South_agency/iStock Unreleased via Getty Images

The Safest Port in the Storm

A hawkish Fed has raised interest rates five times this year, including a historic and unprecedented three hikes of 0.75% or 75 basis points each in their last three meetings. In a bid to curb raging inflation, ranging from the core 6% to the headline 8%, the Fed has clearly shown no mercy to investors, taking the Fed Funds rate from 0 to 0.25% to 3 to 3.25%. And it’s not done yet – the markets are expecting two further hikes of 75 and 50 basis points in the next two meetings left in 2022.

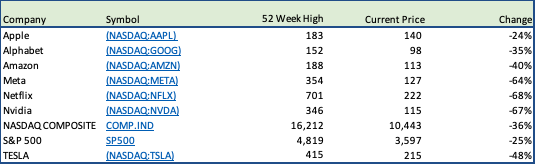

Interest rate hikes didn’t spare anyone – the S&P 500 has dropped 25% from its all time high of 4,819 to 3,597. The NASDAQ COMP.IND and market leaders “The FAAMNNG’s” Meta (Formerly Facebook)(NASDAQ:META), Alphabet, (NASDAQ:GOOG), Amazon (NASDAQ:AMZN) Netflix (NASDAQ:NFLX) Nvidia (NASDAQ:NVDA) and Tesla (NASDAQ:TSLA) suffered worse.

Apple (NASDAQ:AAPL) not surprisingly, turned out to be the safest port in the storm that engulfed the markets this year, dropping “only” 24%, even edging the S&P 500, which is a huge sign of stability and faith in the company.

The Drop in the Tech Bellwethers – FAAMNNG’s (Seeking Alpha)

A flight to quality is common during corrections and bear markets and having seen a few! I’ve usually resorted to consumer staples and other defensives. This time around I’ve bought Apple on dips and believe it would be best line of defense and then some, as we work our way out of this bear market.

Q4-2022 and Q1-2023 Revenue Outlook Remains Solid

Long time Apple analyst Gene Muster re-iterated his faith in Apple claiming that lead times are higher at this stage for the iPhone 14, than it was for the iPhone 13.

There was some consternation about Apple ordering an extra 6 million units for the I-Phone 14 and then walking it back. The short term drama aside, it’s still on its initial target of selling more than 90Mn phones in Q1-2023 (Oct-Dec 2022). Clearly, there’s no lack of demand and as initial reports have shown, the larger and more expensive iPhone 14s are selling better than the smaller base models, whose ASP’s (Average Selling Prices) will help Apple’s Sep and Dec quarter revenues.

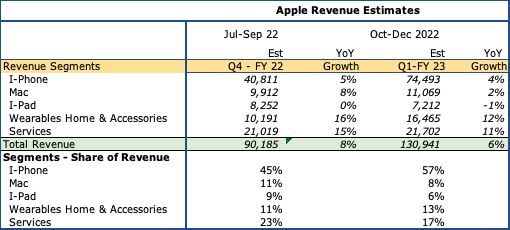

Apple’s Revenue Segments (Apple, Fountainhead)

I expect iPhones to grow 5% in Q4-22 and 4% in Q1-22, its biggest quarter of the year. Importantly, this is the first post Covid Dec quarter and single digit growth is still impressive on the back of 33% revenue growth in 2021.

The drop in worldwide PC shipments also doesn’t seem to have hurt Apple. According to IDC, Mac shipments grew 40% to 10,060 in Q3-22. However, more conservatively, I’m estimating that Mac will grow 8% in Q4-22 and 2% in Q1-23.

As has been the trend in the past several years, wearables, (I-Watch) and Services will carry the lion’s share of growth at 16-12%, and 15-11% in each quarter, respectively.

The Bull Case

Apple’s Biggest Moat – It is a fully integrated company. It designs its own system on chips (SOC), the hardware and architecture of all its devices and the operating system that goes in them. Unlike the “Wintel” combination of Microsoft Windows and Intel, which was produced as a commodity and sold under several brands of PC’s worldwide – Dell, Lenovo, HP, Asus to name a few, Apple never stepped out of its walled garden. It valued and provided the best user experience, put in all the best features and charged 30-35% higher than the competition. The same thing repeated itself in mobile phones – The I-Phone comes with the IOS, while the Android is free to be used by anyone else in the industry. And guess what, there was a time when Apple was making 90% of the profits in the cell phone business! This is a fantastic business model and I don’t see any immediate threats to it in the near future.

Growth from Wearables and Services – The I Watch, with 30% of market share of wearables, is in a class by itself, with the next two competitors in the low and mid teens. Initially dismissed as a fad, it has grown to a must have in the Apple eco system and with its foray into health, it will remain a major catalyst for growth for Apple.

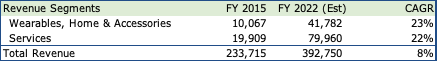

Apple’s wearables and Services Segments (Apple, Fountainhead)

Around 2015, when I-Phones were close to 70% of Apple’s revenues, there was a lot of hand wringing about how difficult it would be to move the needle of a $234Bn behemoth. The general refrain was that I-Phones were saturated, we had seen the best of Apple and it was relegated to a low to mid teens PE ratio and some even dismissed it as a hardware company! Well, seven years later the Wearables segment, which consists mainly of the I-watch has grown at an astounding 23% per year to $42Bn!

Similarly, Services has grown at 22% to $80Bn and has the best margins. The $2.99 you pay each month for extra storage brings in a lot of green for Apple!

Brand Loyalty – You can’t cut the cord. Apple’s brand value and stickiness is priceless. I started with a Fitbit and once I was gifted an I-Watch there’s been no turning back. The user experience is excellent across all its products and addictive. I was at a dinner with some friends and someone had forgotten their I-Phone; a friend gave her a Samsung Galaxy to make a call. She was worse than a deer in headlights! Absolutely clueless and handed it back with a shudder! You can’t pry an I-Phone out a dead person’s fingers!

Rewarding its shareholders – Apple throws up gobs of cash, $104Bn of operating cash in FY 2021 alone, of which $14Bn was returned as dividends and $86Bn used for buybacks. With net margins of 21-22% of almost $400Bn in sales, and growing at 6%, Apple should continue to generate about a $100Bn of cash each year.

Expanding its Eco System – Apple Pay – Remember the derision and ridicule Apple Pay was subjected to when it was in in its infancy? Well, according to Statista, Apple Pay now has a 92% overall share in overall US mobile wallet transactions. The point here is that Apple has the luxury, the cash and the resilience to wait and keep expanding its eco system. Something, smaller and weaker competitors don’t.

Very disciplined with its cash – Apple doesn’t waste money chasing expensive acquisitions, in FY 2020 it spend only $1.5Bn on strategic investments. These are strictly within its areas of competence. It spent a hefty $22Bn in R&D in 2021, which is essential and lifeblood of tech companies.

Valuation and Summary

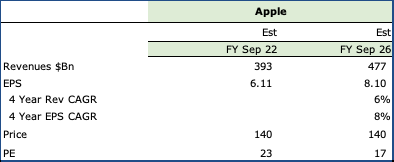

Apple, Fountainhead

I’m not recommending Apple as a growth story, the next 4 years are expected to grow at single digits, even as wearables and services hold up that mantle for years to come. And sure, there could be the A/R segment or autos in the future, which could well be the subject of another article and discussed at length.

At this juncture, the investment objective is two fold — one is clearly to own a AAA rated blue chip, which has so far outperformed the broader, supposedly more hedged S&P and other tech stalwarts and will be a solid bastion holding up to the Fed’s whack a mole, whack anything strategy.

The second is the valuation. Clearly, the 0.25% Fed Funds rate and the (ERP) Equity Risk Premium of 4.5% put equity valuations way beyond its long term averages. At its peak of 4,819 in Nov 2021, the S&P 500 was about 24X, 2021 earnings of $200. With the Fed Funds rate rising and approaching 4.25% that valuation and multiple was not tenable. It had to fall. Now at 3,570 the S&P 500 is valued at a more sedate 16.4 PE.

The same rationale applies to Apple. It’s multiple too has come down from 29 to 21X forward earnings. As interest rates stop rising and inflation gets under control in 2023 the multiples will expand. As the blue chip generating a ton of cash, fully integrated, best brand in the world, with all its moats and competitive advantages, Apple will go back to a much higher multiple and valuation.

I own Apple and recommend buying it.

Be the first to comment