koto_feja/iStock via Getty Images

Intra-Cellular

The intelligent investor is a realist who sells to optimists and buys from pessimists. – Ben Graham (Warren Buffett’s mentor)

Amid a biotech bear market, a few special companies still managed to break the down trend. These are innovative firms with certain characteristics that prevent them from participating in the bear market. One is the novelty of their drugs that is game-changing. For a company with an approved therapeutic, their sales have to be ramping up aggressively. That aside, these innovators are also a good target for a potential acquisition.

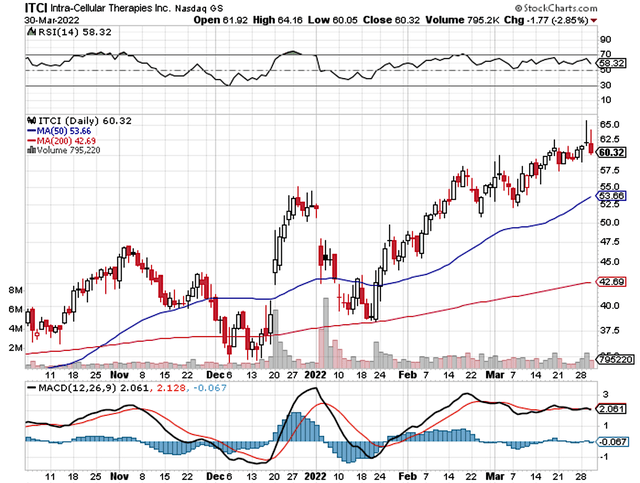

That being said, I’d like to revisit the investing story of Intra-Cellular Therapies (NASDAQ:ITCI). Riding on the success of its lead medicine (Caplyta), Intra-Cellular enjoyed over 74% appreciation in the past year while most bio-stocks suffer from devastating depreciation. In this research, I’ll feature a fundamental analysis of Intra-Cellular and provide my expectations of this Phillip Fisher growth bio-equity.

About The company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the subsequent section. I noted the prior research:

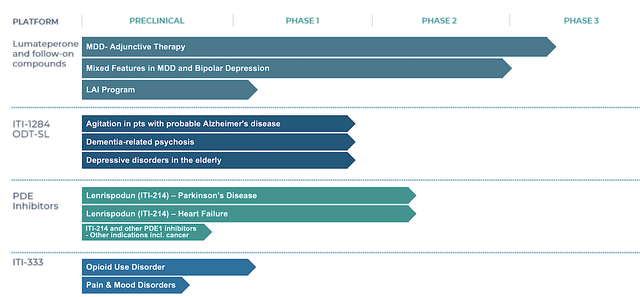

Operating out of New York, Intra-Cellular is focused on the innovation and commercialization of stellar therapeutics to fill the unmet needs in psychiatric medicines. As shown in the pipeline, the company is rapidly advancing an interesting portfolio of powerful drugs. They include ITI007 (i.e. lumateperone, aka Caplyta), ITI214 (a PDE1 inhibitor), ITI1284 (a deuterated form of Caplyta), and ITI333.

Strategies For Brewing A Blockbuster – Being First or Being Differentiated

As you can see, when it comes to innovation success there are two strategies. The first is to make sure your drug gets to the market before others. Being the “first-mover” gives you the advantage of garnering the whole market to yourself. In this scenario, you’re essentially operating a monopoly. By having the whole market, you have the autonomy to set the price for a worthwhile profit margin. As you can appreciate, having a good margin is important because therapeutic development is highly capital intensive and time-consuming. Without banking a profit, innovation will dry up. In other words, no one wants to spend roughly $1B to develop a drug in a decade-long process only to lose money in sales.

Now, let’s say if you’re not the first-mover, your molecule has to be different from others. That is to say, there is a much lower demand for another “me too” drug. Additionally, the profit margin of bio-similars is quite low and thereby renders your efforts unfruitful.

As you can see, Intra-Cellular already gained two approvals under its championship belt. The first is for Caplyta’s use as a neuroleptic to treat schizophrenia (i.e., schizophrenia). The second is for its utility as a treatment for bipolar depression (i.e., BDP). For both of these approved indications, Caplyta delivers unique efficacy/safety profiles. Simply put, it’s superior and different from the rest of the competition.

Caplyta Is A Stellar/Unique Neuroleptic for Schizophrenia

Shifting gears, let us dive deeper into the differentiating characteristics of each approved indication. That way, we can better appreciate this drug for patients and Intra-Cellular as an investment for shareholders.

As a debilitating mental condition (in which the patient has a different perception of reality from the norm), schizophrenia is characterized by “negative and positive” symptoms that require lifelong treatment. Examples of positive symptoms include hallucination, delusion, disorganized speech, and disorderly thinking. Some negative symptoms are flat affect, poverty of speech, a lack of motivation and desires (anhedonia).

Asides from stigmatization, schizophrenia is quite destructive because the symptoms prevent the patient from carrying out daily functioning. Adding injury to the insult, the available medications (i.e., neuroleptics) have significant adverse effects. For instance, patients taking neuroleptics can suffer from extrapyramidal symptoms which are disorganized bodily movement or even contortion. That aside, most neuroleptics can only manage positive symptoms while having no effect on the negative symptoms.

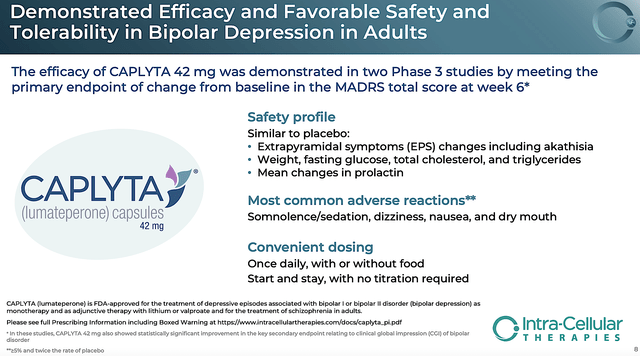

Approved in December 2019, the FDA brought great news to patients as Caplyta is unique from other neuroleptics. That is to say, Caplyta is the rare medicine that demonstrated superior efficacy in treating the highly-difficult-to-treat negative symptoms. Just as important, Caplyta has the best safety profile. Simply put, the side effects of Caplyta are similar to that of a placebo. And, this safety profile spans from schizophrenia to BPD treatment.

Caplyta Is Differentiated For Bipolar

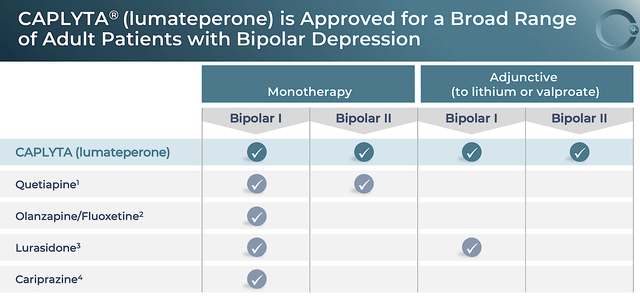

Like the previous year, the FDA also brought another early Christmas present to patients and shareholders in the form of Caplyta approval for BPD in December 2021. Viewing the chart below, you can see that Caplyta is the only medicine that can treat both bipolar 1 & 2 alone and as an add-on (i.e., adjunct). In other words, there is no other psychiatric med like Caplyta that has such a broad utility across a spectrum of psychiatric diseases. That characteristic makes it special.

Caplyta Launch Progress

As you know, the underlying science and therapeutic merits of Caplyta are powerful. Let us see how that translates into launch progress and sales. After all, sales figures would give you more insight into the success of your investment. On that note, Intra-Cellular knows they have a great drug. As such, the company is highly proactive in building a professional sales team in readying for the launch as soon as the approval news came.

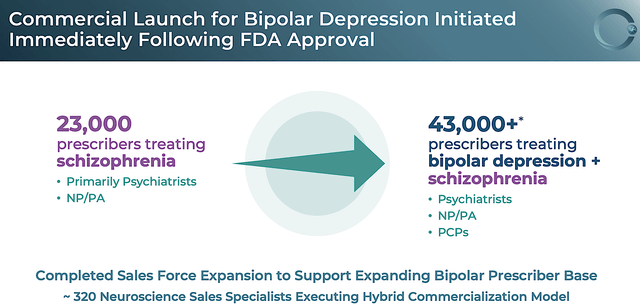

Specifically, Intra-Cellular completed the development of 320 sales reps to conduct visit physicians and online campaigns. In reaping the fruits of its labor, the number of prescribers for Caplyta quickly jumped from 23K (i.e., for schizophrenia alone) to over 43K (for both schizophrenia and BPD).

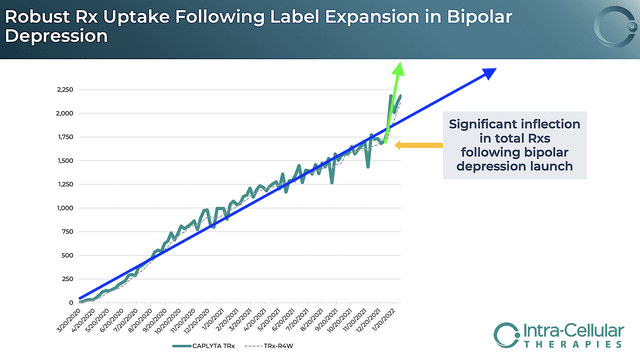

As reflective of robust growth, you can see from the figure below that the prescription (i.e. Rx) uptake is spiking up. Looking at the blue line (for schizophrenia alone), Caplyta Rx grows on a steady trajectory. When coupled with BPD, you can see the huge inflection point (i.e., green line) which indicates extremely robust sales growth to come.

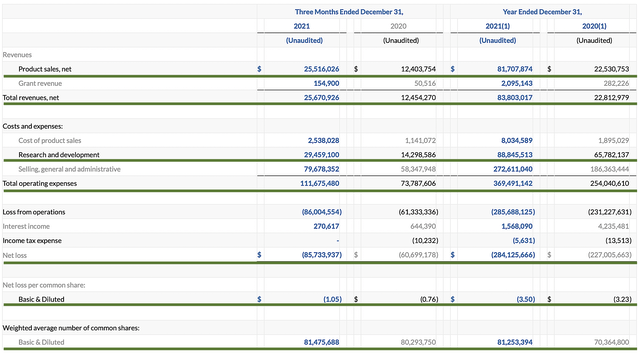

Asides from the Rx growth, you should analyze the actual sales figure. For 4Q2022, Caplyta revenues registered at $25.5M compared to $12.4M for the same period a year prior. On a year-over-year (YOY) basis, that’s a 106% improvement. For the whole year (i.e., Fiscal 2021), Caplyta sales came in at $81.7M versus $22.5M for the prior year. Therefore, the annual sales growth represents a staggering 263%. Due to the label expansion (as shown in the inflection point), you can expect the sales growth to be stronger going into 2H this year and beyond.

Galvanizing Philip Fisher Growth Strategy

Another sign that you should look for (in determining if you have a lucrative investment) is if the company has a prudent growth strategy. For biotech, growth by label expansion is a highly effective approach. It’s similar to the growth approach taught by Phillip Fisher who is one of Warren Buffet’s two mentors.

Fisher stated that it’s more effective to grow by expanding similar businesses like how a tree grows by forming additional branches. The experience and wisdom gained from one business can be transferred to another. For biotech, the relationship with the FDA and the expertise gained from one approval helps facilitate additional label expansion. Though there are still risks with additional label expansion, it’s substantially deleveraged.

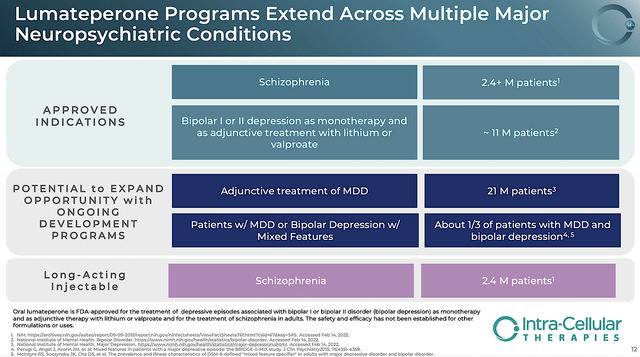

With Caplyta approved to treat schizophrenia, Intra-Cellular can transfer that expertise into the BPD label expansion. As such, the company can send Caplyta to many more patients. From the figure below, you can see the combined addressable patients for both BDP/schizophrenia is +35M. By further expanding the label for the (mixed feature, LAIJ, etc.), Intra-Cellular can add another +45M patients.

Competitor Landscape

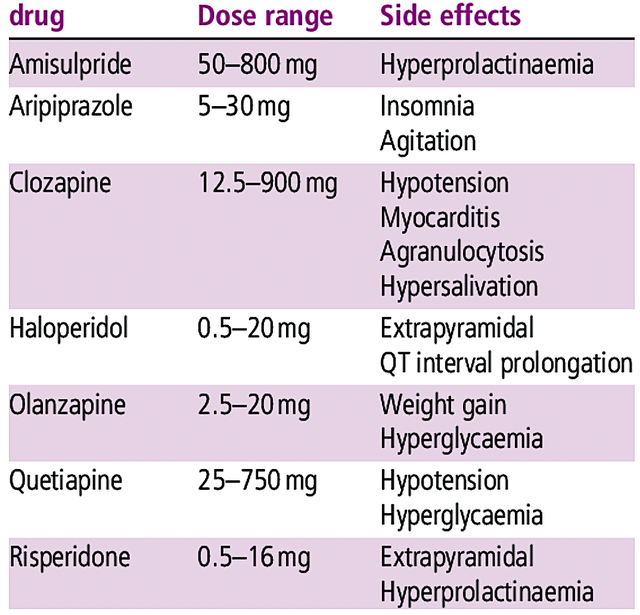

On competition, there are other neuroleptics like risperidone (Risperdal), quetiapine (Seroquel), olanzapine (Zyprexa), ziprasidone (Zeldox), paliperidone (Invega), aripiprazole (Abilify) and clozapine (Clozaril). Nevertheless, most of these drugs have substantial adverse effects that limit their utility. For example, patients taking these drugs on a long-term can start to produce milk (i.e., prolactinoma).

Hindered by adverse effects, conventional drugs cannot compete with Caplyta. That aside, you have newer drugs being developed by companies like Axsome Therapeutics (AXSM) that have better efficacy/safety profiles. Notwithstanding, Caplyta is apparently a far differentiated drug.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, you should analyze the 4Q2021 earnings report for the period that ended on December 31.

As follows, Intra-Cellular procured $83.8M in total revenues compared to $22.8M for the same period last year. As you know, the bulk of revenues came from Caplyta sales which registered in the tripled digits growth rate. Due to the BPD label expansion, you can anticipate that figure to ramp up more quickly. That aside, the research & development (R&D) for the respective periods tallied at $29.4M and $14.2M. I view the 107.0% R&D increase positively because the capital invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $85.7M ($1.05 per share) net loss compared to $60.6M ($0.76 per share) decline for the same comparison. With increasing R&D investment and launch cost, it’s logical for the bottom-line depreciation to widen. Over time (as Intra-Cellular is deeper into the launch), you can expect the bottom line earnings to improve in the next few years. If a larger company buys up Intra-Cellular, they can immediately leverage their existing sales force to reduce the launch cost.

About the balance sheet, there were $412.3M in cash, equivalents and investments. On top of the $433.7M (generated in the January stock offering), the total cash position is strengthened to $846M. Against the $111.6M quarterly OpEx, there should be adequate capital to fund operations into 4Q2024. Simply put, the cash runway is long.

While on the balance sheet, you should check to see if Intra-Cellular is a “serial diluter.” A company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 80.2M to 92.3M (i.e. 81.4M plus 10.9M recently issued), my math reveals a 15.0% annual dilution. At this rate, Intra-Cellular easily cleared my cutoff for a profitable investment.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Intra-Cellular is if the firm can quickly boost Caplyta sales for BPD. At the same time, it’s important to generate more Caplyta sales for schizophrenia. Though increasing sales growth during the pandemic is challenging (and especially so for a company launching its drug alone), Intra-Cellular’s hybrid launch strategy is demonstrating strong results.

The other concern is the ongoing Caplyta expansion. There is a small risk that the company might not generate more label expansion. Moreover, other young assets (i.e., ITI333, ITI2184, and PDE inhibitor) might not generate good clinical data. Furthermore, Intra-Cellular can grow too aggressively and thus runs into a potential cash flows constraint.

Final Remarks

In all, I maintain my buy recommendation on Intra-Cellular Therapies with a five out of five stars rating. Once in a while, there is certain biotech that will break the bearish trend. Banking on strong fundamentals and increasing market awareness, Intra-Cellular Therapies proved itself to be a great bio-stock for shareholders. On the wings of success is the stellar medicine Caplyta (one having a differentiated efficacy and safety profile that is second to none). The first Caplyta approval is for the treatment of schizophrenia. The Caplyta BPD approval marked a second victory for all. As Caplyta is charting its way to the Promised Lands of Blockbuster, you can anticipate more label expansion in the future.

Despite a challenging COVID environment and without a launch partner, Caplyta still demonstrated early success. If launched by a large partner, you can bet that Caplyta would quickly become a blockbuster in a year. Even without a partner, Intra-Cellular is doing a great job with the hybrid launch that leverages both online and in-person marketing. As an investor, make sure you keep up with catalyst developments like those relating to other molecules, i.e., ITI333, ITI1284, and ITI214.

Last but not least, I’d like to remind investors that the choice to buy, sell, or hold Intra-Cellular is always yours to make. In my view, you should take partial profits on Intra-Cellular while keeping the rest to ride the upsides. If you already took partial profits, just sit still on this great company to enjoy the fruits of your excellent stock picking.

Be the first to comment