JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

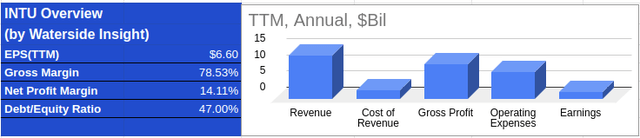

Intuit Inc. (NASDAQ:INTU) has a solid and stable financial performance track record. However, its near-term prospect is weakened by higher leverage and lower marginal growth for 2023. We analyze the specifics based on its own guidance while assessing its fair valuation given this prospect. We believe its valuation is fair, if not a bit rich.

Company Overview

Intuit, incorporated in 1984 and headquartered in Mountain View, California, is a financial management and compliance products and marketing services provider aiming at consumers and small businesses. The company’s global platform, which includes TurboTax Credit Karma, QuickBooks, and Mailchimp, is designed to help consumers and small businesses manage their financials, get and retain customers, save money, pay off debt, and do taxes with ease. The company provides specialized tax products to accounting professionals, who are considered key partners to help it serve small business customers. Intuit has four reportable segments: Small Business & Self-Employed, Consumers, Credit Karma, and ProConnect.

Strength

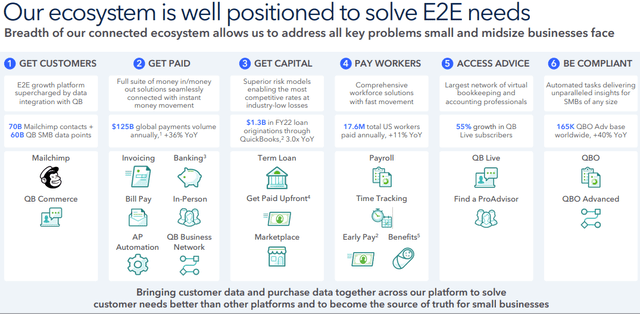

The biggest strength of Intuit is the vertical integration of the financial, tax, compliance, and marketing needs of consumers and small businesses. As the company explained in its 10-K, there is rapid innovation and disruption in each of these spaces, with customers’ needs constantly shifting, and those changes could make existing products and services quickly become obsolete. That’s why we wouldn’t call this a cross-selling among their products. To vertically integrate them while innovating becomes necessary for Intuit to stay competitive, as the company itself also touted. Customers can come to get paid, get capital access, pay workers, access advice, and stay compliant & organized while getting customers via marketing programs all on its platforms. With vertical integration comes cost savings, ease of use, high availability, and effective distribution. This is what truly makes it competitive. The chart below shows how the process works for small businesses.

Intuit EcoSystem (Intuit Q3 Presentation)

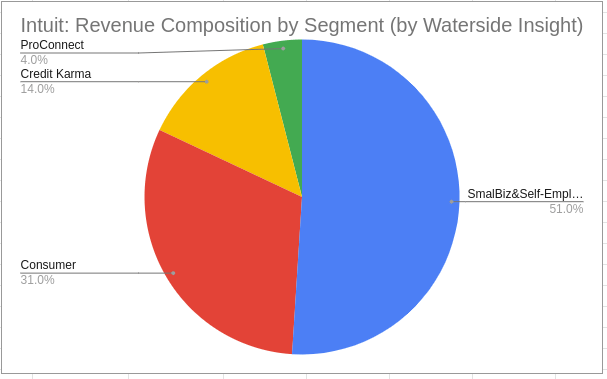

Within this ecosystem, its Small Business & Self-Employed is the core business, accounting for 51% of the total revenue. Most likely, the MailChimp acquisition it did in 2021 will contribute to this part of revenue more directly, although it hasn’t reported specifically yet. Its direct consumer segment that provides accounts for 31%. And Credit Karma has already pulled its weight by contributing 14% of total revenue. Overall, the vertical integration’s different parts are well functioning.

Intuit Revenue by Segment (Calculated and Charted by Waterside Insight with data from the company)

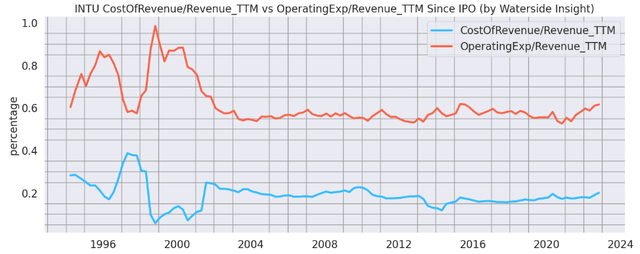

Similarly, it has been able to keep the cost of revenue and operating expenses within a stable range compared to revenue. Although both were ticking up by a notch, they were still within the historical norm.

Intuit Cost of Revenue vs OpExp (Calculated and Charted by Waterside Insight with data from the company)

The nature of Intuit’s business also makes it resilient to business downturns. If we look back at the 2008 recession, the dent it made to the company’s free cash flow and net income was almost a blip. Companies that cut IT spending are unlikely to cut their financial management software spending, as those become more critical in calculating cost savings. The company could have similar resilience this time around.

Weakness/Risks

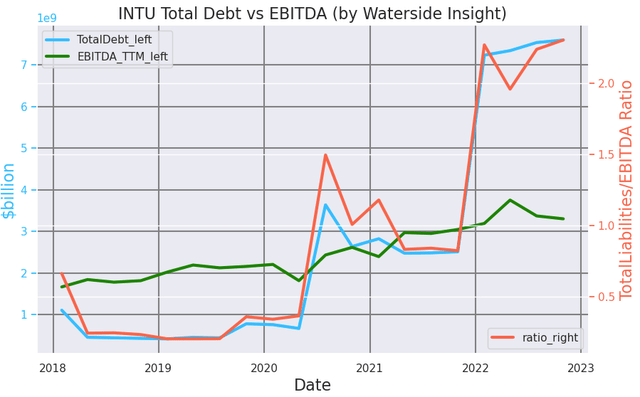

Precisely because of Intuit’s stable performance, the following weakness stands out more. Intuit finished the acquisition of MailChimp by the end of 2021, a few months before the Fed started raising the interest rates. This deal cost it $12 billion, of which $4.7 billion was funded by an unsecured term loan.

Intuit Total Debt vs EBITDA (Calculated and Charted by Waterside Insight with data from the company)

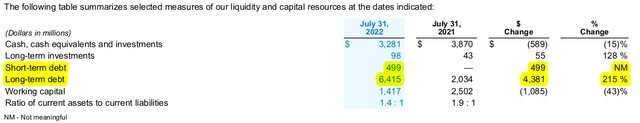

The specific breakdown of the debt increase was disclosed in its 10-K. The long-term debt increased by 215% to $6.4 billion and that brought the total debt to above $7 billion.

Intuit Debt Profile (Intuit 2022 10-K)

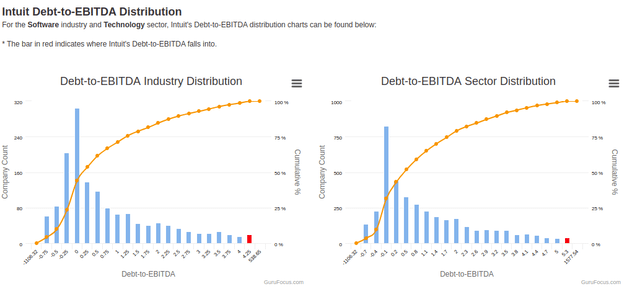

For the software and tech sector, if we put this number in sector and industry comparison, Intuit is in the highest bracket.

Intuit vs Industry, Sector (GuruFocus)

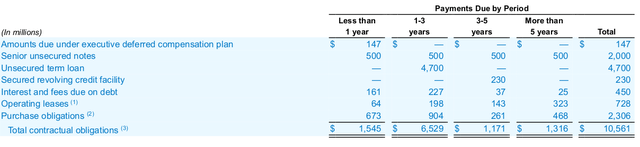

Looking at Intuit’s debt structure, it has the most debt maturing in 1-3 years. This will coincide with the persistently higher interest rate environment we have had since 2008. The Fed is probably not going to cut rates back down to the 2021 level any time soon. The increased cost of capital will have a continuous impact on its cash flow and income.

Intuit Payment Schedule (Intuit 2022 10-K)

The question is, within a rising interest rate environment, can Intuit balance its stable cash flow while paying off a lump-sum debt obligation of $6.5 billion within three years? Its current ratio has dropped to 1.3X already. Given how stable its margins have been, it will be hard to anticipate a jump in the near term in normal times, let alone when a recession is looming large. They can pay this debt. That’s never the question. But how much will it weaken their earnings and cash flow, given the lower guidance given for FY 2023?

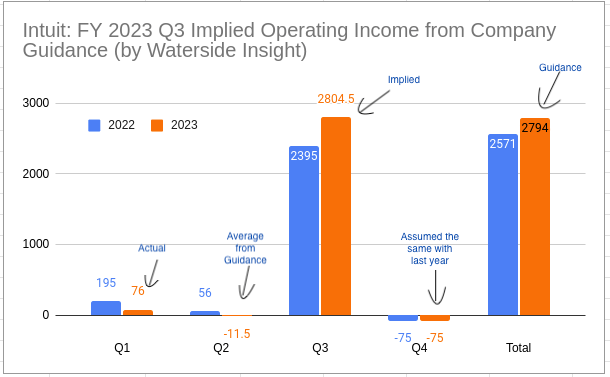

Now we want to take a look at its 2023 performance and guidance given in its factsheet. From the data in this summary, we calculate what could be its FY 2023 operating income implied by the guidance and Q1 FY 2023 actual number. Note that its fiscal year starts in the Q4 of the calendar year. Its Q1 FY 2023 result is less than half of its Q1 FY 2022 result. Given its guidance for Q2 2023, we averaged it to be $11.5 million. And if we assume it will have the same performance in Q4 FY 2023 as with Q4 FY 2022, taking the lower end of its whole year guidance of $2.794 billion, its implied Q3 FY 2023 operating income will be 2.804 billion, an 8.7% increase YoY.

Intuit Q3 FY 2023 Implied Operating Income (Calculated and Charted by Waterside Insight with data from the company)

Given the weakness in the first two quarters of FY 2023, and the fact that almost each of its segments received lower FY 2023 guidance in its revenue growth rate, we see Intuit is almost hanging by a thread for FY 2023 Q3’s growth rate to save the whole year’s growth.

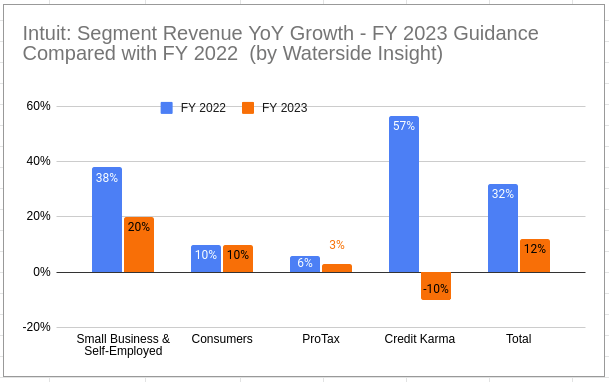

Intuit Revenue by Segment Guidance FY 2023 (Calculated and Charted by Waterside Insight with data from Intuit FactSheet of 2022)

Its largest revenue contribution unit of Small Business & Self-Employed will grow only at about half of 2022’s rate. According to sources, MailChimp’s revenue in 2020 was $800 million, and the integration of the unit into its platform provided $762 million of revenue in FY 2022 for the largest segment. So we suppose the lower growth rate for this unit in FY 2023 has already factored in MailChimp’s contribution. Credit Karma, which initially provided strong growth for two quarters in FY 2022, will have a negative growth rate. Its overall growth rate of FY 2023 will be less than half of FY 2022. To be fair, it is still an impressive growth rate given the recession prospects the economy is skirting. According to its disclosure, it has $500 million of debt payment due by July 2023. Could a lower revenue marginal growth rate on top of higher debt redemption payments make the bottom line disappoint?

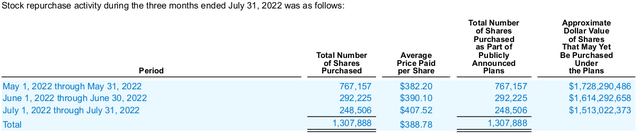

With that, we also want to highlight its stock repurchase activity in 2022, which averaged $388.78 and used about half a billion dollars. Now the market price is almost back to that exact level at $390.63.

Intuit Stock Repurchase Activity of 2022 (Intuit 2022 10-K)

This has resulted in its first significant push in shareholder return since 2004. Together with the approval in 2021 and 2022, it has a total of $4 billion stock repurchase plan. It could again attempt to do a stock buyback if the price drops again, which could further constrain its cash flow. We will pay attention to that.

Financial Overview

Intuit Financial Overview (Calculated and Charted by Waterside Insight with data from the company)

Valuation

Taking into consideration all the analysis above, we use our proprietary models to assess the fair value of Intuit with a ten-year projection forward. In our bullish case, the company has a slowdown in cash flow generation in the next three years but is compensated by the acquired units’ contribution, and then resumes its usual steady growth pace; it is valued at $447.4. In our bearish case, the company has a slowdown in cash flow generation in the next three years, but it took a long time for the acquired units to contribute significantly and then resumes its usual growth pace; it is valued at $274.54. In our base case, the slowdown in cash flow generation shows in 2023, abates in the next two years, with some reasonable contribution from acquired units, and then resumes its usual growth pace; it is valued at $342.18. We can see the upside and downside difference is quite large, implying some more volatility to be expected ahead. The current market price is above our base case valuation.

Conclusion

Intuit’s vertically integrated ecosystem, strong financial performance, and resilience to the recession are the strength we highlighted for the company. In the meantime, the rising debt amid a rising interest rate environment, along with a slower marginal growth rate, could make its bottom line less robust in 2023. We think the stock is fairly priced with some risks to the downside at this point and recommend a hold.

Be the first to comment