Kunakorn Rassadornyindee/iStock via Getty Images

By Jim Wiederhold

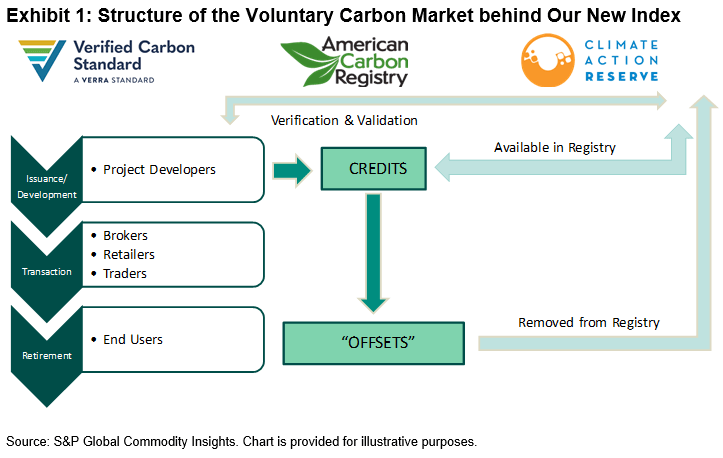

The S&P GSCI Global Voluntary Carbon Liquidity Weighted is the first-to-market benchmark for the current performance of global voluntary carbon futures markets. The index is designed to track the CBL Nature-Based Global Emissions Offset (NGO) futures, underpinned by the Verified Carbon Standard registry, and the CBL Global Emissions Offset (GEO) futures, allowing delivery from CORSIA-eligible carbon offset credits from all three major registries (see Exhibit 1). Both futures contracts are traded at the CME Group. In contrast to compliant markets like the EU Allowances, voluntary carbon markets are not government mandated but go through stringent verification and validation channels to ensure underlying projects have an impact—whether that be reforestation, avoided deforestation, renewable energy, or carbon capture, among others.

Exhibit 1

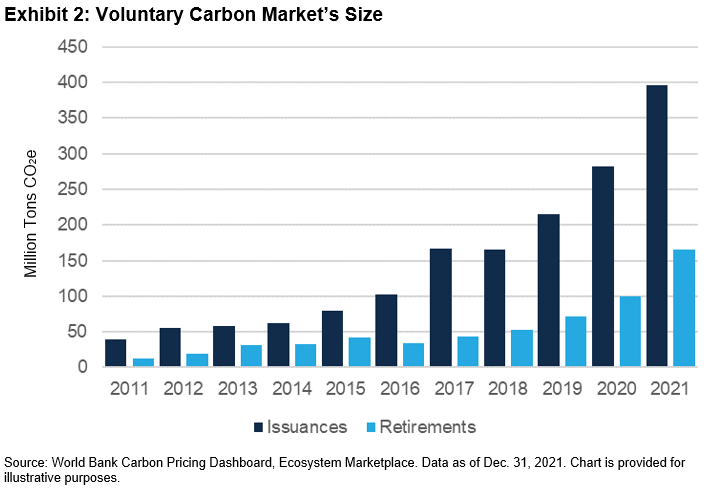

The underlying futures contracts from the CME Group are some of the newest offerings in the carbon market. The speed with which liquidity has built in these contracts and the growth in issuance (and retirement) activity indicates a strong appetite for voluntary offset credits by the private sector (see Exhibit 2). A key instrument in the world’s ability to combat climate change and accomplish the energy transition from fossil fuels to electrification, the voluntary carbon marketplace will likely continue to gain importance while providing price discovery and ease of transacting for many market participants who want to verify their reduction of tons of CO2 equivalent.

Exhibit 2

This index may be of interest because market participants can see the price appreciation potential, or they would like to hedge their climate risk exposures. Due to the evolving nature of carbon markets, an important characteristic of the index is the flexibility to reweight, add or remove constituents at regular intervals to ensure that it can adapt over time.

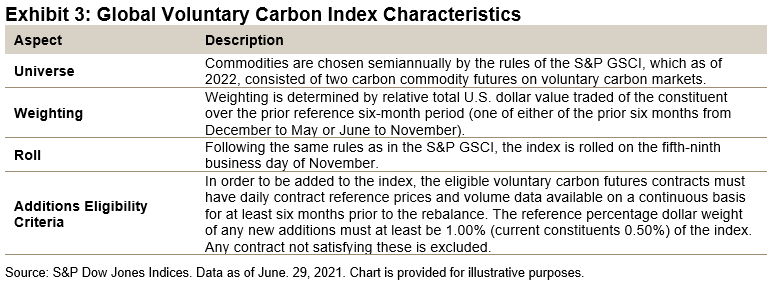

Constituents in the index are weighted semiannually based on their current underlying liquidity. Minimum contract trading and liquidity rules for constituent inclusion, similar in design to the eligibility criteria used for the broad S&P GSCI, are also applied. Exhibit 3 highlights some of the important characteristics of the S&P Global Voluntary Carbon Liquidity Weighted Index.

Exhibit 3

This new index demonstrates S&P DJI’s continued efforts to provide innovative and new thematic alternative benchmarks in the commodities space. This theme offers exposure to the energy transition. With other major asset classes suffering heavy losses in the first half of 2022, the diversification benefits of alternatives have never been more apparent.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment