NicoElNino

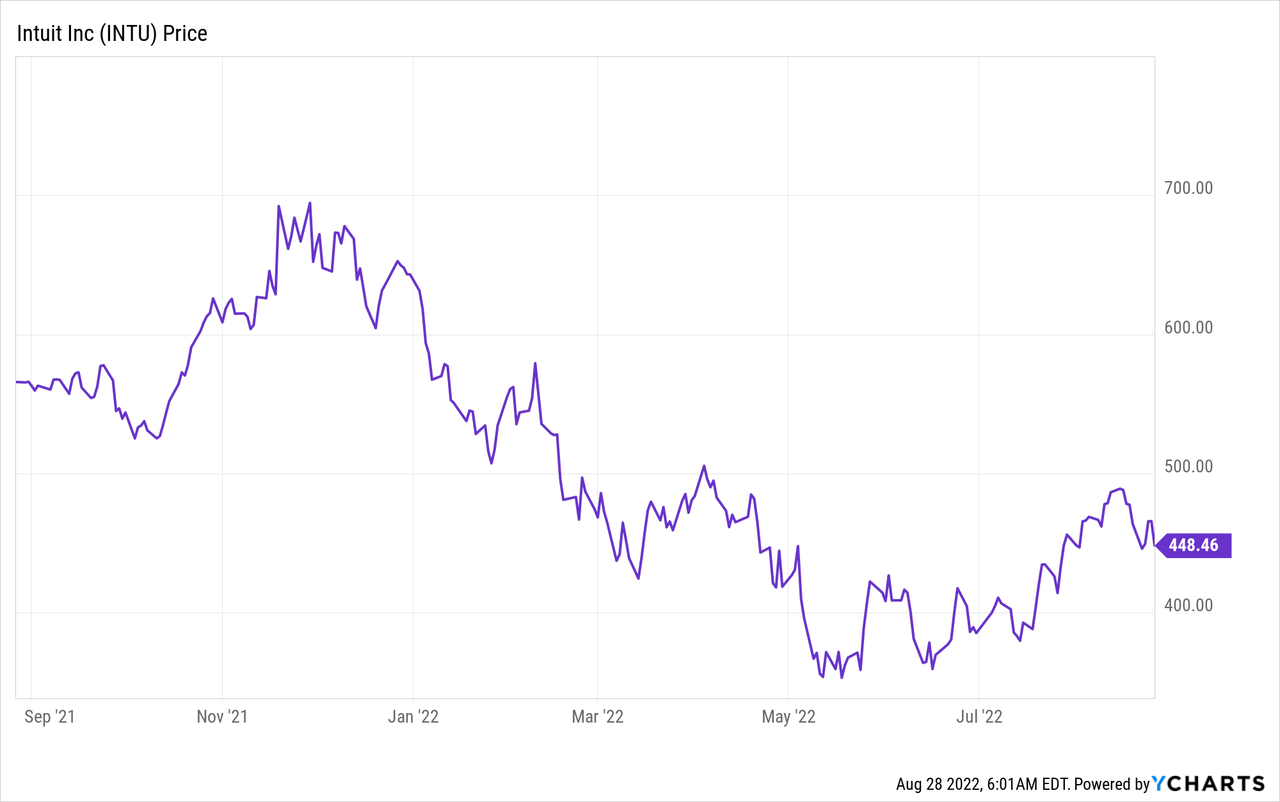

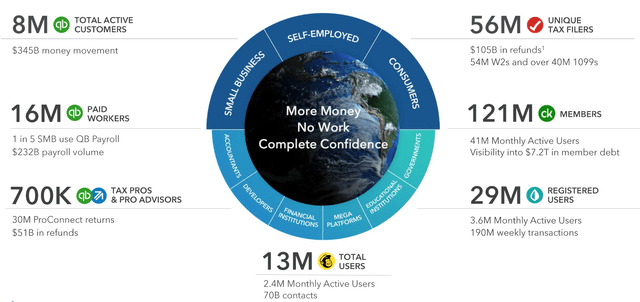

Intuit (NASDAQ:INTU) is a market leading financial software provider which is primarily focusing on helping small businesses. The company has been a pioneer in digital accounting and benefited hugely from the pandemic which caused an acceleration in digital technology by businesses. In 2022, the company had over 100 million customers and they have consistently produced solid financial results. In the most recent quarter the company beat revenue and earnings estimates by analysts, and management even bought back a staggering $1.9 billion in the fiscal year 2022. The board has also approved a $2 billion stock repurchase program and the company now has authorization for the purchase of up to $3.5 billion of its shares. In this post I’m going to break down the recent financial results and dive into the valuation.

Business Model Review

In my previous post on Intuit, I covered its products and business model in great detail; here is a quick review.

Intuit offers a menu of financial software products which includes QuickBooks, TurboTax, Credit Karma, Mint and now email automation platform Mailchimp which was recently acquired. Management’s mission is to help solve its small business customer problems, which include everything from “Getting Customers” to tracking accounting and filing tax returns.

The company makes its money primarily from subscription services and benefited hugely from the recurring revenue nature and have “stickiness” of its products.

Intuit (Investor presentation)

Management has outlined “5 Big Bets” as part of their strategy. These include:

- Revolutionise keep the benefit

- Connect people with experts

- Unlock Smart Money decisions

- Be the center of small business growth

- Disrupt the small business mid market.

The company’s competitive advantages include best-in-class technology, network effects, from resources and integrations with its products and big data. Intuit collects a vast amount of data on its small business customers. This includes granular information such as revenue growth, bank account balances, number of workers paid, credit card usage, etc. Using this data the company can hypersonalize offers and upsell to these customers which is a key advantage which only comes with scale.

Roaring Financials

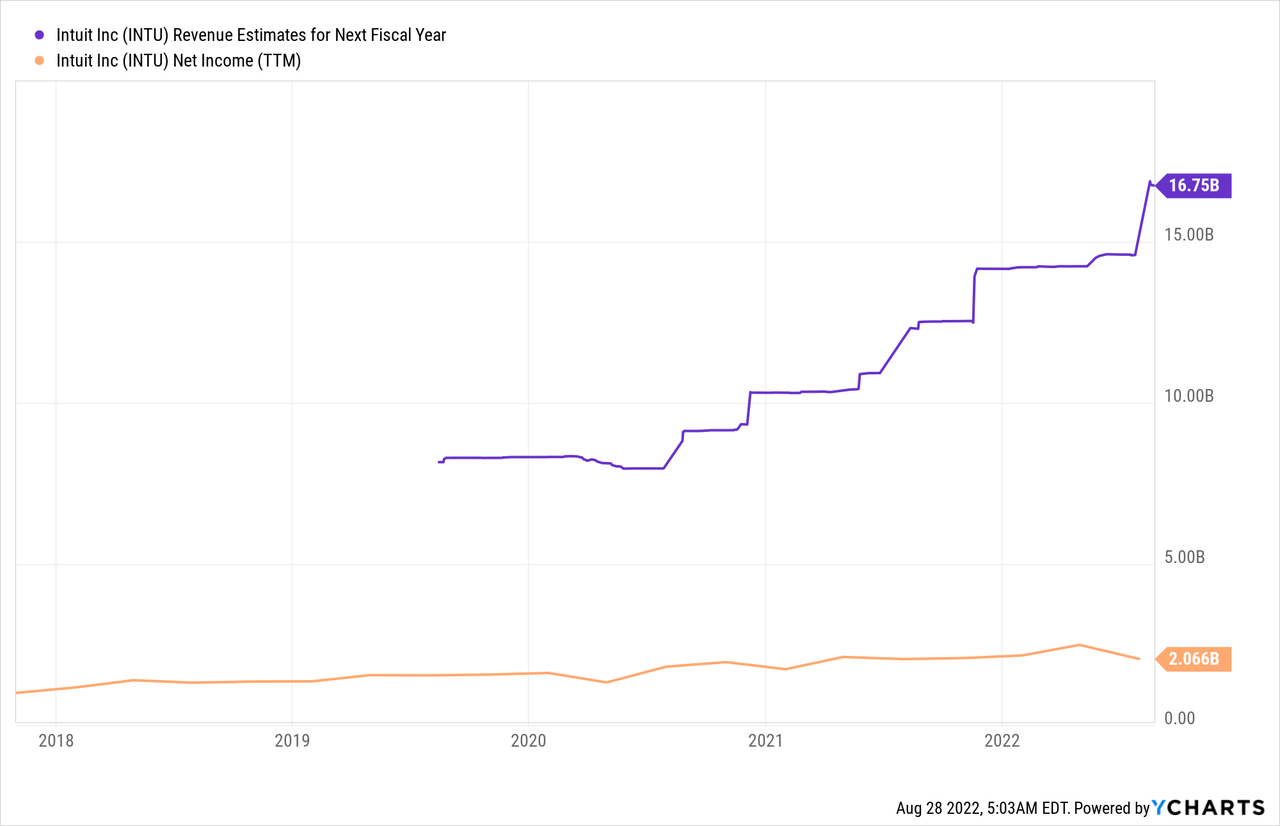

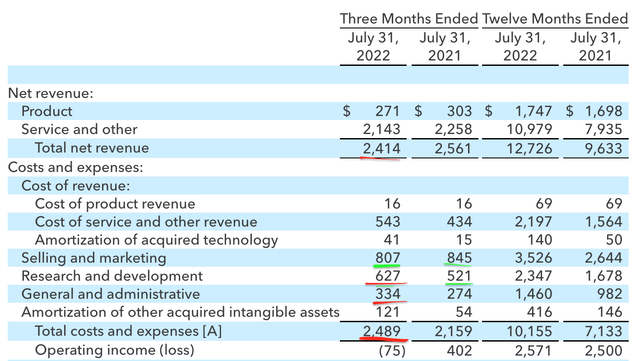

Intuit generated solid financial results for the fourth quarter of FY 2022. Revenue was $2.4 billion which beat analyst expectations by $84.28 million. This revenue was down 6% year over year, but this was mainly due to an earlier IRS tax filing date and thus not driven by negative factors. Revenue was driven by rapid growth of 41% in Small Business revenue to $1.8 billion and Online Ecosystem revenue also increased by a rapid 66%. Credit Karma revenue popped by 17% year over year to $475 million

For FY 2022, revenue roared by 32% which includes an 8% boost from the Mailchimp acquisition. Small Business revenue popped by a rapid 38% and Online Ecosystem revenue grew by a blistering 61% year over year. Management’s goal is to be the “source of truth for small businesses” and they aim to execute on this will three strategies; grow the core, connect the ecosystem and expand globally. These strategies are all performing well so far.

Consumer group revenue edged forward by 10% year over year of $3.9 billion. While Credit Karma raked in $1.8 billion in revenue.

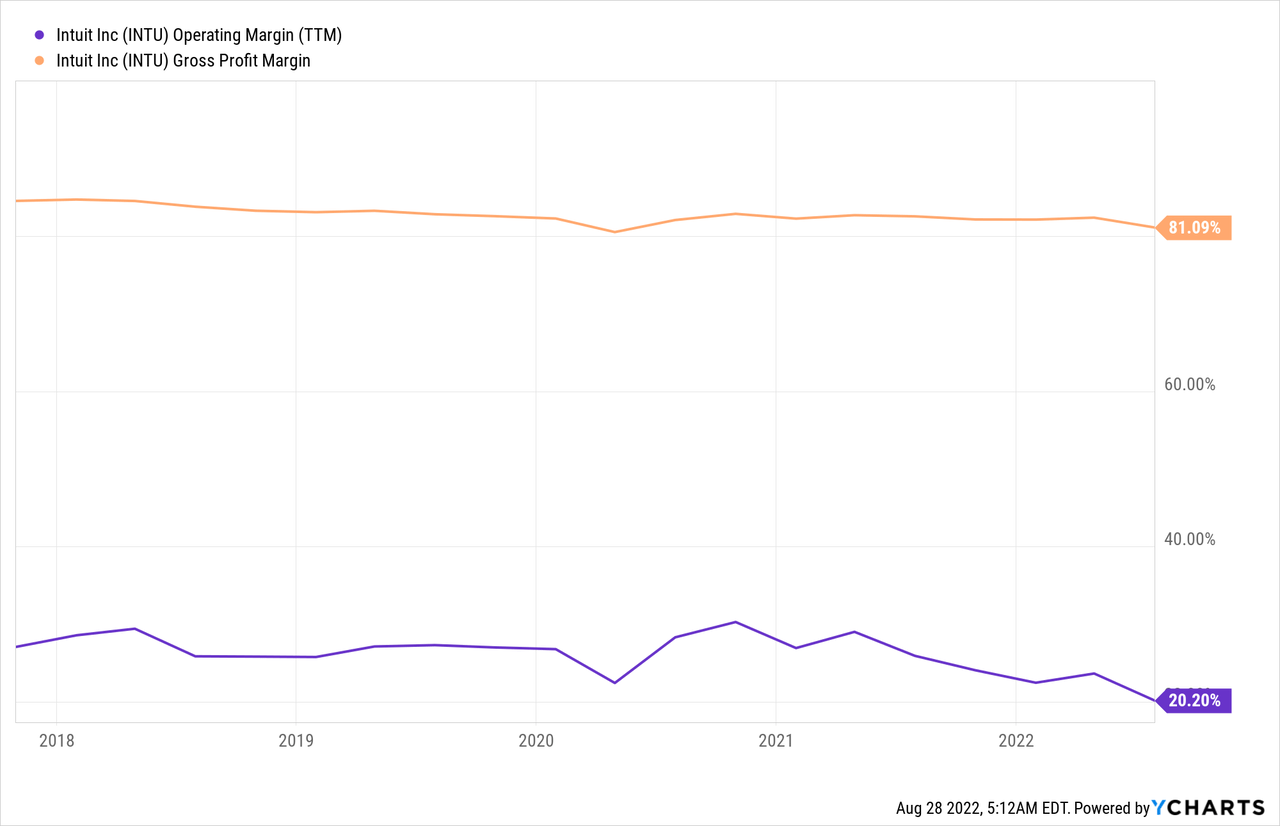

As a software company, Intuit generates super high margins of over 81% which has been fairly consistent over the past number of years. When we dive under the hood, we can see that overall operating expenses have increased by 15% year over year. This looks to have mainly been driven by a 21% increase in general and administrative expenses to $2.5 billion the quarter ending July 31st 2022. Research and Development expenses also nudged up slightly by ~20% which I don’t deem to be a negative as companies which tend to invest more into R&D create more shareholder value long term. Sales and Marketing expenses decreased by 4% year over year, which could be a sign of increased marketing efficiency and operating leverage taking hold. It also may have been a conscious choice by management to “dial down” marketing spend as more uncertain economic conditions have been forecasted.

Q4 earnings (author screenshot financial statements)

For the full fiscal year 2022, Intuit generated solid GAAP operating income of $2.6 billion, which increased by 3% year over year. On a non-GAAP basis this rose by a substantial 29% to $4.5 billion. This “non-GAAP” figure excludes non-cash expenses such stock based compensation, amortization of acquired technology, goodwill, etc. Intuit has generated a solid operating margin of above 20% over the past couple of years, it has dipped slightly in the past couple of quarters due to high operating expenses. But the good news is management is forecasting a strong recovery with its operating margin expected to expand by 100 basis points versus FY ’22.

Earnings per share [EPS] was $1.10 on a normalized non-GAAP basis, and this beat analyst expectations by $0.12 which was a positive.

Intuit has a fortress balance sheet with $3.3 billion in cash and short investments with $6.9 billion in debt. The vast majority of this debt is long term and thus easily manageable.

The board approved a quarterly dividend of $0.78 per share, which isn’t incredibly high but for a technology company this is great and it also increased by 15% year over year.

For the full fiscal year 2023, management is guiding for between $14.5 and $14.7 billion up between 14% and 16% year over year. With both GAAP operating income expanding to between 9% and 13% to the range of $2.8 and $2.9 billion.

Advanced Valuation

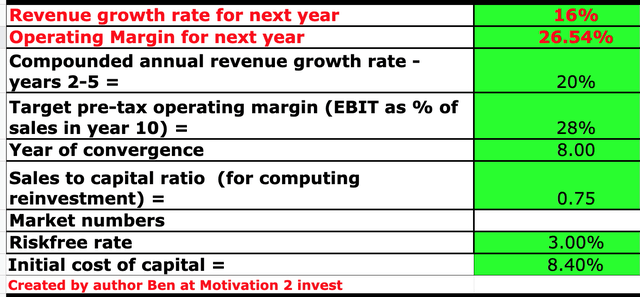

In order to value Intuit, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have revised my previously forecasted revenue estimates downwards to 15% revenue growth for next year and 20% for the next 2 to 5 years. This is aligned with management’s guidance and driven by my expected recovery in software spending following a recession driven dip in the next few quarters.

Intuit stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have forecasted the operating margin to expand to 28% over the next 8 years. I expect this to be driven by decreasing inflation, cross selling synergies from acquisitions and its focus on larger SMB customers. To increase the accuracy of the valuation, I have capitalized R&D expenses.

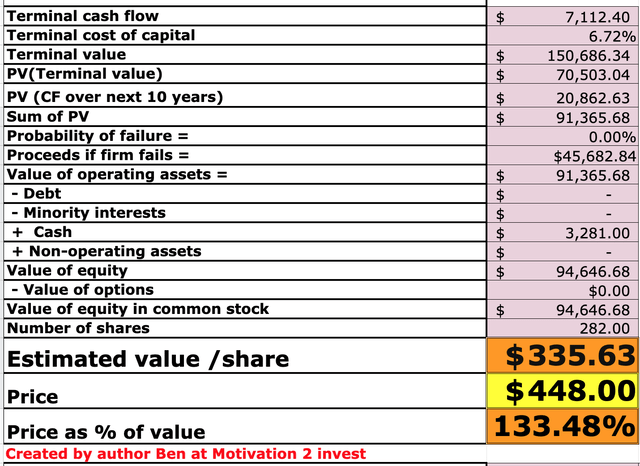

Intuit stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $335/share, but the stock is trading at ~$448 per share at the time of writing and thus is ~33% overvalued. As an extra data point, the stock price found support on the technicals a few months back at ~$368 per share and thus this could also be an indication of a buy point.

If I adjust for a faster 25% growth rate over the next 2 to 5 years, which could be driven by another acquisition. I get a value which pegs the stock just 9% overvalued, which isn’t crazy.

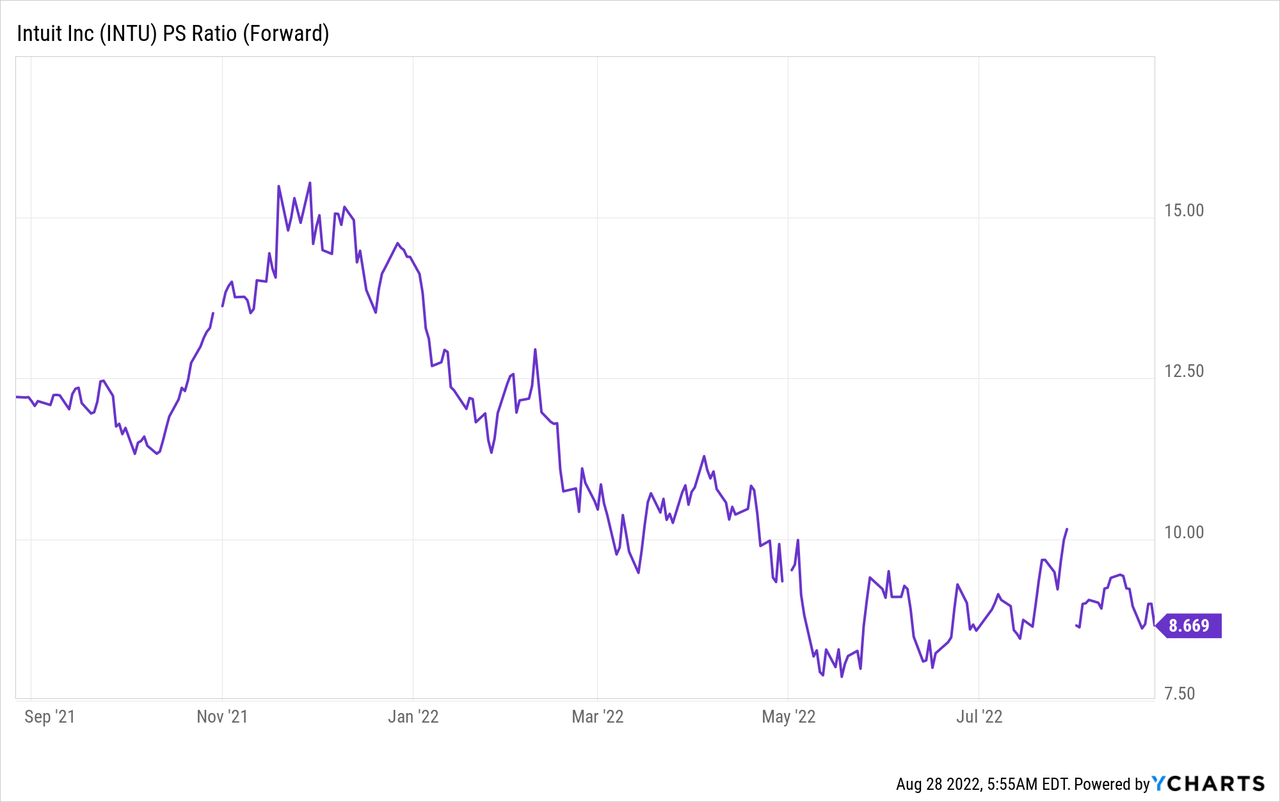

On a relative basis, Intuit is trading at a Price to Sales Ratio = 8.67 which is 14% cheaper than its 5 year average.

Risks

Recession/New Business slowdown

Many analysts are forecasting a “shallow but long” recession which is expected to start in the fourth quarter of 2022. Small Businesses are often less protected from the volatilities of an economic downturn and tend to “feel” rising input costs much more. I do not believe small businesses will end subscriptions with accounting software but they may be less enticed to purchase upsells or invest into customer growth.

Final Thoughts

Intuit is a tremendous company with an industry leading brand and gold standard accounting software. The company knows its customer persona deeply, the small business market and has a relentless focus on helping them solve every problem. This “customer centric” is famous of many great companies such as Amazon (AMZN) and thus I believe Intuit will continue to perform strong long term. The only issue is the valuation which is a little spicy right now and thus investors may wish to wait for a pullback before entering.

Be the first to comment