djgunner

International Seaways (NYSE:INSW) stock price increased by 18% in the past month as VLCC rates were hiked in October. As European countries’ embargo on Russian oil starts in December, they need to source oil and refinery products from other countries than Russia. Thus, I expect the EU’s oil and refinery products imports from the United States and other countries to increase in the following quarters. It means higher crude tanker revenues for INSW. Also, I expect the company’s product carriers’ revenues to increase in the second half of 2022 due to increased demand for refinery products. The stock is a buy.

Quarterly highlights

In its 2Q 2022 financial result, INSW reported shipping revenues of $188 million, compared with 2Q 2021 shipping revenues of $43 million. The company’s voyage charter revenues increased from $8 million in 2Q 2021 to 15 million in 2Q 2022. INSW’s total operating expenses increased from $64 million in 2Q 2021 to $101 million in 2Q 2022, driven by increased vessel expenses. The company’s net loss attributable to the company of $19 million in 2Q 2021 turned into a net income of $60 million in the second quarter of 2022. INSW reported a net income per diluted share of $1.38, compared with a net loss per diluted share of $0.67.

The company’s consolidated total assets increased from $1519 million on 30 June 2021 to $2364 million on 30 June 2022. INSW reported 2Q 2022 crude tanker TCE revenues of $59 million, compared with 2Q 2021 crude tanker TCE revenues of $31 million. Its crude tanker TCE per day increased from $13237 in 2Q 2021 to $25279 in 2Q 2022. INSW reported 2Q 2022 product carriers’ TCE revenues of $126 million, compared with 2Q 2021 product carriers’ TCE revenues of $14 million. Its product carriers’ TCE per day increased from $13085 in 2Q 2021 to $28244 in 2Q 2022. “For the three and six months ended June 30, 2022, we derived 32% and 34%, respectively, of our TCE revenues from our Crude Tankers segment compared with 70% and 75% for the three and six months ended June 30, 2021, respectively,” the company reported. “As of June 30, 2022, the company’s operating fleet consisted of 75 wholly-owned, finance leased or bareboat chartered-in and time-chartered-in vessels aggregating 8.2 million deadweight tons. In addition to our operating fleet of 75 vessels, three dual-fuel LNG-powered VLCC newbuilds are scheduled for delivery to the company in the first quarter of 2023, bringing the total operating and newbuild fleet to 78 vessels,” the company announced.

The market outlook

The International Energy Agency (IEA) estimates the growth rate in global oil demand to decrease, driven by renewed Chinese lockdowns and the ongoing slowdown in the OECD countries. However, IEA expects that due to large-scale switching from gas to oil (as a result of skyrocketing gas prices), the decrease in the growth rate of the global oil demand (as a result of Chinese lockdowns and economic recession) will be partially offset. “Robust oil use for power generation in the Middle East and in Europe due to record natural gas and electricity prices is providing additional support,” IEA reported.

World oil demand is projected to increase by 2.1 million barrels per day in 2023. World oil production rose to 101.3 mb/d in August 2022 and is expected to increase to 101.8 mb/d in 2023. European Union and United Kingdom’s oil imports from Russia decreased by 880 kb/d since the start of the year to 1.7 mb/d. On the other hand, their oil imports from the United States increased by 400 kb/d to 1.6 mb/d. The EU embargo on Russian crude oil and product imports that comes into effect in December 2022 and February 2023, respectively, means that European countries will need to increase their oil and refinery product reallocations from other countries. From February 2023, European Courtiers (which so far largely maintained Russian diesel import volumes at around 600 kb/d) will substitute Russian diesel by importing from other countries, especially the United States.

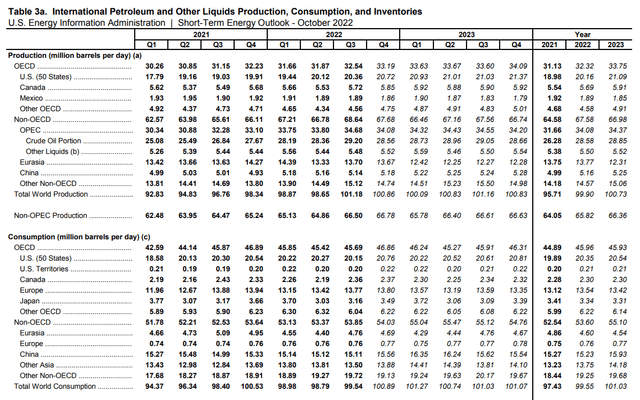

Furthermore, Energy Information Administration (EIA) expects that world petroleum and other liquids production and consumption will increase in 2023 (see Figure 1). Total world petroleum and other liquids production and consumption in all of the quarters of 2023 are expected to be higher than 100 million barrels per day. U.S. oil production was 20.12 mb/d in 2Q 2022 and 20.36 mb/d in 3Q 2023. It is expected to increase to 20.72 mb/d in 4Q 2022, to 20.93 mb/d in 1Q 2023, and to more than 21 mb/d in 2Q-4Q 2023. U.S. petroleum and other liquids consumption is expected to increase from 20.35 mb/d in 2022 to 20.54 mb/d in 2023.

Figure 1 – International petroleum and other liquids production and consumption

Performance outlook

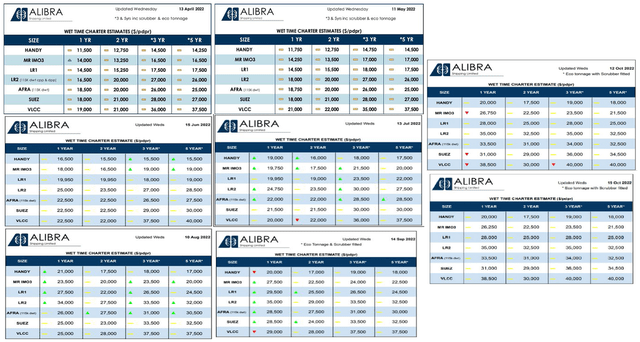

“The increase in TCE revenues in the first half of 2022 of $193.6 million, or 215%, to $283.5 million from $89.9 million in the corresponding period of the prior year reflects a net aggregate $112.6 million rates-based increase resulting from higher average daily rates earned across INSW’s fleet sectors, with the exception of the VLCCs,” the company explained. Figure 2 shows that in the third quarter of 2022, time charter estimates for MR IMO3, AFRA, LR1, and LR2 vessels were higher than in 2Q 2022. Also, we can see that in October 2022, rates are almost the same as on 14 September 2022. Thus, I expect INSW’s product carriers’ revenues in 3Q 2022 to be stronger than in 2Q 2022. Moreover, I expect the company’s results in 4Q 2022 to be as strong as the third quarter of the year. Also, according to Figure 3, the time charter estimates for VLCC vessels in August 2022 started to increase. We can see that time charter estimates for VLCC vessels in October 2022 are significantly higher than in previous months. Thus, I expect INSW’s crude tanker revenues in 3Q 2022 to be higher than in 2Q 2022. Also, I expect its crude tanker revenues in 4Q 2022 to be significantly higher than in 2Q 2022. Thus, I project the share of INSW’s crude tankers revenues in its total revenues to increase in the second half of 2022.

Figure 2 – Wet time charter estimates

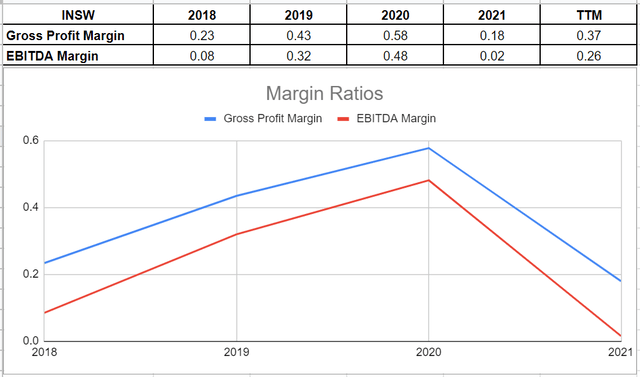

I looked at INSW’s profitability ratios in this thorough article to assess how well the company can turn a profit and use its assets to make money for its investors. I examined the profitability ratios to provide insights into the financial health of the company. I calculated the ratios in comparison to previous years to be more helpful.

Generally, margin ratios evaluate the company’s ability to turn revenues into profits. INSW has had higher gross profit and EBITDA margins in TTM compared with the end of 2021. In detail, INSW’s profit margin approximately doubled to 0.37 in TTM compared with its level of 0.18 in 2021. Also, after a severe decline to 0.02 in 2021 from its level of 0.48 in 2020, its EBITDA margin increased back to 0.26 in TTM. Examining the EBITDA margin has the advantage of excluding fluctuating costs and providing a clear view of the company’s performance. In summary, International Seaways Inc’s profitability metrics across the board of margin ratios indicate that the company is in a solid condition and the management can balance its financial statements (see Figure 3).

Figure 3 – INSW’s margin ratios

Summary

Disruption to trade flows caused by the war in Ukraine combined with the European energy crisis increased the demand for tankers, and the current situation will not change soon. The company’s TCE revenues in crude tanker and product carriers segments will likely increase in the next few quarters. International Seaways is well-positioned to benefit from the hiked VLCC rates. I am bullish on the stock.

Be the first to comment