Gumpanat

You wouldn’t expect a company that controls 80% of its market, which is expected to grow at a 10% CAGR for the next decade, to be down 35% YTD, yet Intuitive Surgical (NASDAQ:ISRG) finds itself in this exact position. An abysmal quarter further amplified that major negative catalysts are beginning to take hold, forecasting more pain ahead.

Competitive Edge

Many know Intuitive as a surgical robotics company, we know it as an integrated ecosystem of health services.

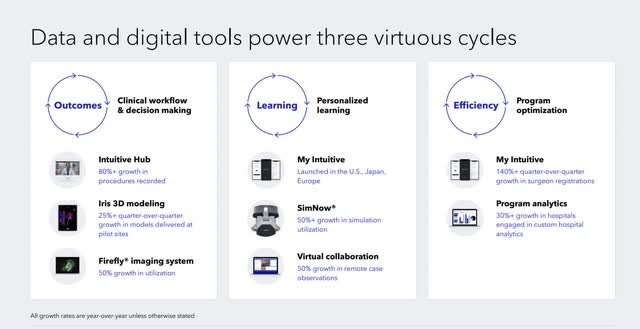

Despite having a 20-year technological head start, the company wanted to prepare for competitors to eat away at market share. And so, management took a page out of Apple’s (AAPL) playbook to combat the issue: create other services to trap customers.

J.P. Morgan Healthcare Conference

Its education and data analytics apps have shown strong growth, helping hospitals become increasingly efficient at surgeries. These tools make it easier and cheaper to purchase more da Vinci systems or their new Ion platform, a great selling point for that product.

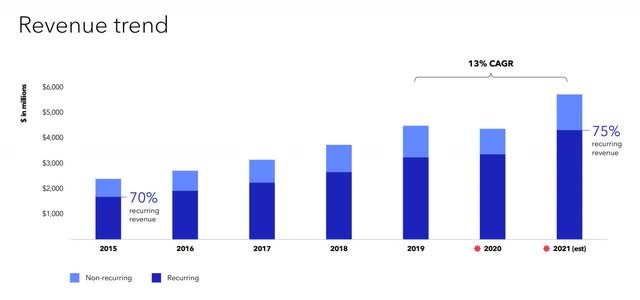

Added features combined with regular maintenance costs have made Intuitive a recurring revenue powerhouse, accounting for 75% of revenues.

J.P. Morgan Healthcare Conference

Intuitive’s sticky business model makes Johnson & Johnson’s (JNJ) Ottova robot or Medtronic’s (MDT) Hugo system irrelevant to them as existing consumers will likely continue to spend on their products because switching costs are too high.

Both competitors also announced that pricing will be comparable to the da Vinci machines, meaning management can use their pricing power and reputation to win over surgeons.

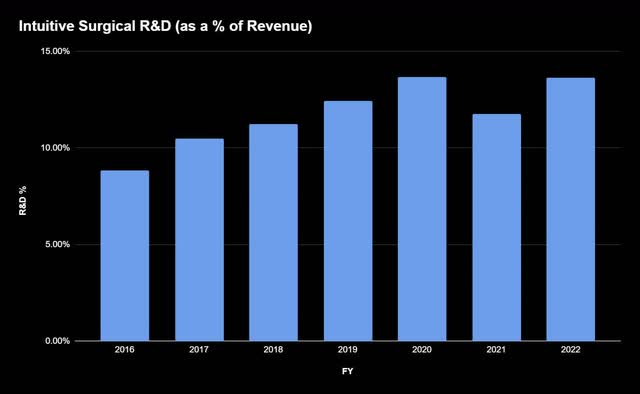

Having customer loyalty dramatically reduces the need for marketing expenditures, and with no debt on the balance sheet, gives Intuitive the flexibility to plow cash into R&D.

In 2022, R&D as a % of Revenue is projected to reach an all-time high, a bullish sign as we know increased investments will translate to new revenue streams, helping the company distance itself from other players.

But if their moat is this wide then it begs the question, what headwinds caused a dreary Q2 and a bleak outlook? For this, we must turn to Intuitive’s only consumer: hospitals.

Negative Catalysts

Although the healthcare sector is often branded as recession-proof, healthcare equipment companies face downturns due to the poorly run privatized hospital industry.

To better understand the problem, we need to examine the 2010s carefully. Medical innovation was at its peak with biotechs on the rise and Intuitive’s new da Vinci Xi machine released in 2014, leading patients to want the highest standard of care via new-age, expensive treatments. To meet demand, hospitals big and small began taking on long-term debt to afford medicines and surgeries, an action encouraged by record-low interest rates ripe for abuse.

Just look at Connecticut’s hospital system. In FY 2011, medical facilities in Danbury, Hartford, Norwalk, and more were tripling debt into the billions only 3 years removed from the worst financial crisis in history. This robust appetite for debt only expanded through the decade, becoming the primary driver of growth. However, in today’s macroeconomic backdrop, the financial leverage hospitals have been accumulating is finally being exposed.

Rate hikes have led to a drastic slowdown in borrowing, and the massive amounts of debt on the balance sheet means more cash must flow towards paying things down. Whatever money is not being used to become more financially stable, is going towards inflated expenditures. Over the past year, medical supplies have increased by 20.6% along with drug expenses going up 36.9% leading 1/3 of hospitals to have negative margins.

These ugly margins combined with massive amounts of debt leave minimal room for CapEx, including Intuitive’s robotic machines. Hospitals aren’t going to shell out $1.5M on a da Vinci system or $600K on an Ion platform and then spend $200k in annual maintenance and technology fees. We are seeing this problem unfold right in front of our eyes.

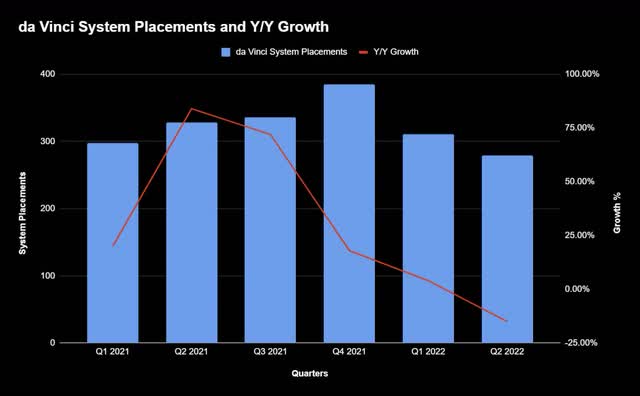

Author, Intuitive Surgical Investor Relations

In the past quarter, the company posted a rare negative growth rate on systems placed, proving that 2021 was a fluke. Last year’s high growth rate reflected a bounce back from COVID-19 disruptions and easy 2020 comps, masking the impact of a worsening economic situation.

Stretched Valuation

With impending headwinds on growth, bullish sentiment should take a backseat as the stock continues to undergo a necessary correction to better represent its current situation.

The market expects an earnings growth rate of 46.8% (FWD PEG of 4.68) when its actual earnings growth is no more than 10%, nearly 5x less. Overvaluation can also be seen in its forward P/S ratio of 13 which, excluding the past 2 years of ridiculously high metrics, is well above historical averages. Free cash flow is projected to be half of last year with a record low FCF yield of 1%, a distressing sign of a significant sales and profit slowdown.

Conclusion

As investors bottom feed for growth names, Intuitive proves as an excellent case study that some, even high-quality ones, are not done with their sell-off. However, strong company internals means it will be one to watch when the recession blows over in 6-8 quarters.

Be the first to comment