alvarez

Earnings Strength

Industrias Bachoco, S.A.B. de C.V. (NYSE:IBA) is expected to announce its third quarter numbers at the end of this month, and it will be interesting to see if the poultry producer can hit its numbers. Going on the momentum in the seasonally strong second quarter where the company reported a significant earnings beat, we would be surprised if Industrias Bachoco does not indeed beat consensus once more in Q3 (GAAP earnings of $0.52 estimated).

What we witnessed in Q2 was that Industrias Bachoco was able to take advantage of higher sales on the front end to boost earnings on the back end. Higher raw-material costs are causing havoc in many industries, but up to now, IBA continues to take advantage of the supply/demand breakdown, which is aiding the bottom line. Net sales grew by almost 27% in the second quarter, where over 8% of IBA’s revenue growth was volume-led (demand strength). EBITDA margin almost hit 16%, with SG&A costs dropping to 8% as a percentage of company turnover in the quarter. Suffice it to say, irrespective of the RYC Alimentos acquisition, margins and sales are on the rise at IBA.

Therefore, given the growth IBA is experiencing, let’s delve into the company’s trends concerning its profitability, the technicals, and the company valuation. Strength in these three areas usually means rising prices are on the way for this poultry producer.

Profitability

IBA’s return on capital (ROC) now almost comes in 10% over a trailing twelve-month average, which is well ahead of the industry average of 6.18%. Although predicting forward-looking earnings can be very difficult even in the best of times, when we have a company that has growing sales and margins and also can demonstrate that it can invest its cash at high rates of return, these trends stack the odds in favor of holdings a successful investment over time.

In fact, given IBA’s balance sheet which we see below in local currency, the company´s present debt-to-equity ratio comes in at a very low 0.05, which really means that interest expense is minimal for the company. Suffice it to say, external trading imbalances (Supply/demand breakdown, costs, inflation, etc.) may adversely affect the company’s really strong forward earnings expectations, but from an internal standpoint, IBA certainly has its financial affairs in order.

Valuation

Although IBA’s forward GAAP earnings multiple of 7.97 will be what attracts investors from a valuation standpoint, the company’s sales, assets, as well as its cash-flow all look cheap compared to the industry as well as IBA’s historic multiples, as we can see below.

| Multiple | IBA Trailing 12 Month Average | Industry Average | IBA 5- Year Average |

| Price/Earnings | 7.35 | 20.11 | 11.73 |

| Price/Sales | 0.52 | 1.17 | 0.71 |

| Price/Book | 0.93 | 2.39 | 1.93 |

| Price/Cash-Flow | 10.78 | 13.97 | 11.81 |

Sales are expected to rise by 22%+ in fiscal 2022 and by close to 10% next year. Suffice it to say, even if these projections do not pan out as expected, IBA is working off a very keen valuation where we can see shares are currently trading under book value. Furthermore, cash, inventory, and property plant & equipment make up more than 76% of the company’s assets, so there definitely is merit to the company’s low book multiple and the potential for more growth here.

Technicals

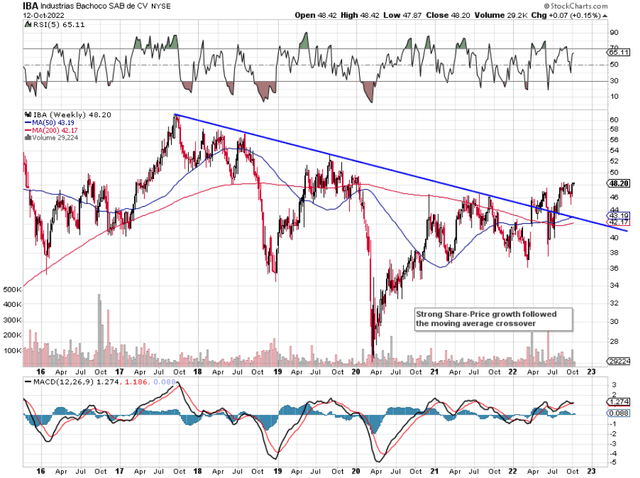

Two events happened recently in IBA’s long-term technical chart which are noteworthy. The first is that shares broke through the multi-year downcycle trendline, which dates back to 2017. This means what was once overhead resistance should now convert into upside support. Secondly, the move above that trendline corresponded with a bullish move of the faster 50-week moving average above the corresponding 200-week average. These events demonstrate that there likely has been a change in the long-term trend here which the market is beginning to price in. Shares have rallied almost 19% over the past three months alone, so it will be interesting to see if this momentum can continue for the rest of the year.

IBA Long-Term Technicals (Stockcharts.com)

Conclusion

Based on the very encouraging trends we witnessed in Industrias Bachoco’s recent earnings report as well as its low valuation, improving profitability and bullish technicals, we believe this stock is a buy at present for the long-term investor. We look forward to continued coverage.

Be the first to comment