Zinkevych/iStock via Getty Images

There is exciting news coming from Invitae’s (NYSE:NVTA) Q421 earnings call. The management team announced the intention to shift the focus from external capital-fueled growth to self-funding. To achieve that, the company will have to turn operating cash-flow positive. However, it will not be a one-year job. It will likely take more than twelve months to achieve it, and there will be hiccups along the way. Nevertheless, seeing the management team committing to that goal is very encouraging.

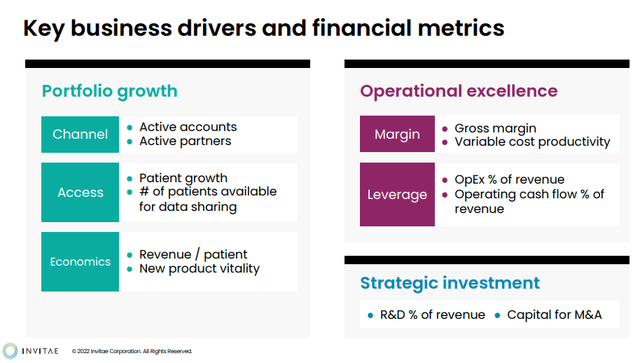

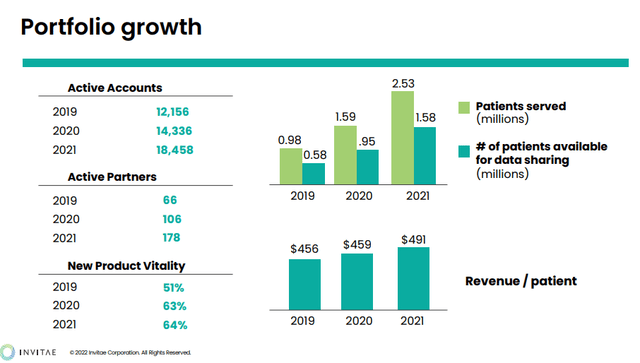

This change in direction will also materialize through a change in financial metrics. Before that, the company shared ASP (average selling price) and cost-per-unit figures, meaning that investors had little to see. Most analysts valued the company on sales multiples, which is not a great measure when used alone. Now, the company will share growth figures for commercial access points (hospitals, clinics, pharmaceutical companies) and patient population. Additionally, the company will now also focus on operating cash-flow metrics. Namely, the company targets positive operating cash flow. At the same time, the company will also focus on non-GAAP gross margins, targeting 50% in the long term.

Key business drivers and financial metrics (Invitae)

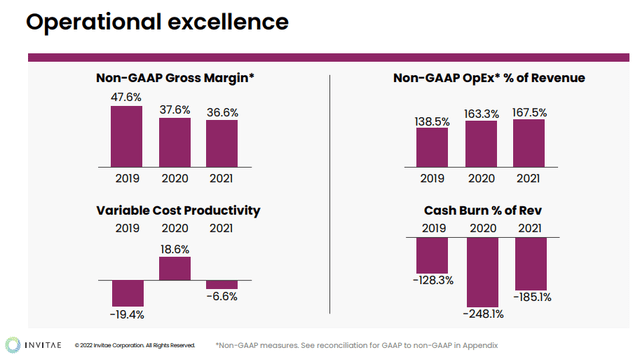

Operational excellence (Invitae)

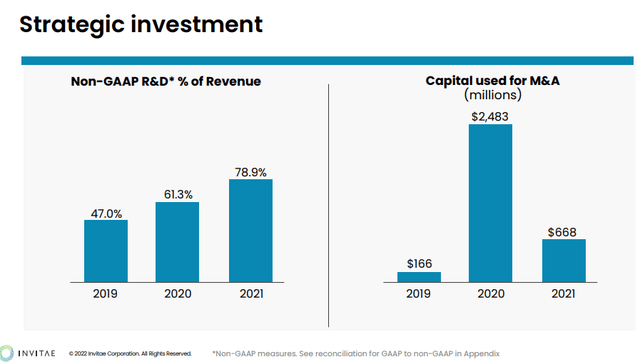

Strategic Investment (Invitae)

To achieve the necessary improvements in the gross and operating margins, the company will need to move some levers. Among them is the two-year $3 billion acquisition spree integration. That is fundamental given that they’ve acquired so many companies.

Therefore, product improvements coupled with modernization and automation of the acquired assets should help to improve productivity while keeping top-line growth. The company is also shifting from an intense dive into M&A to a more opportunistic stance.

Let’s deep dive and see what the company has bought.

Invitae’s Acquisitions

Singular Bio

Singular Bio is a company developing single-molecule detection technology. Its technology enables high-quality nucleic acid analysis for application in non-invasive prenatal screening (NIPS). The idea is to detect problems in the fetus in early pregnancy using a blood sample. Singular Bio claims that its platform allows high-volume screening by combining advanced optics, custom chemistry, and molecular biology.

In theory, this technology should enable lower testing costs. Invitae already has NIPS services, but these are still expensive. The idea is to decrease costs and pass them to the patients, thus increasing the total addressable market. Sean George, Invitae’s CEO, pointed out that this might turn the NIPS market into a 50% gross margin business.

Jungla

One of the most demanding problems in genomics is understanding what a particular mutation will do. That is especially troublesome if the mutation is unknown. If we have many observations of the same phenomenon, we can generate correlations. However, that is not possible for new mutations. Those are called a variant of unknown significance or VUS. Now, to offer some perspective on this problem, the occurrence of mutations is not that rare. New DNA, as the one parents pass to their children, will generate hundreds of mutations.

Jungla specialized in an approach predicting the impact of VUSs. Through machine learning, they look at the particular variant and predict its effect on the protein. Obviously, Inviate, being one of the largest companies in genetic testing services, needed a solution to VUSs. Jungla’s cloud-based platform is a clear addition to Invitae’s current suite of genetic variant interpretation tools.

One important note regarding this acquisition is that it reveals how close genomics is to proteomics. Likely, in the future, these fields will intersect a lot. Therefore, companies like Quantum-Si (QSI), and its protein sequencing technology, will play an important part in expanding genomic testing.

Diploid

Diploid is another company knocking the variant interpretation problem. The company developed Moon, an artificial intelligence software capable of going through huge amounts of data (whole genome sequencing data) and provide a diagnosis in minutes. Diploid’s technology, at least in theory, seems to enable scaling while decreasing the cost of diagnosis.

The technology is especially well-suited for rare genetic diseases, which is critical for children with rare genetic disorders in neonatal and pediatric intensive care units. Going from whole-genome sequencing data to a diagnosis in minutes is critical for providing rapid and accurate treatments.

Genelex Pharmacogenetic and YouScript

The patient population has genetic variations that affect their response to medication. These differences make that two people taking the same drug may have different responses to the treatment. Genelex offers low-cost testing to provide insights relative to the impact of medication on patients.

YouScript is a clinical decision support and analytics platform. The company’s software predicts probable drug interactions, genotype-based drug and dosage recommendations, and analysis of common medications, foods, and recreational drugs.

Coupling both companies together will enable clinicians at the point of care to easily make prescription choices. Medical staff will have access to the drug and gene interaction and can assess the risk of adverse side effects.

ArcherDX

ArcherDX is a precision oncology company. It will allow Invitae to integrate germline testing, tumor profiling and liquid biopsies technologies under one roof. The result will be an offering going from diagnostic testing to therapy monitoring and optimization. The company is currently developing STRATAFIDE for therapy optimization, while its personalized cancer monitoring product will enable the therapy assessment and enable early recurrence identification.

One Codex

One Codex is a platform for microbiome analysis used across academic, commercial, and clinical institutions. The company’s platform has two main goals: analyzing microbial data against a large collection of microbial reference genomes while presenting the results in a digestible format for users.

Genosity

Genosity is a genomics testing company. Invitae is currently developing a personalized cancer monitoring platform. Genosity has developed technology and skills that have the potential to augment Invitae’s offering, namely by reducing the turnaround time of complex sequencing-based tests. Given that the company already works with Genosity on several projects, the management already knows the gains it can obtain with this company.

Investment takeaway

The company is a serial acquirer, which raises warning flags. However, going through the various acquisitions, we can see that they seem to form a mosaic where one leverages the other. Basically, we see several testing and software technologies enabling a wide range of offerings. By developing a platform that attracts network participants allows the company to increase the utility of genetic information for them.

The integration of all these different companies will be one of the most critical factors. Integrating the different technologies will be a driver for sales through new or improved offerings. It will also help Gross Margins through improved efficiency. Finally, the restructuring of the current Opex levels will be necessary.

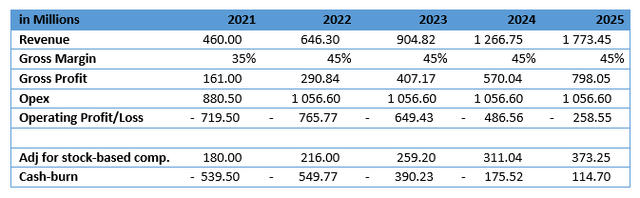

All-in-all, this is a tipping point for Invitae. The company needs to execute this plan, or else it risks months of turmoil through management reshuffling and strategy pivots. Therefore, are the company’s expectations realistic? In my opinion, this process will take more than two years. If we take a simple approach and try to model the management’s guidance, we’ll get the following:

2025 model estimation for operating profit and cash burn (Auhor)

The underlying assumptions are revenue growth of 40% per year, 45% gross margins, and Opex growing 20% in 2022 (and remaining constant thereafter). The main result of the estimations of this model is that the company will only reach zero cash burn in 2025. These assumptions are not conservative, and we cannot say that there is a great margin for error. Also, there is significant further dilution implied in these figures. On the bright side, the genomic field is on the cusp of growing substantially during the next decade, and Invitae seems well-positioned to catch that wave.

In my opinion, the price volatility of this stock will remain very high. During the following years, the periods where the company will seem to be getting closer to the model will likely result in double digits P/S ratios. Those periods when things seem to be getting off-track will see dramatic reversals. Volatility aside, I think that the company, by the middle of the decade, can be trading at a double-digit market cap.

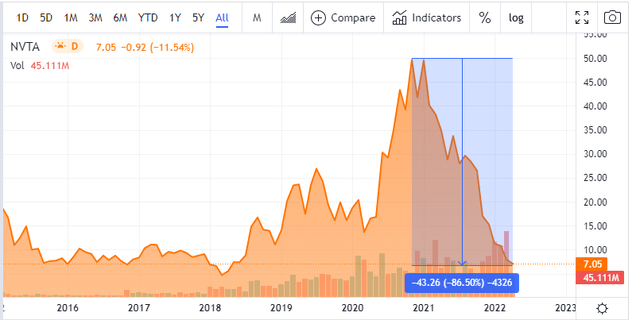

Invitae’s stock price (Seeking Alpha)

The company is trading more than 85% below its all-time high and close to its 2018 all-time low. Given the company’s revenue and asset build-up, since 2018, the market seems to be dismissing Invitae’s progress. After reviewing the acquisitions and the revamped strategy, I think that if the management team shows evidence of the ability to eliminate the cash burn in a reasonable time frame, the market will reward the stock handsomely.

Be the first to comment