CHUNYIP WONG/iStock via Getty Images

Introduction

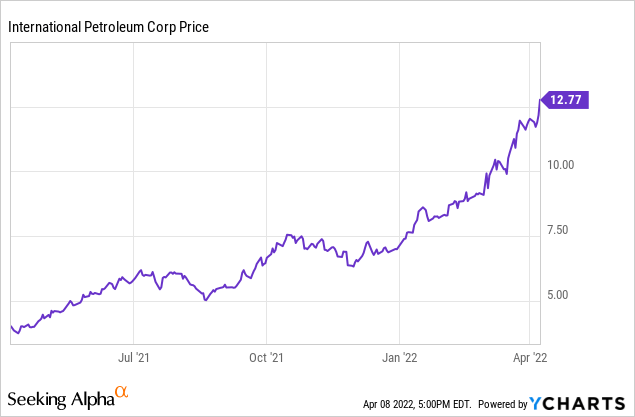

International Petroleum (OTC:IPCFF) is a Canadian oil company producing oil and gas in Canada, Malaysia and France. The well-known and widely respected Lundin family is the main shareholder of International Petroleum within excess of 25% of the shares owned. Thanks to the high oil price and the rapidly improving balance sheet, IPCO has been able to reduce its net debt and is committed to an aggressive share buyback program.

International Petroleum has its main listing in Stockholm but fortunately it also has a liquid secondary listing in Toronto where it’s trading with IPCO as its ticker symbol. With an average daily volume of approximately 100,000 shares, the Toronto listing is sufficiently liquid for normal trading needs. There are currently 151M shares outstanding, resulting in a current market capitalization of approximately US$1.5B. I will use the USD as base currency throughout this article.

Unfortunately the company website mainly contains download-only links but you can find all relevant information here.

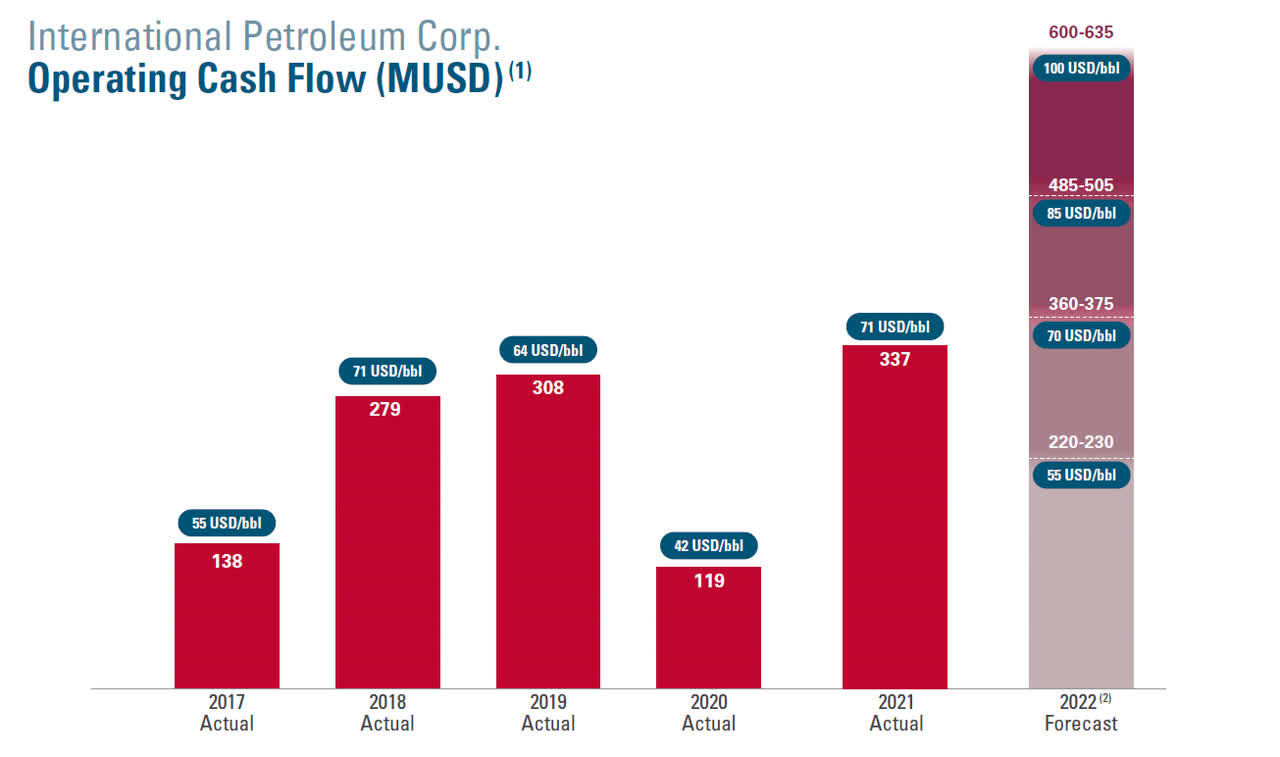

FY 2021 was good, but 2022 will be better if the high oil price persists

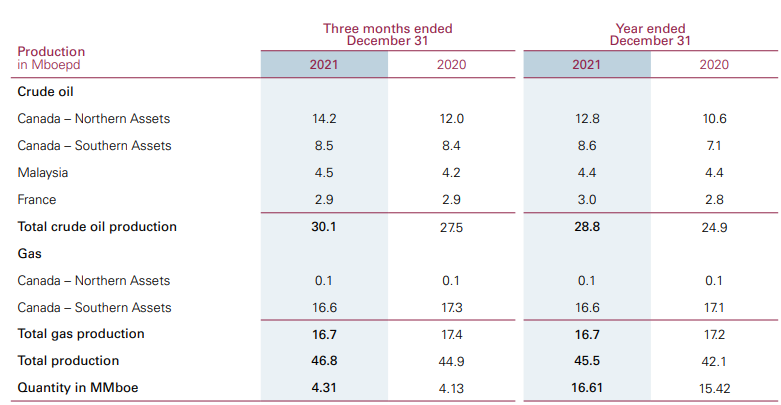

Before diving deeper into the final quarter of 2021, I wanted to have a look at the company’s full-year results first. During 2021, the average daily production rate was approximately 28,800 barrels of oil per day with an additional 16,700 boe/day in natural gas. This brought the full-year average production rate to 45,500 boe/day, up from just 42,100 boe/day in 2020. Additionally, the production rate in the final quarter came in at almost 47,000 boe/day which helped to boost the company’s cash flow.

International Petroleum Investor Relations

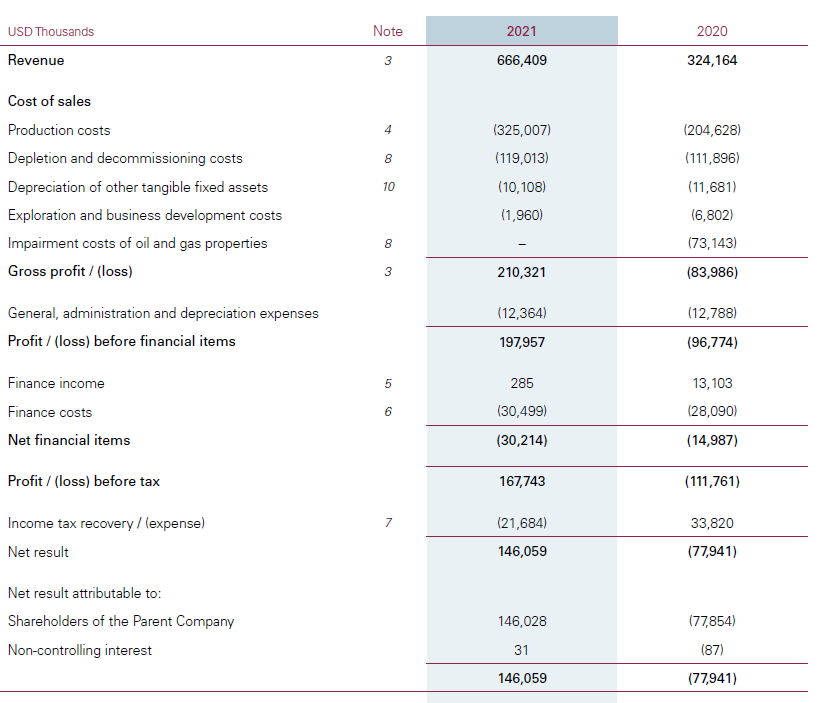

The total revenue in 2021 came in at $666M on a reported basis; this already includes the in excess of $46M paid in royalties but also already includes a hedging loss of approximately $33.6M. The production costs also increased, due to a combination of higher costs related to the production itself, but also related to tariffs and the purchase of diluent to ensure the heavy oil meets the pipeline requirements.

International Petroleum Investor Relations

Despite these higher expenses, International Petroleum remained very profitable with a net income of US$146M which works out to be US$0.97 per share based on the current share count.

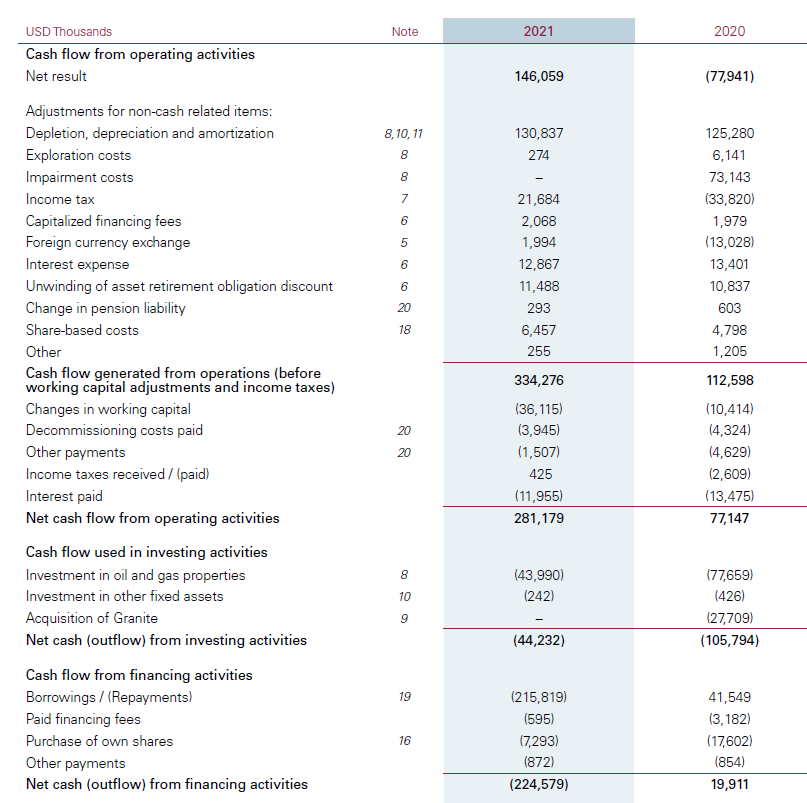

Looking at the cash flow result, International Petroleum’s performance is even more impressive. The company reported a total operating cash flow of $334M but we still need to deduct the interest expenses ($12M) and the normalized tax expenses ($22M) from this equation. That would result in an adjusted operating cash flow of almost exactly $300M.

International Petroleum Investor Relations

As you can see in the image above the full-year capex was just $44M resulting in a free cash flow result per share of $256M for a free cash flow result per share of US$1.7. Applying the current USD/CAD exchange rate indicates the free cash flow per share expressed in Canadian Dollar would clearly exceed C$2/share which means that IPCO still isn’t expensive despite the recent share price run up.

It’s also important to note the operating cash flow in the final quarter of 2021 was just over $100M, so based on the Q4 performance, IPCO should be generating about $400M in adjusted operating cash flow on an annualized basis. Also keep in mind the company has repaid a lot of its debt throughout the year but (unfortunately) it also issued $300M in 7.25% bonds so I’m not sure we will see the interest expenses decrease this year.

The balance sheet is rapidly improving

IPCO has used the majority of its free cash flow to reduce its net debt. Whereas the balance sheet contained a total of $341M in net debt as of the end of Q2 2020, this net debt fell to just over $94M as of the end of 2021. If IPCO wouldn’t be buying back its own shares right now, the company would for sure be debt free by this summer.

And 2022 will be another great year for International Petroleum. Based on the Q4 performance, I was estimating an annualized operating cash flow of US$400M for this year, but looking at the sensitivity analysis provided by the company, I may have been a bit too conservative. At $85 oil, the operating cash flow will likely come in at around $500M and even at $70 oil, the operating cash flow will be $360-375M.

International Petroleum Investor Relations

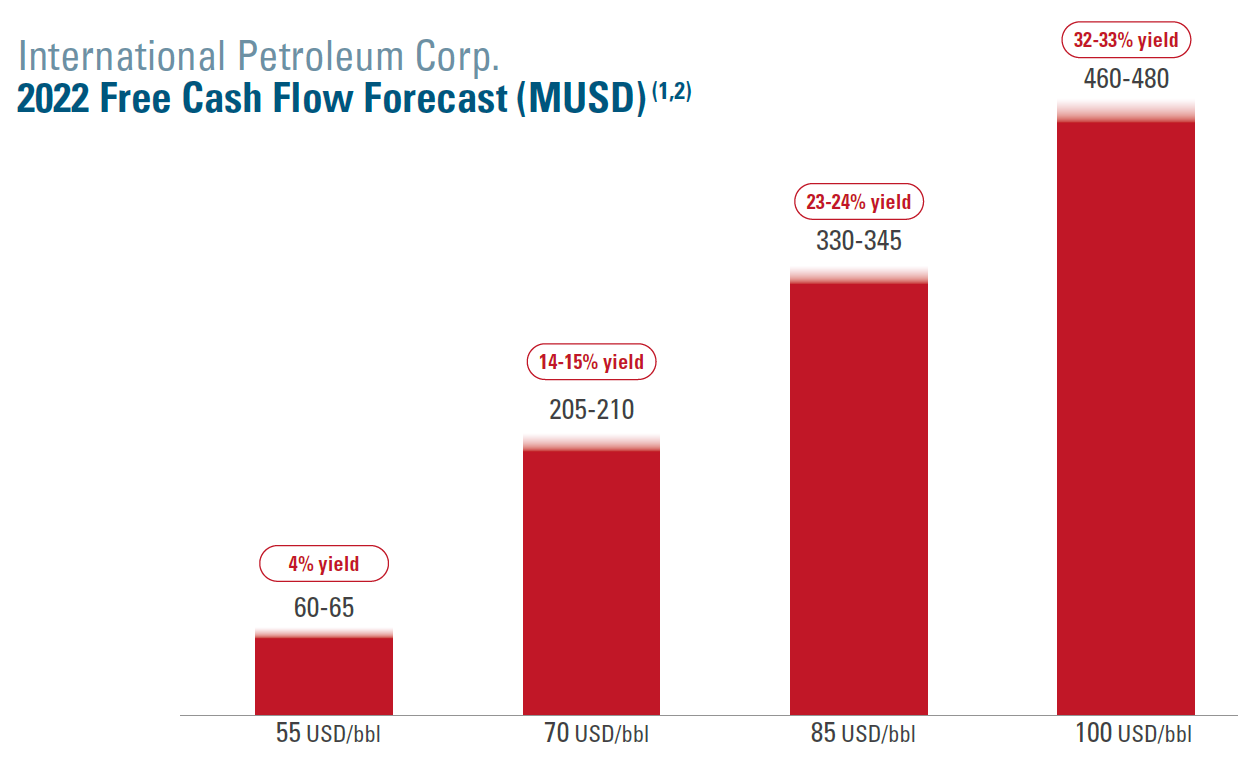

With an anticipated total capex of $127M, IPCO will report very strong free cash flows. As you can see in the image below, even at $70 oil the free cash flow result will exceed $200M and this is the equivalent of C$250M or in excess of C$1.6 per share (assuming IPCO continues to buy back shares). At $85 oil, the free cash flow result will be C$2.75/share.

International Petroleum Investor Relations

And with a reserve life index of 16 years based on the year-end 2021 reserves, International Petroleum is in an excellent shape. Using $75 oil, IPCO expects to generate $1.2B in free cash flow over the next five years. And even at $55 oil, the cumulative free cash flow will be $600M in the same five-year period.

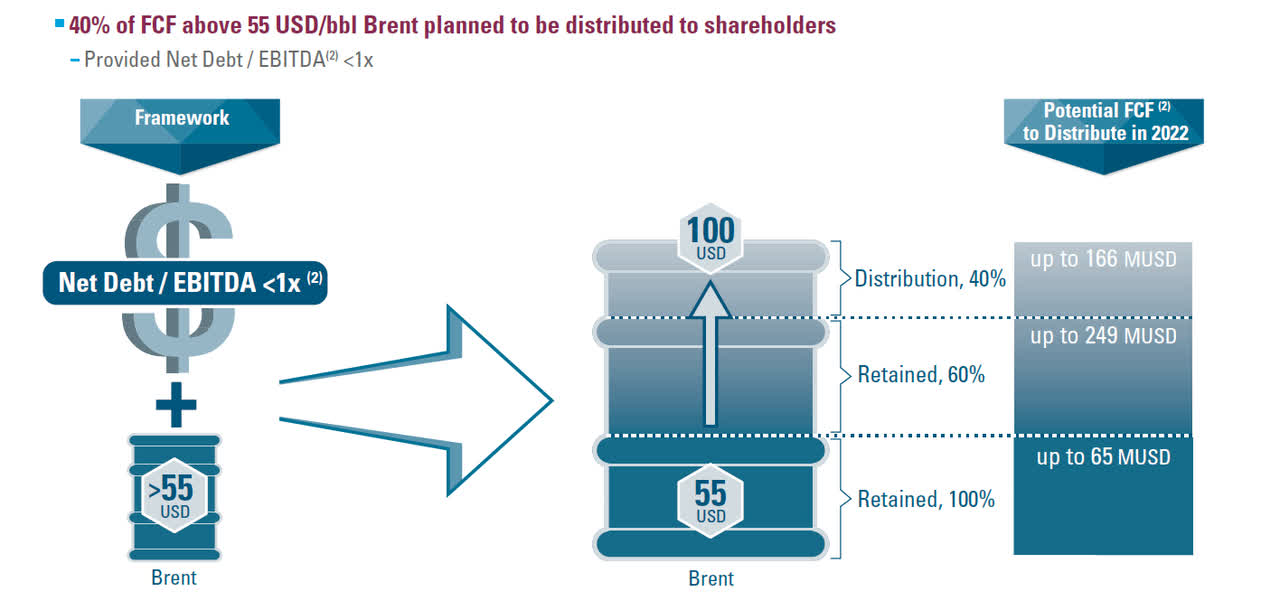

This also means shareholders will share in the wealth as the company is planning to spend 40% of the free cash flow generated above $55 USD will be distributed to the shareholders.

International Petroleum Investor Relations

Investment thesis

IPCO’s share price has almost doubled since the end of 2021 but the company still isn’t expensive if you believe in an oil price of $70/barrel for the next decade. I currently don’t have a position in International Petroleum as my limit order in December wasn’t hit, but I think the company is still attractive on major pullbacks. The balance sheet will likely move into a net cash territory soon and the financial flexibility will allow International Petroleum to figure out its own future.

Be the first to comment