Investors seeking thrills do not have to go to Cedar Point or Six Flags once they reopen – there are plenty to be found in riding the rollercoaster stock market.

An all-time intraday high on the S&P 500 of 3,393 was reached on February 19th before tumbling to 2,237 on March 23rd, a decline of about 35% in just a month. The miraculous recovery has been nearly as violent, with a bounce of 28% so far to 2,874 in just another month.

It is remarkable that during these unprecedented times the total return on the S&P 500 this year is only -10% and the index is off an all-time high by a mere 15%. Who knows what indexes will do in the coming few months? As J.P. Morgan famously said when asked about the stock market, “It will fluctuate.” Stocks in the aggregate are not cheap by most traditional metrics and the economy will need an indeterminate time to heal, but that may not matter much in light of a $6 trillion Fed balance sheet.

Despite this setup, there are some individual equities that have not rallied as much off their lows and represent good value in conservatively run businesses. One good example of this is Investors Title Company (ITIC).

![]()

Investors Title’s current company logo. Source: Company.

Investors Title is a regional title insurer with roughly $140 million in premiums and a market capitalization of $215 million. For a period of time following the financial crisis the stock sold at a very cheap valuation, with a discount to book value of as much as 40%. Today it sells for a small premium to book value, so it would be a mistake to assume that valuations could not get cheaper from here or that forward returns will rival the returns coming off 2009 lows. Still, today’s valuation relative to both earnings and book value is quite reasonable and the company remains significantly overcapitalized. Meanwhile, the founding Fine family has managed the company extremely well and the likelihood is good that premium growth will continue to exceed that of the industry.

What is key in sizing up Investors Title currently is that while current economic conditions are likely to reduce the company’s earnings by half this year and next, it should not endanger its financial strength. Valuations on normalized earnings are ~9x earnings, in line with the largest players in the industry and attractive historically. But, what sets the company apart is its large overcapitalization, which will allow it to pursue growth opportunities, return substantial capital to shareholders, or both. Adjusting for the overcapitalization of the company, the stock is trading at roughly 5x earnings, suggesting an attractive opportunity within an industry that has shown good economics for many years.

Historical Premium Growth of ~9% Per Year

Investors Title was founded in 1972 in North Carolina and the company still writes more business in that state than any other, although South Carolina, Georgia, and Texas are now also important in the overall business mix. The company is licensed to do business in forty-four states but is only writing policies in twenty-three and approximately 80% of its premiums are written in the four states mentioned above.

The national title insurance market is concentrated in four companies that have a combined 85% share of the market: Fidelity National (FNF), First American (FAF), Old Republic (ORI), and Stewart Information Services (STC). The other 15% of the market is controlled by regional, independent players that include Investors Title, which writes about 1% of premiums nationally. Within the states that the company operates, its competitive position is somewhat better. Based on data from the companies’ filings and the NAIC, Investors Title controls 28% of the North Carolina market, 9% of South Carolina’s, 3% of Georgia’s, and a little more than 1% of the market in Texas. In all four states, Fidelity National is the market leader.

Policies are written through both company branches and independent agencies. Since the branches are concentrated in North Carolina, as the company’s business mix has shifted outside of that state, so has the mix of business written through independent agencies. Today, about 70% of business runs through agencies, although some of these agencies are partially owned by the company.

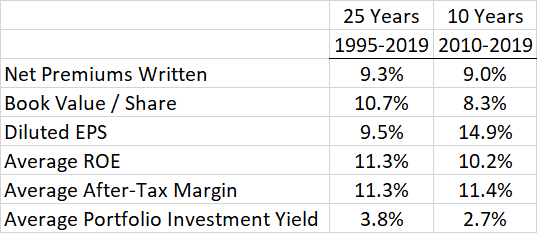

Reviewing the historical financials of Investors Title reveals a company that has been able to consistently show strong growth and good returns on capital over a meaningful period of time. For both the last ten and twenty-five-year periods premium growth has been 9% per year.

CAGR and averages of key financial metrics of Investors Title Corporation for the periods 1995-2019 and 2010-2019. Note: GAAP accounting required 2019 and 2018 results to include mark to market gains from the investment portfolio in net income, which is removed from these numbers for consistency and transparency. This adjustment is made for all figures presented in this article. Source: Author.

CAGR and averages of key financial metrics of Investors Title Corporation for the periods 1995-2019 and 2010-2019. Note: GAAP accounting required 2019 and 2018 results to include mark to market gains from the investment portfolio in net income, which is removed from these numbers for consistency and transparency. This adjustment is made for all figures presented in this article. Source: Author.

Return on equity has been consistently strong as well at 10%-11% per year. These results would have been stronger had the company not been so consistently overcapitalized (as discussed further below).

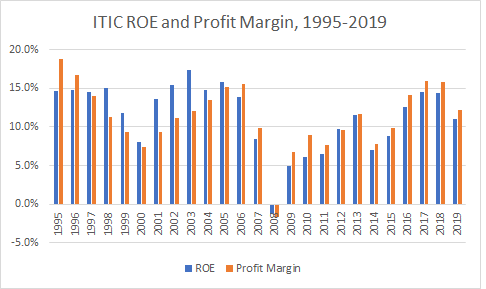

Investor Title return on equity and after-tax profit margin, 1995-2019. Source: Author.

Investor Title return on equity and after-tax profit margin, 1995-2019. Source: Author.

Outside of the period of and immediately after the financial crisis, returns and margins have been between 10% and 15%, closely following the economic cycle. It would obviously be quite attractive to shareholders if the company could continue expanding at a sustainable 9% rate and at double-digit returns on equity. So, the pertinent question is will they?

The company does not give a great amount of detail or explanation on its strategy. Nothing is known about its future plans and little is known about the rationale of past decisions.

The last period of substantial growth occurred because of entry into Texas in the third quarter of 2010. From a standing start, $31 million in premiums were being written by 2013. The reasons behind this expansion can only be speculated, but it is not hard to imagine why Texas was an attractive market to the company. For one, it is an enormous market, the largest in the country along with California. But, perhaps more importantly it is an extremely attractive market in particular to a company attempting to take share from more entrenched competition. Rates in the state are set by regulators, meaning it is impossible to compete on price in the state and these prices have been set very generously, with Texas in the top 10% of average rates in the country. (This situation has changed somewhat with the state lowering prices, including last year, since Investors Title entered the market.)

One advantage of being among the smallest players in an industry, and a geographically concentrated one, is that these opportunities exist for growth that might not exist for larger players.

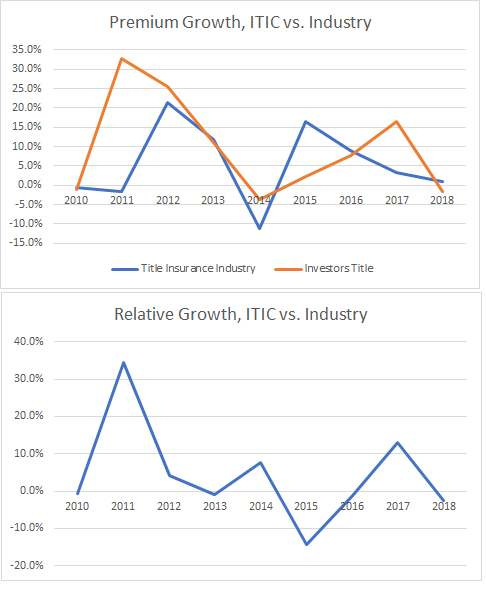

Premium growth of Investors Title versus the title insurance industry as a whole. Source: Compiled by the author from Investors Title financial filings and the NAIC.

The industry has grown at ~5% per year for the last decade. Most of the excess growth of the company has come about from its entry into Texas. That leaves two potential future scenarios to consider. If other opportunities similar to Texas do not present themselves (or if the company cannot find ways to grow distribution within their existing footprint), then it seems likely that an industry growth rate of 4%-5% per year can be expected, plus or minus depending on the strength of housing markets where the company competes versus the country at-large. But, the second scenario (and more likely one) is that opportunities will continue presenting itself and allowing the company to grow at around double the industry.

Extremely Overcapitalized Balance Sheet

One reason that opportunities have been exploited by the company in the past is that it has the balance sheet strength to go after them. Title insurance may have extremely low loss rates, but writing premiums still requires sufficient reserves and balance sheet strength. If recent events have taught anything, it is in the long run conservatism and excess liquidity can be a strength rather than a weakness. Even so, Investors Title is quite overcapitalized compared to competitors. How much?

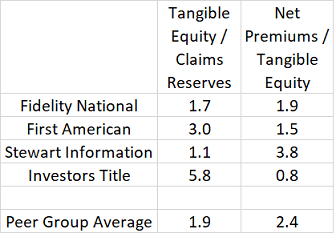

Tangible equity divided by claims reserves and net premiums divided by tangible equity for Investors Title and peers at year-end 2019. Source: Author.

Tangible equity divided by claims reserves and net premiums divided by tangible equity for Investors Title and peers at year-end 2019. Source: Author.

Investors Title held about $180 million in tangible equity on its balance sheet at the end of last year along with $31 million in reserves for claims while it wrote $146 million in net premiums. That means its writing less business than it has in capital and held capital equal to almost 6x its estimated future claims losses.

Three of the companies largest peers had comparable averages of 1.9x and 2.4x respectively. Whether you gauge capital levels on Investors Title’s premium levels or claim reserves you end up with roughly $100 million of excess capital. To be clear, I think the conservative nature of the company’s balance sheet has been a competitive advantage on balance and it may be that opportunities are presenting itself as a result of that excess capital. But, at close to half of the current market capitalization, that amount of capital does seem even more redundant than even the most conservative of operators would desire.

The company has started recognizing this and paid special dividends in the last three years of about $45 million. It has also been an acquirer of stock at times in the past, spending $28 million in the past decade, although it has not bought back shares since 2016.

The fact that the company was declaring special dividends when the share price was high and buying back shares when the share price was lower is an encouraging sign for future capital allocation. It would not be surprising if share repurchases had resumed over the past two months and more special dividends in the future are an option.

The thing that is important in considering Investors Title’s excess capital is that it will be put to use in some combination of supporting premium growth or is able to be returned to investors.

Coronavirus Impacts and Future Industry Conditions

How this turbulent time in the world, and the title industry, ultimately resolves itself is not knowable. The company’s 2020 letter to shareholders, published on April 13th, made the following statement:

As of this writing, much uncertainty exists around the impact of COVID-19, both on the overall economy and on our own business. In general, the high activity levels seen in 2019 continued uninterrupted through most of the first quarter of this year, as lower interest rates fueled an increase in demand for mortgage refinancing. By late March, however, mortgage applications began to trail off from volumes observed in previous weeks. Predictions about the impact of the virus on home sales are constantly evolving, but we expect the volume of transactions to be curtailed as long as quarantining measures are in place and the economic repercussions from business closures linger.

It sounds as though Q1 will turn out fairly well (the actual results should come out in May), but the depth and duration of the “trail off from volumes observed in previous weeks” is not precisely disclosed.

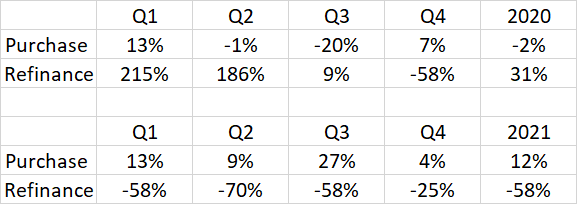

The Mortgage Bankers Association (MBA) expects refinance activity to remain extremely strong into Q2. Tightening lending standards by many mortgage issuers may limit how many borrowers are eligible to refinance, though. Somewhat surprisingly, the MBA sees new purchase activity at almost flat levels in the second quarter before diving 20% in Q3 and returning to growth in Q4.

Source: MBA

Source: MBA

Kroll is predicting a 13% decline in title insurance premiums for the full year 2020, since refinancing carries lower premiums for title insurance than new purchases.

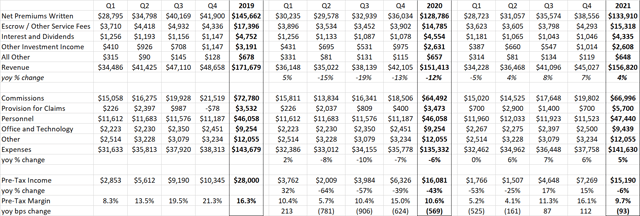

Investors Title actual 2019 results and forecasted 2020 and 2021 results. “Escrow / Other Service Fees” is non-premium title income as well as income from trust and tax-free exchange services. “Other Investment Income” is income from partial interests in title agencies. Results exclude realized and unrealized investment gains. All dollar amounts in thousands. Source: Author

Investors Title actual 2019 results and forecasted 2020 and 2021 results. “Escrow / Other Service Fees” is non-premium title income as well as income from trust and tax-free exchange services. “Other Investment Income” is income from partial interests in title agencies. Results exclude realized and unrealized investment gains. All dollar amounts in thousands. Source: Author

The above model shows a decent Q1, with revenues 5% higher from 2019 as well as higher income. However, double-digit declines in revenue are modeled to begin in Q2 and carry through to the end of the year. Investment income should gradually decline as lower interest rates more than offset the effect of rising investment balances. While commissions should follow premiums, provisions for claims are expected to be relatively flat in 2020 until they start to rise significantly in 2021 from potentially higher mortgage defaults. Other operating expenses are held flat for 2020 and projected to be up 2%-3% in 2021.

The sum of all of those assumptions produces a consistent $15 million – $16 million in pre-tax income over 2020 and 2021, compared to $28 million in 2019. The hit to income is likely to be large over the next couple of years, but the company should hold up better than companies in many other industries and never endure a period of liquidity or solvency pressures.

The shape of things to come after 2021 is difficult to lay out with any kind of precision. Housing prices today are historically quite high relative to incomes. At the end of last year the ratio was 4.4x versus a longer-term average of about 3.5x (and a peak ratio in December 2005 of 5.1x). Those high housing prices are supported by low interest rates, which make monthly mortgage payments more affordable. In that sense, the current housing market is a similar story as the stock market, with valuations that historically make no sense, yet somewhat do when once interest rates are considered.

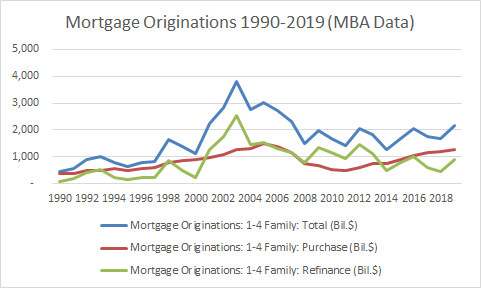

Mortgage origination volume, 1990-2019. Source: MBA

Mortgage origination volume, 1990-2019. Source: MBA

It helps that recent mortgage originations are not at anything like extreme highs. Total mortgage originations peaked in 2003 as interest rates fell to multi-year lows and housing prices had been surging for several years. Purchase originations (somewhat more important to title insurers) peaked in 2005 at $1.5 trillion, while in 2019 they were still less than $1.3 trillion.

All of this would tend to lend some credibility to the notion that profits in recent years were not achieved due to historically unreasonable levels of mortgage activity.

Valuation

Book value per share is the simplest way to gauge Investors Title’s attractiveness. Using year-end book value figures and a recent price of $112 per share gives a ratio of 1.10x against an average ratio of about 1.25x going all the back to 1995. How much has book value eroded since the end of last year? Not by all that much.

The company’s $105 million bond portfolio has a 70% weighting to municipal bonds, a 24% weighting to government bonds, and a small 6% weighting to corporates. The bonds also have a relatively short duration, with more than 60% maturing in between one and five years. We do not know the specifics of what is in the portfolio, but if the bonds behaved anything like the averages for municipal, government, and corporate debt it seems likely that the company earned a ~$1 million capital gain year-to-date from fixed income. (There could be some risk here in the specific revenue bonds that the company owns since it is not known what specific projects are backed by those bonds.)

The equity portfolio was $61 million at year-end. If it has behaved like the S&P 500 and the company did not move money out of stocks so far this year, then equities have likely produced a paper loss of $6.7 million.

Netting those two numbers against expected pre-tax income of $3.8 million in Q1 implies a comprehensive pre-tax loss of $1.9 million, which after taxes should amount to $1.5 million. If you want to adjust the book value for year-to-date activity, you end up with a price to book ratio of 1.12x, not that much different from using year-end figures.

That valuation suggests that if the company did nothing to even partially remedy its overcapitalization and stagnated at profitability levels that existed in the years immediately following the financial crisis, it would be a mediocre investment today. But, if capital continues to be put to work – either by returning it to shareholders through repurchases or more special dividends or through the expansion of the title business – and profitability does not permanently retrace levels seen during periods of low mortgage originations, the investment case becomes rather compelling.

Over the last three years average net income has been about $20 million if all income related to investments is excluded. Cash and securities were $205 million at years-end against a market capitalization of $215 million. If $100 million of the cash and securities was treated as excess and the remaining $105 million were left to earn 2% per year (investment yield last year was 2.5%), then net income would amount to $22 million per year excluding any future capital gains against an adjusted enterprise value of $115 million. That adjusted price to earnings ratio is only 5.2x and removing $100 million of capital would still leave tangible equity more than 2 1/2 times reserves for claims.

A more reasonable exercise might involve treating only half of the excess capital as being excess and the remainder being held as part of the conservative culture of the company. The same math as above comes to an adjusted multiple of 7.2x and would still leave the company with an abundance of capital to pursue growth opportunities.

The leading players in the industry, Fidelity and First American, trade at about 9x earnings for reference. Without treating any of Investors Title’s capital as excess and instead assuming that its entire investment portfolio earns a small amount of investment income would also imply about 9x normalized earnings. At today’s prices, an investment in any of the three above companies seems relatively attractive with the big assumption that industry profitability is only temporarily impacted by macro concerns. But, Investors Title’s balance sheet makes it the superior play at the moment.

The company is not as cheap today as it was a decade ago coming out of the financial crisis, an economic calamity centered on the housing industry. There was a period of time then when shares could be purchased for a 40% discount to book value. Forward returns will not be so good from here, but neither will the forward returns from most other assets. Having come down from nearly twice its book value a few years ago, Investors Title looks poised at today’s valuation to once again provide market-beating returns.

Disclosure: I am/we are long ITIC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment