MBezvodinskikh/iStock via Getty Images

The argument that bitcoin (BTC-USD) is money faces an uphill battle. It’s hard to spend in the real world and its value is highly volatile. That doesn’t stop some advocates of the cryptocurrency from insisting that BTC is coin of the realm. If so, it’s not obvious by running correlation analytics on BTC against several conventional asset classes.

To recite the obvious, BTC is highly volatile and this volatility shows up via correlations. But it’s worse: the correlations for BTC are all over the map, which creates an extra layer of uncertainty. In other words, not only is BTC’s volatility high, factors that appear to influence its movements are highly unstable.

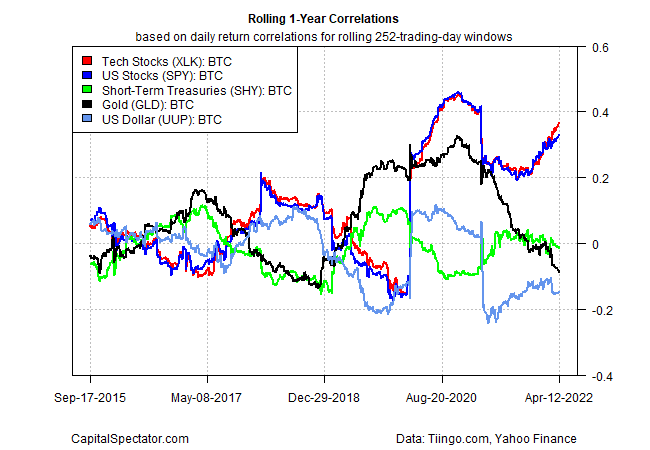

A chart tells the story. I ran correlations on BTC against a set of ETFs representing US stocks generally (SPY), tech shares (XLK), short-term US Treasuries (SHY), gold (GLD), and the US Dollar Index (UUP). The result is a wild ride of continually shifting correlations in recent years. (Note: 1.0 = perfect positive correlation, 0 = no correlation, -1.0 = perfect negative correlation.)

At the moment, US stocks and tech shares show a relatively high degree of correlation with BTC lately. But that compares with moderately negative correlation before the pandemic.

Meanwhile, Treasuries, gold, and the greenback are negatively correlated (in varying degrees) with BTC lately, although that’s far from a stable relationship, as previous years suggest.

The main takeaway: it’s not obvious what factors are influential for BTC, at least on relatively persistent basis – a conclusion that echoes my review of the cryptocurrency through a factor-analysis lens.

BTC, in short, doesn’t appear to be money per se. Rather, it’s a strange flavor of risk asset and one whose profile remains very much in flux.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment