Gary Ennis/iStock via Getty Images

If nothing else, September was a reminder of the perennial challenges of being a long-term investor: portfolio setbacks (the third-worst month for U.S. stocks of the past two years), unexpected distractions (a surprise inflation uptick), and uncertainty about the future (renewed recession debate).

The prescription for overcoming such obstacles is a simple one, though: “Invest through it.”

The Federal Reserve did what most people expected last month by raising interest rates another 0.75%, but that didn’t prevent grumblings on the Street about the Fed being “late to the game”—that is, trying to make up for not raising interest rates sooner by raising them too aggressively, too late. That, critics claim, only increases the odds of sending the economy into a recession.

For investors, it may be an academic point, since even if the Fed was late to the game, they have little choice but to play it out. Last month the central bank again made clear that it doesn’t plan to stop raising rates until early next year, and that it has no intention of pivoting to rate cuts any time soon after that.1

As unwelcome as the stock market’s retreat to new year-to-date lows last month may have been, the job of the long-term investor is to remember that such setbacks are inevitable, and to remain on course when things look most discouraging.

U.S. equities

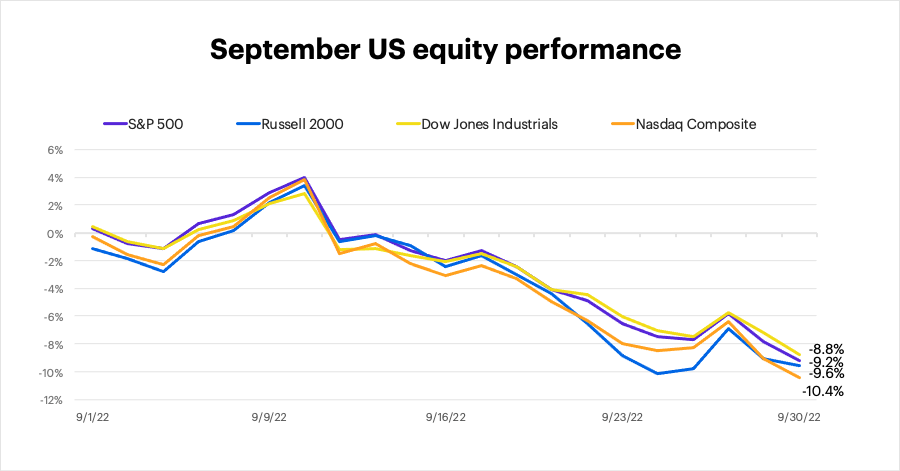

All the major U.S. indexes lost ground in September. The S&P 500 fell 9.2%, while the tech-heavy Nasdaq Composite and small-cap Russell 2000 posted slightly steeper losses:

FactSet Research Systems

FactSet Research Systems

Sectors

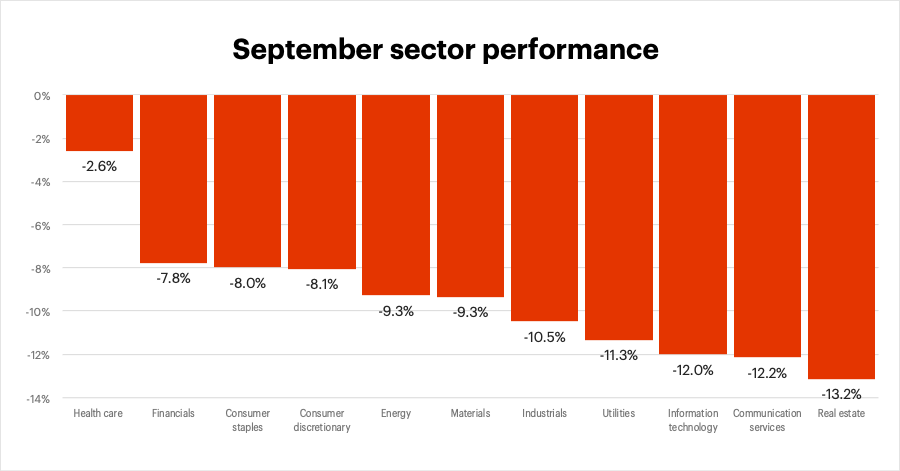

All S&P 500 sectors were negative for the month, but health care held up best to the selling pressure. Five sectors fell more than 10%—including real estate, which lost more than twice as much as it did in August:

FactSet Research Systems

FactSet Research Systems

International equities

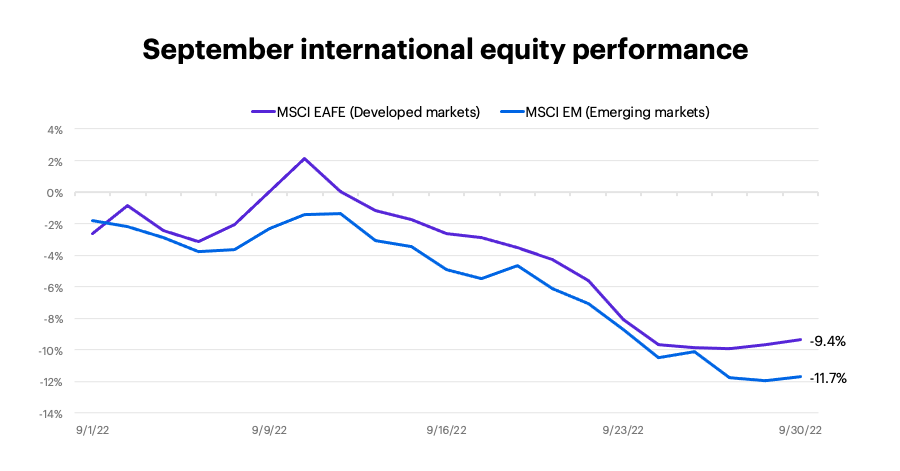

Overall, global markets underperformed the U.S. in September, with developed markets slightly stronger than emerging markets, and Asian equities particularly weak within the emerging space. The MSCI Emerging Markets Index fell 11.7% while the MSCI EAFE Index of developed markets fell 9.4%:

FactSet Research Systems

FactSet Research Systems

Fixed income

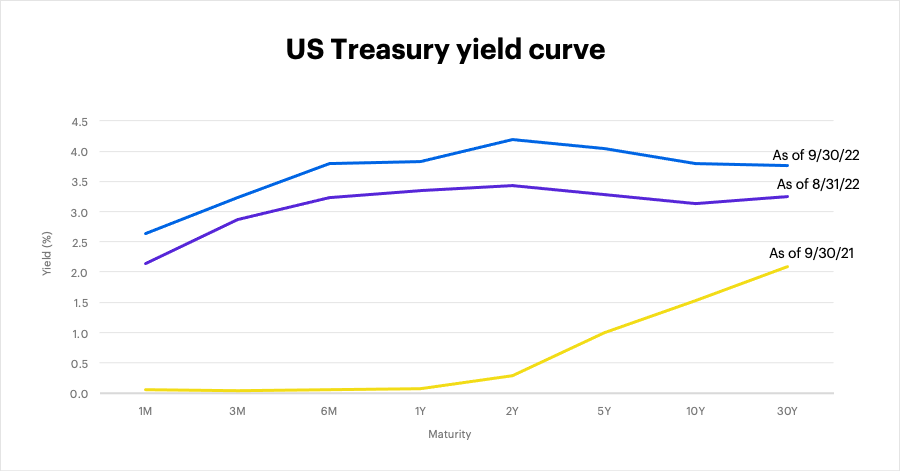

Little changed in the fixed-income market last month: interest rates jumped—sharply—and much of the yield curve remained inverted (shorter-term rates were mostly higher than longer-term rates), signaling potentially decreased confidence in the longer-term economic picture. The benchmark 10-year T-note yield closed September at 3.8%, up from 3.13% at the end of August, but still below the 1-year, 2-year, and 5-year yields. The 2-year yield jumped 0.76 percentage points to 4.2% in September—its highest level since 2007, and its second-biggest monthly increase of the past 20 years:

FactSet Research Systems

FactSet Research Systems

Looking ahead

Here are a few thoughts as we head into the final quarter of the year:

- Recession still a distraction. Four months ago, we noted that 1) it was uncertain whether a recession would occur, and 2) recessions are a normal part of the economic cycle. Both points are as valid now as they were then. If a recession occurs, it will have real economic consequences, but it won’t be a reason to rethink a long-term, diversified investing approach.

- Quality stocks. Investors may want to consider repositioning to higher-quality stocks—those with proven cash flow, and/or an established track record of raising dividends in good times and bad.

- Dollar strength pros and cons. The Fed’s aggressive rate-hike campaign has caused the U.S. dollar to surge, attracting international investors seeking positive yield (and a possible safe-haven). While a strong dollar has its benefits—it can take some of the sting out of inflation by making imports cheaper—it can also dampen economic growth because it makes U.S. exports more expensive. One way to offset some of this potential risk would be to include some international equities in a portfolio.

Challenging times like these can test investor resolve to stay the course, but those that do are in a better position to reap the benefits that a diversified, balanced portfolio has historically proven it can deliver over the long haul.

Be the first to comment