Joe Raedle

Thesis

American Airlines (NASDAQ:AAL) is set to report its Q2 earnings release on July 21, as AAL fell in June 2022 to levels last seen in November 2020. The sentiments over airline stocks remain discernibly weak, as AAL is still mired in a long-term downtrend.

Coupled with the worsening macro headwinds, high inflation environment, and surging energy costs, the market has also battered AAL.

However, we note that AAL has likely bottomed in June, as it reached technically oversold zones across most of its critical timeframes. Despite the recent recovery, we believe AAL remains attractive from a valuation perspective.

Therefore, we believe investors can still consider capitalizing on its potential recovery and add exposure at the current levels.

Consequently, we rate AAL as a Buy, with a near-term price target (PT) of $17, implying a potential upside of about 17% (as of July 18’s close).

AAL’s Robust Q2 Corporate Update Quelled Fears

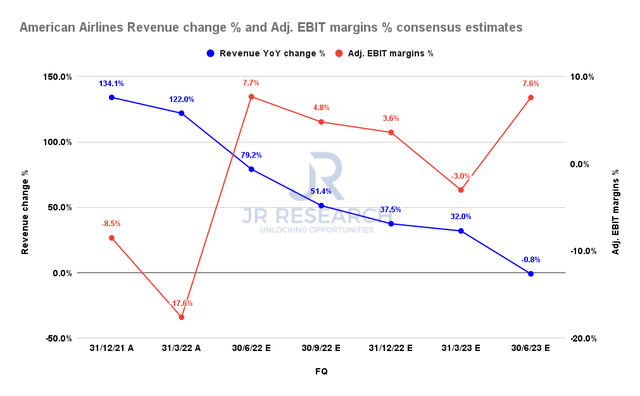

AAL revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

The company released its corporate update last week, as it guided to revenue of $13.4B for Q2’22, up 12% from Q2’19. The revised consensus estimates point to a 79.2% YoY increase in revenue in FQ2’22. Its adjusted EBIT margins are also expected to recover to 7.7%.

However, surging costs will likely crimp its profitability estimates through FQ1’23, as revenue continues to moderate. American Airlines also highlighted that it expects fuel costs to range between $4.00 and $4.05 a gallon, much higher than Q1’s $2.80 per gallon. Furthermore, Citi also highlighted that its “ex-fuel seat mile cost and jet fuel kerosene expense pressure look a little worse than expected.”

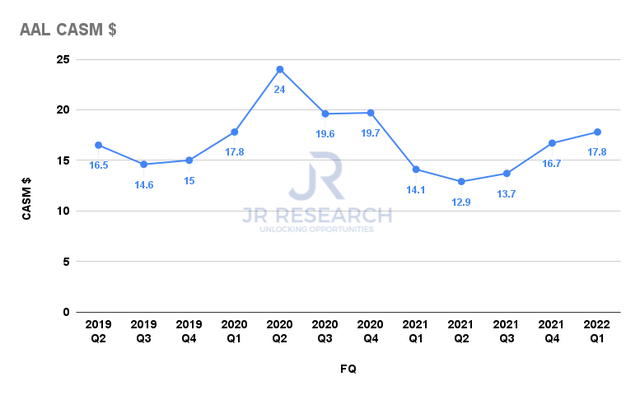

AAL cost per available seat mile (Company filings)

Therefore, we urged investors to watch the trend in its cost per available seat mile (CASM) which has been trending up since Q2’21. However, if energy costs and inflation fell over the next two years, it could help lift the company’s profitability margins. Stifel also updated in a recent note that it expects the energy markets to come under further pressure, attributed to the increasing likelihood of an economic slowdown.

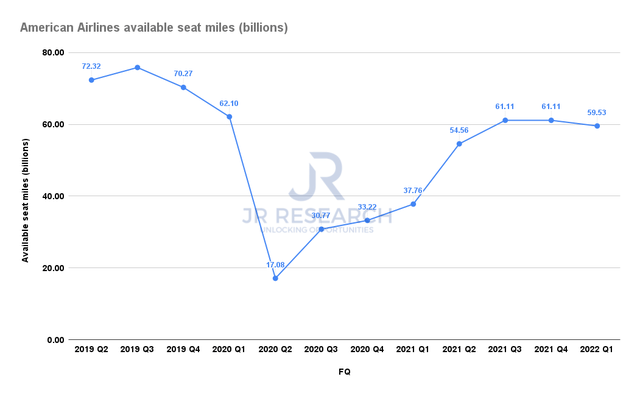

AAL available seat miles (Company filings)

Therefore, we believe the market’s focus could return to AAL’s ability to deliver revenue growth in the current climate, given its current capacity constraints, as seen above. Management also highlighted in an early June conference the challenges with its capacity. It added (edited):

We haven’t changed any guidance in terms of capacity for the year, and that, I think, is a smart move. We know that there are constraints out there in terms of aircraft. There are constraints around pilots from a mainline perspective. And on the regional side, there is pressure. We don’t have the pounds that we need to fly a full regional schedule. So I think that capacity is going to be something, at least from an American perspective, is we’ve got to fly within the resources that we have. (Bernstein 38th Annual Strategic Decisions Conference)

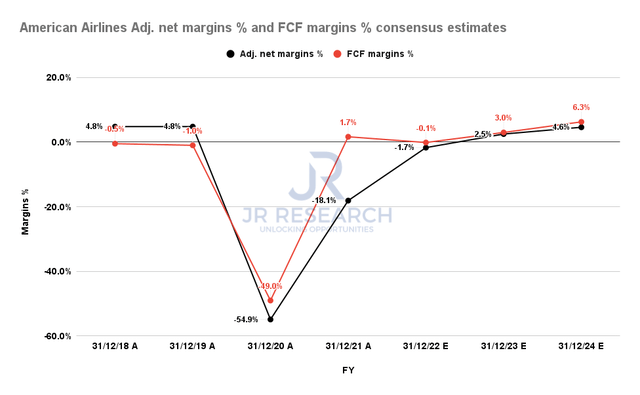

AAL adjusted net margins % and FCF margins % consensus estimates (S&P Cap IQ)

Notwithstanding, the consensus estimates (neutral) expect American Airlines to recover its 2019 profitability by FY24. It also includes AAL delivering much improved free cash flow (FCF) margins towards 2024. Despite the recent macro headwinds, management also seems confident in executing its game plan to recover its pre-COVID profitability. CEO Robert Isom accentuated (edited):

We’ve got to prove it. I want to make sure that when we go out and we say we’re going to do something, we actually execute upon it. And the confidence in that is that number one, I see what’s going on. I know that we’re running a reliable airline. I know that it’s competitive to those that are in the business. So I have great confidence there. And then I also know that the work that we put in. I know that the expense reductions that we’ve taken on during the pandemic are real. I know that the fleet simplification is real. It’s hard for a casual observer, not on the inside, to be able to see that. I see it. I see us being able to put our assets to work in the places that are going to be really profitable. (Bernstein Conference)

AAL’s Valuation Is Undemanding

| Stock | AAL |

| Current market cap | $9.44B |

| Hurdle rate [CAGR] | 15% |

| Projection through |

CQ4’26 |

| Required FCF yield in CQ4’26 | 19% |

| Assumed TTM FCF margin in CQ4’26 | 6.3% |

| Implied TTM revenue by CQ4’26 | $53.08B |

AAL reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a market-outperform hurdle rate of 15%, with an FCF yield of 19%. Notably, AAL’s buying upside was rejected in April 2022 at a yield of 10.9%. However, it gained support at its June bottom at a yield of 19.5%. Therefore, we used a conservative FCF yield metric to assess whether American Airlines can deliver our revenue target by CQ4’26.

Assuming a blended FCF margin of 6.3% (lower than the revised consensus estimates), we require AAL to post a TTM revenue of $53.08B by CQ4’26, which is likely achievable.

Is AAL Stock A Buy, Sell, Or Hold?

We rate AAL as a Buy with a near-term PT of $17, implying a potential upside of 17% (as of July 18’s close).

However, more conservative investors can consider waiting for a retracement before adding exposure.

Otherwise, we believe we used conservative metrics in our valuation, which indicates that AAL is still attractive, even at the current levels.

Be the first to comment