BlackJack3D/iStock via Getty Images

I’m assigning C3.ai (NYSE:AI) a positive risk/reward rating based on its exceptional leadership team, discounted valuation, fortress balance sheet, its industry-leading position, strong technical underpinnings, and asymmetric potential return profile. Operating within one of the largest secular trends of our time, artificial intelligence, opens the door to explosive growth potential. C3.ai is a top choice for high-risk, high-reward investors seeking exceptional opportunities.

Risk/Reward Rating: Positive

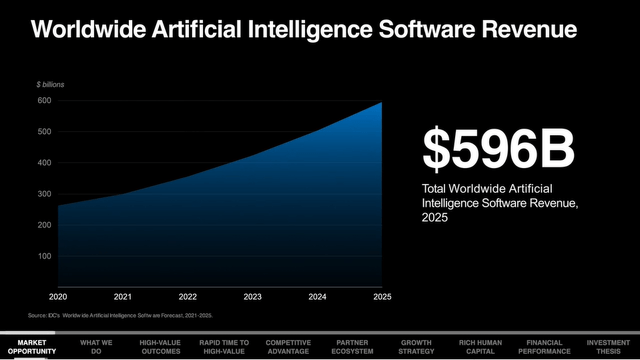

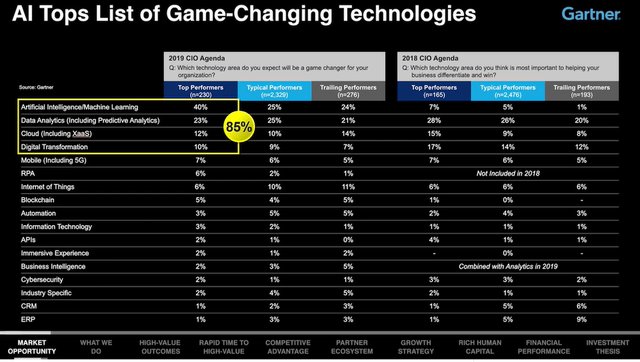

The marketplace broadly expects Artificial Intelligence or AI to be an immense opportunity and views it to be a game-changer technology in the future. By way of logical extrapolation, if it’s a game-changer technology, AI will become a requirement for enterprise adoption in order to remain competitive.C3.ai’s spring 2022 investor presentation illuminates each of these AI possibilities: Both a game changer and required adoption. The following two screenshots from the presentation summarize the size of the market opportunity and its importance to chief information officers.

Source: C3 AI’s spring 2022 investor presentation

Source: C3 AI’s spring 2022 investor presentation

In essence, as described in the presentation by C3.ai’s Chairman, CEO, and Co-founder, Thomas Siebel, the software industry is on the brink of a secular growth shift, from a history of descriptive systems to a future of predictive systems.

C3.ai: Game Changer And Required Adoption

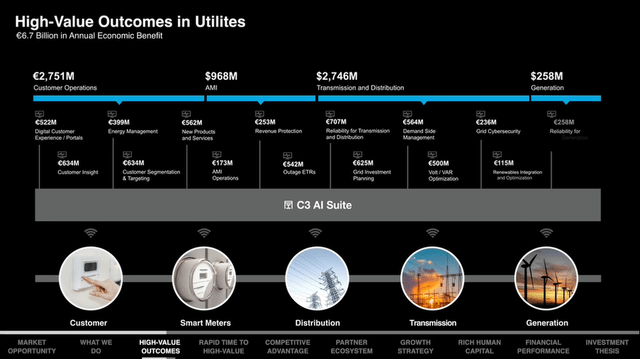

C3.ai speaks directly to the game-changer nature of AI as well as the competitive requirement for enterprise AI adoption in discussing how customers use its platform and the benefits that are expected to be achieved. The following three screenshots from the spring presentation detail C3.ai’s value proposition.

What’s particularly unusual about the customer detail is the precise quantification of economic value across business segments that C3.ai’s platform is expected to deliver. Please note that I have detailed the annual economic benefit expected in the header above each image.

Leading European Utility Company: $6.7 Billion Euros Per Year

Source: C3 AI’s spring 2022 investor presentation

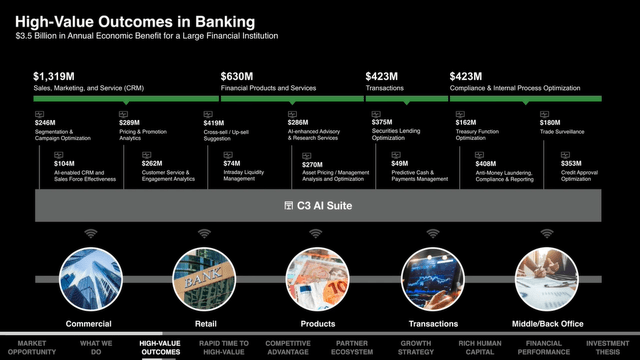

$3 Trillion Asset Financial Institution: $3.5 Billion Per Year

Source: C3 AI’s spring 2022 investor presentation

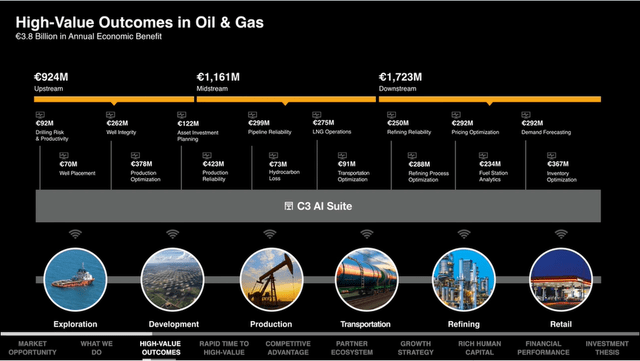

Top Five Global Energy Company: $3.8 Billion Euros Per Year

Source: C3 AI’s spring 2022 investor presentation

For the three customers above, the expected annual economic benefit to be derived from implementing C3.ai’s platform is $14 billion. This is an extraordinary value proposition across just three clients. If the benefits are achieved, these companies would clearly have a competitive advantage in their respective industries. The value proposition is extraordinary in light of C3.ai’s revenue base of $253 million in its just-completed fiscal year 2022. Based on the above customer details, C3.ai’s platform offers an incredible return on investment and is truly a game changer if the benefits are realized.

Growth Strategy

C3.ai’s growth strategy is threefold: Penetrate existing customers, expand multi-tiered distribution, and expand its ecosystem.

Penetrate Existing Customers

In terms of penetrating existing customers, C3.ai believes it has reached roughly 5% penetration of its existing client base. As a result, existing customer penetration alone represents an enormous growth opportunity from a $253 million revenue base. If the 5% figure is in the ballpark, existing customers represent a $5 billion opportunity. More conservatively, if penetration is closer to 10%, the opportunity remains substantial at $2.5 billion.

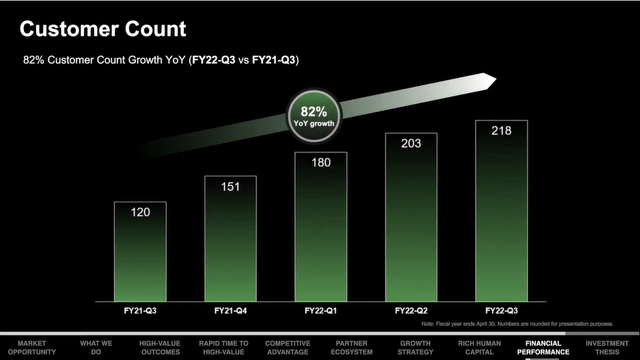

These penetration estimates are well supported by Palantir’s (NYSE:PLTR) customer penetration trajectory. Please refer to my prior Palantir reports for greater detail: Palantir Visibility Into The Upside and Palantir Red Flag Or Opportunity. C3.ai targets similar key customers with similar adoption trends. As a result, Palantir represents an excellent comparable company for valuing C3.ai. Interestingly, similar to Palantir, C3.ai’s existing customer base is quite small at only 218, as can be seen in the following screenshot from the presentation.

Source: C3 AI’s spring 2022 investor presentation

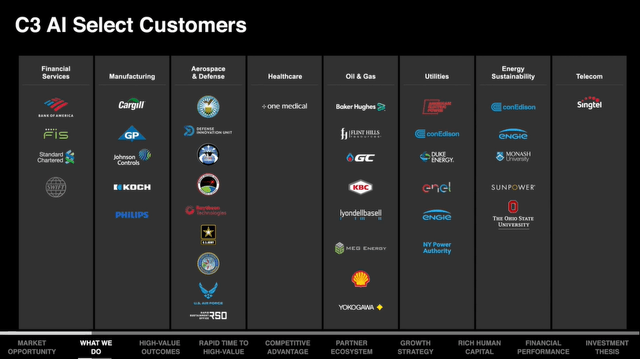

Customer growth of 82% is exceptional, although off of a small base. Importantly, C3.ai is targeting large strategic customers for its market entry. These customers represent some of the largest individual opportunities for AI over time. Additionally, as industry leaders, they should help drive C3.ai adoption amongst industry peers. The following screenshot provides color as to C3.ai’s existing customer base.

Source: C3 AI’s spring 2022 investor presentation

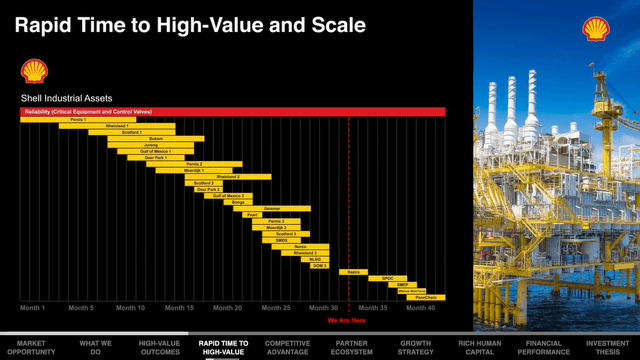

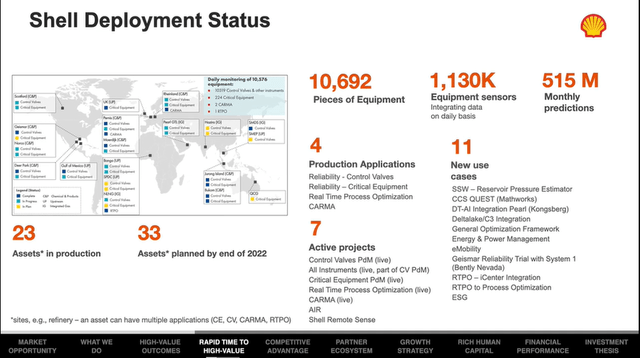

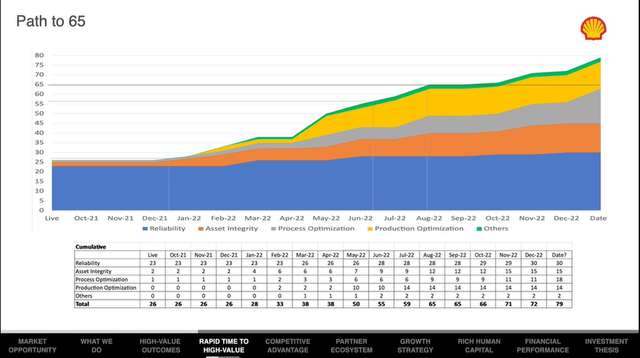

Shell, the top five energy company highlighted previously, is expected to derive $3.8 billion euros per year of economic value and has decided to standardize on C3.ai’s platform. The following three screenshots provide an excellent overview of how C3.ai’s platform is generally adopted and implemented through time. I have provided a header above each to highlight the process of customer penetration and the visibility that this creates. The screenshots also shine a spotlight on the true nature of the AI opportunity as a continual process rather than a discrete solution.

Shell: Detailed Implementation Plan Through Time

Source: C3 AI’s spring 2022 investor presentation

Shell: Detailed Deployment Roadmap Creates Visibility As AI Enables The IoT Revolution

Source: C3 AI’s spring 2022 investor presentation

Shell: Detailed Implementation Roadmap Creates Visibility

Source: C3 AI’s spring 2022 investor presentation

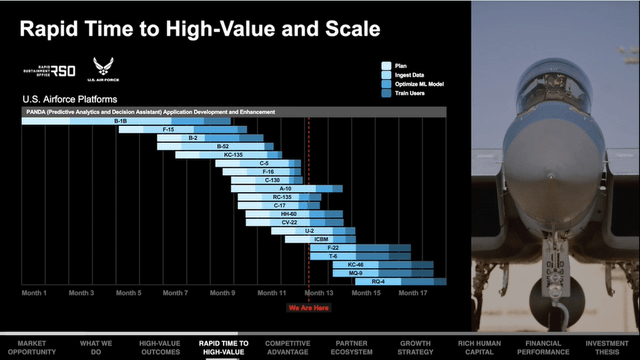

The same adoption cycle is on display in the next screenshot detailing the US Air Force’s C3 AI implementation.

US Air Force: Detailed Implementation Roadmap Creates Visibility

Source: C3 AI’s spring 2022 investor presentation

The US Air Force is nearing year one of its implementation while Shell is approaching year three. C3.ai’s client penetration occurs via a well-defined and detailed implementation roadmap. This process and the long-term strategic nature of AI adoption are conducive to a high degree of visibility into the ultimate opportunity size at each customer. As a result, the company’s estimated 5% penetration, or a more conservative 10% penetration estimate, is likely well supported by internal customer data. Of importance, notice that AI is the application layer that enables the full potential of the IoT or Internet of Things revolution.

Growth Strategy: Multi-Tiered Distribution And Expand Ecosystem

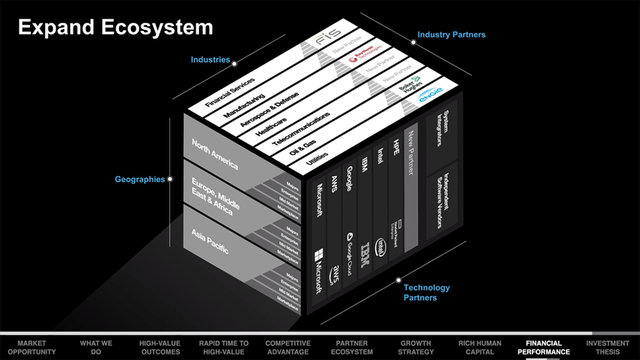

The two remaining legs of the C3.ai growth strategy are interrelated and pertain to new customer acquisition. The multi-tiered distribution strategy is comprised of three vectors: Geographic, industry vertical, and partner ecosystem. Segmenting C3.ai’s market penetration strategy by geography is common, as is the segmentation by industry vertical.

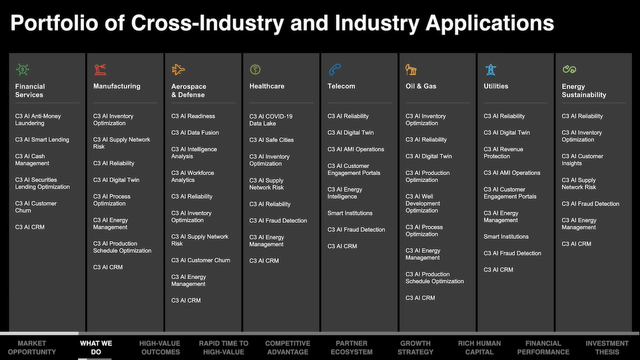

The industry segmentation takes on added importance for C3.ai as each industry has its own unique AI requirements. Industry segmentation creates the opportunity for C3.ai to develop standardized industry solutions which are the key to creating economies of scale. Meaning, a primary challenge to broad AI adoption is the cost of developing customized solutions. Customized solutions lack scalability due to the inability to sell them to the broader marketplace. The following screenshot displays C3.ai’s scalable solutions.

Source: C3 AI’s spring 2022 investor presentation

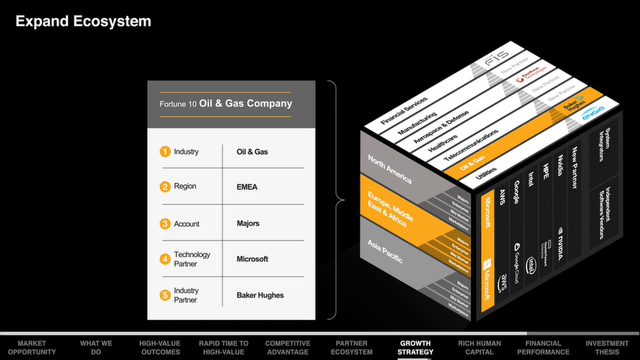

The multi-tiered distribution and ecosystem expansion strategies can be visualized in the two images below. They highlight how the strategy was applied to the Shell opportunity. Notice that C3.ai is partnered with a leading energy service company on the top of the cube, Baker Hughes (NASDAQ:BKR), and a leader technology firm on the side of the cube, Microsoft (NASDAQ:MSFT).

Source: C3 AI’s spring 2022 investor presentation

Source: C3 AI’s spring 2022 investor presentation

C3.ai is partnered with industry leaders in four major verticals: Financial services, aerospace and defense, oil and gas, and utilities. At the same time, it’s looking to expand its partnerships with leaders in the remaining industries. This appears to be an optimal approach as the industry leaders know the intricacies of their markets best and can enable more rapid and full penetration of each vertical.

In addition to industry vertical leaders, C3.ai has partnered with all major technology product and service providers. This ensures that it can serve the entire enterprise universe regardless of each company’s existing technology infrastructure. Similar to its industry vertical strategy, C3.ai’s technology partner strategy is the optimal approach in that it’s technology agnostic, which ensures C3.ai can compete across the entire AI opportunity set.

Growth Strategy: Summary

The growth strategy being implemented by C3.ai looks to be perfectly suited for the AI market opportunity. It targets industry-leader partners for vertical distribution and all major technology platform leaders for breadth of distribution. As new customers are acquired, they then enter the process of implementation, which offers extraordinary growth potential by fully penetrating each customer’s long-term AI opportunity set.

Competition

Importantly, paraphrasing Siebel from the presentation, C3.ai views its AI opportunity to be largely a matter of execution at this stage. Siebel believes there’s little market risk in that the AI software opportunity estimate of $600 billion by 2025 is a high confidence industry projection. He views there to be little technology risk as C3.ai is in the marketplace at scale today with a broad and industry-leading AI portfolio. Finally, Siebel believes that there’s no meaningful competitive risk in the near term, leaving execution as the key to C3.ai’s success.

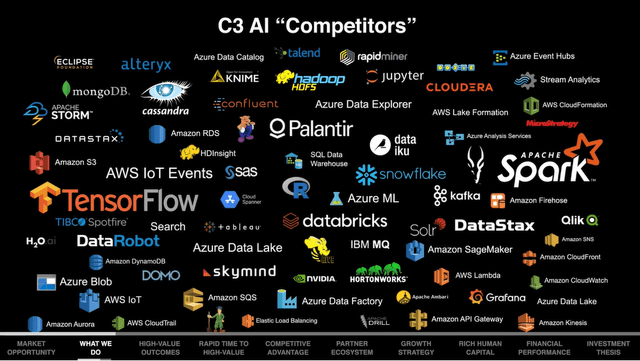

In other words, Sibel views C3.ai’s future success to be largely in the company’s control, which is an ideal position. The market’s view of AI and the industry players is more nuanced and understandably confusing as AI is applicable across all information systems. There are an incredible number of firms and products that many consider to be under the AI umbrella. C3.ai captured the market’s view of the competition in the following image.

Source: C3 AI’s spring 2022 investor presentation

Competitors? Yes And No

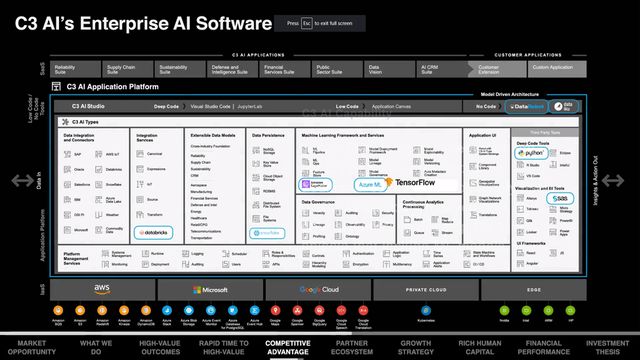

Upon review, many of the firms and offerings in the above image do indeed compete with C3.ai in terms of specific AI-related applications or features. That said, they do appear to be largely tangential competition, perhaps with the exception of Palantir. The following screenshot demonstrates how many of these leading firms and offerings integrate with C3.ai’s platform approach. They are circled in blue on C3.ai’s console image.

Source: C3 AI’s spring 2022 investor presentation

In essence, C3.ai has designed its platform to be a new AI-specific software layer that incorporates the leading-technology tools of the day. The company has positioned itself on top of or parallel to these providers and can accommodate its clients use of their preferred tools. In this respect, C3.ai faces little meaningful competitive risk, as suggested by Siebel. I view Palantir, in the center of the competitive collage, as a natural competitor and possibly a great fit to be a suitor for C3.ai.

Valuation

Given my view that Palantir is a natural competitor of C3.ai, it’s helpful to view C3.ai’s valuation on its own and in relation to Palantir as a comparable enterprise. It should be noted that C3.ai remains an earlier stage company and is unprofitable. Management expects to reach sustainable free cash flow generation within two to three years. This is in line with the lone analyst earnings estimate for 2025.

While the earlier stage nature of C3.ai and the industry generally creates heightened risk, there’s heightened opportunity. Investors are well compensated for the heightened risk by C3.ai’s strong balance sheet. The company has a book value of just under $1 billion, which is nearly all cash and equivalents. C3.ai has a fortress balance sheet from the perspective of its early stage of growth.

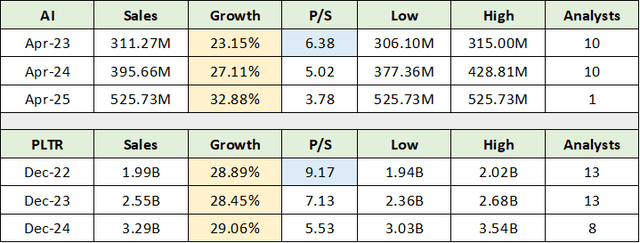

Due to the lack of current earnings and the nature of C3.ai’s secular growth opportunity, sales estimates are the most important metric for intermediate-term valuation purposes. The table below was compiled from Seeking Alpha and displays consensus sales estimates for C3.ai (the top section) and Palantir (the bottom section). I have highlighted in yellow the consensus growth rates, and in blue the current valuation to sales.

Source: Seeking Alpha. Created by Brian Kapp, stoxdox

Notice that the expected growth rates are nearly identical over the coming three years, while C3.ai trades at a substantial discount to Palantir. In my prior Palantir reports, I cover the challenge that Palantir faces in terms of its traditional customized software development approach. Palantir has discussed its priority to address this in referring to “productizing” its offerings in recent times.

Given its scalable industry solutions outlined above, C3.ai should have a distinct market advantage in the AI space. The value proposition on offer from C3.ai, $14 billion across three companies outlined above, should be well received across the broad marketplace. It should be noted that Palantir is taking a much broader approach than AI with its platforms. This too opens the door for C3.ai, an AI-focused company, to gain significant traction across the broad AI opportunity set.

C3.ai’s 30% discount to Palantir on a price-to-sales basis points to the opportunity for multiple expansion. This offers a relative buffer within a generally high valuation multiple industry. In fact, many leading application software companies trade in the 12.65x sales range today. Relative to the AI opportunity set and its software peers, C3.ai trades at a substantial discount. The discounted valuation is further reinforced by roughly $9 per share of net cash on C3.ai’s balance sheet.

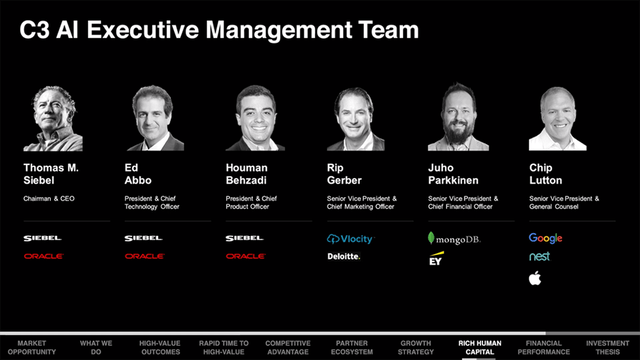

Leadership: A Competitive Edge

C3.ai’s executive leadership offers additional downside support and enhanced execution potential. Siebel created the leading CRM platform prior to Salesforce (NYSE:CRM), Siebel Systems, which was acquired by Oracle. Many of the Siebel Systems veterans are with C3.ai, and the board of directors appears to be top quality. I have included two screenshots below for those interested in the executive leadership details.

Next, I will walk through the price action which appears quite constructive, and then wrap things up.

Source: C3 AI’s spring 2022 investor presentation

Source: C3 AI’s spring 2022 investor presentation

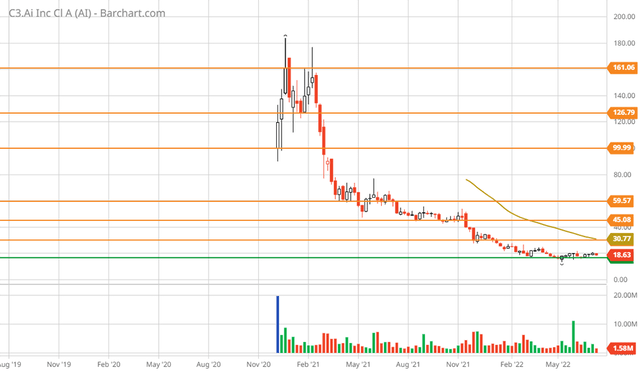

Technicals

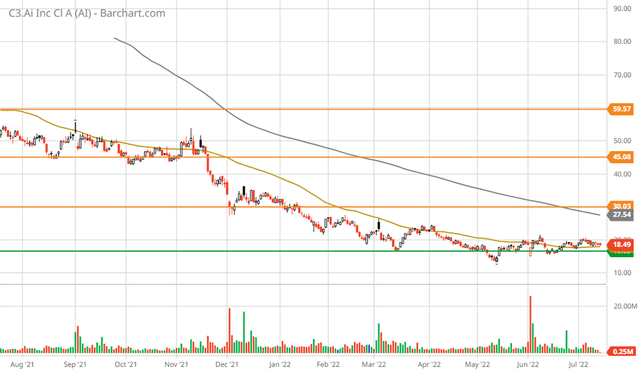

The technical backdrop for C3.ai is one of well-defined resistance levels (the orange lines on the charts below) and emerging signs of strong support (the green line). The following three-year weekly chart provides a bird’s eye view of C3.ai’s trading history. Notice that the company came public during the most speculative phase of the bull market in December 2020 and opened at $100 per share. The shares are currently priced near $19 or roughly -80% below the opening price.

C3 AI 3-year weekly chart (Created by Brian Kapp using a chart from Barchart.com)

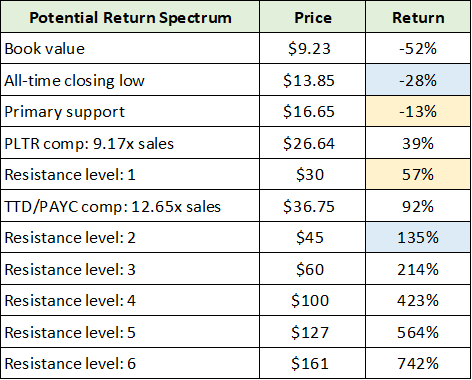

There are six well-defined resistance levels highlighted by the orange lines, which represent upside technical price targets. Only one support level is visible, which is represented by the green line and is the primary downside technical price target. The return potential to each of these targets and other key levels discussed above are summarized in the table below.

Created by Brian Kapp, stoxdox

I have highlighted in yellow what I view as a high probability potential return spectrum over the short term (0 to 1 year). The blue highlighted cells represent an additional high-probability potential return spectrum over the nearer term (0 to 3 years).

The following 1-year daily chart provides a closer look at the first three technical upside targets and the primary support level. Please note that the gold trend line is the 50-day moving average (near $18) while the grey line is the 200-day moving average ($27.54). The moving averages represent additional support (50-day MA) and resistance (200-day MA) levels.

C3 AI 1-year daily chart (Created by Brian Kapp using a chart from Barchart.com)

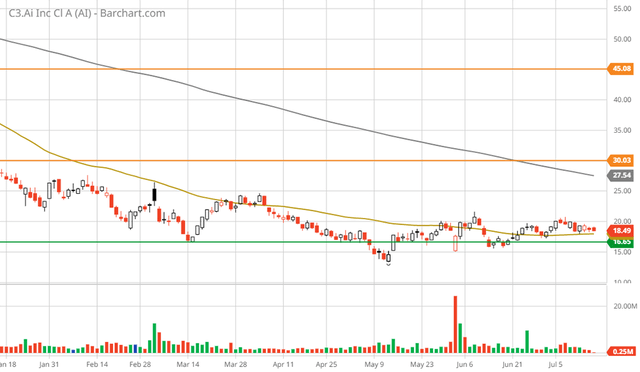

While the upside resistance levels are clearly defined and well above the current price, the most interesting technical behavior is in relation to the primary support level (the green line). C3.ai provided disappointing guidance when it reported its fiscal year 2022 fourth quarter results on June 1, 2022. The stock sold off nearly 20% the next day in reaction to the company’s cautious guidance, before finishing the day down only 5%. C3.ai went on to rally over 12% the following day.

Importantly, in the above chart, notice the massive volume surge over the three days following the guidance cut on June 1, 2022. What’s interesting is that C3.ai did not breach its prior closing low of $13.85 reached on May 11, 2022. In essence, lower near-term growth was already priced into the shares compared to what was guided to by management on June 1, 2022. This type of price behavior in reaction to a large guidance cut is generally bullish, especially when accompanied by a surge in trading volume as this points to heavy accumulation.

Management guided to mid-20% revenue growth in the near term due to week macroeconomic conditions. Previous expectations were for revenue growth in the mid-30% range. Of note, on the Q4 2022 conference call, management stated that 30% to 35% revenue growth remains achievable under more favorable macroeconomic conditions.

Given the price action since March 2022, the green support level now resembles the neckline of an inverted head and shoulders bottom formation. This level has been thoroughly tested and held since March 2022, which suggests the area near $16 should offer exceptionally strong support. The following six-month daily chart provides a closer look at the bottoming pattern.

C3 AI 6-month daily chart. (Created by Brian Kapp using a chart from Barchart.com)

Notice that the shares are sitting on top of the 50-day moving average (the gold line). Business conditions could deteriorate further in the short term which would open the door to further downside risk below the primary support level. That said, technically speaking, C3.ai has carved out a substantial bottom formation while exhibiting bullish price action in response to materially reduced guidance.

It should be noted that C3.ai has a dual class structure with the voting power vested in Siebel. This renders C3.ai ineligible for inclusion in most indices. While this theoretically lends itself to less liquidity in the shares, it can be a material positive from a technical perspective in a bear market.

On the upside, with heavy insider ownership and a public float of only 80 million shares, the supply of shares could become quite tight if C3.ai continues to execute successfully. This dynamic could offer a powerful boost to upside momentum under bullish conditions for C3.ai.

Summary

The technical setup appears quite bullish from a long-term investment perspective as it’s an ideal environment for those looking to accumulate the shares. In fact, from the perspective of a long-term investor, one would be hard pressed to find a larger secular growth opportunity than artificial intelligence universally applied. C3.ai is a uniquely positioned pure play on this megatrend with an exceptional leadership track record. The discounted valuation and fortress balance sheet further reinforce C3.ai as a top asymmetric risk/reward opportunity for those seeking exceptional growth potential.

Thank you for reading. We continually curate the most asymmetric and broadly relevant risk/reward opportunities of our times. The stoxdox platform is designed to empower all investors by providing the highest quality, unbiased, professional analysis delivered in an actionable format. We will be launching a Seeking Alpha Marketplace in the near future. Please follow us to keep abreast of updates and the coming Marketplace launch.

Be the first to comment