Vertigo3d

Investors Title Company (NASDAQ:ITIC) is a Chapel Hill, North Carolina based company that has primarily issued title insurance policies since the middle of the 1970s. The company is relatively small when compared to peers with national scale. Over the last year it has recorded $278 million in premiums, compared with industry leader Fidelity National (FNF), whose premiums totaled about $8.5 billion.

Investors Title was started by J. Allen Fine in anticipation of an increased need for title insurance from increased sales of mortgages on secondary markets. The Fine family continues to manage the company, and has done so quite well over time, regularly earning double digit returns on equity and growing premiums at a rate of about 9% per year. The family’s ownership stands at 24% today and Mr. Fine’s two sons currently occupy the roles of Chief Operating Officer and Chief Financial Officer.

I last wrote about Investors Title soon after the pandemic began in April 2020. Expecting potential upheaval in the real estate market, I suggested that premiums could decline by 12% in 2020 and only modestly improve in 2021. Despite that, shares looked cheap at a price to book ratio of ~1.1x and significant excess capital. Performance since that time has been strong and it would be an understatement to say that market conditions exceeded my expectations. Throughout the past two years, the company has paid a significant amount of its excess cash flow back to investors in the form of special dividends. However, book value per share has also grown since the end of 2019 by 21% and shares are once again trading at a not too dissimilar price to book value as they did in April 2020 of 1.14x. Given potential expansion opportunities and the current valuation, investors may want to consider accumulating shares despite today’s negative market conditions.

Investors Title Company’s Appeal Within the Title Industry

Three primary reasons exist for the appeal of Investors Title shares when the valuation becomes attractive. The management of the Fine family has always been exceptional, the ownership of the Fine family minimizes agency costs, and the size and scope of the company’s operations mean that they are playing a very different game than the industry giants. None of those factors seem likely to change anytime soon.

The company primarily operates in only four states, which represent about 80% of total premiums: North Carolina, South Carolina, Georgia, and Texas. As opposed to the national, publicly traded peers that compete with Investors Title, the company can pick and choose where it wants to grow based upon the economics of potential expansion. Currently, Texas appears to be an opportunistic priority. About $5 million has been spent so far to buy agencies in Texas and payroll and other back-end costs have also increased by an above average amount to expand within Texas. Results so far appear to be bearing fruit as Texas premiums so far this year have increased by 83% compared to a 15% decline in non-Texas premiums. The company discloses little about its plans for future expansion, but the last major housing downturn was also the last time that a significant market expansion occurred, with the initial entry into the Texas market in 2010. It would not be unreasonable to think that the company will continue to be opportunistic and counter-cyclical in its approach.

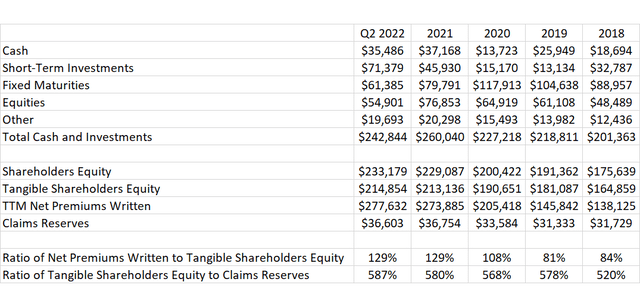

An enormously strong balance sheet allows for the pursuit of these opportunities. The company has consistently been overcapitalized throughout its history. The investment portfolio at the end of June totaled $243 million, with 44% of the figure invested in cash or short-term investments.

Investors Title selected financial information, 2018 to present. (Author based on financial filings)

How much of those investment funds are excess? The company has retained tangible equity nearly six times the amount of estimated claims reserves on the balance sheet. Many other publicly traded title insurers also own non-title related businesses, but it does not seem aggressive to assume that tangible equity could comfortably be at only twice what the level of claims reserves are, which would imply as much as $140 million of the investment portfolio is excess. If the company wanted to become even more aggressive, the balance sheet could even be further levered up.

This amount of excess capital has been put to excellent use over time and the current expansion in Texas may only be the beginning of expansion in the current cycle.

Industry Conditions

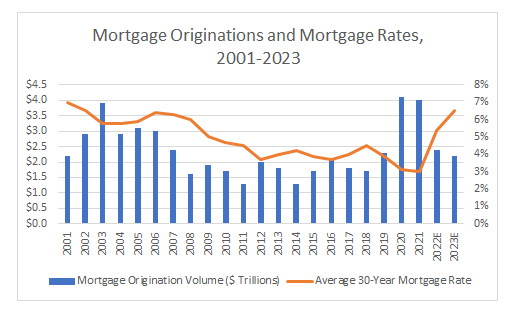

If the real estate market was what could be called an “average” market at the moment, Investors Title shares would be a steal. But, mortgage rates moving from below 3% to above 7% in a single year has taken its toll on both the residential and commercial real estate markets.

It currently appears as if full-year mortgage originations are likely to come in at about $2.4 trillion this year compared to $4.0 trillion in 2021. Freddie Mac is estimating that 2023 originations could decline again to $2.2 trillion.

Mortgage originations and mortgage rates, 2001 to 2023 (FRED, MBA, and Freddie Mac)

While we cannot predict precisely just how strained mortgage originations will become, volume at levels similar to before the pandemic would not be a tragedy. Keep in mind that the dollar amounts of mortgage originations being projected consider a much sharper drop in unit originations at higher prices than prevailed prior to the pandemic – should prices steeply decline as they did after the financial crisis, then origination volumes could look starkly different in coming years.

On the positive side, it also appears that forward projections also assume that repurchase volume will stay historically low. Given that there is a realistic scenario where mortgage rates do moderate to something in the 5% to 6% in the next couple of years, an argument could be made that some pent up refinancing demand could take place.

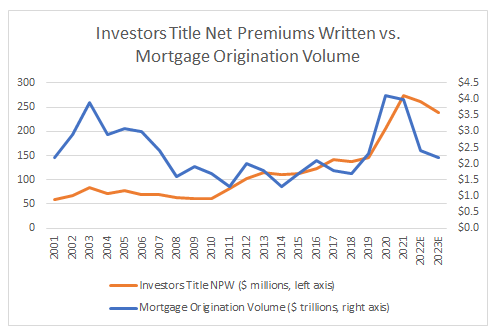

Investors Title is in the enviable position of taking market share on a pretty consistent basis. Premiums have averaged growth of about 9% per year going back to the turn of the century.

Investors Title net premiums written versus mortgage origination volume (Investors Title financial filings, MBA, and FRED)

Between the mortgage originations peak in 2003 and 2010, premiums written did decline by a significant 27% compared to a decline in mortgage originations of 51%. Starting in 2010, the company’s entry into Texas provided growth that dwarfed external market influences. A large reason why premiums this year have fallen less than the mortgage market has fallen industry-wide has been because so much of the fall has been refinancing, which typically come in with lower premiums than purchases. It still remains safe to presume that given the expansion happening in Texas that premium volume will fall at a much lower rate than the market. My current projections calls for about a 4% full-year decline this year (YTD they have increased by 3%) and another 9% decline in 2023.

Valuation

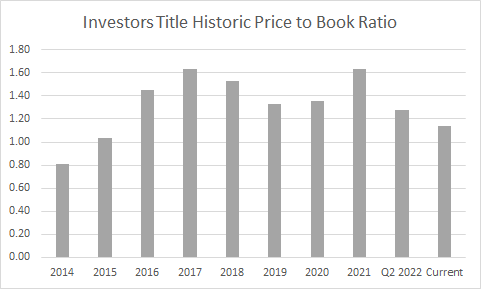

How do we value Investors Title? The easiest and simplest way is to use a price to book ratio. For a fairly long stretch after the financial crisis, the company traded at a discount to book value, but since the middle part of the last decade has consistently traded at a premium. Over the last five years, the average ratio has tended towards about 1.5x.

Investors Title historical price to book ratio (Author’s calculation)

A fair value at 1.5x book value, would imply a price of $184 today. Adjusting for expected market declines in the fixed income and equities portfolio would imply a price closer to $170.

This is a fair way to value the company, and I believe it lines up closely with a better mental model given its overcapitalization. Depending on your margin assumptions, it does not seem unreasonable to think that net income not attributable to investment income could be about $25 million per year normalized (that compares to $20 million pre-pandemic). Assuming an extremely conservative multiple of 8x given market conditions presently, I think the underwriting and other profits of the title business are worth $200 million. If $140 million of capital truly is excess, then fair value would be $340 million, or $179 per share.

Looking Forward

Investors Title is the case of a wonderful company with excellent management trading very reasonably, but with huge market headwinds in front of it. I will be most interested in understanding more about expansion possibilities with coming earnings reports and seeing how the company can capitalize on a potential downturn. A fair value of $170-$180 today is not at all aggressive in my opinion, and provides a reasonable margin of safety.

Having laid out the argument for shares, I would be remiss if I did not also mention again that shares did trade below book value for an extended period of time following the financial crisis. The most sensible course for investors today is likely to dollar cost average into the name over a period of several months or more to protect against potential volatility. If monetary policy continues to be more aggressive than currently forecast, it could result in an extreme bargain.

Be the first to comment