Uwe Krejci

iShares MSCI Germany ETF (NYSEARCA:EWG) is an exchange-traded fund that provides investors with direct exposure to German equities. The fund has performed very poorly in recent times, unfortunately, due to political uncertainty that is proximate to Germany. That is, most importantly in relation to the escalation of the Russo-Ukrainian War this year, which has exacerbated regional tensions as well as leading to sky-high energy price increases as a knock-on effect. Natural gas for example makes up almost 30% of Germany’s overall energy mix; before the recent war escalations, just over half of gas consumed in Germany was imported from Russia.

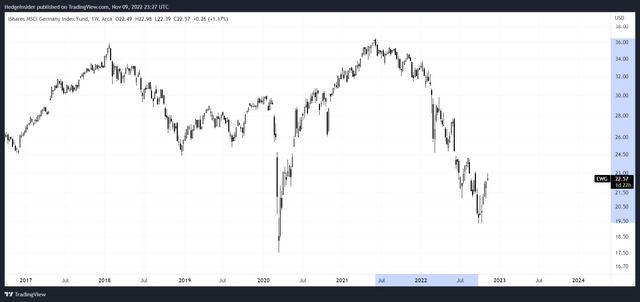

I have to admit, I have been consistently wrong in my view on EWG. I have been bullish since before 2022 even began, on the basis of under-valuation. Unfortunately with war and energy prices/headline inflation readings spiking, equity risk premiums have expanded further just as forward earnings have faced these headwinds. A combination of falling returns on equity coupled with higher risk premiums, not to mention higher risk-free rates (as bond yields have risen on the back of both political risk and higher inflation), EWG has been put under immense pressure. The chart below shows the recent peak-to-trough, of about -47% on a price-only basis.

TradingView.com

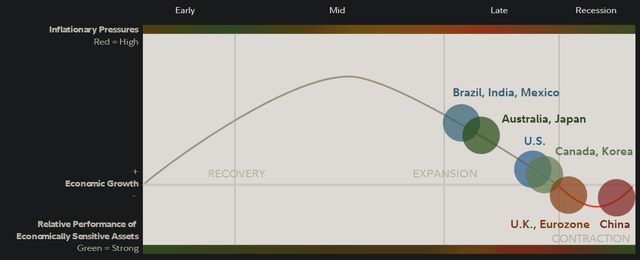

Equity markets have broadly fallen this year across the world, as have bond prices. It has been one of the most difficult years in a long time for investing. Cash has been one of the best bets. This is however not entirely surprising given that the world is currently heading into a recessionary period (at least, if you include most major countries including the U.S. and countries across the eurozone, which includes Germany). The chart below from Fidelity as of Q4 2022 shows current global business cycle positioning.

Fidelity.com

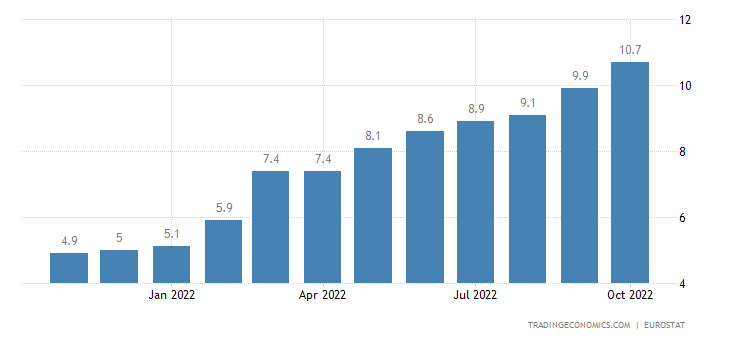

Recent inflation readings driven mostly by food and energy, but which have started to feed through into core inflation readings, have sent bond yields higher. Part of my thesis on the relative attractiveness of German equities was that given yields were so low regionally, the total implied cost of equity seemed very attractive; the ECB’S deposit facility rate was negative even in June (-0.50%) but has since spiked to 1.50% (October 2022). The ECB are probably behind in getting on top of local inflation; the chart below shows headline year-over-year inflation for the euro area.

TradingEconomics.com

With 10.7% year-over-year inflation, the ECB needs to raise rates fast. If we look at the German 30-year yield, it is currently yielding 2.098% at the time of writing. Allowing for the possibility of some term premia, and long-term inflation expectations of maybe 1-2% in a stable environment, the implication is that the natural rate of interest (or “r-star”) might be something between 0-1% for Germany and the euro area. However, while the ECB’s rate has risen substantially from 1.5%, euro area core inflation was 5% in October 2022. So, the real (inflation-adjusted) short-term rate is actually -3.5% (negative), which is in fact very loose monetary policy (regardless of any quantitative tightening exercises).

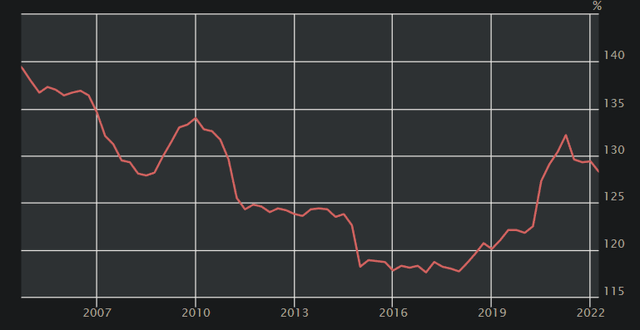

So, unless core inflation readings begin to plunge, the ECB needs to raise rates to find the difference. We should expect further rate hikes by necessity. The “difference” in this case is between about +1% and the current negative real rate of -3.5%, or 4.5%. Ideally, inflation will start to subside. This is possible given that German total credit to the private non-financial sector (scaled by GDP) has been contracting recently, per data from the Bank for International Settlements.

bis.org

This reflects a negative credit impulse, which is a leading factor. The current material drop into 2022 Q1 should begin to feed into lower nominal growth and inflation readings very soon. The regional fiscal impulse will also have contracted given the very high stimulus generated through COVID-19.

EWG does however still have to contend with the current facts, which are certainly not supportive, especially as the region heads into a recession. The fund nevertheless still has $1.21 billion in assets under management.

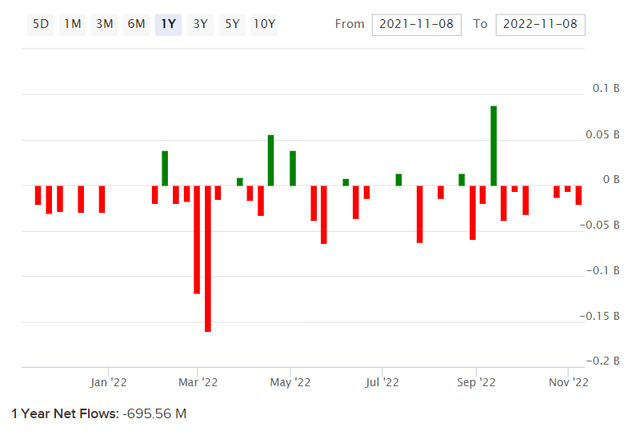

ETFDB.com

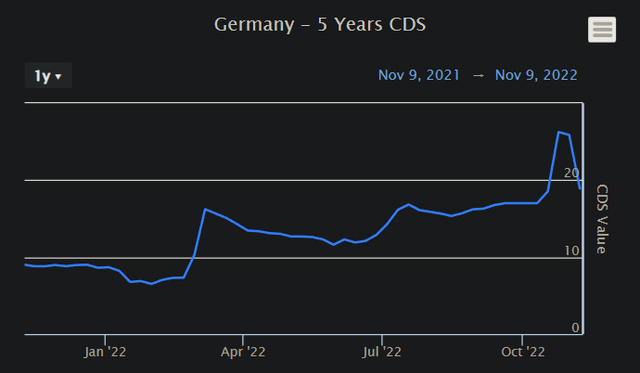

This does however follow negative outflows of about $696 million over the past year, which reflects a significant drop in investor confidence. At the start of the year, Professor Damodaran argued that German equities did not require a country risk premium given that the country is a developed market with no idiosyncratically risky characteristics. However, certain measures such as five-year CDS (protection on German bonds) have worsened since then.

worldgovernmentbonds.com

This is only one directional measure, but it reflects the increase in perceived risk among investors. Therefore, while I would assign a base equity risk premium of between 4.2-5.5% for mature markets like Germany, in this case I would start at 5.5%. Meanwhile, the fund’s historical beta has been about 1.27x on a five-year basis, so EWG could in theory require an equity risk premium of up to 7% (i.e., 5.5% scaled by 1.27x). The current 10-year yield in Germany is 2.18%, which is a risk-free rate proxy that I am happy to add to the 7% ERP, taking our cost of equity to an approximate 9.2%.

In terms of a forward earnings multiple, you could then argue that long-term nominal inflation might be up 0-2% once all is settled, and so assuming zero real earnings growth at that stage, a mature forward earnings multiple for German equities might be about 13.90x. The current multiple according to Morningstar is 9.23x (forward earnings). EWG seeks to track its benchmark index, the MSCI Germany Index. The most recent factsheet for this index reflects a forward price/earnings ratio of 9.85x as of October 31, 2022. The price/book ratio of 1.24x implied a forward return on equity of 12.59%, which is fair for a small, concentrated portfolio of mature businesses in a developed market.

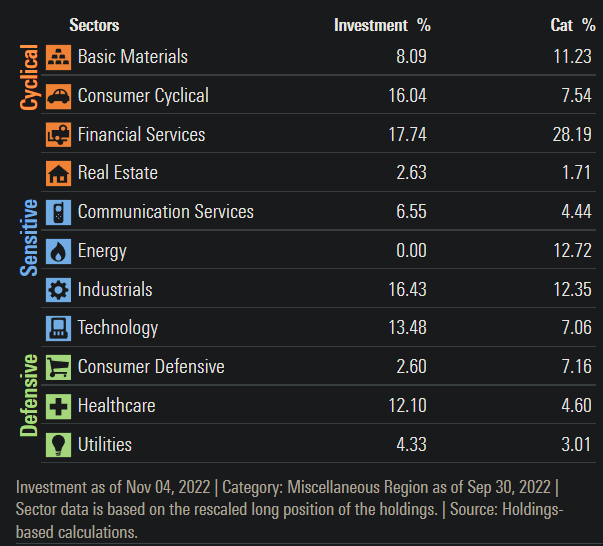

Therefore, on valuation alone, long term I can imagine EWG growing by up to 50% from present prices. However, this presumes a return to normality, which may be a while off given Russia’s protracted war in Ukraine that will likely continue to put pressure on the German economy given their exposure to Russian energy imports and volatile energy prices in the medium term. Nevertheless, the forward earnings yield of circa 10% and the underlying return on equity of about 12.5% means that forward returns in EWG should be relatively good. The portfolio itself is not particularly concentrated in any mix of sectors, with a balance across cyclical, economically sensitive, and defensive sectors.

Morningstar.com

I don’t see any particular cyclical bias. And on an earnings power basis, EWG is still undervalued. However, political risk remains high, and uncertainty remains. Meanwhile, Purchasing Power Parity models do not even suggest that euro (in spite of its recent falls) is particularly over- or under-valued. It is probably trading at close to fair value. So, while there might not be any material upside potential, downside potential still exists if the euro were to be repriced even lower based on political risk. The fact that the euro no longer carries a negative interest rate is constructive, but political risk always beats monetary policy in the end.

I am finally going to take a neutral stance on Germany going forward, as I am not able to predict what happens next with respect to Russia, which I think is probably crucial. However, I would maintain the view that even in spite of everything that is happening and has happened, EWG is most likely undervalued. That is, taking a long-term optimistic view on geopolitics, and believing in the potential for a negative credit impulse to help quell core inflation measures (in the 0-6 months).

Be the first to comment