georgeclerk

Thesis

Amazon.com, Inc. (NASDAQ:AMZN) is a large and complex business that spans e-commerce, cloud, advertising, and more. While this article focuses primarily on the e-commerce business and its cyclicality, I rate Amazon as a buy mostly due to its strong cloud and advertising businesses which are experiencing faster growth and have higher margins.

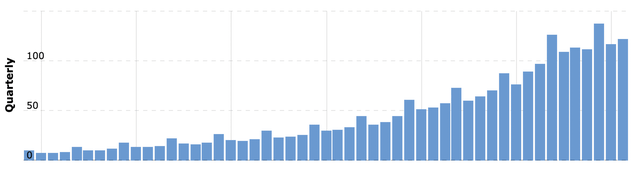

How Does Amazon Stock Perform During The Holiday Season?

The above chart shows Amazon’s quarterly revenue. One thing that should jump out is that once every four quarters, there’s a large bump which subsides the following quarter. This bump is due to higher spending during the holiday shopping season in Q4.

Amazon typically receives a similar bump in cash flow in Q4; in many years, Amazon’s free cash flow was negative for three quarters but heavily positive in Q4.

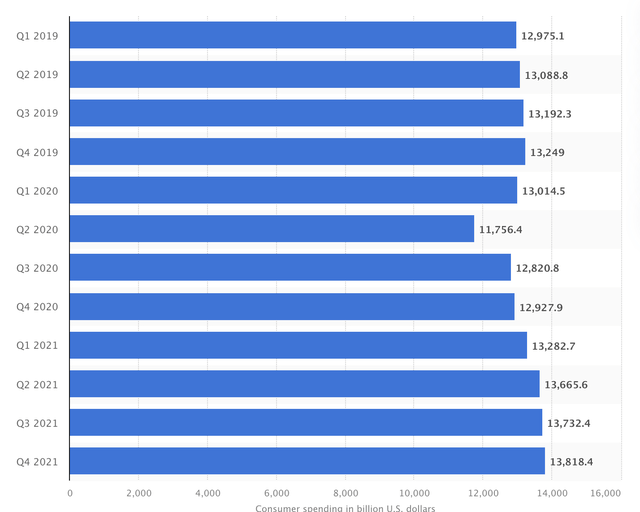

This bump is mirrored in the above chart, which shows quarterly consumer spending trends in the USA going back to 2019. Q4 always commands the most spending, although the bump in this chart is less pronounced than in Amazon’s chart and the trend is disrupted by Covid in 2020.

Like other large retailers including Walmart (WMT), Amazon has historically been successful at capturing a large part of consumers’ holiday spending through aggressive advertising and discounts. That strategy has served the company well, as evidenced by its consistent Q4 revenue bump.

Amazon is kicking off the holidays early this year, with an early access sale for Prime members on October 11 and 12. This appears to be a trend this year, as Walmart, Kohl’s (KSS), Macy’s (M), Bed Bath & Beyond (BBBY), Target (TGT), and Best Buy (BBY) are all holding “holiday” sales in early October as well. I went to Home Depot the other day and even they had a Christmas section set up by October.

Shopping events are shifting earlier this year because spending during the holidays is expected to be weaker due to inflation and other macroeconomic issues. Per Adobe Analytics, online sales are only expected to rise 2.5% in November and December this year, compared to 8.6% last year. This will be the slowest increase since 2015.

With fewer dollars to go around, retailers are fighting harder for their share of customers’ wallets, and the earlier they throw their hat in the ring, the more likely they are to come out with their fair share. Some of these retailers are currently dealing with inventory issues as well, and discounting items now will help them move the excess inventory sooner. Adobe Analytics expects electronics to be discounted by an average of 27% this year, compared with 8% last year, in part due to inventory issues.

Although Amazon always generates the most revenue in Q4, that doesn’t mean that its stock always performs best in Q4. Over the past five years, AMZN stock has an average Q4 return of 3.2%. That’s compared to an average annual return of 37% between 2017 and 2021 for AMZN stock. So while the returns have been positive, investors shouldn’t expect the best returns in Q4 just because Amazon generates the most revenue in Q4. Growth is usually looked at on a year-over-year basis, so each Q4 is compared to the strong Q4 in the prior year rather than the Q3 in the current year.

Why Has Amazon’s Stock Price Been Dropping?

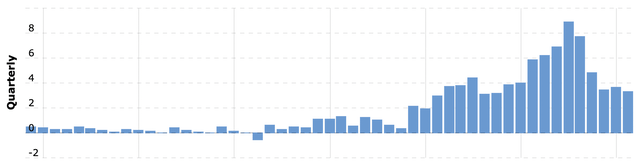

While aggressive promoting and discounting to drive revenue growth has been a successful strategy for Amazon in the past, the impact to the bottom line was less pronounced. As shown in the chart above, Amazon’s quarterly operating income often sees a bump every fourth quarter, but the trend is much less consistent compared to the revenue bump.

In fact, the peak towards the right of the graph actually happened in Q1 of 2021, and operating income has been declining since then, including in Q4 of 2021. It’s been even worse for cash flow, as Amazon’s free cash flow went negative in 2021 for the first time in over a decade. This decline has been one major reason why Amazon stock peaked in July of 2021 and fell 40% since then.

Of course, there have been other issues that contributed to the decline as well. The overall market is down more than 25% this year, and while Amazon has historically outperformed the market, it’s difficult to generate lucrative returns in the face of a market crash. Amazon’s revenue growth has also slowed this year to its slowest rate since at least 2010 as it laps difficult Covid comps.

Is AMZN Stock A Buy, Sell, Or Hold?

In the short term, the best-case scenario for Amazon is that operating income expands materially in Q4 due to a successful holiday season. This has happened in the past; for example, in 2014 Amazon’s operating income would have been negative if not for Q4, but after reporting a strong Q4, Amazon stock rose 27% in Q1 of the following year when it reported results.

Of course, with demand appearing weak and Amazon’s competitors aggressively discounting due to inventory issues, it’s also possible that Amazon will not have a strong Q4. The overall market could continue to sell off, and cyclical consumer brands like Amazon could continue to receive the worst of the selloff. If the company gets overly aggressive with its discounts, it could continue to experience declining operating margins as well.

In the short term, it’s anyone’s guess as to how AMZN stock will perform. Not only is it difficult to predict the strength of the holiday shopping season and its impact on Amazon’s top and bottom line, but even if one were to correctly predict that, it doesn’t guarantee that AMZN stock will move in the same direction as Amazon’s business metrics in the short term. Market volatility can outweigh actual earnings results for months or even years.

In the longer term, I’m cautiously optimistic that Amazon can get back on track. That’s mostly thanks to its AWS and advertising segments, which are less cyclical than the e-commerce business and also have higher margins and faster growth. I’ve covered these segments more in past articles, but in short, I believe that these segments will drive significant free cash flow and operating income growth for Amazon in the coming years. That’s based on my perspective as a software engineer, understanding where cloud computing is now and where it could be in 10 years.

Financial analysts agree, as according to Seeking Alpha the average analyst expects a forward P/E of 8 for Amazon in 2031. That’s compared to 9 for Microsoft, 12 for Apple, 11 for Walmart, and 15 for Costco. While Amazon has the highest P/E of the group now, it’s expected to see the fastest bottom line growth and ultimately have the lowest P/E in a decade.

That potential makes Amazon a buy today, as long as investors can stomach investing in a company which is currently less profitable and less shareholder-friendly than its big tech and big retail peers.

Conclusion

In the price targets that I share with Tech Investing Edge members, I actually have a lower price target for Amazon relative to some of its big tech peers, even though I view it as having the highest uncertainty of the group. While I share analysts’ optimism about Amazon’s ability to expand its profit margin over the next decade, I also view the current lack of high profitability, growth, and shareholder returns as a risk. While I rate AMZN stock as a buy going into the holiday season because I do have a price target that implies market-beating returns for the stock in the coming years, I would also encourage investors to consider increasing exposure to other big tech companies before looking at Amazon.

Be the first to comment