FG Trade

A Quick Take On Third Harmonic Bio

Third Harmonic Bio, Inc. (THRD) intends to raise $153 million from the sale of its common stock in an IPO, according to an amended registration statement.

The company is a clinical stage biopharma developing treatments for inflammatory and intestinal conditions.

While Third Harmonic is developing promising treatments for common health conditions, it won’t start Phase 2 efficacy trials until 2024 at the earliest, so investors in THRD would need to be very patient.

So, I’m on Hold for THRD’s IPO due to a very long wait time until the next reasonable catalyst to the stock in 2024 or 2025.

Third Harmonic Overview

Cambridge, Massachusetts-based Third Harmonic was founded to develop KIT inhibition capabilities in an oral small molecule drug to treat conditions such as urticaria (hives), asthma and gastrointestinal conditions.

Management is headed by Chief Executive Officer, Natalie Holles, who has been with the firm since August 2021 and was previously President and CEO of Audentes Therapeutics and prior to that was Senior VP, Corporate and Business Development at Hyperion Therapeutics.

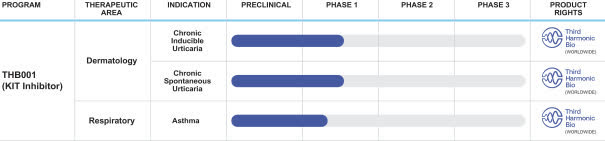

The firm’s lead candidate is THB001 and is in Phase 1 trials for dermatologic and respiratory condition treatments.

Management expects to report results from its Phase 1b proof-of-concept trial for treating chronic inducible urticaria by the second half of 2023.

Below is the current status of the company’s drug development pipeline:

Company Pipeline Status (SEC EDGAR)

Third Harmonic has booked fair market value investment of $170.2 million as of June 30, 2022, from investors including Atlas Venture, BVF Partners, General Atlantic, Novartis (NVS, OTCPK:NVSEF), and OrbiMed.

Third Harmonic’s Market & Competition

According to a 2022 market research report by Technavio, the global market for treating various types of urticaria is forecast to increase in value by $1.3 billion from 2021 to 2026.

This represents a forecast CAGR (Compound Annual Growth Rate) of CAGR of 10.35 over the study period.

Key elements driving this expected growth are an increase in the incidence of urticaria, growing treatment options including the introduction of biologic treatment modalities.

Also, North America is expected to account for 41% of market growth through 2026, and the region’s growth rate is forecast to be faster than overall market growth.

Major competitive vendors that provide or are developing related treatments include:

-

Bruton

-

Celldex

-

Allakos

-

Amneal Pharmaceuticals

-

Bayer AG

-

F. Hoffmann La Roche

-

GlaxoSmithKline Plc

-

Johnson & Johnson

-

TerSera Therapeutics

-

Teva Pharmaceutical Industries

-

United BioPharma

-

Viatris

The company is also pursuing treatment conditions in other major markets.

Third Harmonic’s Financial Status

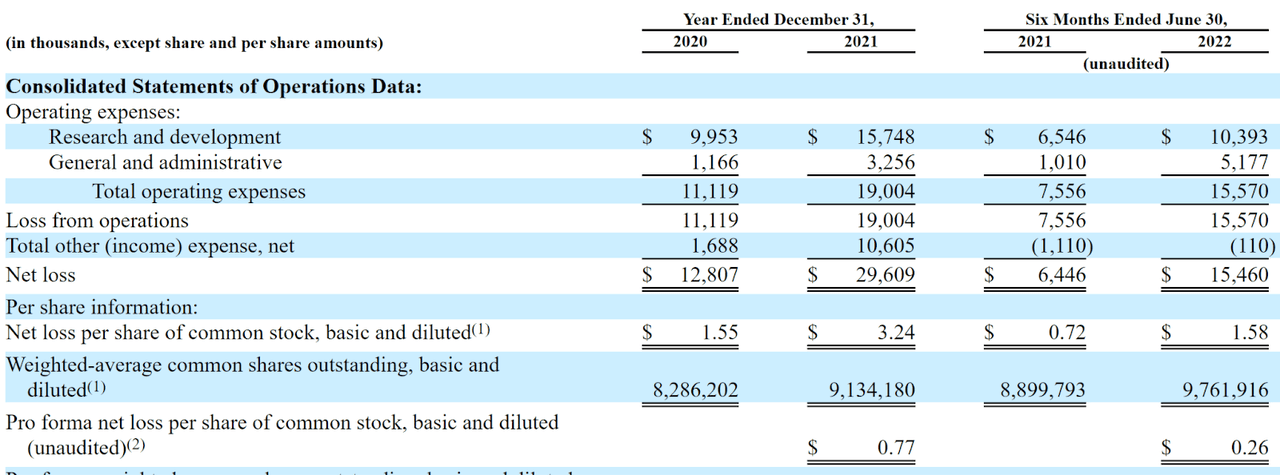

The firm’s recent financial results are typical for a clinical-stage biopharma in that they feature no revenue and significant R&D and G&A costs associated with its pipeline development efforts.

Below are the company’s financial results for the past two and 1/2 years:

Company Statement Of Operations (SEC EDGAR)

As of June 30, 2022, the company had $128.3 million in cash and $5.7 million in total liabilities.

Third Harmonic Bio’s IPO Details

THRD intends to sell 9 million shares of common stock at a proposed midpoint price of $17.00 per share for gross proceeds of approximately $153 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $374 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 24.5%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

approximately $80.0 to $90.0 million to advance the continued clinical development of THB001 for the treatment of urticaria, including through completion of a Phase 1b clinical trial for chronic inducible urticaria and initiation of a Phase 2 clinical trial for chronic spontaneous urticaria;

approximately $30.0 to $40.0 million to advance the continued clinical development of THB001 in additional indications, including through completion of a Phase 1b clinical trial for asthma and to fund further development or acquisition of future programs to advance nonclinical and clinical development; and

the remainder for potential expansion of our pipeline and other research and development activities, as well as for working capital and other general corporate purposes.

Even if we complete this offering, we will need substantial additional funds to pursue our business objectives, which may not be available on acceptable terms, or at all.

(Source – SEC)

Management’s presentation of the company roadshow is available here until the IPO is completed.

Regarding outstanding legal proceedings, management said the firm is not currently a party to any proceedings that would have a material adverse effect on its financial condition or operations.

Listed bookrunners of the IPO are Morgan Stanley, Jefferies, Cowen and LifeSci Capital.

Commentary About Third Harmonic

Third Harmonic is seeking U.S. capital market investment to fund further trials for its product pipeline.

The firm’s lead candidate, THB001, is in Phase 1 trials for various dermatologic and respiratory condition treatments including for chronic hives and asthma.

THB001 intellectual property was in-licensed from Novartis Pharma and the firm is allowed under its agreement with Novartis to utilize third-party intellectual property to further develop THB001.

THRD management is exploring other development opportunities for its THB001 as a treatment for mast cell-caused conditions.

The market opportunities for treatments for these conditions are large and expected to grow at moderate rates of growth over the coming years.

The company’s investor syndicate includes major pharma firm Novartis among several well-known life science venture capital firms.

Morgan Stanley is the lead underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (38.1%) since their IPO. This is a lower-tier performance for all major underwriters during the period.

THRD has top-quality leadership; its C-level executive team includes officers from various other highly regarded biotech companies.

As for valuation, management is asking investors to pay an Enterprise Value that is within the typical range for a Phase 1 biotech at IPO.

While the company is developing promising treatments for common health conditions, it won’t start Phase 2 efficacy trials until 2024 at the earliest, so investors in THRD would need to be very patient.

So, I’m on Hold for THRD’s IPO due to a very long wait time until the next reasonable catalyst to the stock in 2024 or 2025.

Expected IPO Pricing Date: September 14, 2022.

Be the first to comment