Kwarkot

Investment thesis

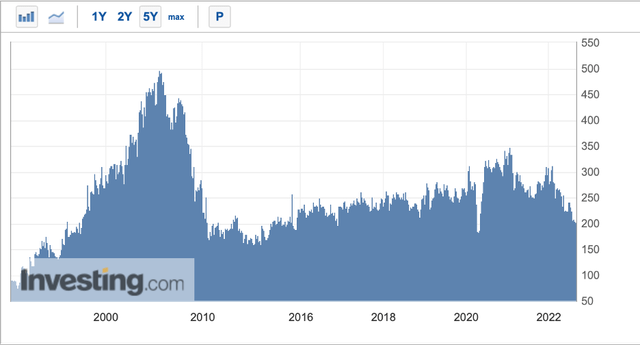

With lower real income and higher cost of mortgages, the U.S. housing market has begun to show the first signs of weakness. In particular, the MBA Purchase Index has reached the lowest level since 2004 (nearly 200 p.). The decline in housing mortgage demand has pulled down construction of new housing, even though the index is at a local high. We recommend reducing the share of investments in developers and use the available capital to invest in residential real estate investment trusts (“REITs”). Our absolute favorite is Invitation Homes Inc. (NYSE:NYSE:INVH) due to its extensive investment program, which will capture the rental housing deficit in the U.S.

The earliest signs of the real estate market weakness

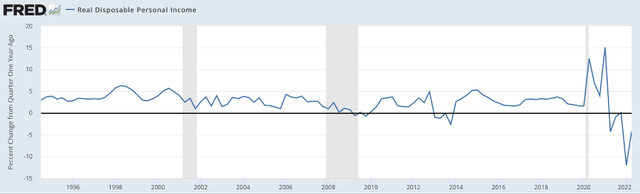

Real household income continues to decline for the second quarter in a row amid the slowdown in economic activity, as well as accelerating inflation across the country. Thus, according to FRED, as of the end of 2Q 2022, real disposable income (after-tax income) decreased by 4.2% y/y.

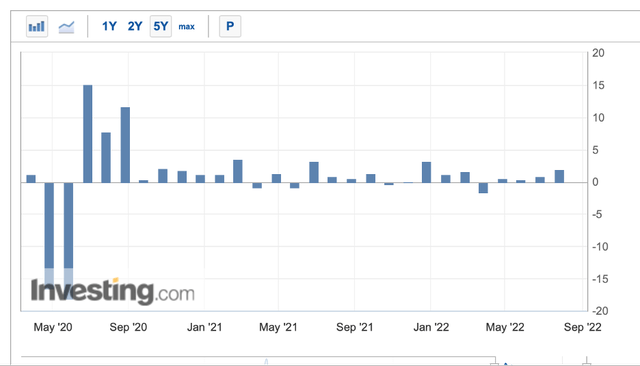

In the wake of lower income, consumers are getting cautious about buying durable goods due to the recession expected in 4Q 2022-1Q 2023 in the U.S. Thus, according to Investing, the rate of durable goods orders growth amounted to zero on a monthly basis against expectations of a 0.6% m/m increase.

Residential housing is no exception. The first weakness is demonstrated by the mortgage market. According to Investing, the Mortgage Index has approached the 200-point level, which is the lowest value since the decline caused by the COVID-19 pandemic.

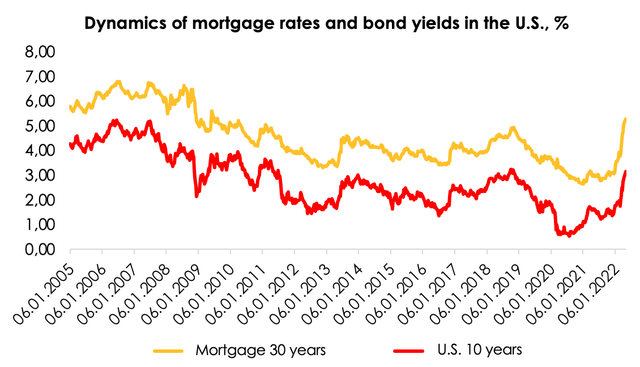

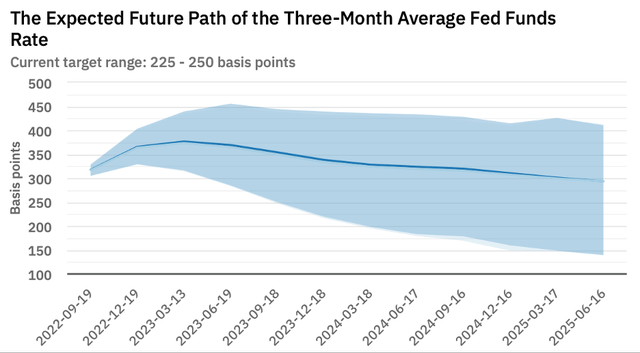

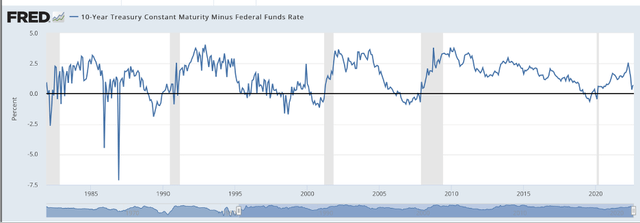

As we have previously reported, the mortgage market is cooling off following higher rates. Typically, 30-year mortgage rates follow the yields of 10-year bonds in the United States, according to FRED, because the average mortgage lifespan is up to 10 years (consumers either pay off the mortgage or refinance it at a lower interest rate). The average spread is ~150 b.p. and expands up to 250 b.p. in times of crisis.

It is worth noting that according to the futures curve, the average U.S. Fed rate until 2025 is expected to be ~3.4%, and the “gap” between the Fed rate and 30-year mortgage yields, according to FRED, is 250 b.p. in non-crisis times and shrinks to almost the zero mark in the face of recession. In other words, U.S. 10-year bond yields will remain at 3% for a long time. The average mortgage rate is likely to exceed 6% as early as 2H 2023. Mortgage bond sales aimed at reduction of the Fed’s balance sheet also have an impact on higher yields.

The bet on REITs is more attractive

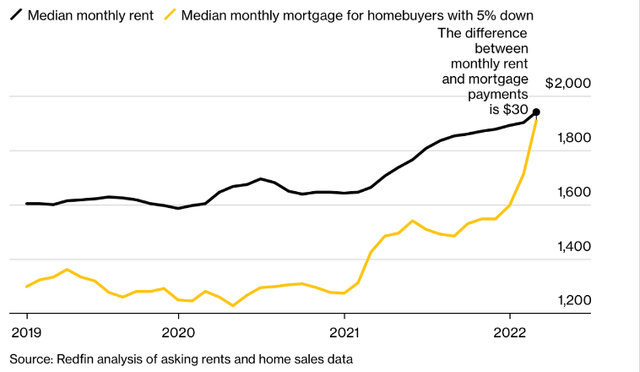

According to Bloomberg, in May, the average payment reached the average rental rate. Buying real estate used to be more profitable due to low rates, but this era has passed.

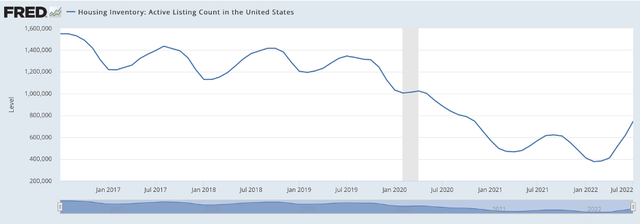

Despite the increase in housing inventory, it is still below 1 mln homes, which shall support prices. Combined with rising rates and nominal property value, the average mortgage payment is likely to increase further.

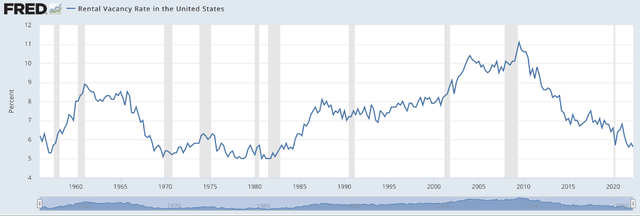

Households have resorted to rental real estate due to unaffordability of housing. According to FRED, in 2Q 2022 the average rental vacancy rate reached its lowest level in 30 years.

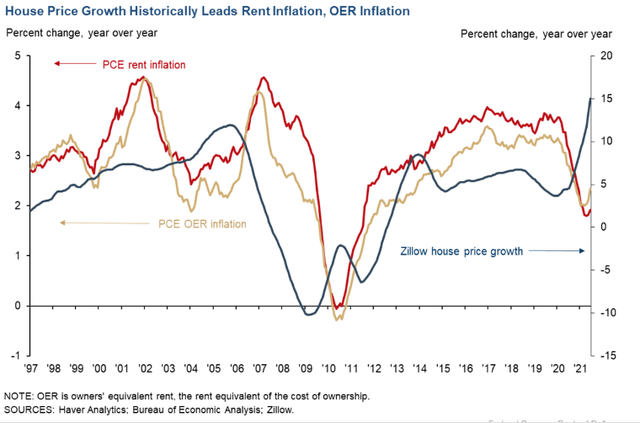

Higher rental rates are now supported by strong demand, and then 2021 high housing prices will come into play. Typically, rental rates react to property value with a lag of 12 to 18 months, according to FED Dallas. In other words, we believe that the bet on residential REITs is reasonable, as we expect the U.S. housing market to be under pressure in the medium term.

REITs during the recession

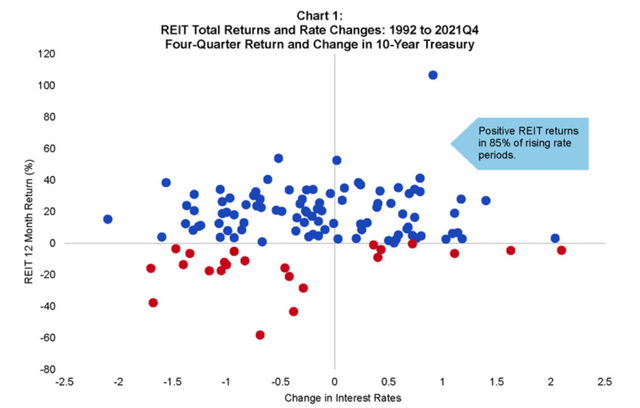

REITs are assumed to perform poorly during periods of tightening monetary policy, as the attractiveness of dividend yield is reduced due to higher risk-free rates. However, according to Nareit, typically REITs raise rental rates faster in times of high inflation, supporting FFO growth rate. Despite the commonly accepted dogma, according to Nareit, REITs have shown positive return in 85% of observations during periods of rising rates.

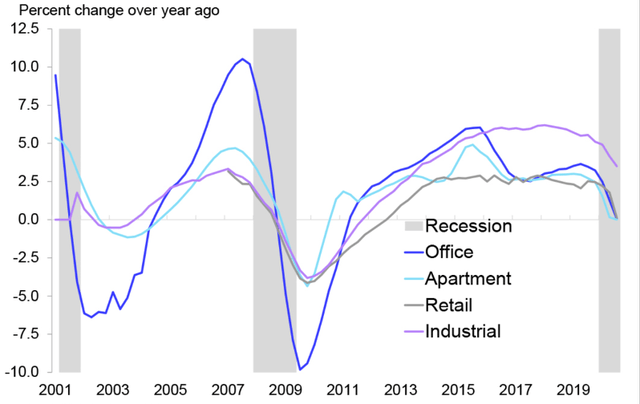

The recession hit hardest the dynamics of rental rates for office real estate, the least hard – for residential real estate. Thus, according to SparrowHawk, during the 2008 crisis, rental housing payments declined to 5% y/y but recovered faster than the market.

Valuation

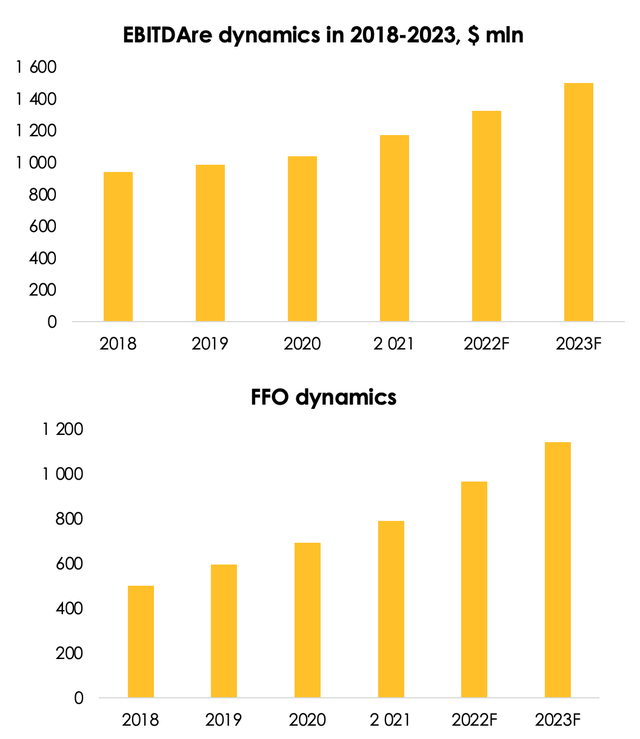

We maintain our 2022 EBITDAre forecast at $1322 mln (+13% y/y) and have revised the 2023 forecast from $1470 mln (+11% y/y) to $1498 mln (+13% y/y). We have also revised the 2022 FFO forecast from $957 mln (+21% y/y) to $966 mln (+22% y/y) and the 2023 forecast from $1098 mln (+15% y/y) to $1141 mln (+18% y/y) due to the accelerating shift of housing from the non-comparable to the comparable properties segment over the valuation horizon (especially in 2023).

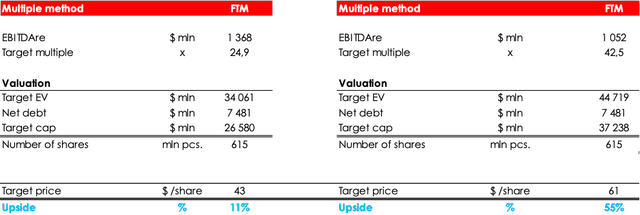

Based on the new assumptions, we maintain our BUY stock rating. The target price is $52. Upside – 33%. Our valuation of the company is based on EV/EBITDAre and EV/FFO.

Invitation Homes Inc. is one of the most attractive REITs, with an extensive investment program that distinguishes it from the closest competitors. Right now, rental property investment funds are a hot trend because of the high demand for rental housing due to sky-high new housing prices.

The main factors behind the growth of securities in the next 12 months:

- Preservation of elevated rental rate growth at the expense of unaffordable housing.

- Consolidation of the rental housing market through accelerated buying of properties, and possible acquisition of competitors.

Risks:

- Sharp slowdown in the growth rate of household income in the US. The latter shall have to look for cheaper rental housing.

- Downward revision in the size of housing investment plans.

Conclusion

The U.S. real estate market is no longer a hot topic due to falling demand for real estate across the country amid accelerating mortgage rates and declining household income. We believe that betting on the real estate market through REITs remains relevant due to persistent higher demand for rental homes caused by unaffordability of the housing owned and shortage of vacant rental housing.

We also believe that INVH stock is attractive to buy now due to rising prices and current property value included in the future rental rates. We recommend keeping an eye on the statistical data (FRED, Zillow and Redfin).

Be the first to comment