-Oxford-

We’re buy-rated on finance software company Intuit Inc. (NASDAQ:INTU). Despite inflationary pressures and rising interest rates, Intuit’s financial tech platform has been resistant relative to the larger tech group, and we recommend buying the stock at current levels.

Intuit operates in the financial software industry, estimated to grow at a CAGR of 9.2% between 2021-2031. We believe Intuit’s position within the financial software industry has made its services more-or-less indispensable, even during market downturns. Intuit’s fiscal Q4 2022 report in August showed revenue growth of 32% Y/Y and outpaced EPS expectations by around 12% – underlying that Intuit’s customer base is more resilient than expected for a fintech company under current conditions.

We expect Intuit to continue outperforming expectations through 2023 for two reasons. First, we expect the company to see demand tailwinds for its two main products: QuickBooks and TurboTax. These two products have proven resilient to Fed interest rate hikes and macroeconomic headwinds for the most part. Second, the shift of financial services from software-based solutions to cloud-based ones. The business world is rapidly shifting to the cloud, and we expect focusing on the cloud will be a growth catalyst for Intuit in the long run. Intuit is still not cheap, but the stock is down 36% YTD. We believe the stock pullback provides an attractive entry point into the heart of the financial software industry.

Bullish on the financial software industry and shift to the cloud within it

Intuit develops and sells financial, accounting, and tax preparation software within the broader financial software industry. We like Intuit’s position within the industry because we expect it the benefit from the rapid shift from traditional methods of managing financial records to finance and accounting information software services. We believe Intuit will ride the growing demand for computerized accounting.

While we’re bullish on the ripe-for-picking nature of the financial software industry, we’re specifically buy-rated on Intuit because of the company’s shift from selling software-based solutions to cloud-based solutions. Cloud is at the center stage of the tech space, and we believe Intuit will gain more momentum going forward with cloud-based solutions. With cloud-based solutions, Intuit will be able to offer customers the flexibility of accessing their information from anywhere. The shift falls within the Software as a Service ((SaaS)) market, forecasted to grow at a CAGR of 25.9% between 2021-2028.

Resilient customer base under current financial stressors

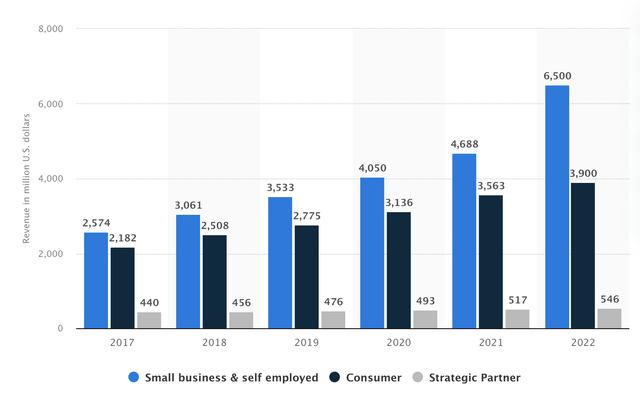

While Intuit has four segments, the company derives most of its revenue from two segments that have proven relatively resilient to the current market downturn: Small Businesses and Self-Employed Groups and Consumers. The former makes up around 51% in FY2022, while the latter accounts for about 31% during the same period.

The following graph outlines Intuit’s total revenues by segment worldwide between 2017-2022.

Each segment encapsulates one of Intuit’s two main products: QuickBooks under the Small Businesses and Self-Employed Group and TurboTax under the Consumer one. If you have a small business, you’ve probably interacted with QuickBooks, and if you file your own taxes, chances are you’ve reverted to TurboTax. We believe Intuit’s QuickBooks and TurboTax exist in a safe haven, even during a market downturn. The company’s FY2022 reported 38% Y/Y growth for Small Business and Self-Employed groups. Consumer Group revenue also increased by 10% Y/Y. We believe the secret to Intuit’s customer-base resilience is that its business model saves companies money and time.

Risks to the buy thesis

Intuit is not without risks. There still remains a lot of uncertainty regarding the budget spending of small businesses and self-employed individuals. Small Businesses and Self-Employed segments make up most of Intuit’s revenue. Hence, the company’s vulnerable to smaller businesses cutting budgets due to near-term global macroeconomic headwinds. The company’s simultaneously vulnerable to the cyclicality of customer demand. Intuit sees the highest demand in the second and third quarters, the U.S tax seasons. The company is reliant on heavy cyclical demand, and we expect that if Intuit does not enjoy the expected demand in the U.S tax season, its profitability will be hurt.

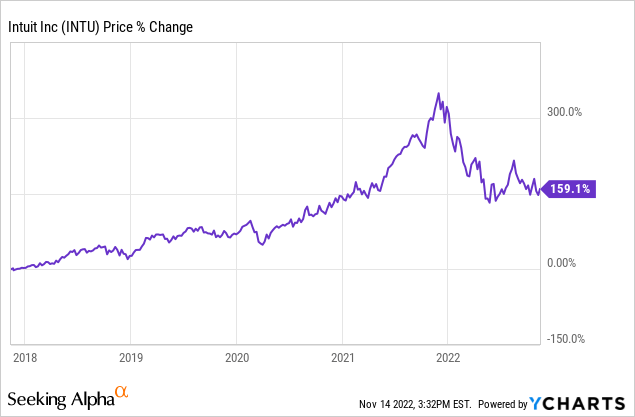

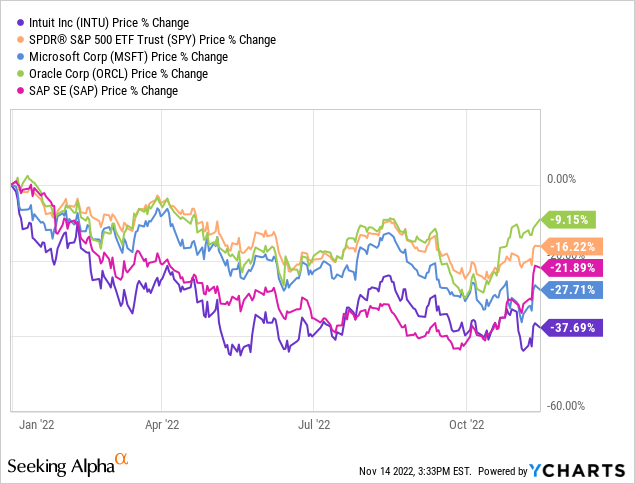

Stock performance

Intuit’s grown an impressive 156% over the past five years. YTD, the stock is down 36% alongside most of the tech peer group. Intuit has underperformed the S&P Index (SPY), which has only dropped about 17% YTD. Relative to the competition, Intuit underperforms YTD of SAP SE (SAP), which fell around 15%; Oracle (ORCL) decreased by about 10%, and Microsoft (MSFT) by about 27%. We like Intuit’s underperformance YTD, as it creates an attractive entry point to invest in the company. We recommend investors buy the stock at current levels, as we expect Intuit to grow meaningfully in 2023.

TechStockPros

TechStockPros

Valuation

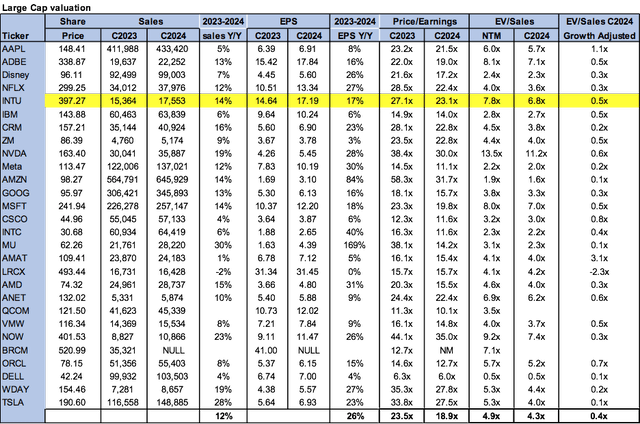

Intuit is not cheap. The stock is trading at 23.1x C2024 EPS $17.19 on a P/E basis compared to the peer group average of 18.9x. On the EV/Sales basis, the stock is trading at 6.8x C2024 versus the peer group average of 4.3x. Intuit is richly valued; nevertheless, we believe the stock is a growth stock and recommend investors buy at current levels.

The following graph outlines Intuit’s valuation relative to the peer group.

Word on Wall Street

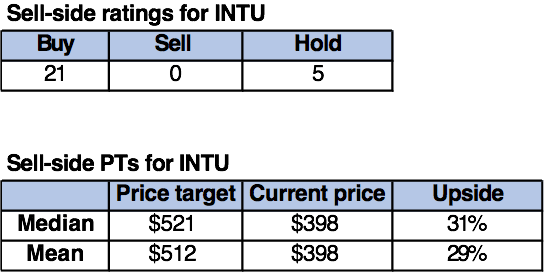

Wall Street is bullish on the stock, and so are we. Of the 26 analysts covering the stock, 21 are buy-rated, and five are hold-rated. The stock is currently trading at $398. The median price target is $521, and the mean price target is $512, with a potential upside of 29-31%.

The following are Intuit’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

While most of the fintech peer group doesn’t look fondly at 2022, Intuit stands out. The company had a great FY2022 – acquiring MailChimp, and increasing revenue by 32% Y/Y. Intuit’s not only profitable, but it’s also growing. We like Intuit’s position within the financial software industry and expect the company to see increased demand tailwinds as macroeconomic headwinds ease. We also believe the company is a “safe haven” during the current market downturn because of its relatively resilient customer base and indispensable services. We recommend investors buy Intuit Inc. on the pullback.

Be the first to comment