Alina555/E+ via Getty Images

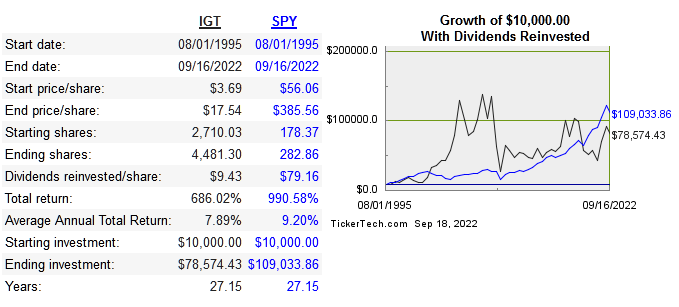

The modern version of this company began in 2006, when Italian-based Lottomatica SpA acquired Gtech Holdings for $4.6 billion dollars. The new combined entity would go on to merge with International Game Technology (NYSE:IGT) in 2015 and keep that name for the whole enterprise. There is almost 50% insider ownership, which represents the controlling stake by privately held De Agostini. Their three segments are global lottery, global gaming, and digital & betting. Below is the long-term share price performance:

dividendchannel

Below are the return on capital metrics, I chose to include EVVTY but it is an entirely online casino business, unlike the rest.

|

Company |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF 10-Year CAGR |

|

1% |

0.5% |

5.9% |

0.7% |

|

|

57.4% |

55.3% |

46% |

na |

|

|

9% |

-3.8% |

na |

15.7 |

|

|

1.7% |

0.8% |

0.9% |

8% |

|

|

10.1% |

1.9% |

na |

19% |

Source: QuickFS

Moat

There is no doubt that digital gambling has a very long secular growth trajectory ahead, but a business so reliant on live casinos is prone to economic cycles. Its moat lies mostly in its market share and specific contracts within the lottery segment. The other strength would be the switching costs associated with being a provider of physical slot machine and lottery services. These aren’t things that would be regularly shopped and should result in long-term relationships with casinos and local governments.

Capital Allocation

IGT has paid a dividend for most of its years, but the obvious issue with capital allocation is the debt levels. Long-term debt jumped drastically after the merger in 2006 and again in 2015. The amounts being allocated to dividends as well as the first ever buybacks announced recently are problematic. Profit margins are good right now, but returns on capital haven’t been very high in the long run. Over the TTM, the numbers are impressive with ROIC of 21.3% and ROE of 35.8%. I don’t see this as the beginning of a trend.

I would like to see debt repayment take higher priority, but also minority investments into their online competitors such as EVO and DKNG would help passively protect against encroaching competition.

Risk

Secular growth will give the top line a boost, but IGT’s has been basically flat for the past decade, and the primary way to grow will be with more acquisitions. While the FCF yield isn’t bad, long-term debt is around 1.5 times revenue. If shareholder yield takes emphasis over debt reduction, and more debt is added with each acquisition, the long-term consequences will be dividend cuts at the least.

Many companies can sustain moderate levels of debt that don’t get out of hand by growing free cash flow. The ability to meaningfully service the debt is important, and IGT is indeed paying down a lot of debt since. It simply isn’t enough in relation to operating profit and free cash flow. I’m often very critical of companies that put too much emphasis into dividends and buybacks while carrying excessive debt, and this is a good example. The economics of the business are fine, and the industry growth provides some tailwinds, but ultimately bad capital allocation is the biggest risk here.

Valuation

Many stocks haven’t been immune to the bear market we are going through this year, and IGT is no exception with a 37% drawdown since November of last year. Below is a multiples comparison:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

|

IGT |

2.3 |

6.5 |

15.1 |

2.0 |

|

EVO |

12.2 |

17.5 |

21.6 |

5.2 |

|

LNW |

3.3 |

10.2 |

27.5 |

4.8 |

|

PENN |

0.9 |

3.8 |

9.1 |

1.2 |

|

BYD |

2.4 |

6.8 |

10.8 |

3.7 |

Source: QuickFS

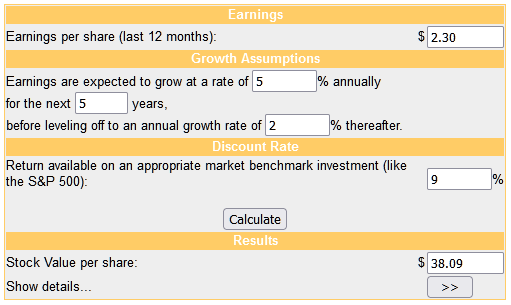

Compared to its peers, there is no apparent discount, so below we will look at a DCF model.

moneychimp

Shares are currently around $17, but the risk issues I mentioned above trump the discount to intrinsic value that the model shows. This is also with a fairly optimistic forecast of earnings growth. I would wait to see much more deleveraging take place before getting interested. The 4.4% dividend yield is not worth the excess leverage.

Conclusion

IGT has been a volatile stock which provided cyclical opportunities, but has failed to show the characteristics of a company that can truly compound its real value over time. There are industry tailwinds in general, but online casinos and sports betting provide serious competition, and have an advantage over live casinos as we saw during the lockdowns.

IGT has a moat insofar as its market share of physical slot machines and lottery contracts, but there isn’t nearly as much growth potential for these segments as there is for online. They are deleveraging a lot, but I would rather see no capital returned to shareholders while debt gets under control.

Be the first to comment