gorodenkoff

A Quick Take On Intrusion

Intrusion (NASDAQ:INTZ) reported its Q3 2022 financial results on November 3, 2022, missing revenue and beating EPS estimates.

The firm provides cybersecurity products and services to U.S. government agencies and enterprises.

While its recent launch of new products is encouraging, the firm’s high operating losses will continue to weigh on the stock in a market environment that punishes companies not making serious progress toward operating breakeven.

I’m on Hold for INTZ in the near term.

Intrusion Overview

Richardson, Texas-based Intrusion was founded to develop a database of global IP addresses and related information for monitoring cyber threat sources.

Management is headed by president and Chief Executive Officer Mr. Anthony Scott, who has been with the firm since November 2021, is also Chairman of the TonyScottGroup and was previously Federal CIO in the U.S. federal government.

The company’s primary offerings include:

-

TraceCop – IP database

-

Savant – Network data mining

-

Shield – Intrusion detection

Intrusion’s Market & Competition

According to a 2020 market research report by Research and Markets, the market for U.S. government cybersecurity is expected to grow by $11.5 billion from 2020 to 2024.

This represents a forecast CAGR of 11.0% during the period.

The main drivers for this expected growth are increasing cybersecurity budgets at all levels of government due to greater cyber threat activity domestically and from abroad.

Major competitive or other industry participants include:

-

Niksun

-

NetScout (NTCT)

-

FireEye

-

Darktrace (OTCPK:DRKTF, OTCPK:DRKTY)

Management says its TraceCop product has ‘limited competitors,’ although it expects competition to emerge in the future, albeit with ‘only a portion of the functions that we are able to perform with TraceCop.’

Intrusion’s Recent Financial Performance

-

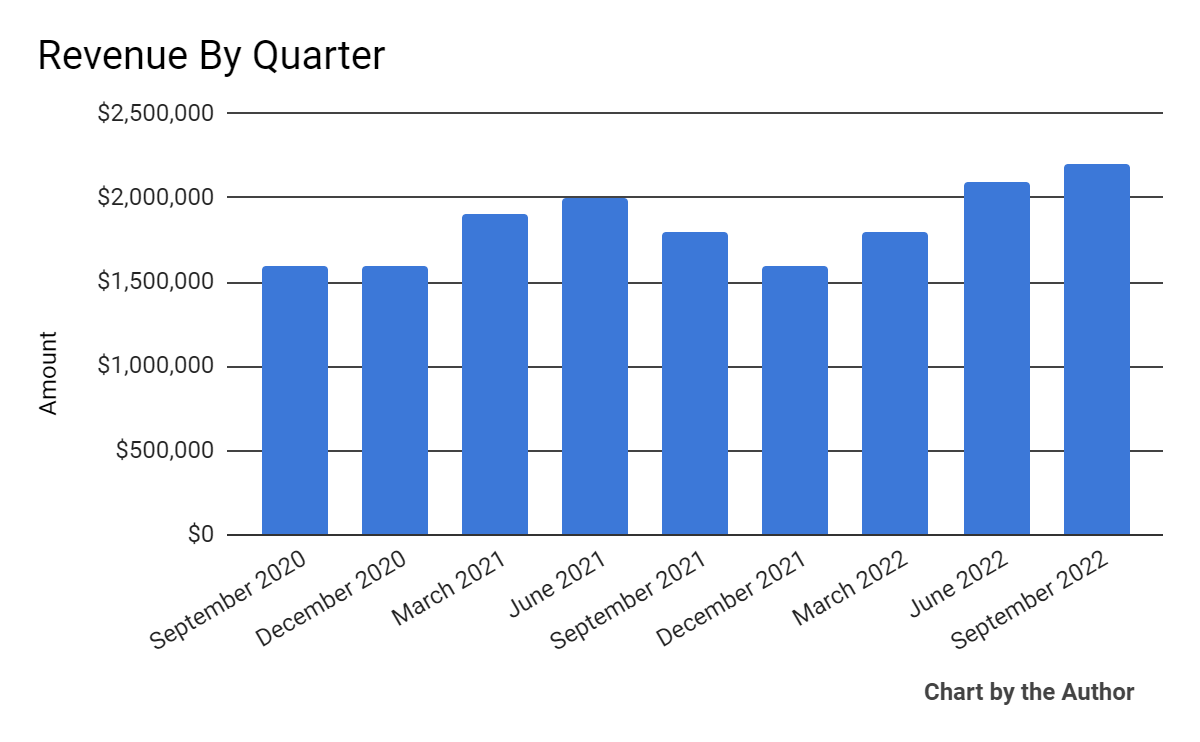

Total revenue by quarter has risen according to the following chart:

Total Revenue (Seeking Alpha)

-

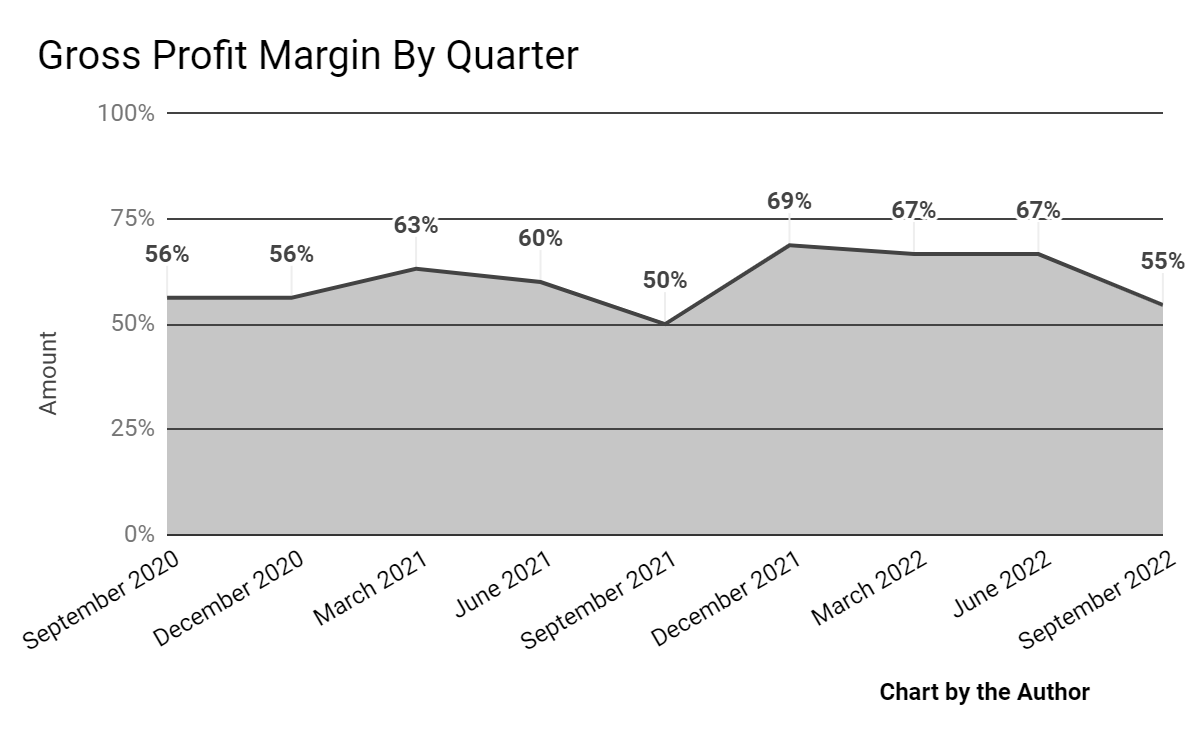

Gross profit margin by quarter has trended higher in recent quarters:

Gross Profit Margin (Seeking Alpha)

-

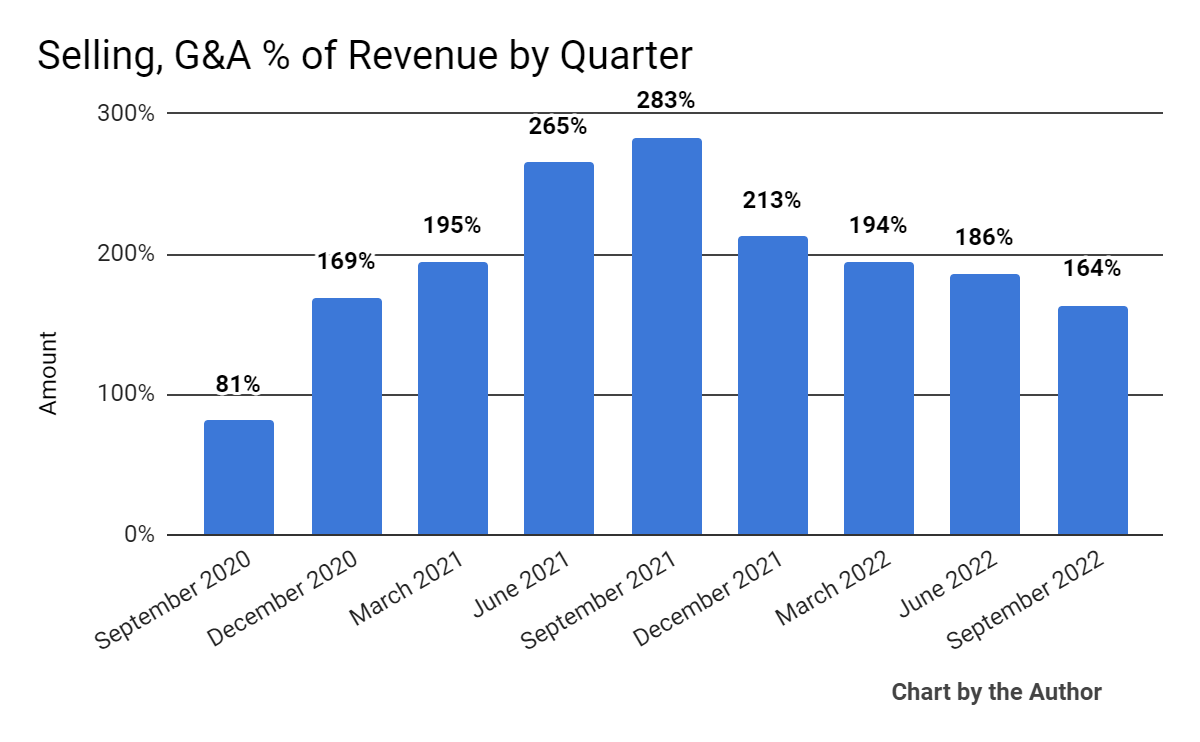

Selling, G&A expenses as a percentage of total revenue by quarter have dropped in recent quarters, although they remain very high:

Selling, G&A % Of Revenue (Seeking Alpha)

-

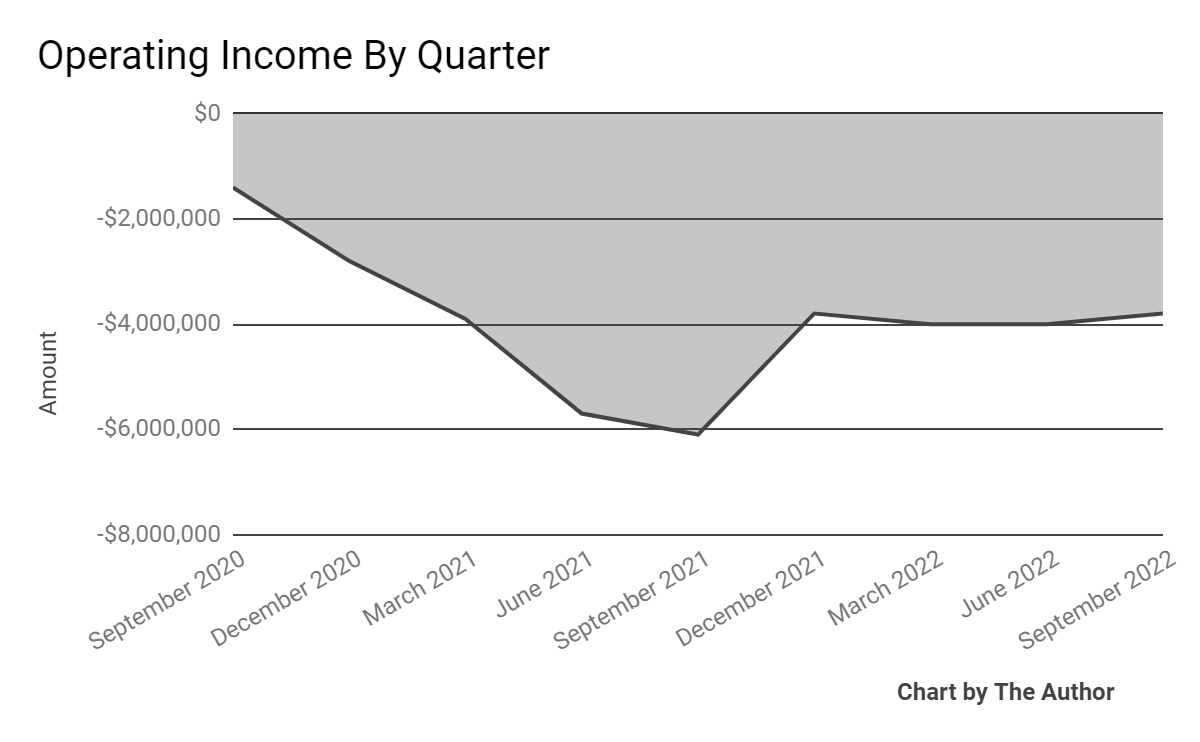

Operating income by quarter remains substantially negative, as the chart shows below:

Operating Income (Seeking Alpha)

-

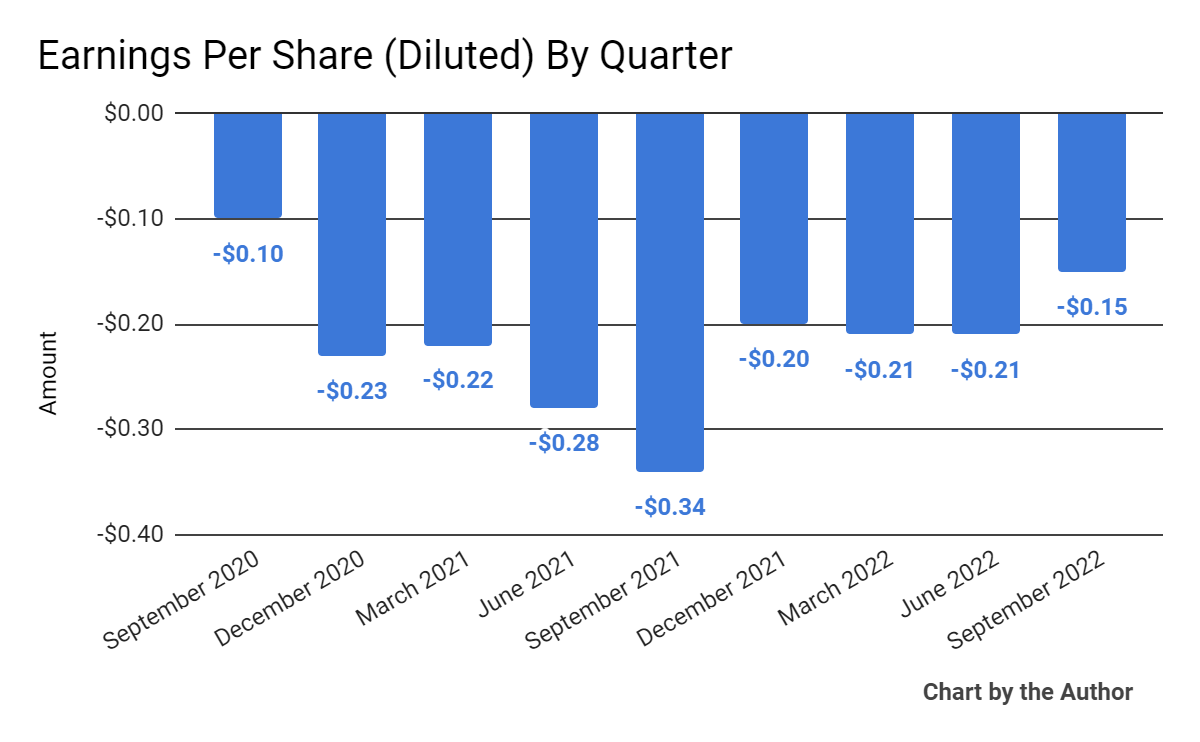

Earnings per share (Diluted) have also remained negative:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

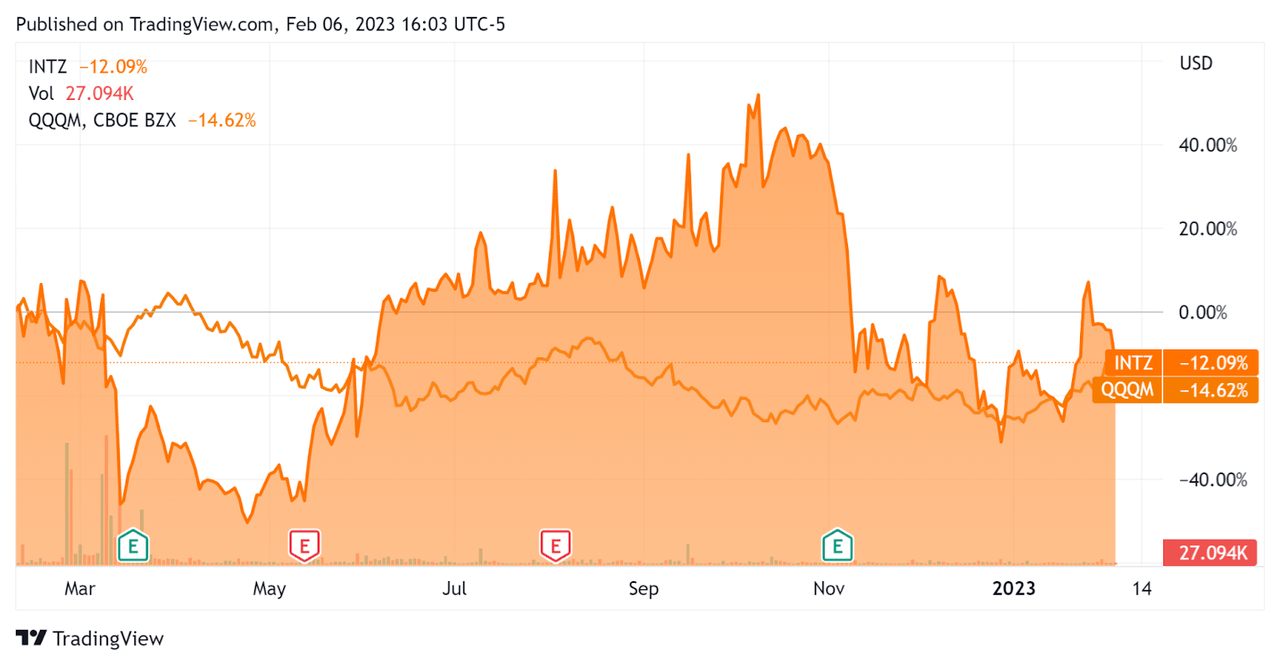

In the past 12 months, INTZ’s stock price has fallen 12.1% vs. that of the Nasdaq 100 Index’s fall of 14.6%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Intrusion

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

10.3 |

|

Revenue Growth Rate |

7.2% |

|

Net Income Margin |

-192.6% |

|

GAAP EBITDA % |

-185.9% |

|

Market Capitalization |

$74,857,600 |

|

Enterprise Value |

$79,708,608 |

|

Operating Cash Flow |

-$13,339,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.77 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

INTZ’s most recent GAAP Rule of 40 calculation was negative (178.7%) as of Q3 2022, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

7.2% |

|

GAAP EBITDA % |

-185.9% |

|

Total |

-178.7% |

(Source – Seeking Alpha)

Commentary On Intrusion

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted its continued efforts in transitioning toward a more channel-enabled sales model along with enhancing its product offerings.

The firm released its Shield Cloud and Endpoint products in Q3 2022, which management termed customer indications of interest since then as ‘highly encouraging.’

As a result, the company believed that its Intrusion Shield system will ‘become the largest source of revenue growth in the future.’

Additionally, SuperMicro will resell its Intrusion technology along with being the company’s primary global supplier of hardware.

As to its financial results, total revenue rose by 20.5% year-over-year, to $2.2 million for the quarter.

Management did not disclose any company retention rate information, other than the loss of an educational customer.

The firm’s Rule of 40 results have been poor, with a moderate revenue growth result offset by a significantly negative operating result contributing to a highly negative figure for this metric.

Gross profit margin has trended higher in recent quarters, but operating losses remain substantial for the firm’s tiny revenue base.

Earnings per share also remain heavily negative, although coming in closer to breakeven in the most recent quarter.

For the balance sheet, the firm finished the quarter with cash and equivalents of $6.9 million after completing a share sale in September and collecting $4 million from investors.

Over the trailing twelve months, free cash used was $13.6 million, of which capital expenditures accounted for $300,000. The company paid $1.3 million in stock-based compensation in the last four quarters.

Looking ahead, management did not provide any forward guidance on expected revenue or earnings per share, other than to say it expects to ‘gain traction’ with its new Shield products.

Regarding valuation, the market is valuing INTZ at an EV/Sales multiple of around 10.3x.

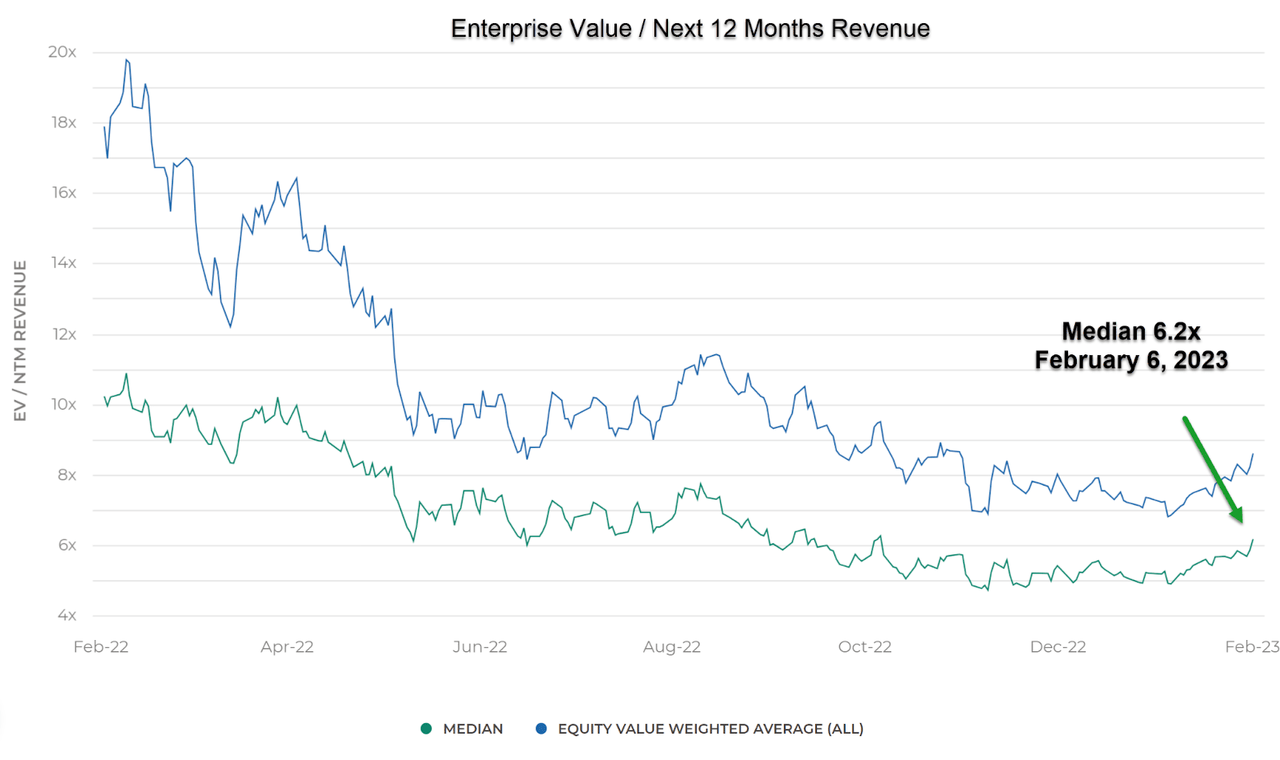

The Meritech Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.2x on February 6, 2023, as the chart shows here:

Enterprise Value / Next Twelve Months SaaS Index (Meritech Capital)

So, by comparison, INTZ is currently valued by the market at a significant premium to the broader Meritech Capital Index, at least as of February 6, 2023.

The primary risk to the company’s outlook is a likely macroeconomic slowdown or recession, which may accelerate new customer discounting, produce slower sales cycles, and reduce its revenue growth trajectory.

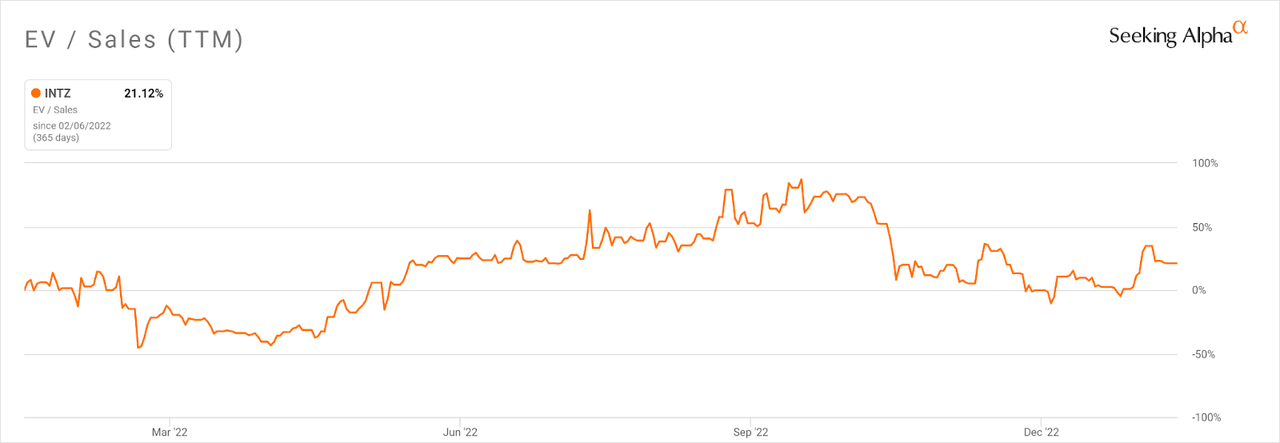

Notably, INTZ’s EV/Sales multiple [TTM] has expanded by 21.12% in the past twelve months, as the Seeking Alpha chart shows here:

EV/Sales Multiple Expansion History (Seeking Alpha)

A potential upside catalyst to the stock could include a notable contract win or additional partnerships with large resellers.

However, the firm’s technology stability doesn’t appear to inspire confidence, while its continued high operating losses suggest that its growth plans will continue to require high levels of expenditures, possibly diluting shareholders with further capital raises.

With such a tiny revenue base and the possibility of a macroeconomic downturn or recession ahead, I’m cautious about Intrusion for the near term.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment