Ron and Patty Thomas

A Quick Take On CW Petroleum

CW Petroleum Corp (OTCPK:CWPE) has filed to raise $15 million in gross proceeds from the sale of its common stock and warrants in an IPO, according to an amended registration statement.

The company provides fuel product blending and delivery services in the southern U.S. region.

The company’s topline revenue has essentially plateaued and it operates in a low margin business.

Although the IPO may attract volatility-seeking day traders, it isn’t cheap on valuation multiples, so I’m on Hold for CWPE.

CW Petroleum Overview

Katy, Texas-based CW was founded to deliver non-branded, blended and non-blended diesel fuel and gasoline products to U.S. customers.

Management is headed by president and Chairman Christopher Williams, who has been with the firm since inception in 2013 and was previously an executive at Platts/Mc-Graw-Hill Financial, a petroleum industry source for financial and commodities analysis.

The company delivers its primary offerings to:

-

Independent fuel retailers

-

Independent and chain convenience stores

-

Boating marinas

-

Other fuel distributors

CW has booked fair market value investment of $1.8 million as of March 31, 2022 from investors.

The company operates primarily in the market area of Houston-Galveston-Brazoria and much of its fuel sold is blended to burn more cleanly than conventional products.

CW also operates a truck terminal and blending facility.

CW’s Market & Competition

According to a 2021 market research report by IBISWorld, the U.S. market for gasoline and petroleum wholesaling will reach an estimated $717 billion by the end of 2022

This represents a 6.5% growth over 2021’s level.

If it achieves this rate of growth in 2022, the industry will have grown at an average of 3% per year from 2017 to 2022.

The main drivers for this expected growth are a sharp rise in the price of fuels, which increases industry revenue as a whole.

Also, a rise in oil prices increases industry purchase costs which has the potential to reduce profit margins.

Major competitive or other industry participants include:

-

Texas TransEastern

-

United Petroleum Transports

-

Dupre Logistics

-

Ag Processing

-

Archer Daniels Midland

-

Cargill

-

Louis Dreyfus Commodities

-

Smaller firms

CW Petroleum Financial Performance

The company’s recent financial results can be summarized as follows:

-

Upward trending topline revenue

-

Uneven gross profit and variable gross margin

-

Variable operating loss

-

A swing to cash used in operations.

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2022 |

$ 1,693,968 |

0.7% |

|

2021 |

$ 8,269,909 |

17.4% |

|

2020 |

$ 7,043,926 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2022 |

$ 295,959 |

-0.3% |

|

2021 |

$ 1,071,321 |

3.1% |

|

2020 |

$ 1,039,201 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Three Mos. Ended March 31, 2022 |

17.47% |

|

|

2021 |

12.95% |

|

|

2020 |

14.75% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Three Mos. Ended March 31, 2022 |

$ (59,457) |

-3.5% |

|

2021 |

$ (1,475,413) |

-17.8% |

|

2020 |

$ 63,096 |

0.9% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Three Mos. Ended March 31, 2022 |

$ (75,056) |

-4.4% |

|

2021 |

$ (1,542,938) |

-91.1% |

|

2020 |

$ 106,839 |

6.3% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Three Mos. Ended March 31, 2022 |

$ (44,565) |

|

|

2021 |

$ 224,095 |

|

|

2020 |

$ 677,441 |

|

(Source – SEC)

As of March 31, 2022, CW had $202,447 in cash and $918,383 in total liabilities.

Free cash flow during the twelve months ended March 31, 2022, was $123,552.

CW’s IPO Details

CWPE intends to sell 3 million units consisting of common stock and one warrant to purchase one share of common stock at the IPO price, at a proposed midpoint price of $5.00 per share for gross proceeds of approximately $15.0 million, not including the sale of customary underwriter options.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

The company’s stock is currently quoted on the OTC under the symbol “CWPE.”

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $32.4 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 32.7%. A figure under 10% is generally considered a “low float” stock which can be subject to significant price volatility.

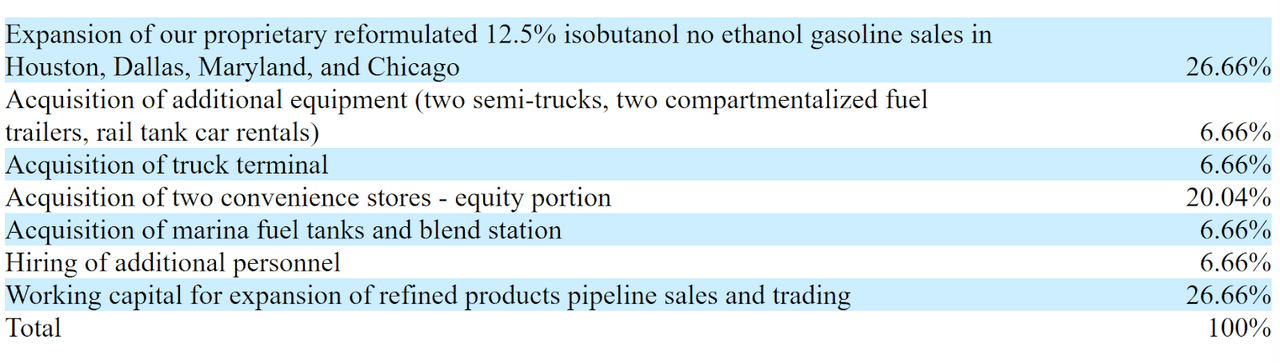

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

Proposed Use Of Proceeds (SEC EDGAR)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the company is not party to any legal action that would have a material adverse effect on its operations or financial condition.

The sole listed bookrunner of the IPO is EF Hutton.

Valuation Metrics For CW Petroleum

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$45,886,475 |

|

Enterprise Value |

$32,445,901 |

|

Price / Sales |

5.54 |

|

EV / Revenue |

3.92 |

|

EV / EBITDA |

-20.56 |

|

Earnings Per Share |

-$0.17 |

|

Operating Margin |

-19.06% |

|

Net Margin |

-19.86% |

|

Float To Outstanding Shares Ratio |

32.69% |

|

Proposed IPO Midpoint Price per Share |

$5.00 |

|

Net Free Cash Flow |

$123,552 |

|

Free Cash Flow Yield Per Share |

0.27% |

|

Debt / EBITDA Multiple |

-0.16 |

|

CapEx Ratio |

-309.88 |

|

Revenue Growth Rate |

0.66% |

(Source – SEC)

Commentary About CW Petroleum

CWPE is seeking public capital market investment to expand its operations into Baltimore and Chicago, open a specialty blending facility and to acquire two convenience stores as it hopes to expand into retail operations with gas stations to serve areas near the Gulf of Mexico and boat owners there.

The firm’s financials have produced slightly growing topline revenue (Q1 2022), variable gross profit and gross margin, uneven operating loss and a swing to cash used in operations.

Free cash flow for the twelve months ended March 31, 2022, was $123,552.

The firm currently plans to pay no dividends on its shares and anticipates that it will use any future profits to reinvest back into its growth efforts.

The market opportunity for distributing gasoline products to wholesale customers in the U.S. is large and expected to grow as the price of fuel products has risen.

EF Hutton is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (65.4%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is the volatility of oil prices which can expose CW to short-term losses.

As for valuation, management is asking investors to pay an EV/Revenue multiple of around 3.9x, which is higher than a basket of publicly held oil & gas distribution companies which had a multiple of 3.6x as of January 2022.

CWPE is a tiny company that is exposed to price volatility in the oil & gas sector, which has been volatile recently.

The company’s topline revenue has essentially plateaued and it operates in a low margin business.

Although the low nominal price for the shares may attract day traders seeking volatility, the IPO isn’t cheap on valuation multiples, so I’m on Hold for CWPE.

Expected IPO Pricing Date: To be announced

Be the first to comment