Pgiam/iStock via Getty Images

Invesco Mortgage Capital Inc. (NYSE:IVR), which used to trade within the range of $150 to $180 prior to the covid-19 pandemic, witnessed a steep fall during the pandemic and recently went through a 1:10 share split. Post-pandemic, the stock recovered significantly but again recorded a huge fall. The stock has fallen by over 51 percent in this year and is currently trading around $14. However, this mortgage-based real estate investment trust (mREIT) generates an exceptionally high yield, which itself is more than adequate for any investor to accumulate this stock. The bigger question remains, is that yield sustainable?

Invesco Mortgage Capital: Portfolio and Dividend

The asset manager for the company is Invesco Advisers, a subsidiary of Invesco. The Georgia-based mREIT has a Debt-to-equity (D/E) ratio of 5.2 and held $664.7 million of unrestricted cash and unencumbered investments at the end of Q1, 2022. Invesco Mortgage Capital has generated a high dividend yield. Its trailing-twelve-month (TTM) yield is almost 25 percent, and the company generated a four-year average yield of almost 192 percent. Over the past 10 years, the annual average yield has mostly been in excess of 100 percent.

Invesco Mortgage Capital primarily focuses on investing, financing, and managing residential mortgage-backed securities (RMBS), commercial mortgage-backed securities (CMBS) and residential and commercial mortgage loans. RMBS consists of both Agency RMBS for which a U.S. government agency or a federally chartered corporation guarantees payment of principal and interest, as well as Non-Agency RMBS, those are not issued or guaranteed by an agency. Agency RMBS consists of almost 92 percent of IVR’s investment allocation, and 87 percent of equity allocation.

Invesco Mortgage Capital aims to reduce the proportion of agency RMBS in its investment portfolio. In Q1, 2022, IVR was able to decrease agency RMBS by 20 percent. This was achieved through reducing investments of $1.5 billion of 30-year specified pool sales and $0.2 billion of paydowns. Compared to March 31, 2021, agency RMBS investments were reduced by approximately 38 percent. The company also increased its exposure towards higher coupon generating securities, replacing the lower coupon ones. As a result of this, the earnings available for distribution are enough to cover the dividend distribution.

Analysts’ estimates suggest that there may be a possible dividend cut in 2023. The management may decide to cut the pay-out because of a likely marginal decline of interest income by $0.005. In the most likely scenario, the available earnings will probably be able to sustain a high yield, if not the historically high yield. The widening interest rate spreads, attractive funding via repo and dollar roll markets, and moderating prepayment speeds (as mortgage rates rise) will be able to generate a steady earnings for Invesco Mortgage Capital. I don’t find strong enough reason to arrive at a conclusion that this mREIT will fail to generate a double-digit yield.

Impact of Rising Interest Rates

The United States is witnessing its worst-ever inflation in the past 40 years, and the Fed has planned a series of interest rate hikes in order to control the inflation. The Federal Reserve (Fed) raised interest rates by 50 basis points during May 2022. As has been reported by Reuters on June 29, 2022:

“Federal Reserve policymakers on Tuesday promised further rapid interest-rate hikes to bring down high inflation, but pushed back against growing fears among investors and economists that sharply higher borrowing costs will trigger a steep downturn.”

The U.S. central bank may hike interest rates by almost 3 percent this year. Higher interest rates will increase the cost of mortgage loans. This will most likely curb the demand for mortgaged properties, and will ultimately impact the revenue and earnings of the mortgage REITs like Invesco Mortgage Capital. Higher interest rates will not only reduce the volume of new mortgage loans but also may reduce the interest spread, as IVR will try to reduce the burden of its customers in order to grow for the time being.

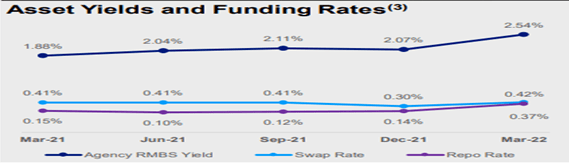

However, there is a positive factor too. The mortgage market may be benefited through the money that’ll be pumped into the financial system due to the hike in interest rates. The net interest spread had consistently been in excess of 2 percent. In case of an interest rate hike, this spread will only get better. A series of interest rate hikes totaling around 2 to 3 percent, thus will be immensely beneficial for Invesco Mortgage Capital.

IVR Yield (Company Presentation)

Investment Thesis

Investors generally judge a mREIT by two factors – dividend yield and book value. Price/Book Value (P/BV) is extremely low at 0.67, while the P/BV of its benchmark index stood quite high at 3.6. In comparison to its peers, the stock seems to be undervalued. However, P/BV has consistently been below 1x for this mREIT. Moreover, there is a huge decline in the enterprise value (EV) from that of pre-pandemic level. From an EV of $4.6 billion in 2019, it has come down to $0.9 billion at present. This surely doesn’t speak well for Invesco Mortgage Capital.

However, on the dividend front, Invesco Mortgage Capital generates enthusiasm. As discussed earlier, dividend yield has historically been exceptionally high and supported by its earnings. A pay-out ratio of 85 percent is also sustainable. Historically the total return has been in the range of 15 to 20 percent despite huge price loss. The stock has some downside potential, but that probably will be compensated through the high yield this stock will be able to generate. Under such a scenario, it won’t be a bad decision to accumulate this stock, since I feel at least a double-digit yield is sustainable.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Be the first to comment