Roman Budnyi/iStock via Getty Images

A Quick Take On Lucy Scientific Discovery

Lucy Scientific Discovery (LSDI) has filed to raise $8 million in gross proceeds from the sale of its common stock in an IPO, according to an amended registration statement.

The company is seeking to provide contract manufacturing services for psychotropic medicines in Canada and potentially the U.S.

Given the degree of regulatory uncertainty, no revenue history and high valuation assumptions, my outlook on the LSDI IPO is on Hold.

Lucy Scientific Overview

Victoria, BC, Canada-based Lucy Scientific was founded to develop manufacturing capabilities for pharmaceutical-grade medicinal psychotropics for the treatment of various mental health and addiction disorders.

Management is headed by President and CEO Christopher McElvany, who has been with the firm since March 2021 and was previously an Executive Vice President at Slang Worldwide, a global cannabis company.

The company’s potential primary offerings include:

-

Psilocybin

-

LSD

-

MDMA

-

Mescaline

-

Others

Lucy Scientific has booked fair market value investment of $30.8 million as of September 30, 2022, from investors including Astatine Capital, Roma Ventures, DPL Capital, Profis Investment, Roxy Capital, Theseus Capital and others.

The firm will seek clients for its contract manufacturing capabilities among research institutions and biopharmaceutical companies.

Lucy has received a Controlled Drugs and Substances Dealer’s License in Canada.

Lucy Scientific’s Market & Competition

According to a 2021 market research report by Data Bridge Market Research, the global market for psychedelic drugs was an estimated $2.1 billion in 2019 and is forecast to reach $6.9 billion by 2027.

This represents a forecast CAGR of 16.3% from 2020 to 2027.

The main drivers for this expected growth are a growing acceptance of psychedelic drugs for the treatment of depression along with an increased incidence of depression-related disorders.

Also, the drugs may have applications in other addictive disorders such as nicotine and alcohol dependence as well as chronic PTSD symptoms.

Major competitive or other industry participants include:

-

Mind Cure Health

-

Mind Medicine

-

Psygen Industries

-

Numinus Wellness

-

HAVN Life Sciences

-

KGK Science

-

Field Trip Health

-

Cybin

Lucy Scientific Financial Results

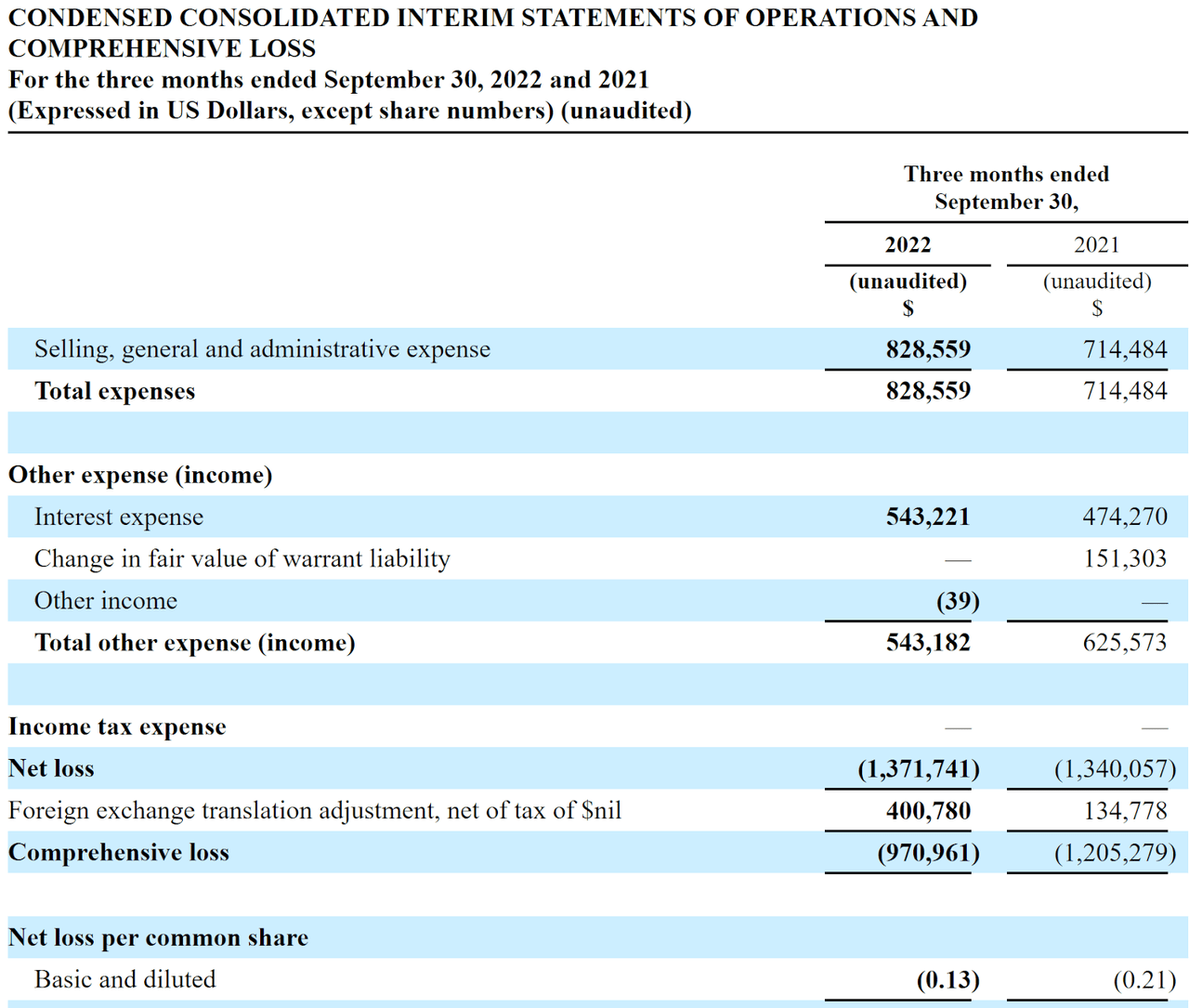

Below are relevant financial results derived from the firm’s registration statement for the three months ended September 30, 2022 and 2021:

Statement Of Operations (SEC)

As of September 30, 2022, Lucy Scientific had $16,398 in cash and $10.8 million in total liabilities.

Free cash flow during the nine months ended September 30, 2022, was negative ($246,529).

Lucy Scientific IPO Details

LSDI intends to sell 2 million shares of common at a proposed midpoint price of $4.00 per share for gross proceeds of approximately $8.0 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $59.3 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 13.14%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

approximately $2.2 million to complete the buildout of and make certain upgrades to our manufacturing and research facilities;

approximately $2.1 million to satisfy certain outstanding liabilities and indebtedness; and

the remainder for working capital and other general corporate purposes, including the additional costs associated with being a public company.

(Source – SEC)

Management’s presentation of the company roadshow is available here until the IPO is completed.

Regarding outstanding legal proceedings, management says the firm is not currently the subject of legal proceedings that would have a material adverse impact on its financial condition or operations.

The sole listed underwriter of the IPO is WestPark Capital.

Commentary About Lucy Scientific

LSDI is seeking to obtain U.S. public market investment capital to pay down its significant debt load (for a company of its size) and for its continued facility and related development plans.

The company’s financials have shown zero revenue to date, significant operating losses, and growing cash used in operations.

Free cash flow for the nine months ended September 30, 2022, was negative ($246,529).

The firm currently plans to pay no dividends on its capital stock and anticipates that it will reinvest any future earnings into its expansion and operating initiatives.

The market opportunity for medicinal psychotropic drugs is still nascent but expected to grow at a high rate of growth through 2027, so the firm has positive expected growth dynamics in its favor.

WestPark Capital is the sole underwriter, and the only IPO led by the firm over the last 12-month period has generated a return of negative (82.7%) since its IPO. This is a bottom-tier performance for all significant underwriters during the period.

Risks to the company’s outlook as a public company include a highly uncertain regulatory outlook for the psychotropics industry in the near term period.

As for valuation, management is asking IPO investors to pay an Enterprise Value of nearly $60 million for a company with no revenue history.

Given the degree of regulatory uncertainty, no revenue history and high valuation assumptions, my outlook on the LSDI IPO is on Hold.

Expected IPO Pricing Date: To be announced

Be the first to comment