atakan/iStock via Getty Images

Thesis

Ally Financial Inc. (NYSE:ALLY) is slated to report its highly anticipated Q2 earnings release on July 19. However, given the worsening macro headwinds, the market has hammered ALLY as it adjusted its valuation. As a result, ALLY has fallen nearly 40% from its 2021 highs.

We believe the market’s reaction has been justified, given Ally’s significant exposure to the automotive segment. The market has also battered the legacy auto stocks as it parsed the impact on large-expense consumer discretionary spending. In addition, worries over credit quality and rising delinquencies have also likely played considerable roles in ALLY’s de-rating.

ALLY last traded at an NTM normalized P/E of 4.69x, well below its 5Y mean of 8.83x. However, we will explain why, despite the battering, investors should continue to bide their time in adding ALLY.

Accordingly, we rate ALLY as a Hold for now.

What To Expect From Earnings?

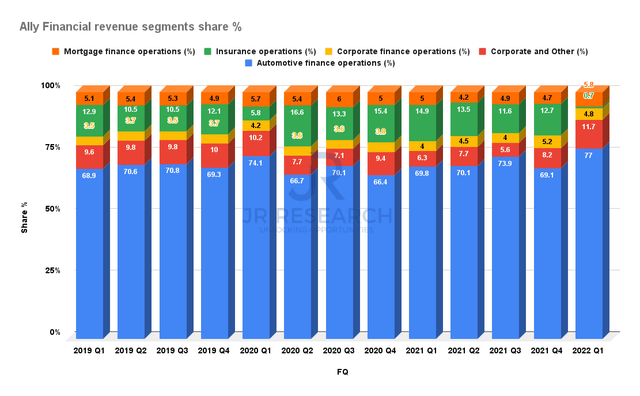

Ally revenue segment share % (Company filings)

Investors in Ally must always consider its exposure to the automotive finance segment. Despite diversifying its business model, 77% of Ally’s revenue was attributed to automotive finance in FQ1. Therefore, investors should parse management’s commentary on the growth and performance of their automotive outlook.

Moreover, investors should observe whether management will revise its guidance, given the worsening macro headwinds that could further impact its auto finance operations. Ally also cautioned such possibilities in its filings (edited):

A rising interest rate environment can pose different challenges, such as potentially slowing the demand for credit, increasing delinquencies and defaults, and reducing the values of our loans and fixed-income securities. Consumer confidence levels and the strength of automotive manufacturers and dealers can also influence the used vehicle market. For example, during the economic crisis that began in 2007–2008, sharp declines in used vehicle demand and sale prices adversely affected our remarketing proceeds and financial results. (Ally Financial FQ1’22 10-Q)

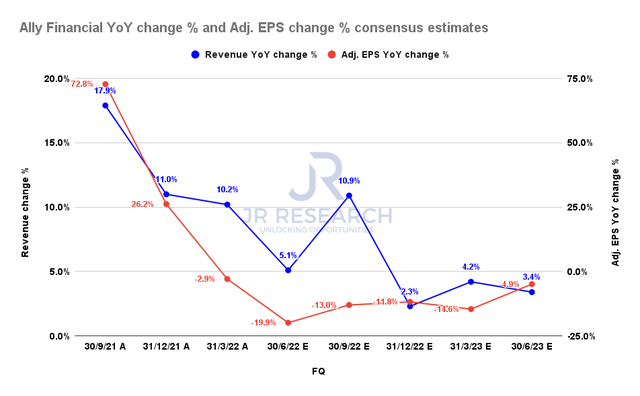

Ally revenue change % and adjusted EPS change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) suggest that Ally could post revenue growth of 5.1% in FQ2. However, Ally’s adjusted EPS growth could decline by 19.9%, picking up the pace from FQ1’s 2.9% decline.

Ally’s adjusted EPS growth is also projected to continue declining through FQ1’23 before bottoming. Therefore, we believe the market has de-rated ALLY significantly to reflect the marked potential impact on its profitability.

Furthermore, Ally Financial’s revenue and adjusted EPS growth is expected to moderate through FY24, reflecting the potential risks of its significant auto exposure.

Is Ally Financial Undervalued?

ALLY last traded at an NTM FCF yield of 4.69x, well below its 5Y mean of 8.21x. Therefore, we believe the market has priced in a considerable extent of the potential risks we highlighted earlier.

Notwithstanding, Ally posted a 5Y EPS CAGR of 30.8%. However, the Street’s estimates suggest that Ally’s adjusted EPS is projected to decline from FY22’s $7.59 to FY24’s $6.87. Despite that, ALLY FY24 normalized P/E of 5.01x has still fallen well below its 5Y average.

Consequently, we believe ALLY seems undervalued. However, investors should also consider that it traded at a P/E as low as 3x at its COVID bottom.

ALLY – No Signs Of A Sustained Bottom Yet

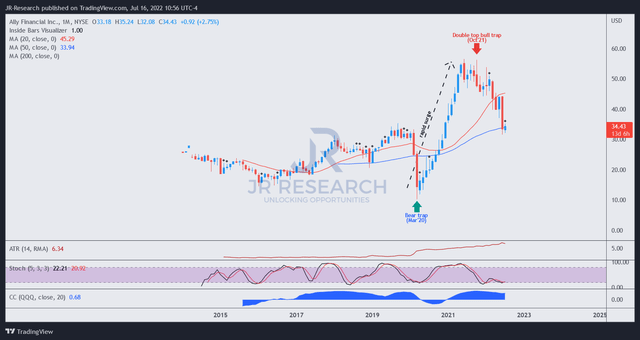

ALLY price chart (monthly) (TradingView)

ALLY’s long-term price action is quite constructive and has also entered oversold zones. Therefore, we believe a near-term bottom is likely. Notwithstanding, we need to observe more constructive price action before we can confidently call for a long-term bottom.

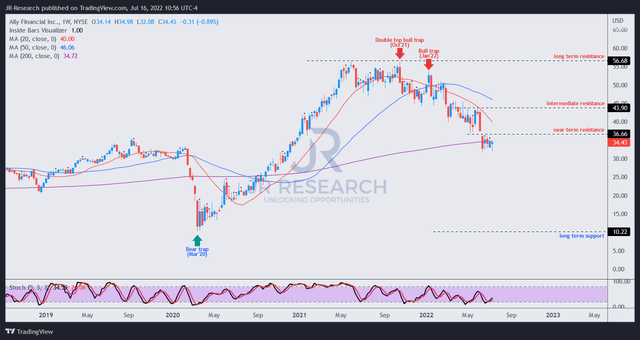

ALLY price chart (weekly) (TradingView)

Furthermore, ALLY remains mired in a dominant bearish bias on its medium-term chart, as seen above. ALLY is also trapped in a medium-term downtrend (expected, given the extent of its decline). Therefore, we need constructive price action that suggests a sustained bottom is likely. However, we have yet to glean any.

Therefore, we believe caution is still warranted.

Is ALLY Stock A Buy, Sell, Or Hold?

We rate ALLY as a Hold for now.

We noted that ALLY’s valuation has been hammered and seems undervalued. Therefore, long-term investors may even consider adding exposure at the current levels. Notwithstanding, the consensus estimates (bullish) suggest that Ally’s operating performance could continue to weaken through FY24. Therefore, using ALLY’s historical valuation averages as a gauge may be less helpful in a much weaker operating climate.

Furthermore, we have not observed constructive price action that suggests the market could overturn its medium-term bearish bias and re-rate ALLY. Notwithstanding, ALLY is already oversold on its long-term chart. Therefore, a near-term bottom is likely.

Consequently, if ALLY can demonstrate constructive bottoming action on its medium-term chart moving forward, it would help its long-term bottoming thesis.

However, we believe it’s still too early to suggest that ALLY has likely bottomed. But, given the forward discounting mechanism of price action, we believe much of Ally’s potential weakness has likely been priced in. As a result, we think that ALLY is likely closer to a bottom than before.

Be the first to comment