spooh

Enterprise Products Partners (NYSE:EPD) has dipped over the past month as recession fears caused a pullback in energy prices. The price of oil nonetheless remains in the triple-digits, which should bode well for the increasing creditworthiness of EPD’s customers. EPD has a track record of being one of the highest quality operators in the midstream sector – yet it is trading at a 7.6% yield. EPD has pared back growth capital expenditure ambitions to the point that free cash flow is now fully covering the distribution. With one of the more conservative leverage profiles in the sector, EPD may finally be positioned for greater distribution growth or even buybacks.

(Head’s up: EPD issues a k-1 tax form – consider the tax ramifications before investing.)

Why Has EPD Stock Dipped?

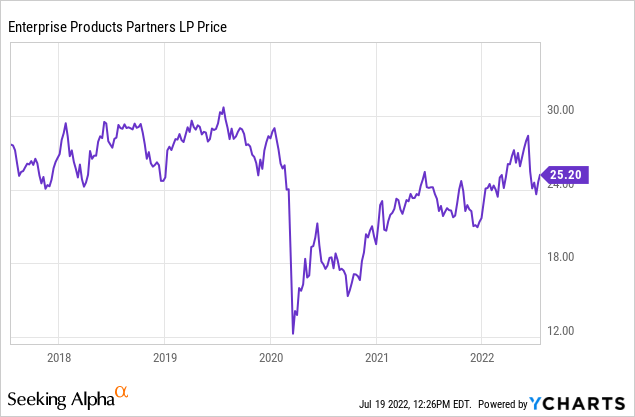

After rallying to above $28 per unit in early June, EPD has since pulled back to around $25 per unit.

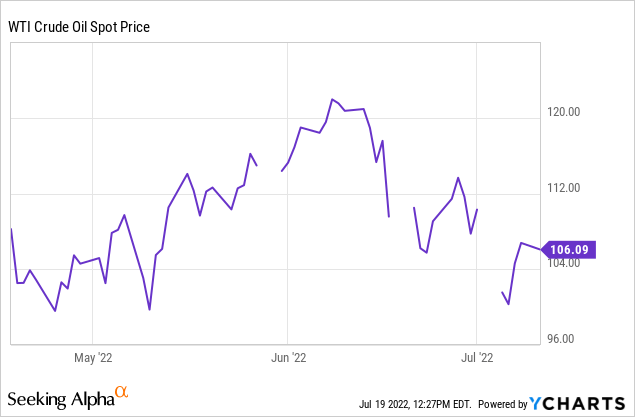

That fall appears to be due to the recent slide in oil prices. The slide in oil prices may be due to increasing fears of a recession.

I last covered EPD in April where I stated that I was upgrading the stock in spite of previously being neutral at lower prices. EPD is trading at about the same levels since then, prolonging an attractive buying opportunity for income investors.

EPD Stock Key Metrics

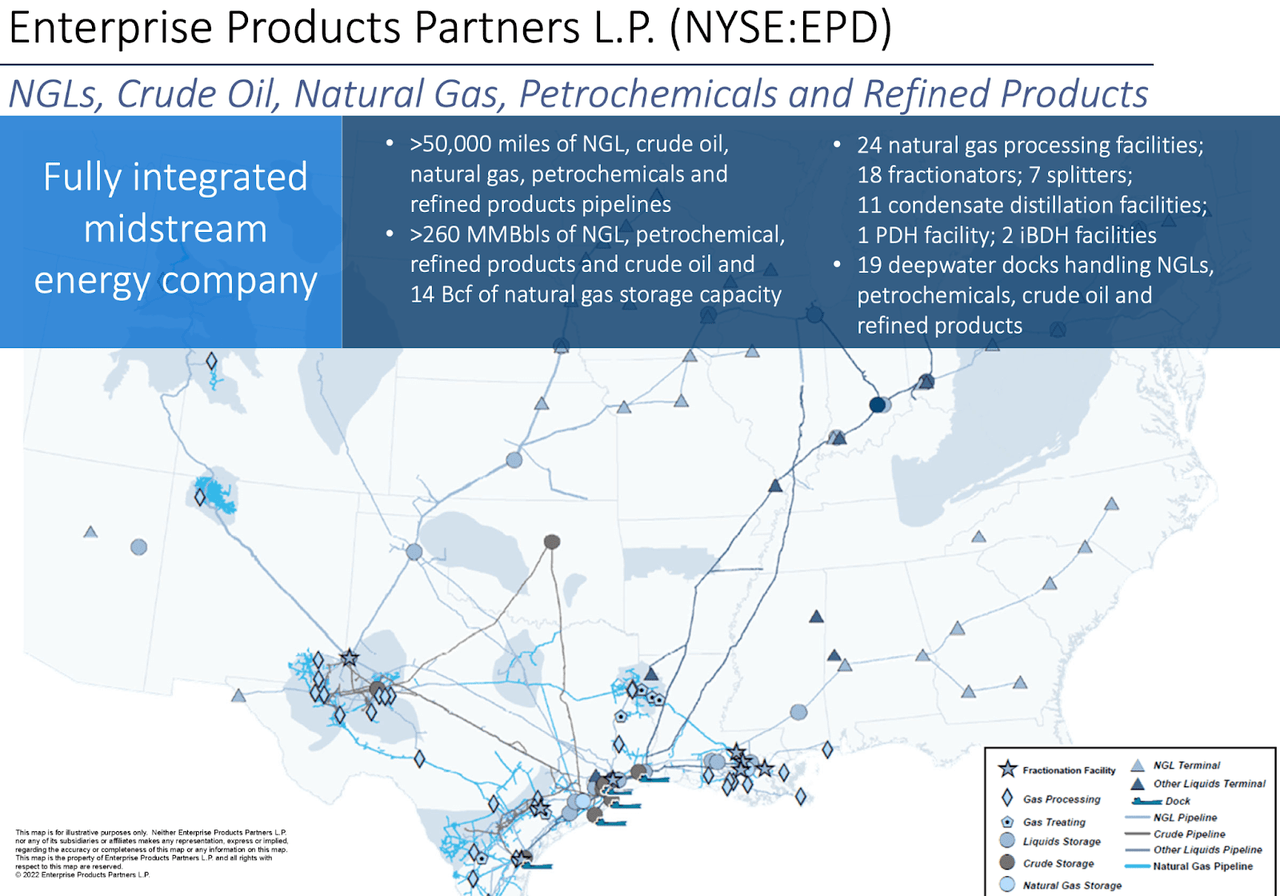

EPD is a fully integrated midstream company, meaning that it helps its customers transport, process and store NGLs, crude oil, natural gas and more through its pipelines and processing facilities.

June 2022 Presentation

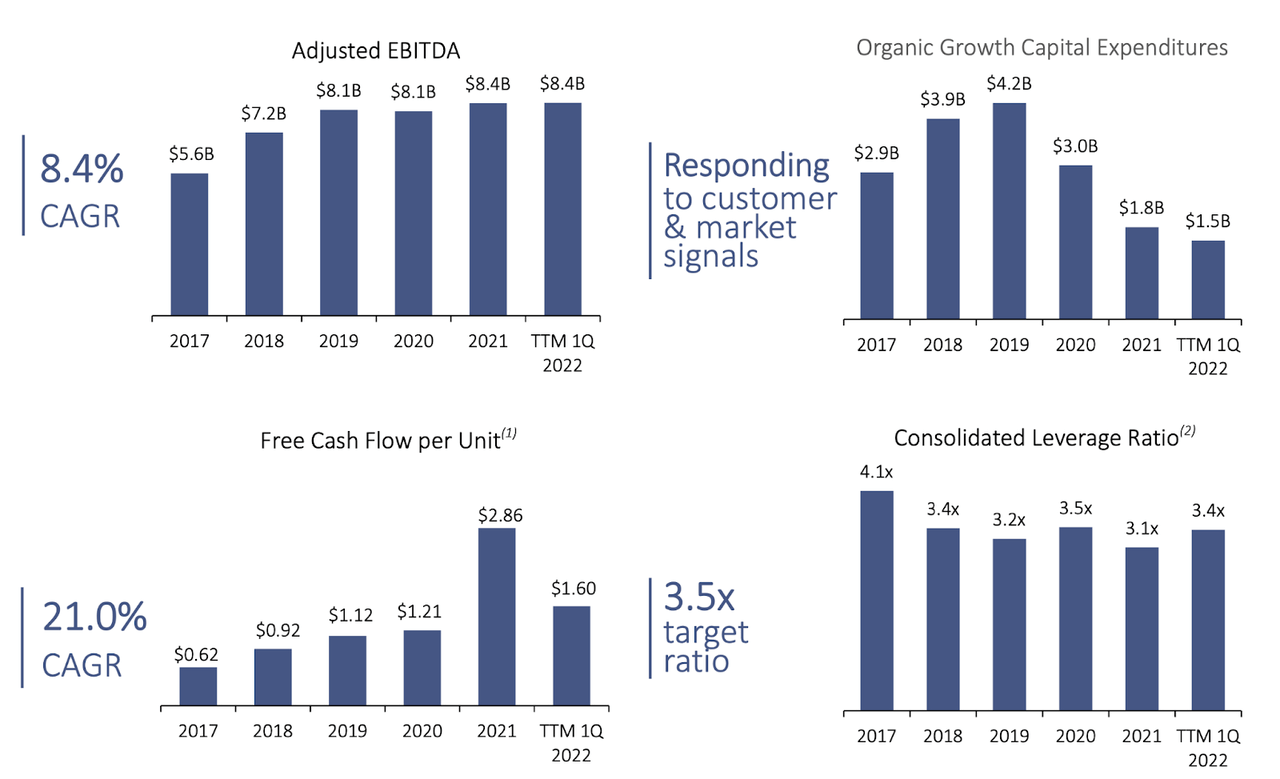

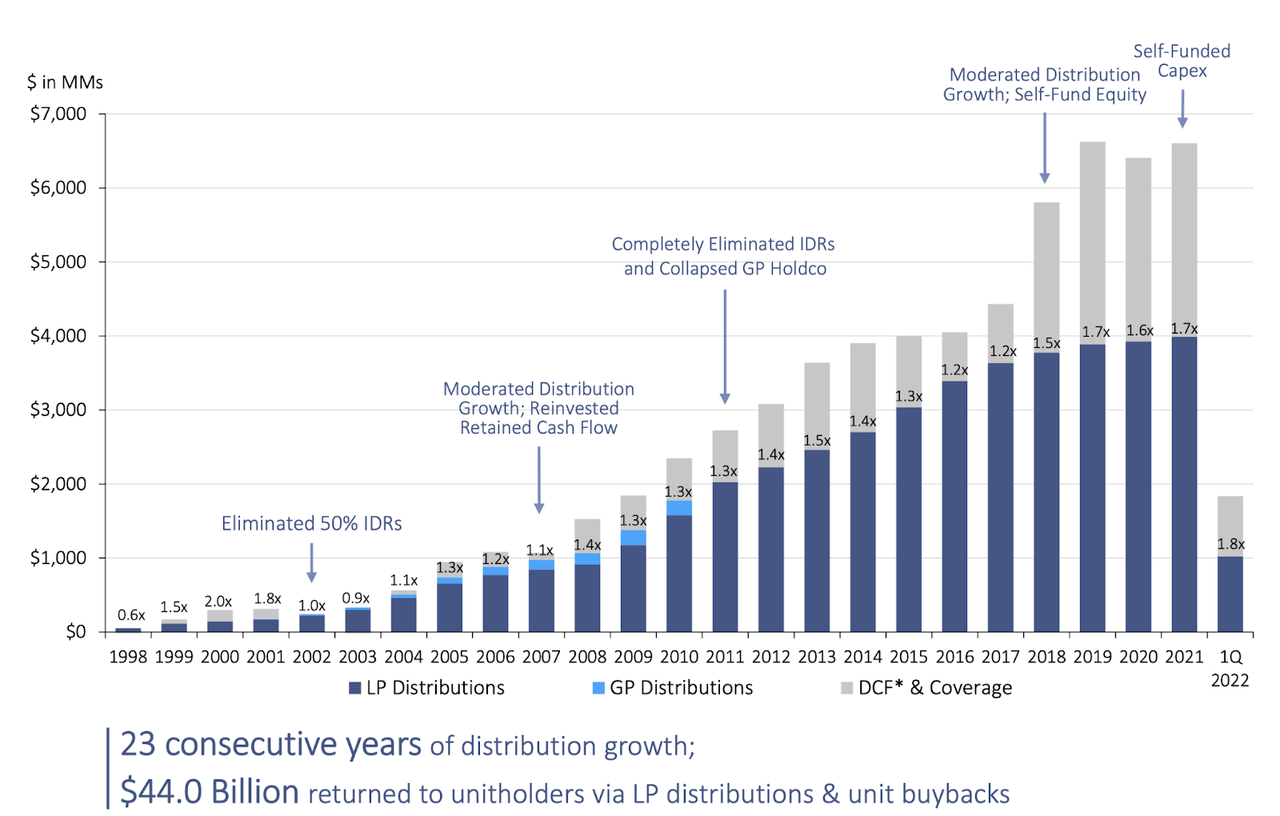

Over the years, EPD has seen sizable improvements in adjusted EBITDA as it realized gains from its expansion projects. What’s more, EPD has scaled back its growth capital expenditures which has enabled strong growth in free cash flow per unit.

June 2022 Presentation

I note that the latest quarter saw EPD spend $3.2 billion to fund its acquisition of Navitas Midstream – excluding that, free cash flow was comparable to the prior year’s quarter. 2021 was the first year in which EPD was able to fund its distribution in full with free cash flow.

June 2022 Presentation

That is a significant achievement because midstream operators historically have had high distribution coverage based on distributable cash flows (‘DCF’) but due to outsized growth capital expenditures did not fully cover the distribution based on free cash flows. That created an implicit reliance on the capital markets to fund ongoing operations – now that EPD is self-funding capital expenditures, that risk has been removed.

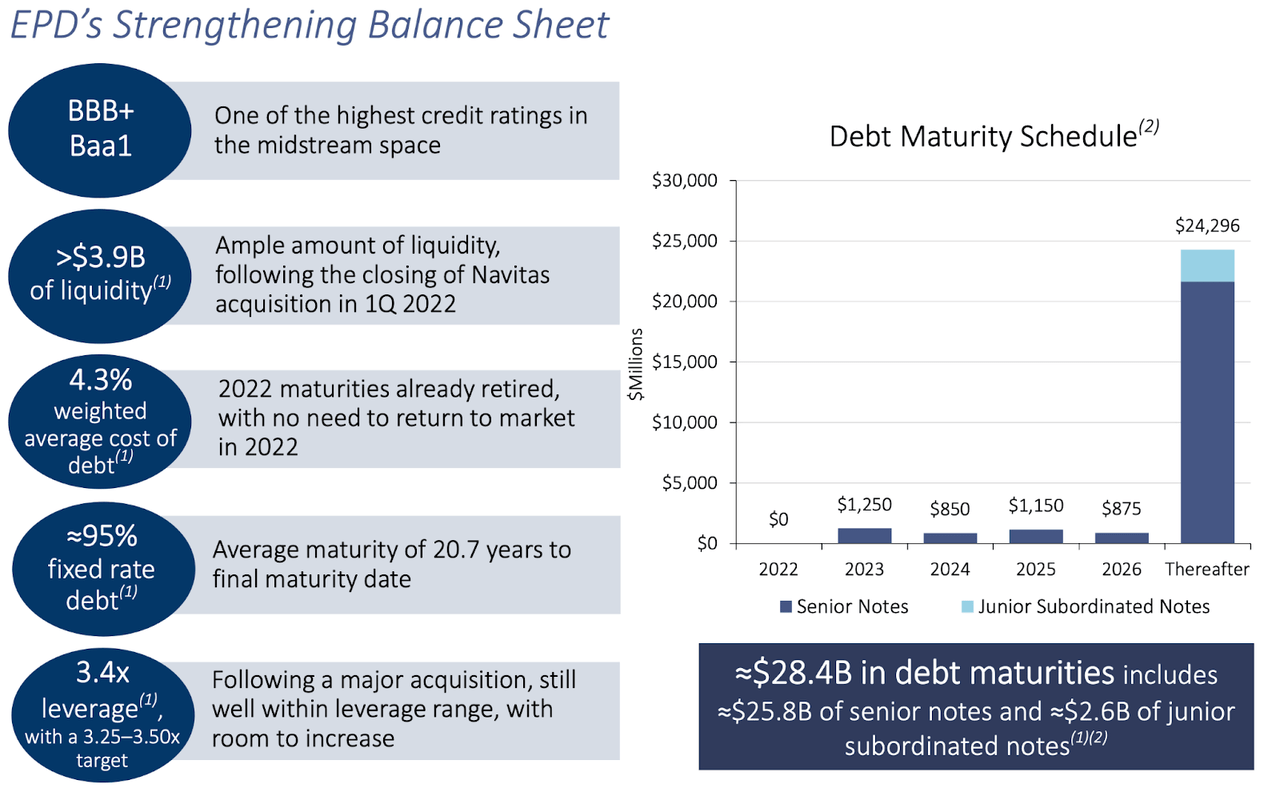

EPD maintains one of the strongest balance sheets in the midstream sector with a conservative 3.4x debt to EBITDA ratio and BBB+ credit rating.

June 2022 Presentation

That balance sheet not only gives EPD a low cost of capital, but also makes it deserving of a premium multiple due to the lower implied risk.

Is Enterprise Products Fairly Valued?

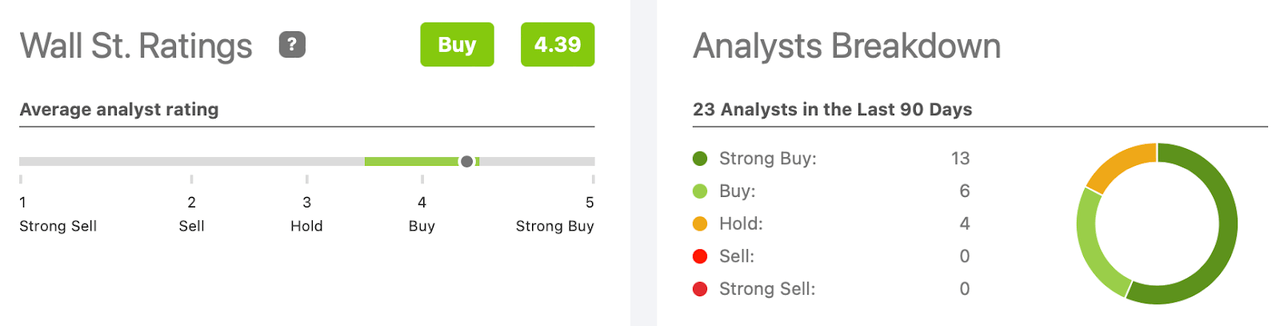

Wall Street analysts have an average 4.39 buy rating on the stock.

Seeking Alpha

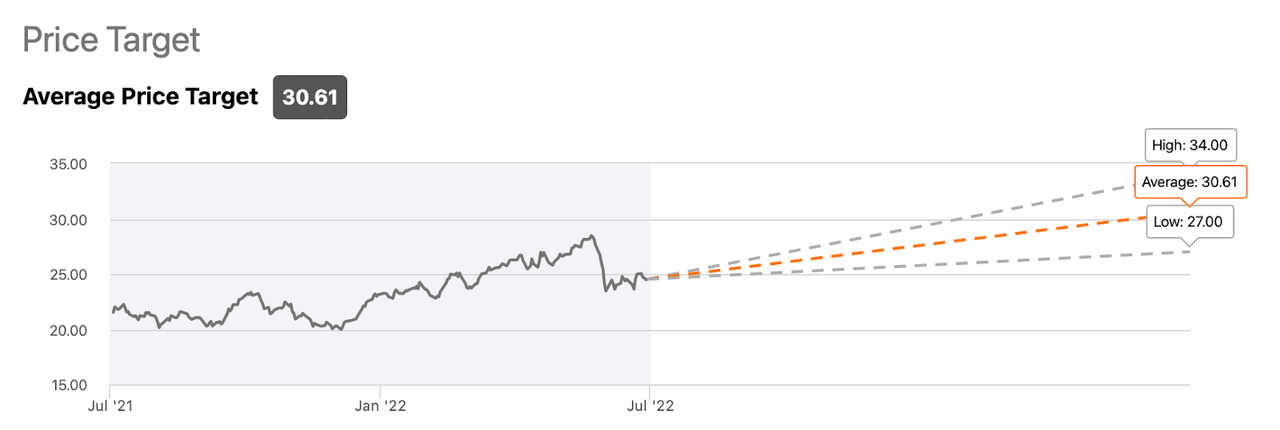

The price target of $30.61 per unit implies just over 20% potential upside from capital appreciation.

Seeking Alpha

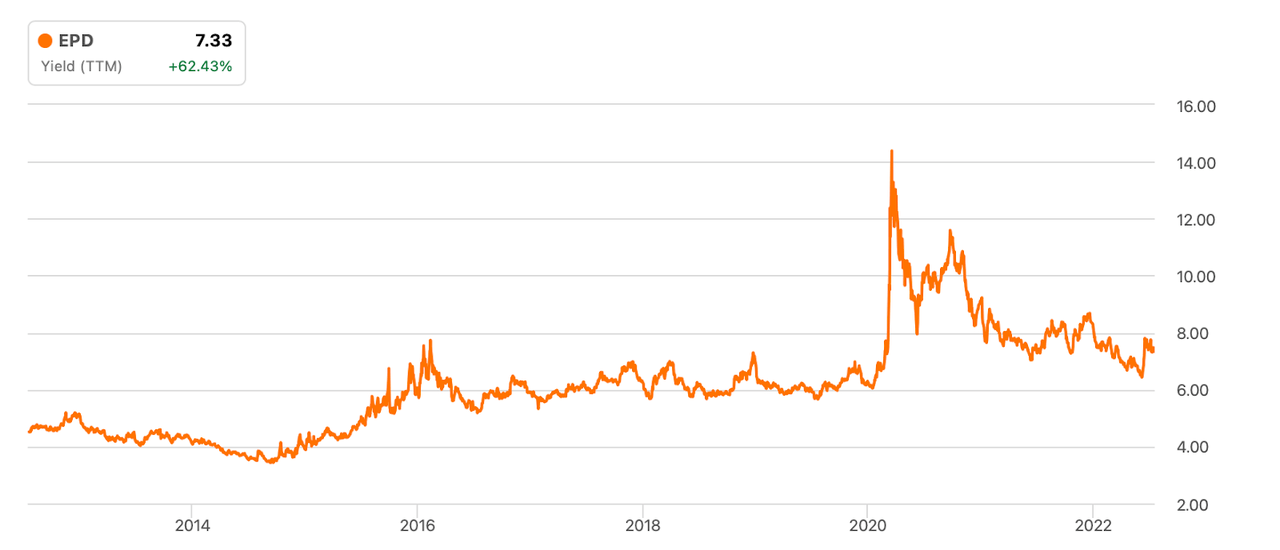

We can see below that outside of the pandemic crash, EPD is trading at its highest distribution yields over the past decade.

Seeking Alpha

Is EPD A Good Long-Term Investment?

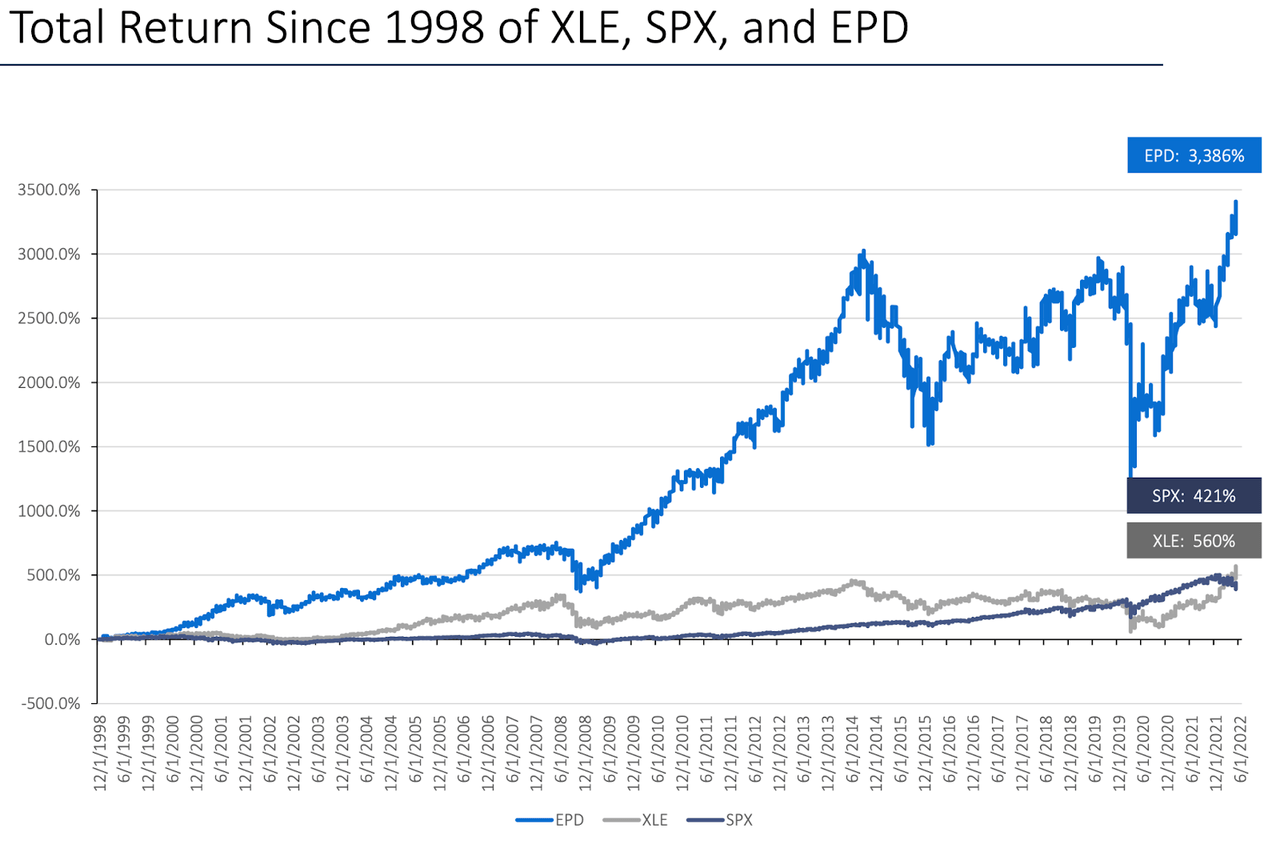

Even though EPD is trading at compelling valuations, it still has materially outperformed both the energy sector and broader equity markets over the past 2.5 decades.

June 2022 Presentation

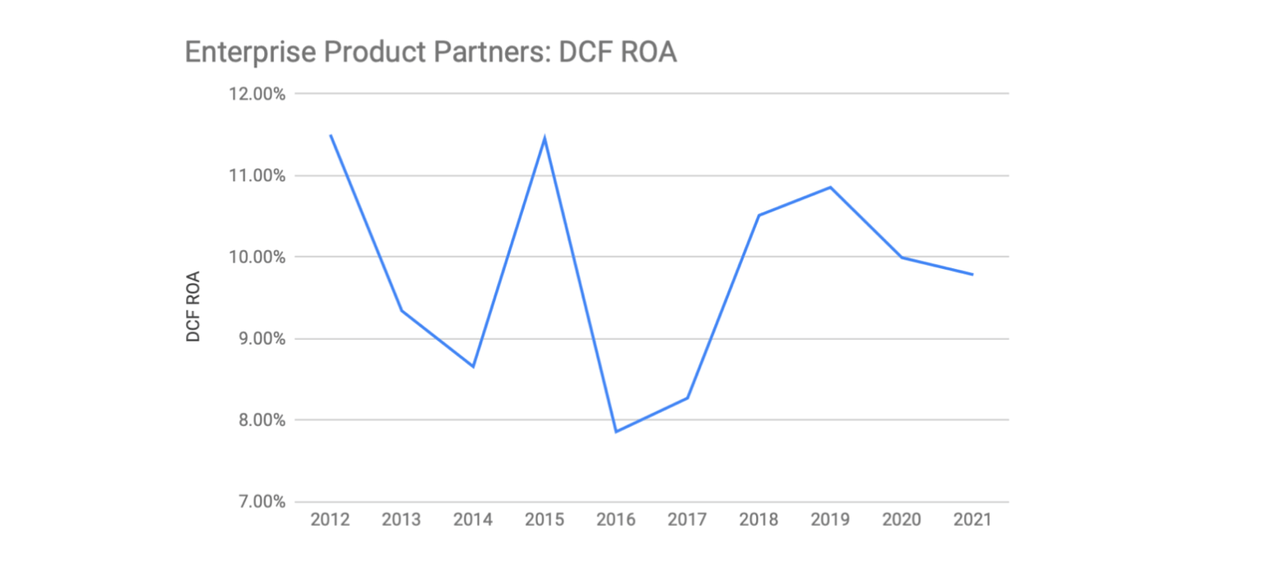

I view the outperformance as being due to strong management execution. I measure the management strength of midstream companies based on a financial metric I call return on assets based on distributable cash flow (mathematically this equates to dividing distributable cash flow by total assets). EPD has sustained double-digit ROA over the past many years.

Best of Breed, data from annual filings

ROA is an important metric because midstream companies primarily grow through growth expansion projects. Good operators will deliver high returns on these projects, enabling them to sustain high levels of profitability. Bad operators will underperform on projected returns from these projects, causing ROA to deteriorate over time. The fact that EPD has been able to sustain such a high ROA in spite of also maintaining low leverage ratios is a testament to the strong management execution.

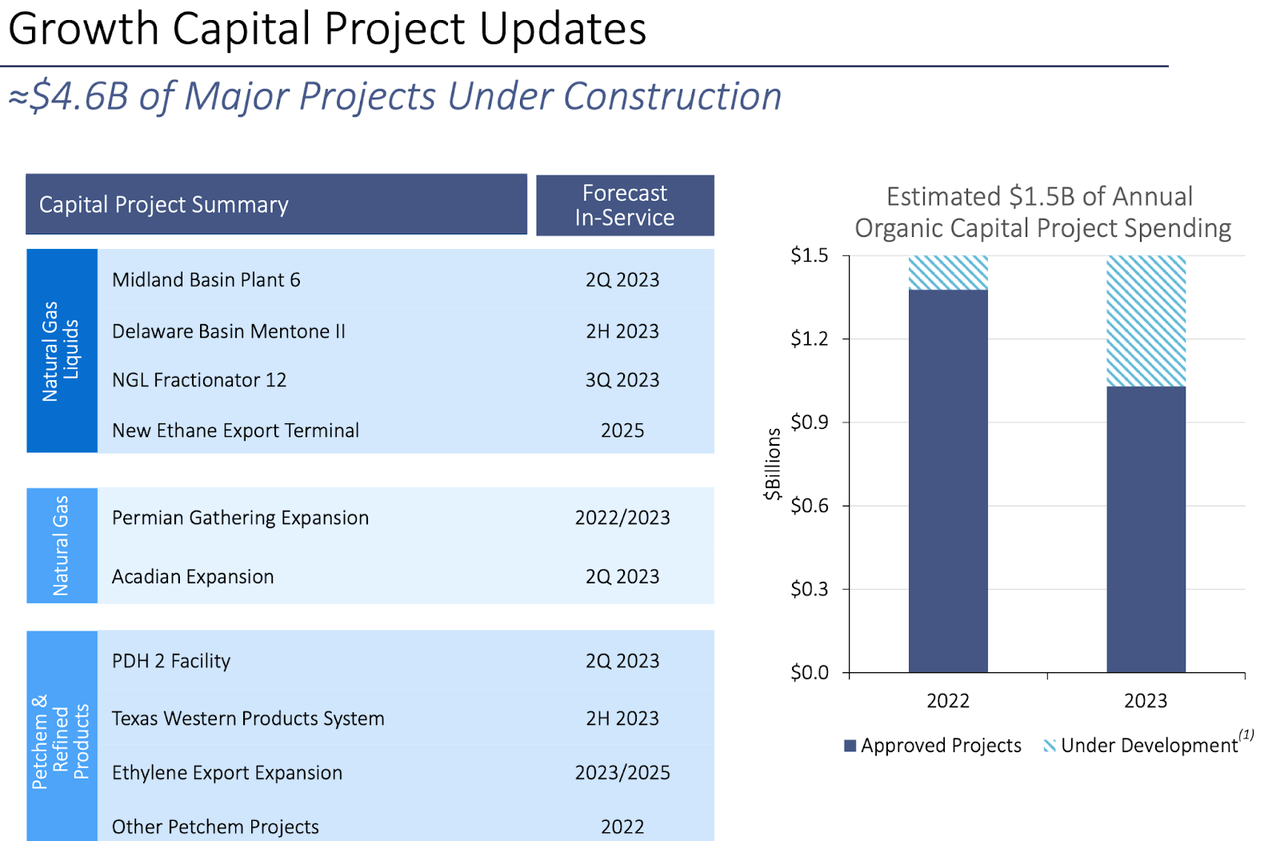

Looking forward, EPD has guided for growth capital to decline, planning around $1.5 billion of annual growth capital spend.

June 2022 Presentation

While that means less firepower for their strong execution, it is arguably the right decision for unitholders because the company will now be able to direct that retained cash towards other uses such as aggressively increasing the distribution or buying back units.

Is EPD Stock A Buy, Sell, or Hold?

The increased potential for unitholder returns is the missing piece of the puzzle holding back the stock over the past several years. While EPD has been a consistent dividend payer for many decades, it had significantly reduced its distribution growth to accelerate self-funding ambitions which led to units trading down substantially. It appears that the political climate was the key catalyst to accelerate that transition as midstream companies were essentially forced to pare back growth expenditure budgets. While that may mean slower growth, it frees up significant cash flow that EPD can use to repurchase units or accelerate distribution growth. EPD has a conservative leverage position meaning that debt should not hold back its multiple. I can see EPD growing at a 3% clip just based on internal operations and growth capital expenditures alone. Assuming that the company commits to $1.5 billion in annual growth capital, the company might have around $1 billion in excess free cash flow after the distribution. That suggests another 2% unitholder yield (potentially through buybacks) that can go to unitholders. EPD is looking like an 8.6% unitholder yield with 3% organic growth. I find it hard to believe that the stock can continue to trade at such a high shareholder yield considering the low leverage and commitment to unitholder returns. I could see EPD eventually trading up to a 6.5% unitholder yield or lower, representing 24% potential capital appreciation upside which in conjunction with the 11.6% implied total return profile should be enough to easily beat the market. While I may previously have viewed EPD to be of higher risk, my assessment of risk has changed due to the high energy pricing environment, which in the near term should help its customers shore up their balance sheets and in the long term may have the potential to lead to sustained market share gains for the US energy sector. There are two key risks here to consider. First, there is no guarantee that EPD management will commit to reducing its growth capital expenditures. Considering the bullish outlook for the energy sector, it would not be surprising if management shifts gears and decides to increase growth capital again. With EPD I am less concerned with their ability to drive strong ROI, but would fear that such a decision would prevent units from achieving my expected multiple expansion. Another risk is if the energy market takes a downturn and makes new lows. While such an event seems unlikely, I note that the recent surge in energy demand seemed highly unlikely amidst the pandemic as well (not to mention for the many years since the last 2016 highs). While the current environment is undoubtedly helping EPD’s customers generate lots of cash, the opposite can be true at lower energy prices. EPD primarily earns fees based on usage of its pipelines, reducing its reliance on commodity prices, but at the end of the day if its customers go bankrupt then EPD will suffer as well. Every passing quarter of these high energy prices helps to reduce that risk, but investors should keep an eye out to see if energy companies will continue to pay down debt or if they might even embark on risky growth projects, repeating the same mistakes of previous market peaks. I rate EPD a buy considering the attractive valuation and strong balance sheet.

Be the first to comment