. The board of directors cited an intention of making shares more affordable to a wider range of investors while adding trading liquidity as the reasoning behind the corporate action.

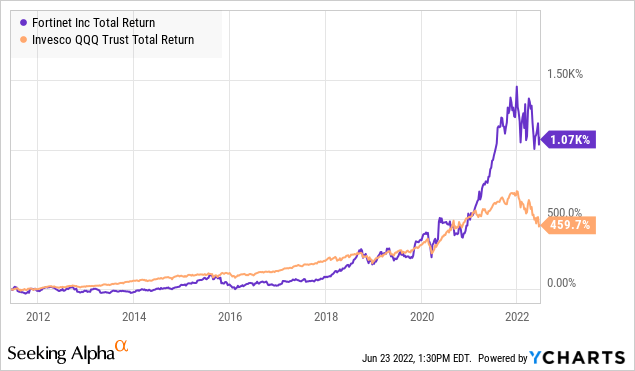

This is the second stock split in the company’s history, with the first going back to 2011 when shares completed a two-for-one split at the time. For context, FTNT has returned more than 1,000% over the period which should keep investors excited about what’s in store in the next decade. While that 10-bagger milestone will be hard to repeat, we see several reasons to believe Fortinet can continue generating positive returns.

FTNT Stock Key Metrics

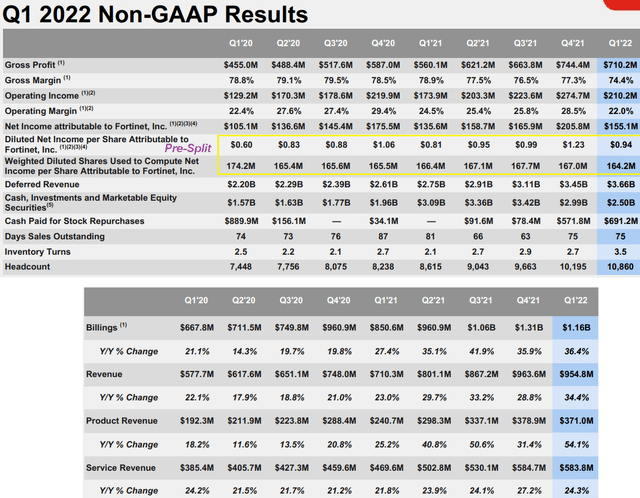

The company last reported its Q1 earnings back in May with EPS of $0.94, which beat expectations by $0.14 and was also up from $0.81 in Q1 2021. Notably, this EPS refers to the pre-split level, meaning Q1 EPS on a post-split basis is approximately $0.19. Revenue of $955 million climbed 34% year-over-year, picking up from the 23% y/y increase in the period last year.

Within total sales, the strength was driven by a 54% increase on the products side to $371 million with the company noting a significantly larger than expected enterprise-level order. This also had the effect of driving the gross margin lower to 74.4% from 78.9% in the period last year given the shift in sales mix. Nevertheless, a 24% y/y increase in services revenue was also a strong point this quarter.

Management explained the spread between product and services growth rate is in part related to global supply chain challenges in different sectors facing customers, but provides some visibility for accelerating services trends into the second half of the year. From the earnings conference call:

To offer one observation about how customers may be responding to the supply chain challenges, we are seeing indications that a subset of customer’s place product orders further in advance, and may have delayed purchases or registrations of the related service contracts. This, together with the timing differences with age product and service revenue recognition, creates a lag between product and service revenue growth rates. We expect quarterly service revenue growth to accelerate throughout the rest of the year.

Another important theme here is the increase in quarterly billings up 36% y/y to $1.2 billion along with a sequentially higher order backlog at $278 million. The message from Fortinet is that the company is experiencing “exceptionally strong demand” that continues to exceed its own equipment supply. By this measure, the company continues to invest in growth including through a 26% increase in firm-wide headcount over the past year. The result of the higher spending has been a near-term pressure on the operating margin at 22% in Q1, down from 24.5% last year, although the expectation is that this will normalize higher going forward.

Finally, we note that Fortinet has generated over $1.2 billion in free cash flow over the past year including $274 million in Q1 which is expected to climb over time. The company has been active with share repurchases including $691 million in Q1 with another $830 million in buybacks authorized through next year.

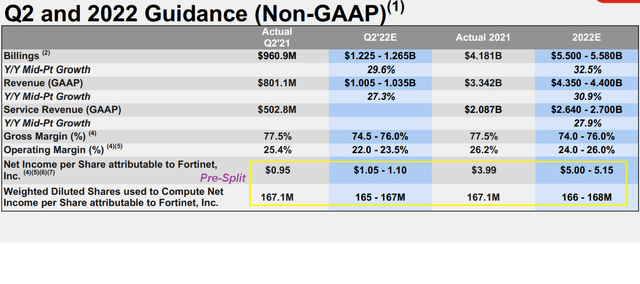

Fortinet sees most of the strong trends from Q1 staying in place into Q2. The company is guiding for full-year revenue growth of 30.9% as a midpoint target. An operating margin in a range of 24% and 26% supports an EPS forecast between $5.00 and $5.15, or $1.00 and $1.03 on a post-split basis.

Is Fortinet A Good Long-Term Investment?

There’s a lot to like about Fortinet with overall solid Q1 results despite the headline-making macro uncertainties. The biggest takeaway for us is that the company is growing above the industry rate across the various cybersecurity and networking segments.

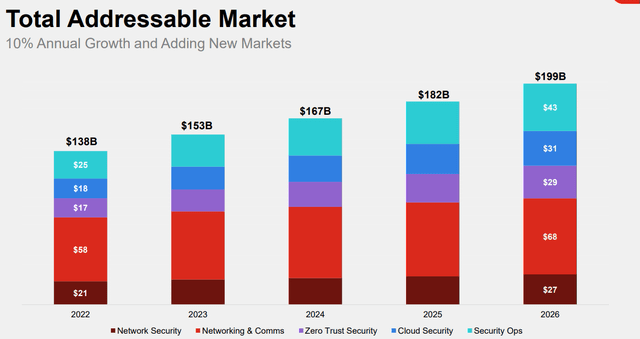

According to Fortinet, its total addressable market this year is approximately $138 billion and is expected to reach $199 billion by 2026. Within this amount, the area of highest growth includes security operations, cloud security, and “zero trust security” which are all covered within the company’s security fabric cybersecurity mesh platform either as a standalone service or through a more complete integration.

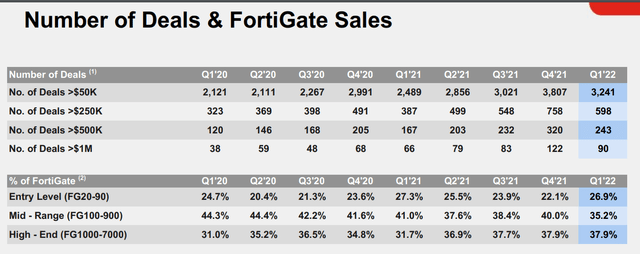

One of the most positive trends we’ve seen for Fortinet is its customer and revenue composition which has shifted toward larger deals while still growing the cohort of smaller customers. In 2021, the company did 350 deals valued above $1 million, up from 213 in 2020. The Q1 2022 figure at 90 climbed by 36% from 66 in Q1 2021. Furthermore, the portion of “high-end” FortiGate product sales has expanded to 38% from 31% in 2020. The setup here implies that customers over time are adding more features and expanding their spending relationship which adds a layer of quality to Fortinet financials through lower cash flow variability.

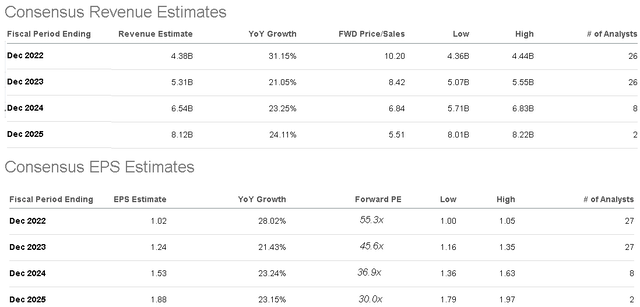

According to consensus, the 2022 revenue and earnings forecasts are in line with the current management guidance of 31% growth and EPS around $1.02. Looking ahead, the market forecasts revenue and earnings growth to average around 23% over the next three years. Part of the bullish case for the stock is that the company can end up outperforming these estimates.

As it relates to valuation, FTNT is trading at a forward P/E of 55x on the consensus 2022 EPS. While this multiple is “expensive” by most measures, we believe the premium is justified considering the growth and earnings momentum. While there are other “cybersecurity” names with higher top-line growth this year focusing on individual market segments, FTNT stands out to us as the more complete pure-play cybersecurity large-cap leader with stronger fundamentals.

FTNT Stock Price Forecast

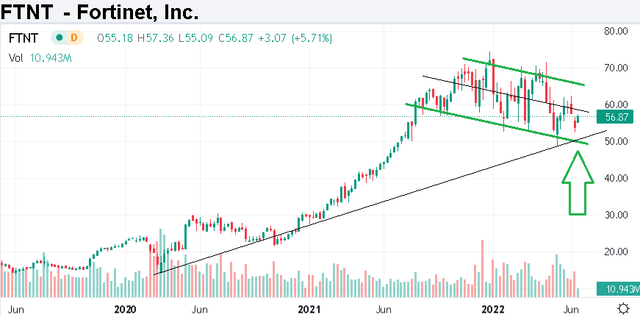

Shares of FTNT are technically down 22% year to date although this considers that the stock ended 2021 at an all-time high right above $70.00 per share. Part of the weakness reflects the broader market volatility which has hit tech and “growth” stocks, in particular, amid economic uncertainties and rising interest rates.

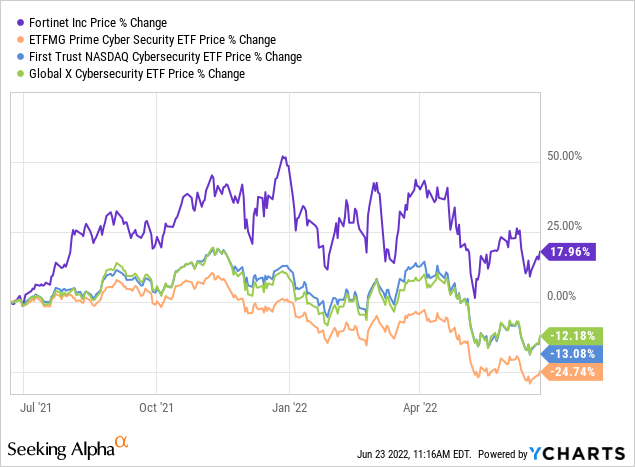

Notably, FTNT is still up 18% over the past year, outperforming cybersecurity ETFs including the First Trust NASDAQ Cybersecurity ETF (CIBR), ETFMG Prime Cyber Security ETF (HACK), and the Global X Cybersecurity ETF (BUG) which each have a negative performance over the period. We believe the financial trends of the company should allow it to continue outperforming in the current market environment.

Taking a look at the stock trading action, shares of FTNT have consolidated gains since a big rally from the early pandemic crash lows in 2020. As long as shares remain above ~$50.00, the long-term bullish momentum is positive in our opinion. We want to see a move above ~$65.00 to confirm a new bullish trend.

Is FTNT Stock A Buy, Sell, or Hold?

We rate FTNT as a buy with a post-split adjusted stock price target of $68.00 representing a 67x multiple on the current consensus 2022 EPS or 55x on next year’s EPS estimate. The thinking here is that FTNT has everything going for it to reclaim its all-time high benefiting from resilient demand for cybersecurity tools and solutions beyond the near-term macro headwinds. Shares are pricey, but we see room for further multiple expansion as the company continues to generate strong free cash flow with exceptional growth trends. Longer-term, firming margins and new growth initiatives can send shares even higher.

In terms of risks, a deeper deterioration of the economic outlook coupled with a widespread decline in business spending could open the door for a weaker operating environment. Disappointing results in the next couple of quarters can force a reassessment of the earnings outlook and send shares lower. The operating margin and number of deals above $1 million are key monitoring points over the next few quarters.

Be the first to comment